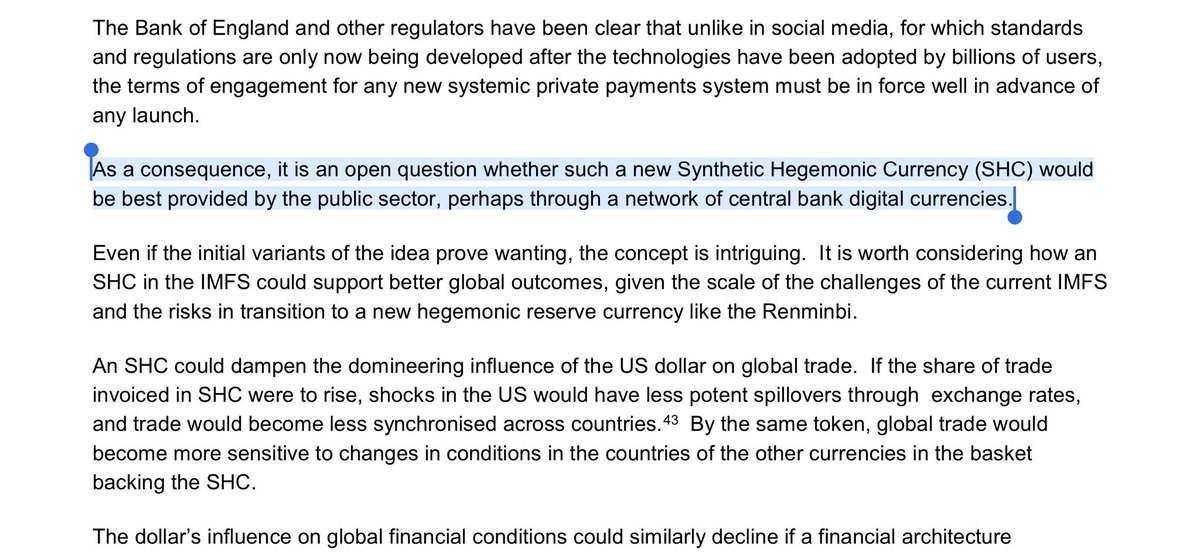

Find out the latest from the Bank of England on how Central Bank Synthetic Hegemonic Currencies (SHC) complement the legacy financial system and support monetary policy through a #NetworkofCentralBankDigitalCurrencies #DLT #Blockchain bankofengland.co.uk/-/media/boe/fi…

What I said in Zug. @bankofengland states, that central bank currencies should be run by central banks to complement the existing system, providing stability, efficiency and managing risk. The beginnings of rearchitecting the entire financial system!

https://twitter.com/gverdian/status/1144187491680968704?s=21

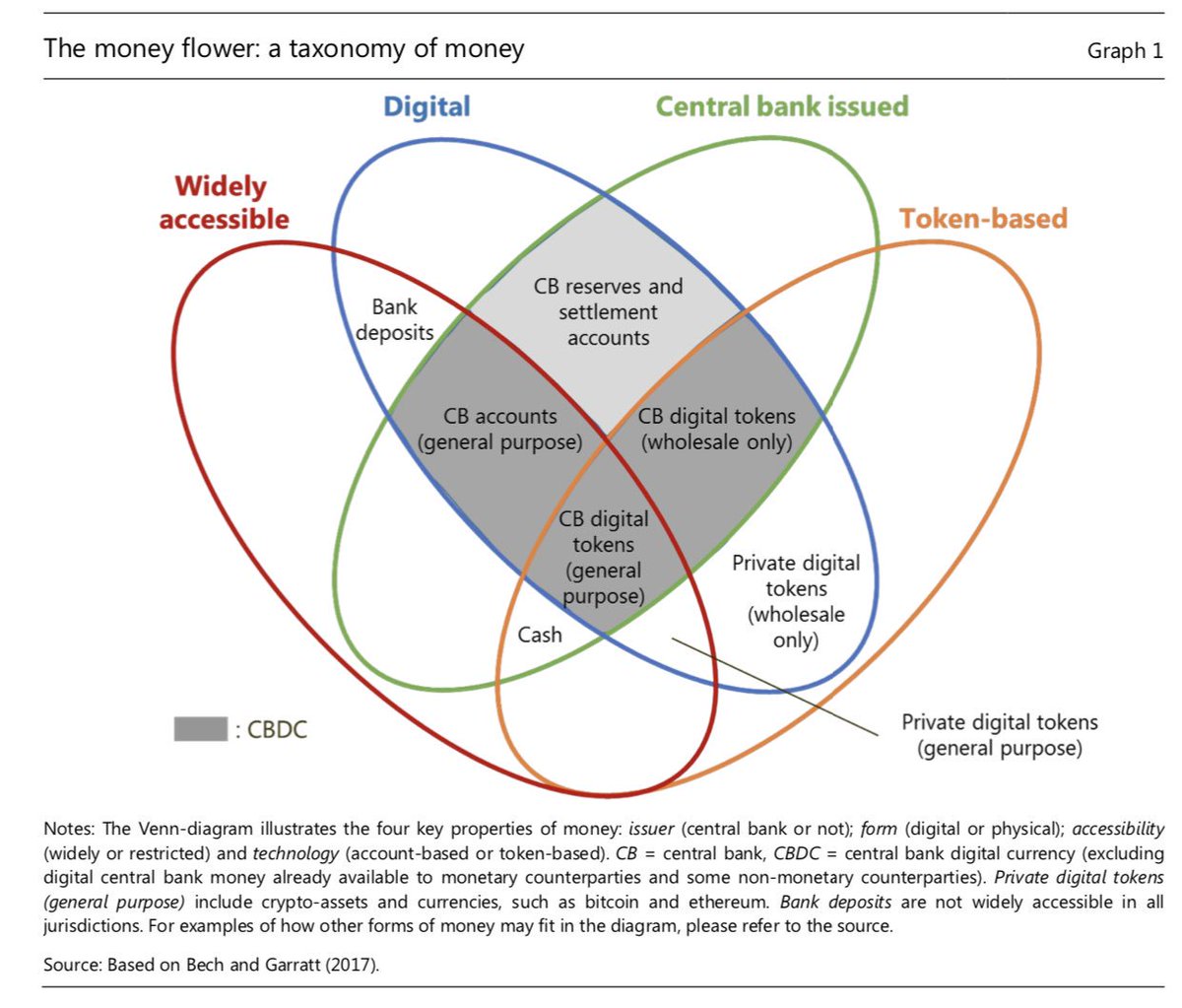

According to @BIS_org, this is how central bank currencies fit into the financial system. bis.org/cpmi/publ/d174…

Also @IMFNews published “The Rise of Digital Money”. Showing the attributes of different types of money and how Synthetic Central Banked Digital Currencies sCBDC work as a private-public partnership to #RearchitecttheFinancialSystem imf.org/~/media/Files/… #blockchain #DLT #DeFI

