Independent economist. Likes charts. IEA Economics Fellow. Schools speaker. Binfluencer. Diploma in Law. FRSA. COYG. Views here are mine only. Also on Substack.

How to get URL link on X (Twitter) App

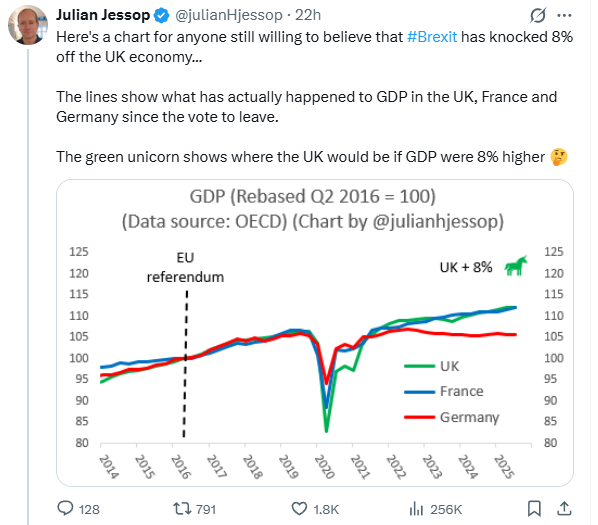

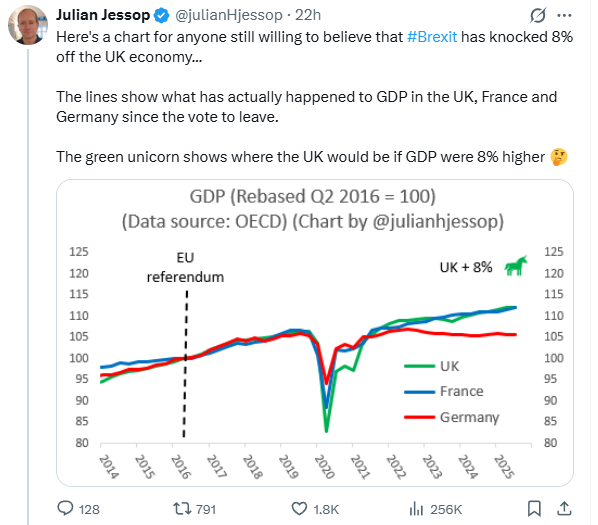

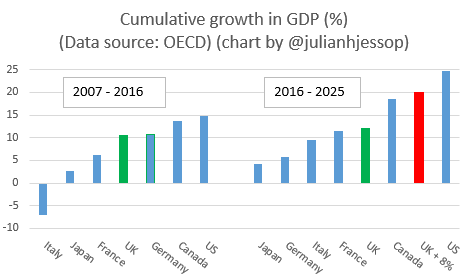

Q1. Now do GDP per head!!

Q1. Now do GDP per head!!

2️⃣ It's not entirely clear whether this U-turn applies to the plan to raise the higher and additional rates, or just the basic rate. But it's hard to raise a lot of money without increasing all three.

2️⃣ It's not entirely clear whether this U-turn applies to the plan to raise the higher and additional rates, or just the basic rate. But it's hard to raise a lot of money without increasing all three.

2⃣ 2-year yields have risen the most, suggesting that the jump is mainly driven by expectations that the short-term boost to growth and #inflation from the Budget (according to the OBR) will prompt the Bank of England to keep official rates higher for longer...

2⃣ 2-year yields have risen the most, suggesting that the jump is mainly driven by expectations that the short-term boost to growth and #inflation from the Budget (according to the OBR) will prompt the Bank of England to keep official rates higher for longer...

Note first that the '23%' figure is unsourced ⚠️

Note first that the '23%' figure is unsourced ⚠️

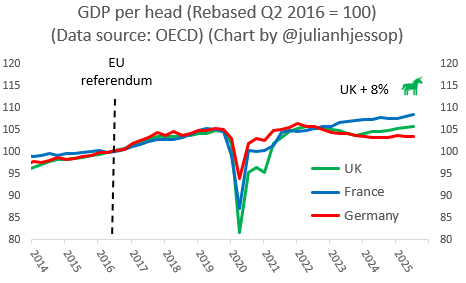

This is partly about being in the right sectors at the time.

This is partly about being in the right sectors at the time.

The main driver has been the increase in the National Living Wage (#NLW).

The main driver has been the increase in the National Living Wage (#NLW).

2. Cumulative #food price #inflation since December 2019...

2. Cumulative #food price #inflation since December 2019...

Earnings data a little better than expected: average total #pay (incl. bonuses) rose 6.0% in 3m to September and regular pay (excl. bonuses) by 5.7%, although still falling in real terms.

Earnings data a little better than expected: average total #pay (incl. bonuses) rose 6.0% in 3m to September and regular pay (excl. bonuses) by 5.7%, although still falling in real terms.https://twitter.com/BruceReuters/status/1576933176823656449The aim of this policy is to cap gilt yields by signalling that the Bank will act as the buyer of last resort to prevent forced sales by pension funds from driving yields even higher.