As we enter the holiday shopping season, the #Fed (much like Santa) increasingly has a keen eye on what’s naughty or nice for the economy. Yes, Santa Clause is coming to town, but #inflation is not.

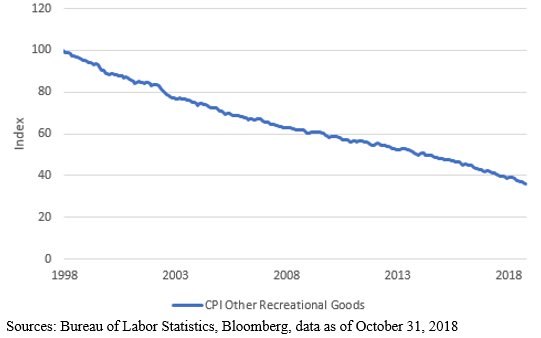

So while the overheating crowd has loudly warned us: you better watch out, you better think twice because #inflation is going to erode household spending power... the cost of many favorite gifts (TVs, phones, GPS, recreational games and electronics) continues to deflate!

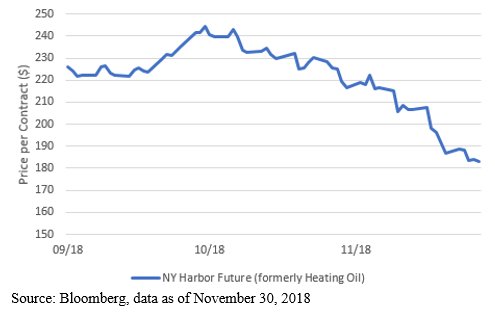

The weather outside may be frightful, but the #inflation hawks can’t deny the bargain prices of home heating oil as we enter the frigid winter months.

On a serious note, the holidays are a truly a season of giving, and keeping that in mind, there is no greater gift than full employment and rising wages for households. The #Fed acknowledges that spurring more jobs is the right policy and isn’t something to be curtailed.

Our workforce faces many future costs: rising U.S. debt burdens, underfunded #retirement plans, rising health care expenses and increased cost of education: yet growing #employment today does far more benefit to combat these issues than fighting the ghost of inflation past.

So while the Grinch would surely see higher #wages as inflationary, we see it as a gift in an economy where the cost of goods (food, energy, apparel, etc.) is in decline; meaning higher disposable #income for household savings, debt reduction, expenses, or a deserved vacation.

In short, higher wages doesn’t mean higher inflation (bit.ly/2FVCT89). So here’s a holiday cheer to a brilliant Fed that seems to realize this more than most!

• • •

Missing some Tweet in this thread? You can try to

force a refresh