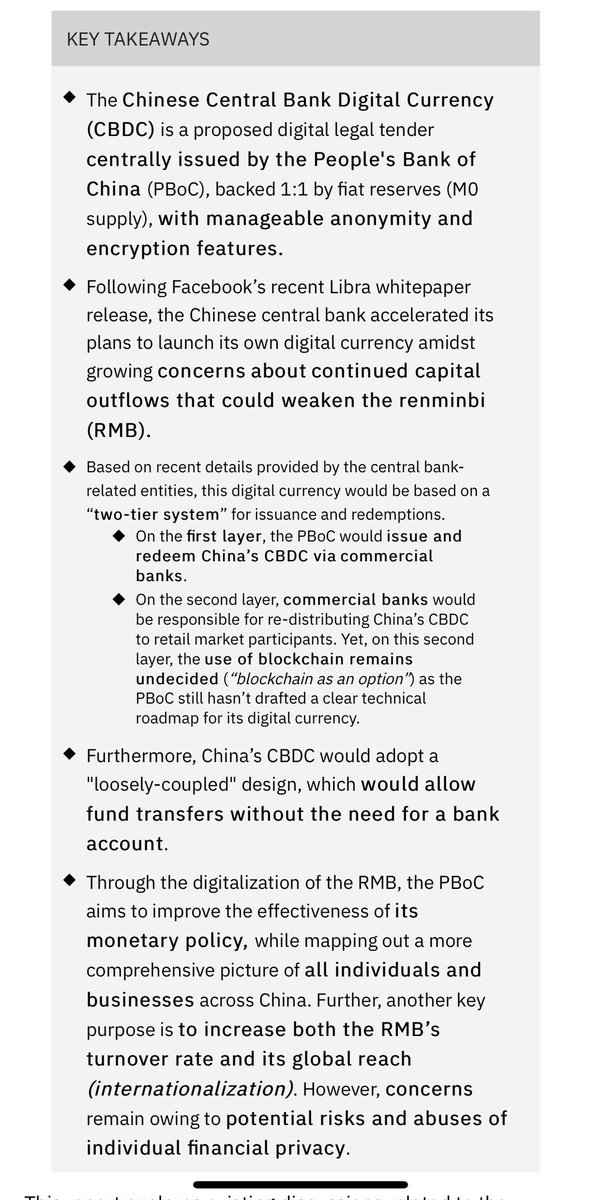

CBDC overview from People’s Bank of China info.binance.com/en/research/ma…

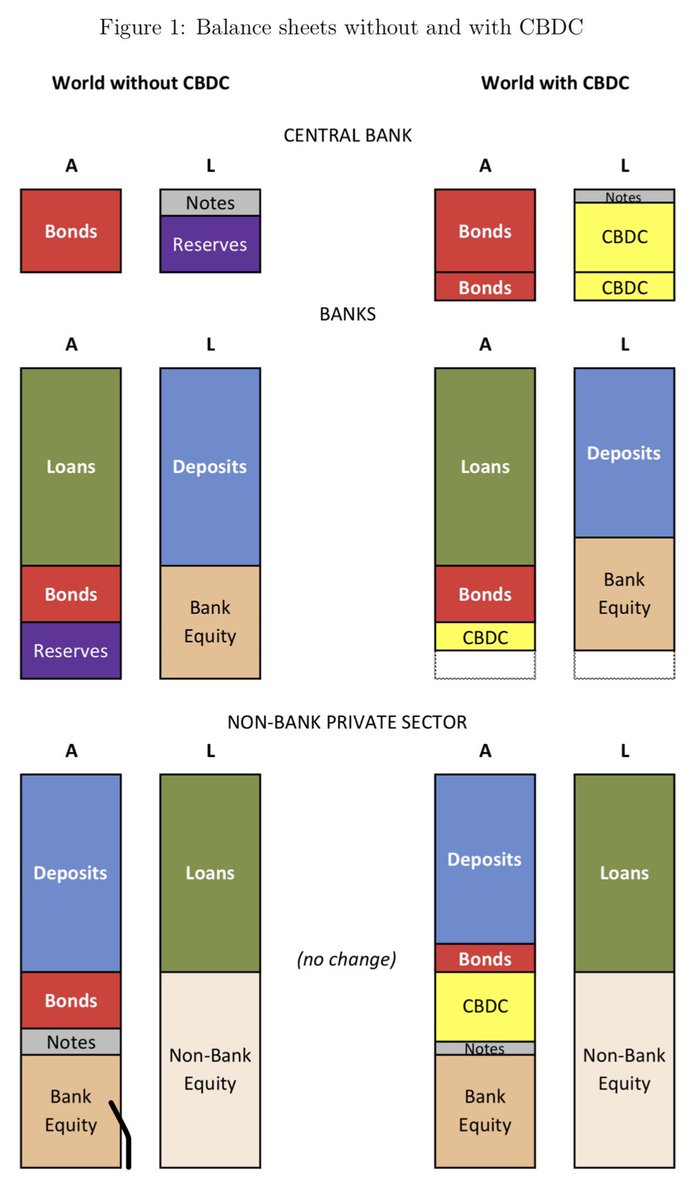

@BoE_Research from 2018 on how CBDCs can be treated by a central bank. This is what Assets and Liabilities look like in a world with CBDC. PDF: bankofengland.co.uk/-/media/boe/fi…

https://twitter.com/boe_research/status/997463768899768320?s=21

@BoE_Research Today, @BIS_org releases Embedded supervision: how to build regulation into blockchain finance

bis.org/publ/work811.p…

bis.org/publ/work811.p…

@ecb’s Benoît Cœuré: Digital challenges to the international monetary and financial system. “Global central banks need to join forces and jointly investigate the feasibility of central bank digital currencies (CBDCs).“ Full speech: ecb.europa.eu/press/key/date…

@ecb President of ECB #MarioDraghi replied to MEP Eva Kaili & recognizes future potential as means of payment while keeping an open mind for the utility of a crypto-Euro

https://twitter.com/EvaKaili/status/1177594744798617600?s=20

From @BIS_org:

#G7 report says #stablecoins might work better than other cryptocurrencies as a means of payment & store of value; they could contribute to more efficient & inclusive global payment arrangements only if significant risks are addressed bis.org/cpmi/publ/d187…

#G7 report says #stablecoins might work better than other cryptocurrencies as a means of payment & store of value; they could contribute to more efficient & inclusive global payment arrangements only if significant risks are addressed bis.org/cpmi/publ/d187…

