Beware the latest dire warnings about the impact of #Brexit on the #tech sector. Main fear seems to be the impact on skilled #migration from the EU, but this would be entirely in the UK government’s hands to manage. Tech is also one of the most global of industries... (1/4)

The UK’s advantages as a location for #tech investment are also largely #Brexit-proof or might actually be strengthened by leaving (e.g. chance to escape some of the crazier regulations). Loss of EU official funding is a red herring too, since the UK is a net contributor... (2/4)

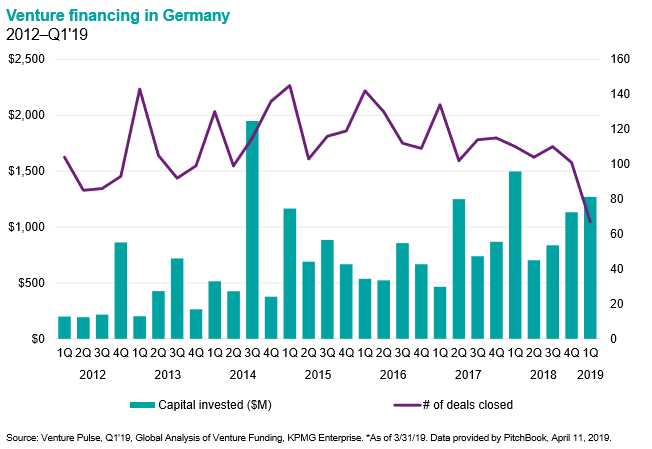

There is some evidence that #Brexit uncertainty is holding back private #investment in the #tech sector – as it is in the economy as a whole. But the UK still tops the league tables and any pause is likely to be temporary. See this from KPMG... (3/4)

kpmgenterprise.co.uk/perspectives/v…

kpmgenterprise.co.uk/perspectives/v…

#ProjectFear headlines have focused on the decline in the number of venture capital deals done in the UK #tech sector. But this is happening elsewhere in Europe too, as the economy slows and confidence falters, and even in France, which some now see as UK's main rival here. (4/4)

• • •

Missing some Tweet in this thread? You can try to

force a refresh