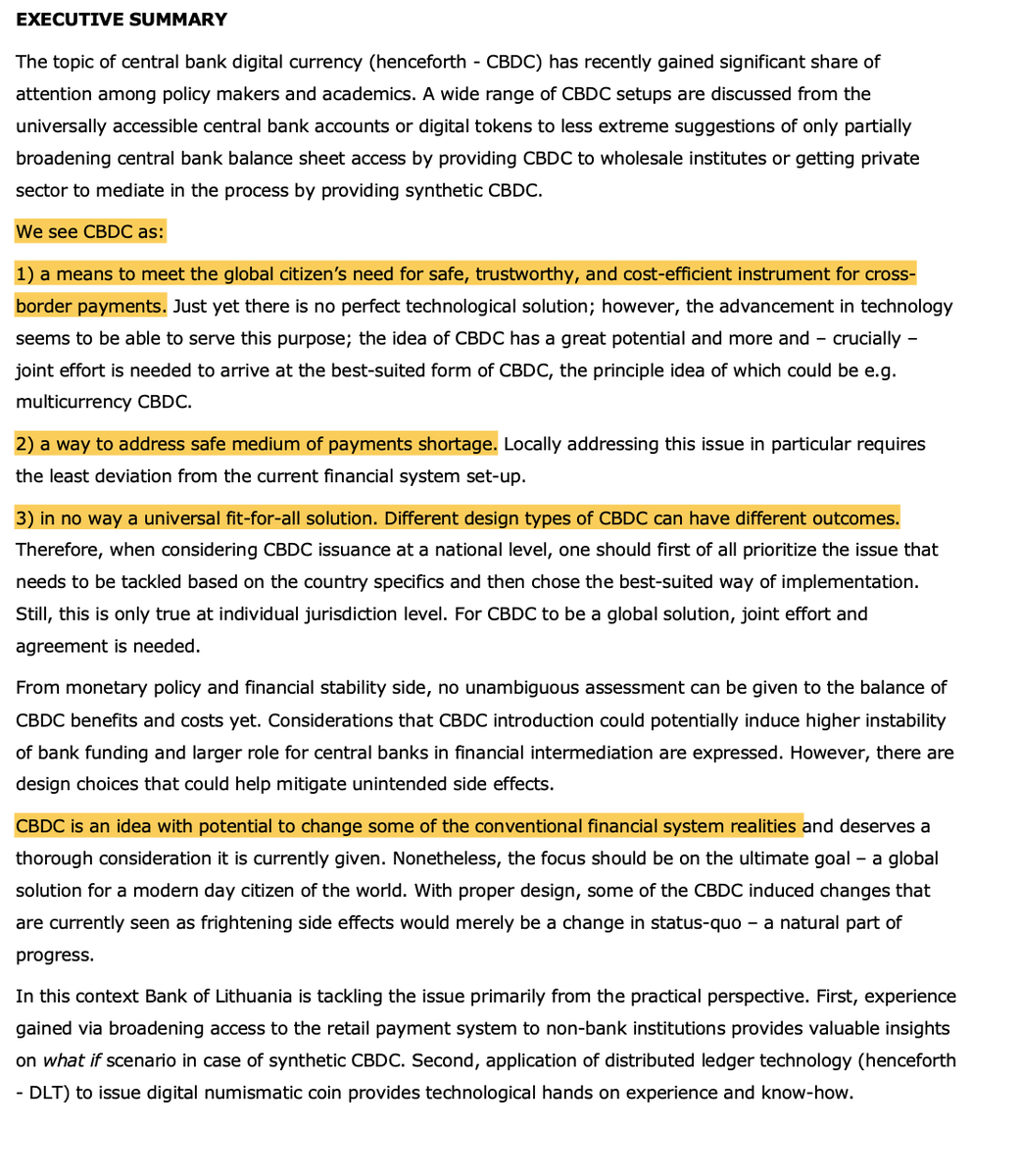

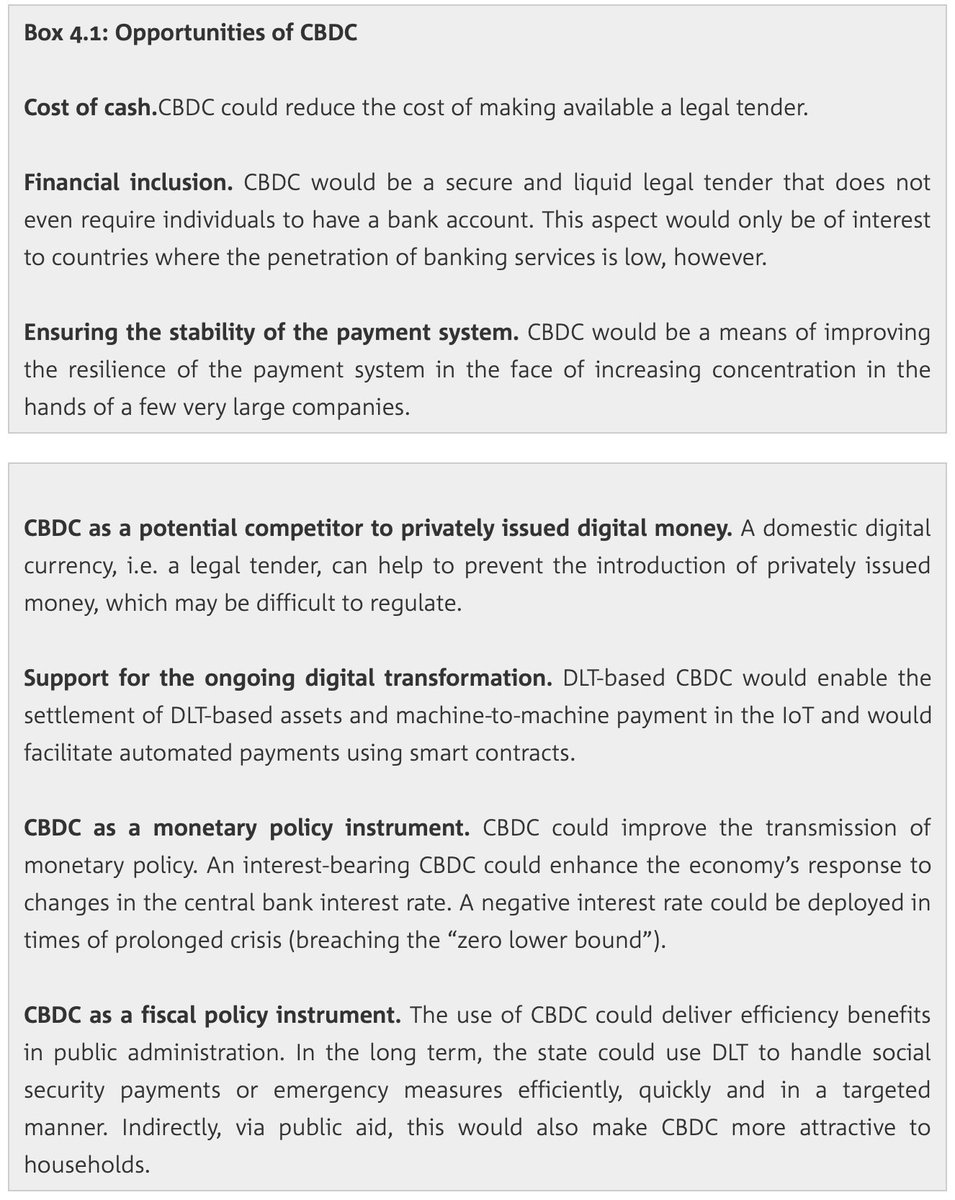

@BIS_org Report from the Central Bank of Lithuania @Lietuvosbankas, see CBDCs:

1) as a means for safe, trustworthy and cost-efficient instrument

2) as a way to address payments shortage

3) with different design types

4) Change the conventional financial system

lb.lt/en/publication…

1) as a means for safe, trustworthy and cost-efficient instrument

2) as a way to address payments shortage

3) with different design types

4) Change the conventional financial system

lb.lt/en/publication…

@BIS_org paper on Wholesale Digital Tokens; digital tokens that could potentially be used to effect settlement. This report focuses on the role of digital tokens as a means of settling wholesale transactions. bis.org/cpmi/publ/d190… PDF: bis.org/cpmi/publ/d190…

@BIS_org @IMFNews can help in 3 ways: by informing the policy debate, by convening relevant parties to discuss policy options, and by helping countries develop policies.

The IMF is helping member countries consider CBDC options and seek advice.

blogs.imf.org/2019/12/12/cen…

#CBDC #sCBDC

The IMF is helping member countries consider CBDC options and seek advice.

blogs.imf.org/2019/12/12/cen…

#CBDC #sCBDC

@ecb paper: Exploring anonymity in central bank digital currencies

Latest research shows that it is possible to build a simplified payment system for central bank digital currencies.

ecb.europa.eu/paym/intro/pub… #CBDC #sCBDC

Latest research shows that it is possible to build a simplified payment system for central bank digital currencies.

ecb.europa.eu/paym/intro/pub… #CBDC #sCBDC

@ecb @EU_Commission: EU Consultation on how to shape the regulatory framework for crypto-assets and stablecoins:

https://twitter.com/EU_Finance/status/1207635617418534913?s=20

@ecb Working Paper: Tiered CBDC and the Financial System. ecb.europa.eu/pub/pdf/scpwps…

@ESMAComms Strategic Orientation 2020-22.

“A sound legal framework for crypto-assets are increasingly becoming areas of focus for ESMA together with the other ESAs, the ESRB, the ECB and the European Commission.”

esma.europa.eu/sites/default/…

“A sound legal framework for crypto-assets are increasingly becoming areas of focus for ESMA together with the other ESAs, the ESRB, the ECB and the European Commission.”

esma.europa.eu/sites/default/…

Digital Dollar Project

Determine advantages of a digital USD, convene private sector thought leaders, & propose possible models to support the public sector.

The Project will develop a framework for potential, practical steps to establish a dollar CBDC.

digitaldollarproject.org

Determine advantages of a digital USD, convene private sector thought leaders, & propose possible models to support the public sector.

The Project will develop a framework for potential, practical steps to establish a dollar CBDC.

digitaldollarproject.org

@BIS_org Central bank group to assess potential cases for central bank digital currencies. The group includes @bankofcanada, @bankofengland, @Bank_of_Japan_e, @ecb, @riksbanken, @SNB_BNS_en bis.org/press/p200121.… #CBDC

@wef publishes the Central Bank Digital Currency Policy‐Maker Toolkit. A framework covering:

– Retail, wholesale, cross‐border CBDC and alternatives in private money such as “hybrid CBDC”

– Large, small, emerging and developed countries.

www3.weforum.org/docs/WEF_CBDC_… #CBDC

– Retail, wholesale, cross‐border CBDC and alternatives in private money such as “hybrid CBDC”

– Large, small, emerging and developed countries.

www3.weforum.org/docs/WEF_CBDC_… #CBDC

@BIS_org Impending arrival of CBDCs - a sequel to the survey on central bank digital currency. Covering the motivations of CBDCs including financial stability, domestic and cross border payments, monetary policy and financial inclusion. bis.org/publ/bppdf/bis… #CBDC #CentralBanks

@BIS_org Why Central Bank Digital Currencies Are The Killer App For Blockchain In 2020 #CBDC

Mobile payments alone are a $5.5T opportunity by 2025

@Bis estimates that over 80% of the central banks are looking at blockchain as a place to issue digital currencies

forbes.com/sites/biserdim…

Mobile payments alone are a $5.5T opportunity by 2025

@Bis estimates that over 80% of the central banks are looking at blockchain as a place to issue digital currencies

forbes.com/sites/biserdim…

The central banks of Britain, the euro zone, Japan, Canada, Sweden and Switzerland announced a plan last month to share their findings to look at the case for issuing digital currencies, amid growing debate over the future of money.

@Reuters uk.reuters.com/article/us-cen… #CBDC

@Reuters uk.reuters.com/article/us-cen… #CBDC

@bankofengland Paper: Should we innovate to provide the public with electronic money — or Central Bank Digital Currency (CBDC) — as a complement to physical banknotes? bankofengland.co.uk/-/media/boe/fi… #CBDC #RTGS

https://twitter.com/quant_network/status/1247478633209442305?s=21https://t.co/hkPzzhWYB1

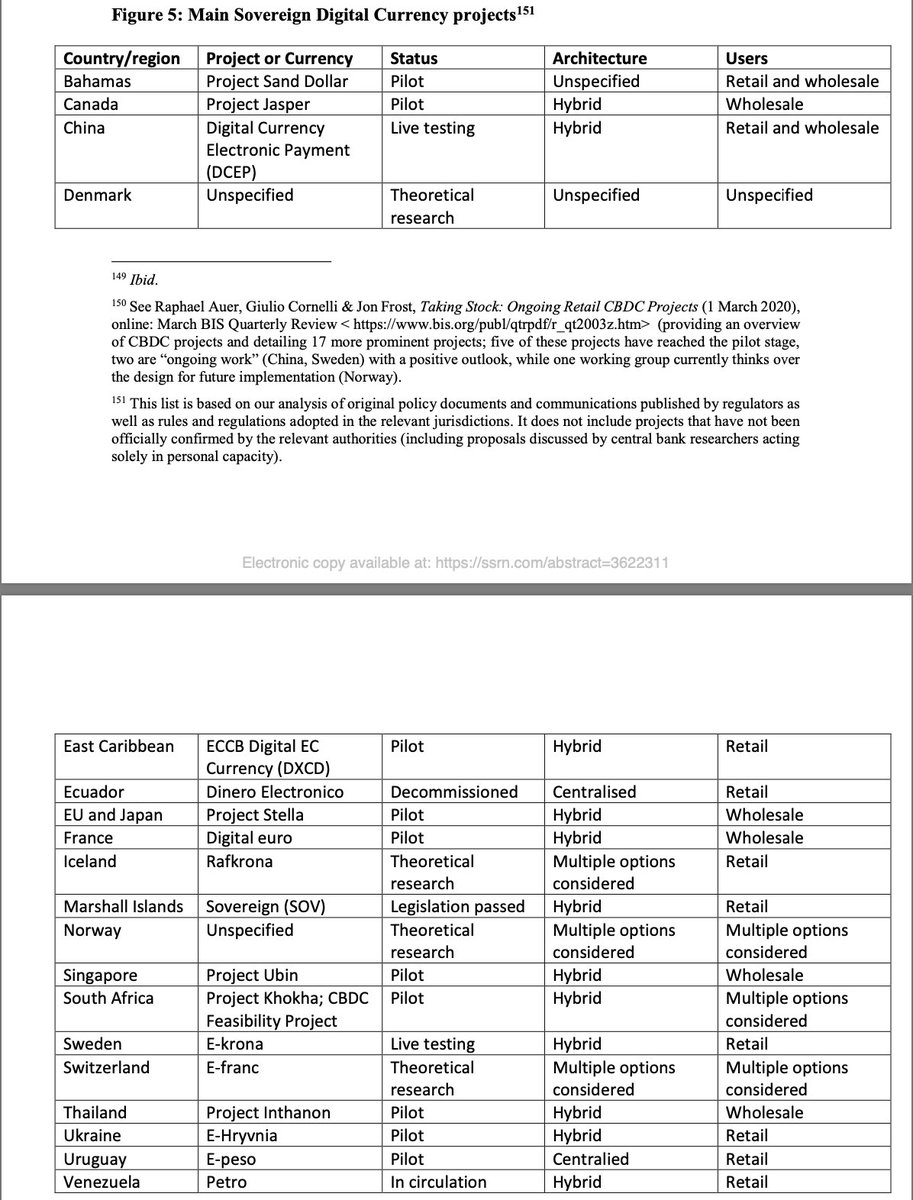

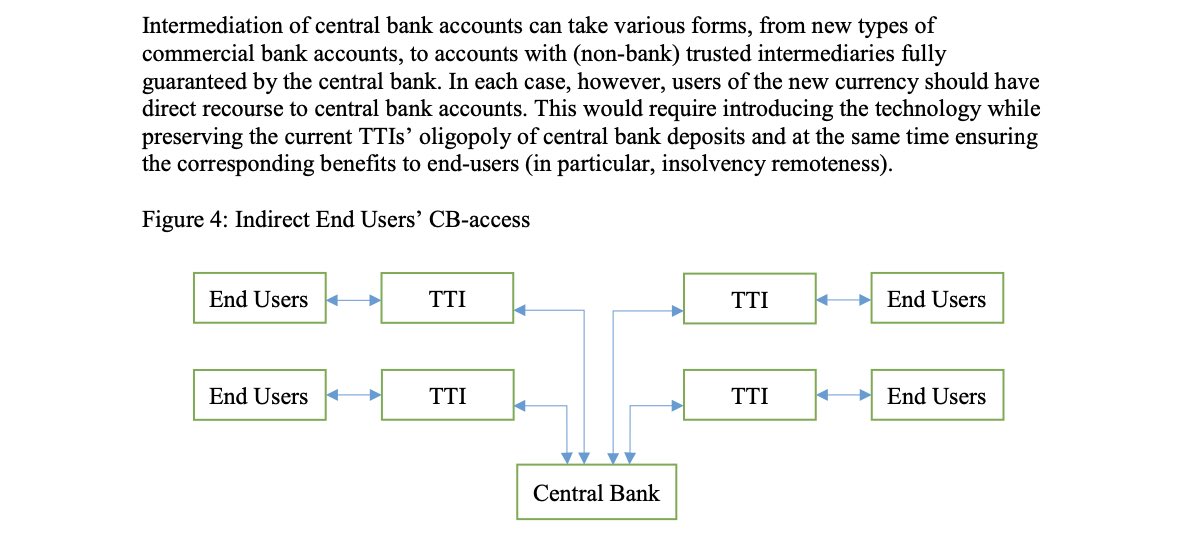

@EBI_EU Working Paper: After Libra, Digital Yuan and COVID-19: Central Bank Digital Currencies and the New World of Money and Payment Systems

Covering end user CB access and the status of Digital Currency projects.

PDF: poseidon01.ssrn.com/delivery.php?I…

#CBDC #DLT #Blockchain

Covering end user CB access and the status of Digital Currency projects.

PDF: poseidon01.ssrn.com/delivery.php?I…

#CBDC #DLT #Blockchain

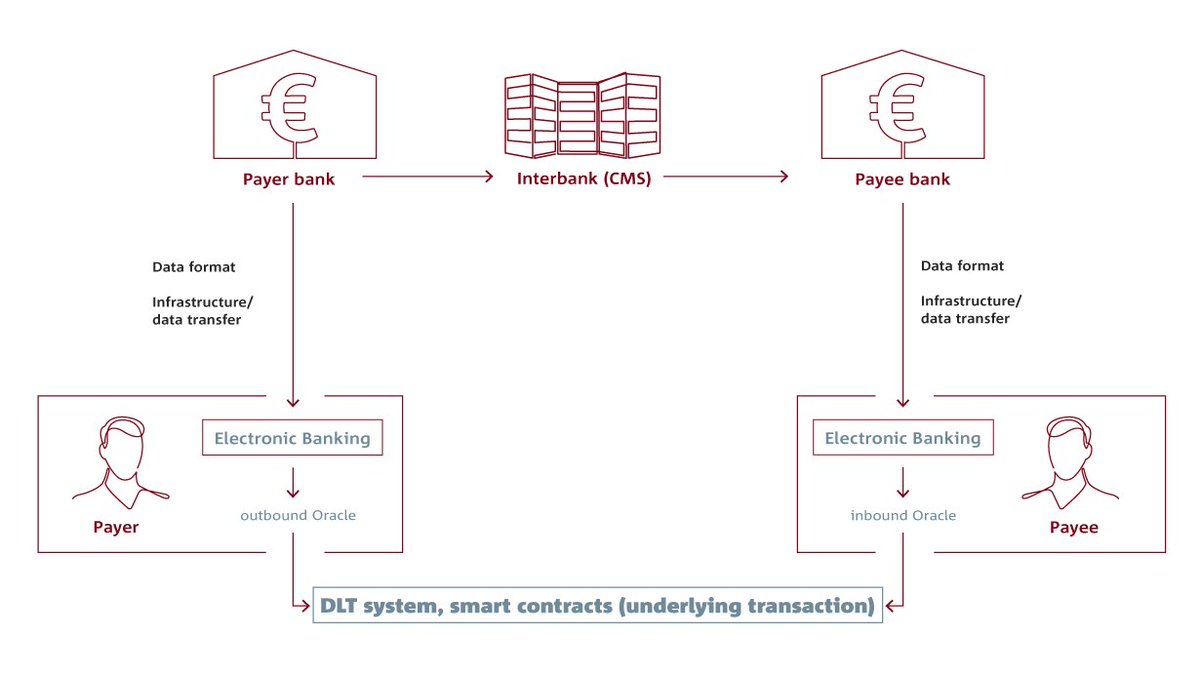

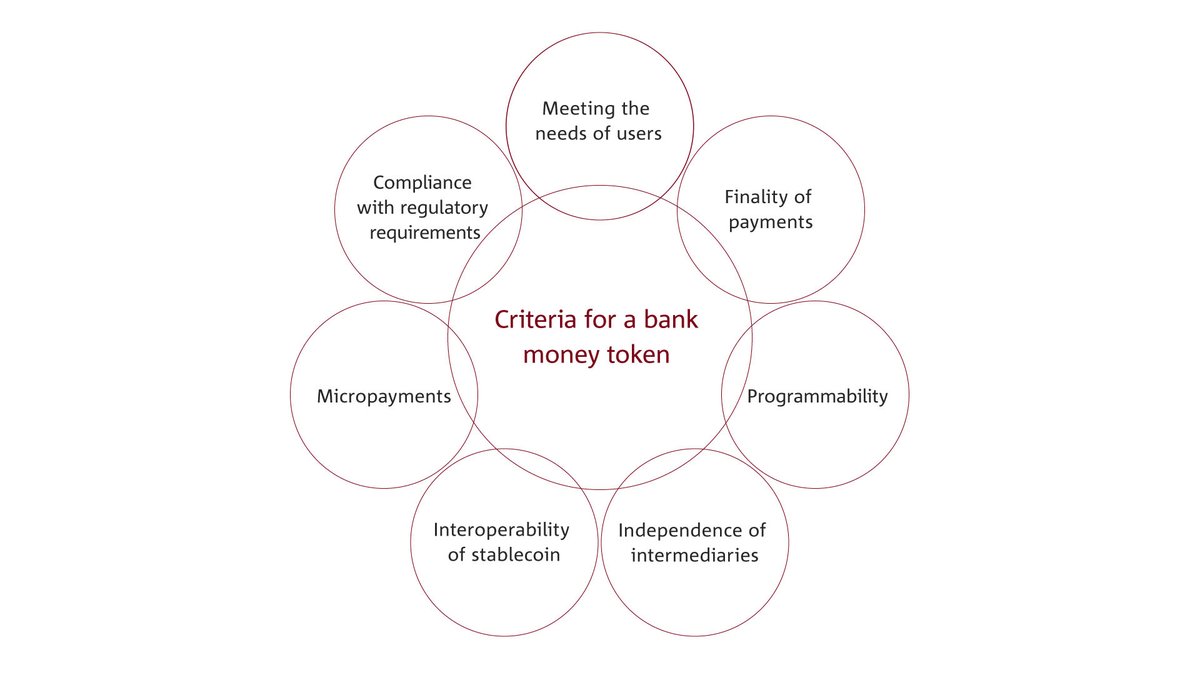

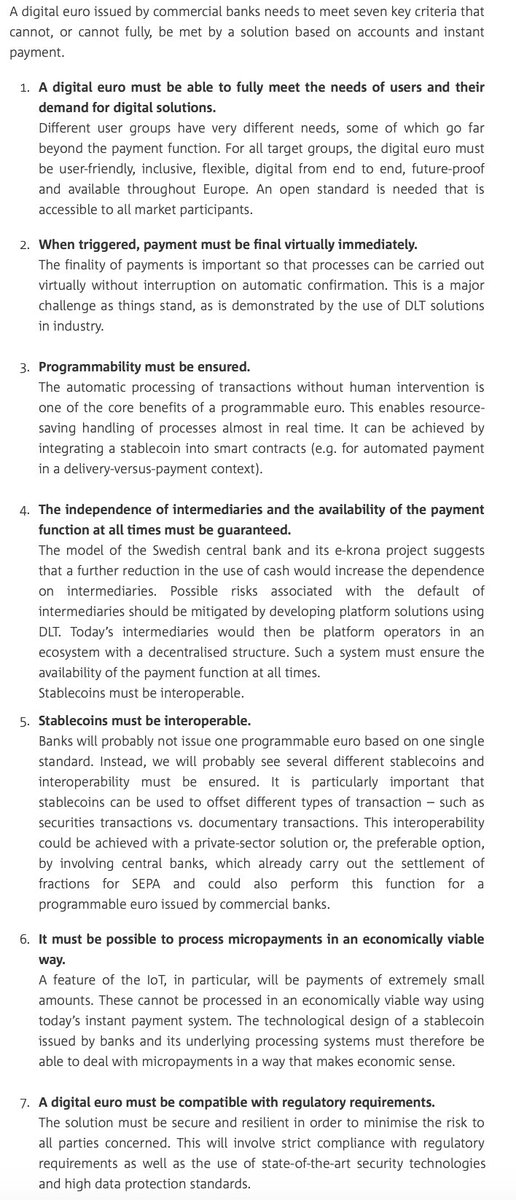

Europe’s answer to Libra – potential and prerequisites of a programmable euro by the Association of German Banks @bankenverband

en.bankenverband.de/newsroom/comme…

Highlighting interoperability: A digital euro issued by commercial banks needs to meet seven key criteria.

#CBDC #DLT

en.bankenverband.de/newsroom/comme…

Highlighting interoperability: A digital euro issued by commercial banks needs to meet seven key criteria.

#CBDC #DLT

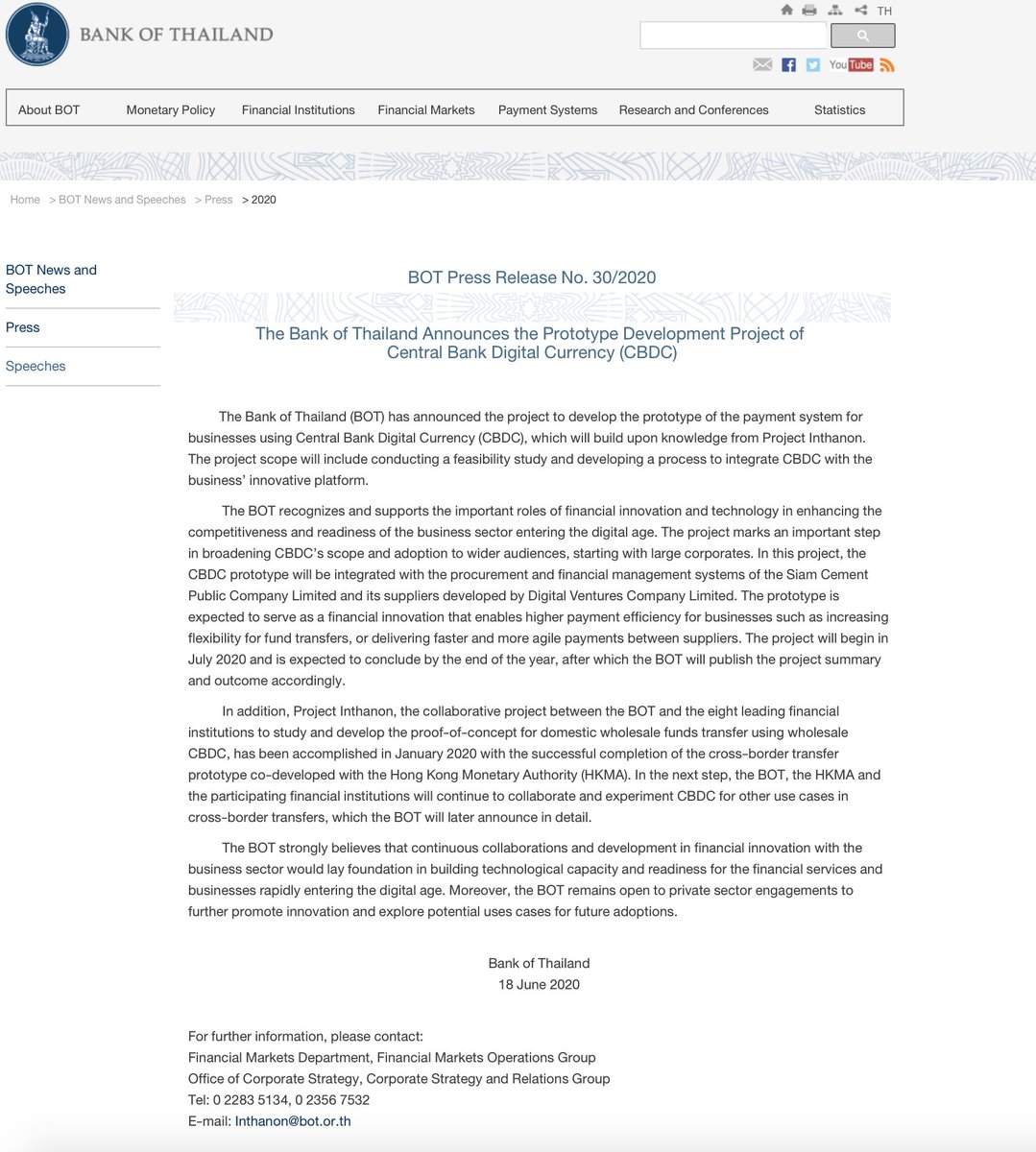

@bankofthailand announces the Prototype Development Project of

Central Bank Digital Currency (CBDC).

The project marks an important step in broadening CBDC’s scope and adoption to wider audiences, starting with large corporates.

bot.or.th/English/Pressa…

Central Bank Digital Currency (CBDC).

The project marks an important step in broadening CBDC’s scope and adoption to wider audiences, starting with large corporates.

bot.or.th/English/Pressa…

@bankofengland Staff Working Paper No. 879

Dollar shortages and central bank swap lines bankofengland.co.uk/-/media/boe/fi…

Dollar shortages and central bank swap lines bankofengland.co.uk/-/media/boe/fi…

From @IMFNews. @Harvard - Learn from the past dominance of GBP v USD. The IMF can have a radical role in the new multipolar international monetary world of CBDCs. imf.org/external/pubs/… #CBDC

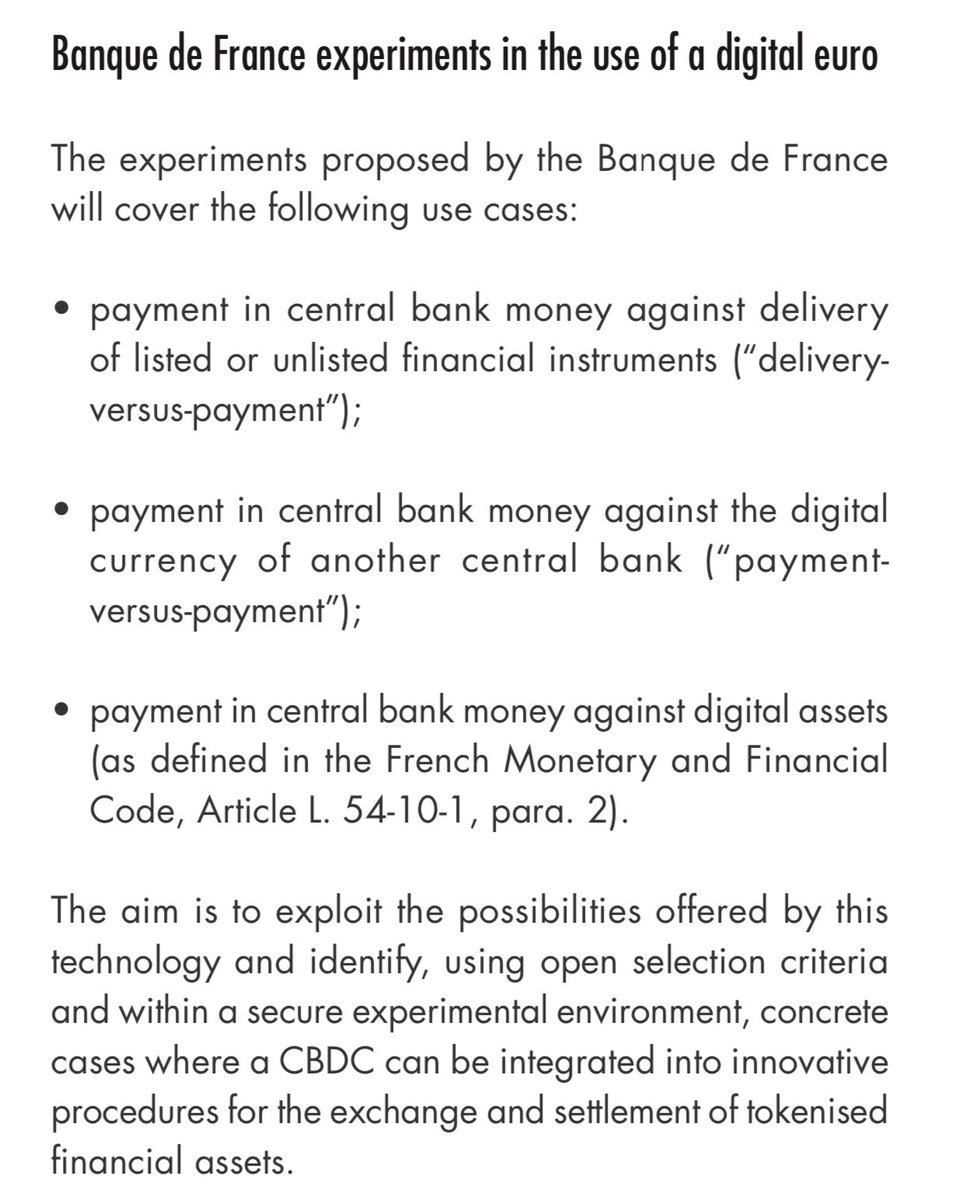

@banquedefrance CBDC use cases

- CBDC DvP

- CBDC PvP (Cross Border)

- CBDC v Digital Assets

PDF: banque-france.fr/sites/default/…

#CBDC

- CBDC DvP

- CBDC PvP (Cross Border)

- CBDC v Digital Assets

PDF: banque-france.fr/sites/default/…

#CBDC

@federalreserve Governor Lael Brainard provided a broad description of the Fed’s ongoing research and plans in the potential development of a U.S. central bank digital currency (CBDC)

forbes.com/sites/jasonbre…

Research by @MIT bostonfed.org/news-and-event…

The CBDC race is on!

forbes.com/sites/jasonbre…

Research by @MIT bostonfed.org/news-and-event…

The CBDC race is on!

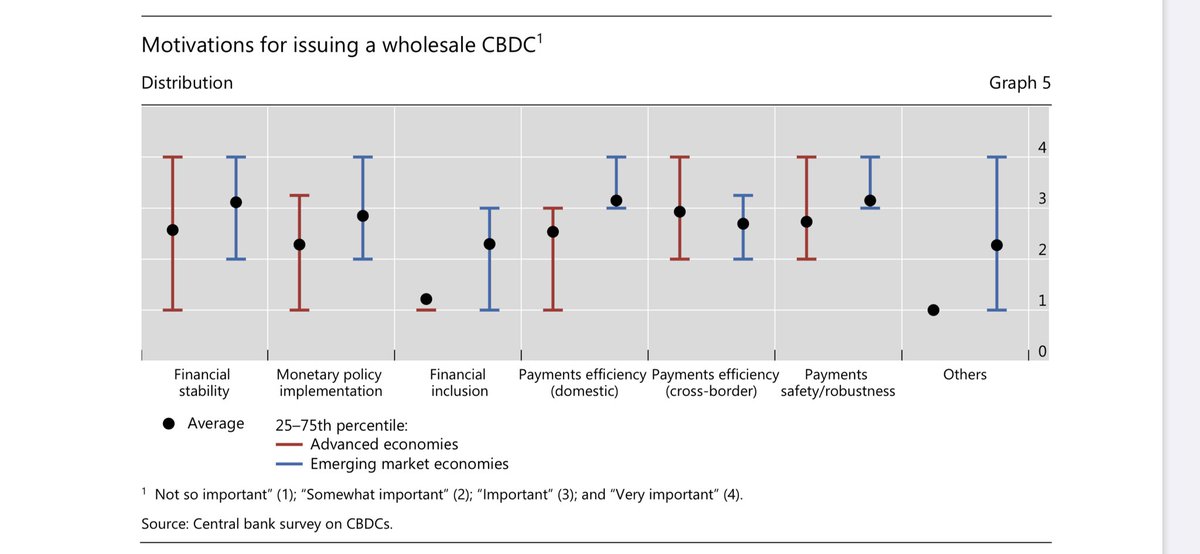

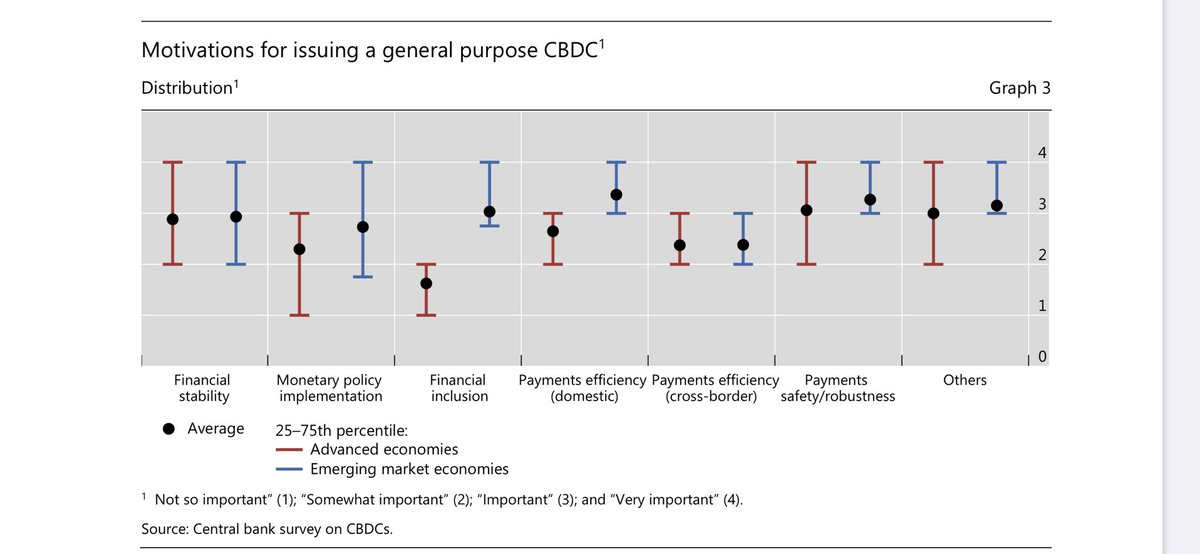

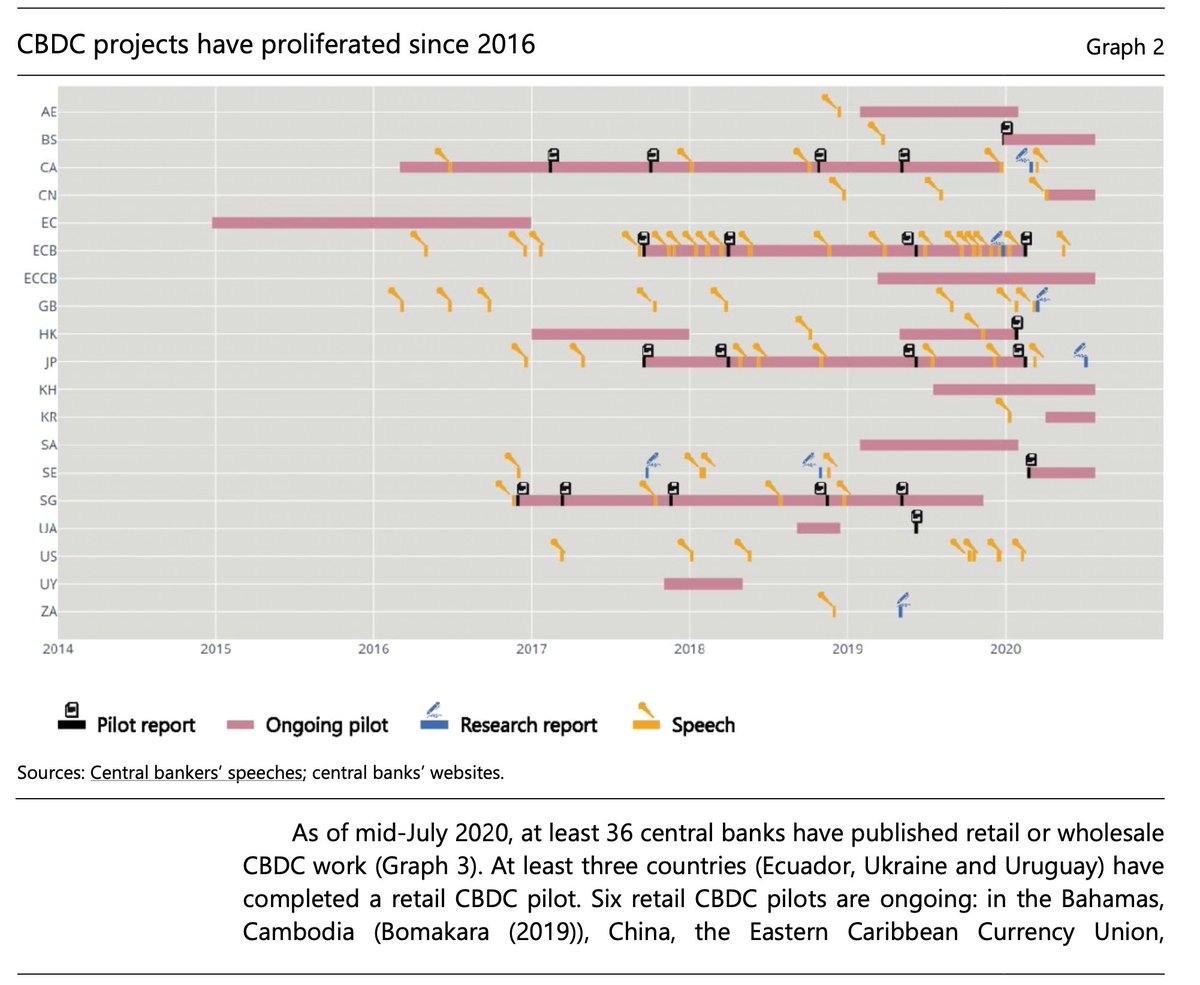

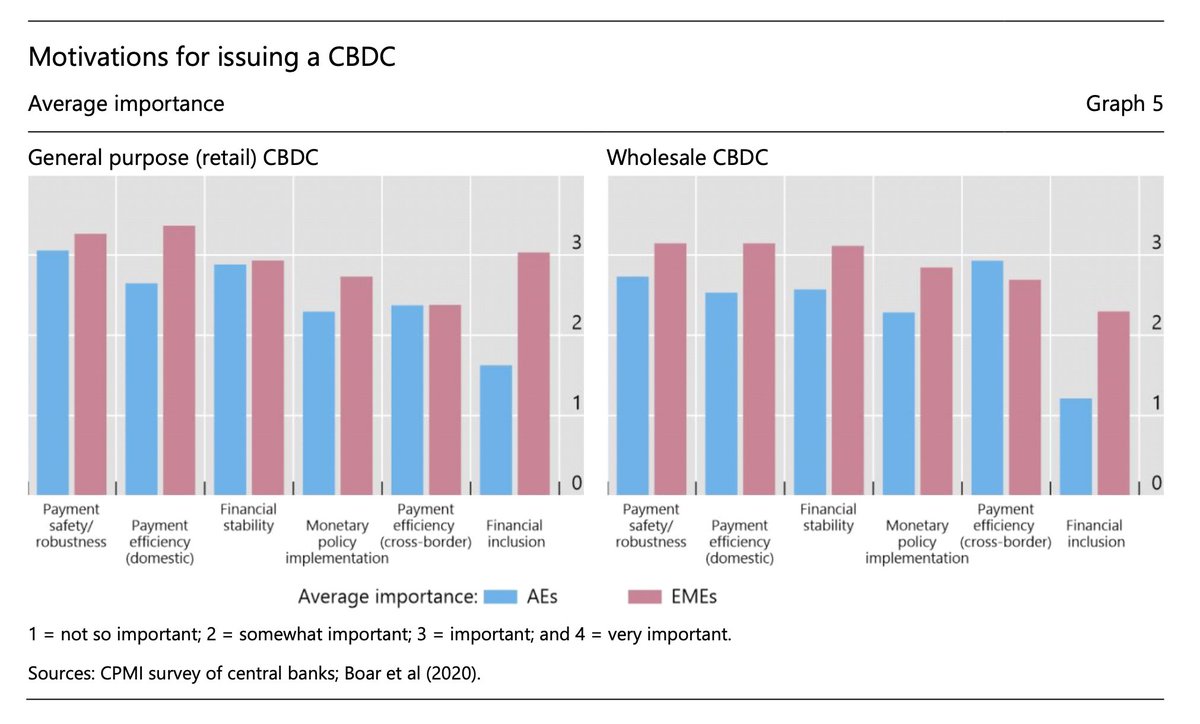

@BIS_org Working Papers No 880

Rise of the central bank digital currencies: drivers, approaches and technologies

Covering:

- Number of CBDC projects since 2016

- Motivations for issuing Retail & Wholesale CBDCs

PDF: bis.org/publ/work880.p…

#CBDC

Rise of the central bank digital currencies: drivers, approaches and technologies

Covering:

- Number of CBDC projects since 2016

- Motivations for issuing Retail & Wholesale CBDCs

PDF: bis.org/publ/work880.p…

#CBDC

@LSE_SRC, @uclcbt and @LSEnews publish new paper by @PaoloTasca Geoff Goodell and Hazem Danny Al-Nakib.

“Now is the time for action to undertake development of such a [CBDC] system” to help respond against system risks to the system.

systemicrisk.ac.uk/publications/s…

#CBDC

“Now is the time for action to undertake development of such a [CBDC] system” to help respond against system risks to the system.

systemicrisk.ac.uk/publications/s…

#CBDC

.@ecb Publishes Report on a digital Euro

Requirement 1: Enhanced Digital Efficiency - Digital Euro should be made available through standard interoperable front-end solutions.

Scenario 6: interoperable designs of CBDCs across currencies

PDF: ecb.europa.eu/pub/pdf/other/…

#CBDC

Requirement 1: Enhanced Digital Efficiency - Digital Euro should be made available through standard interoperable front-end solutions.

Scenario 6: interoperable designs of CBDCs across currencies

PDF: ecb.europa.eu/pub/pdf/other/…

#CBDC

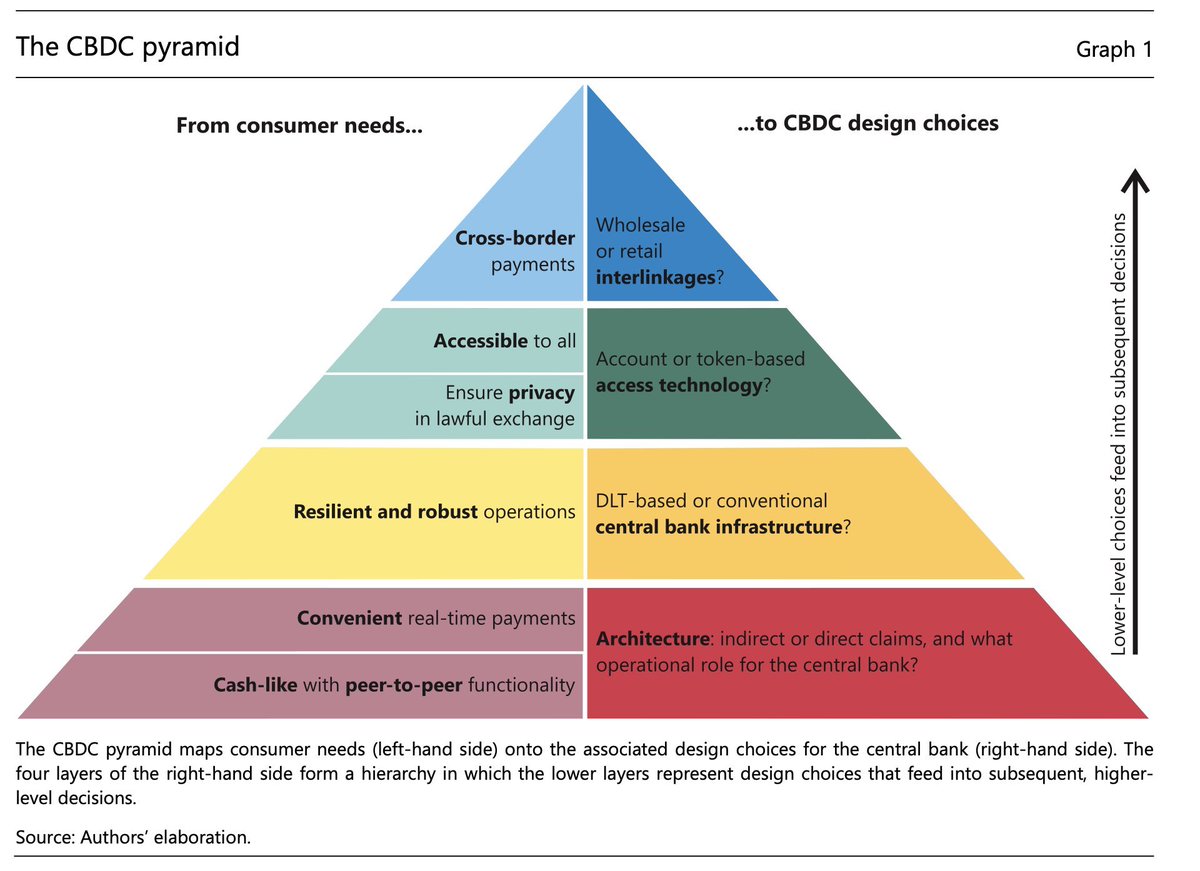

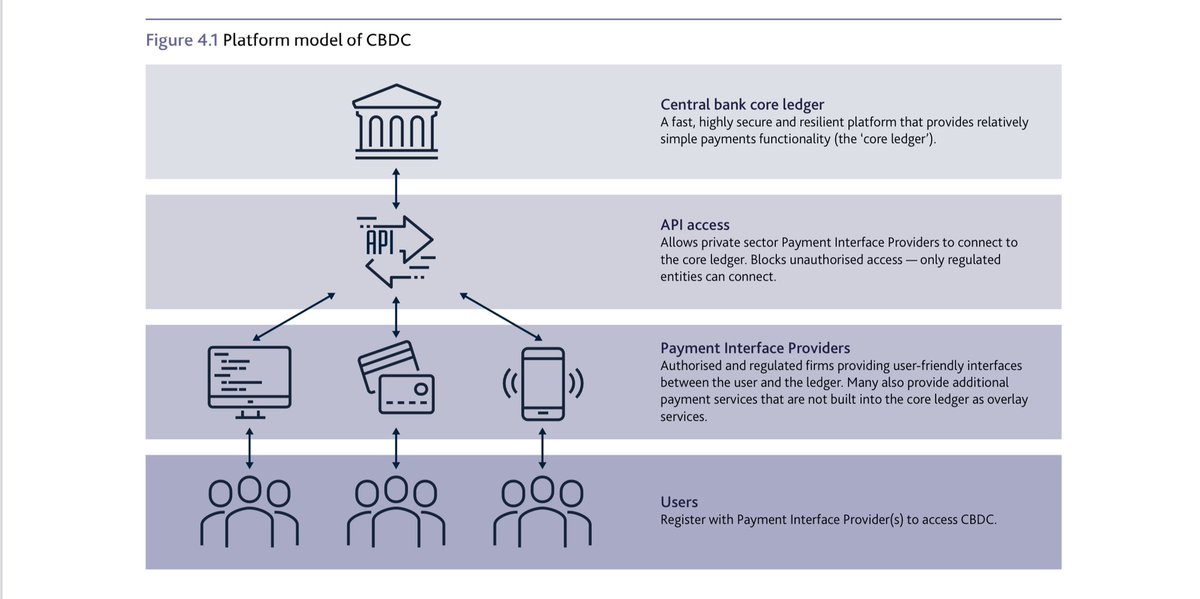

.@BIS_org Report Central bank digital currencies:

foundational principles and core features

Core Features:

Instrument Features: Convertible

System Features: Secure, Resilient and Interoperable

Institutional Features: Standards and legal framework

bis.org/publ/othp33.pdf

#CBDC

foundational principles and core features

Core Features:

Instrument Features: Convertible

System Features: Secure, Resilient and Interoperable

Institutional Features: Standards and legal framework

bis.org/publ/othp33.pdf

#CBDC

.@ecb “We need to make sure that our currency is fit for the future. Inaction is not an option.”

Fabio Panetta, ECB Executive Board Member ecb.europa.eu/euro/html/digi… #CBDC

Fabio Panetta, ECB Executive Board Member ecb.europa.eu/euro/html/digi… #CBDC

.@IMFNews Digital Money Across Borders: Macro-Financial Implications

CBDCs will help evolve the landscape for cross-border payments with new networks and means of payment. The current deposit-based system is not fit for purpose and needs reform.

imf.org/en/Publication…

#CBDC

CBDCs will help evolve the landscape for cross-border payments with new networks and means of payment. The current deposit-based system is not fit for purpose and needs reform.

imf.org/en/Publication…

#CBDC

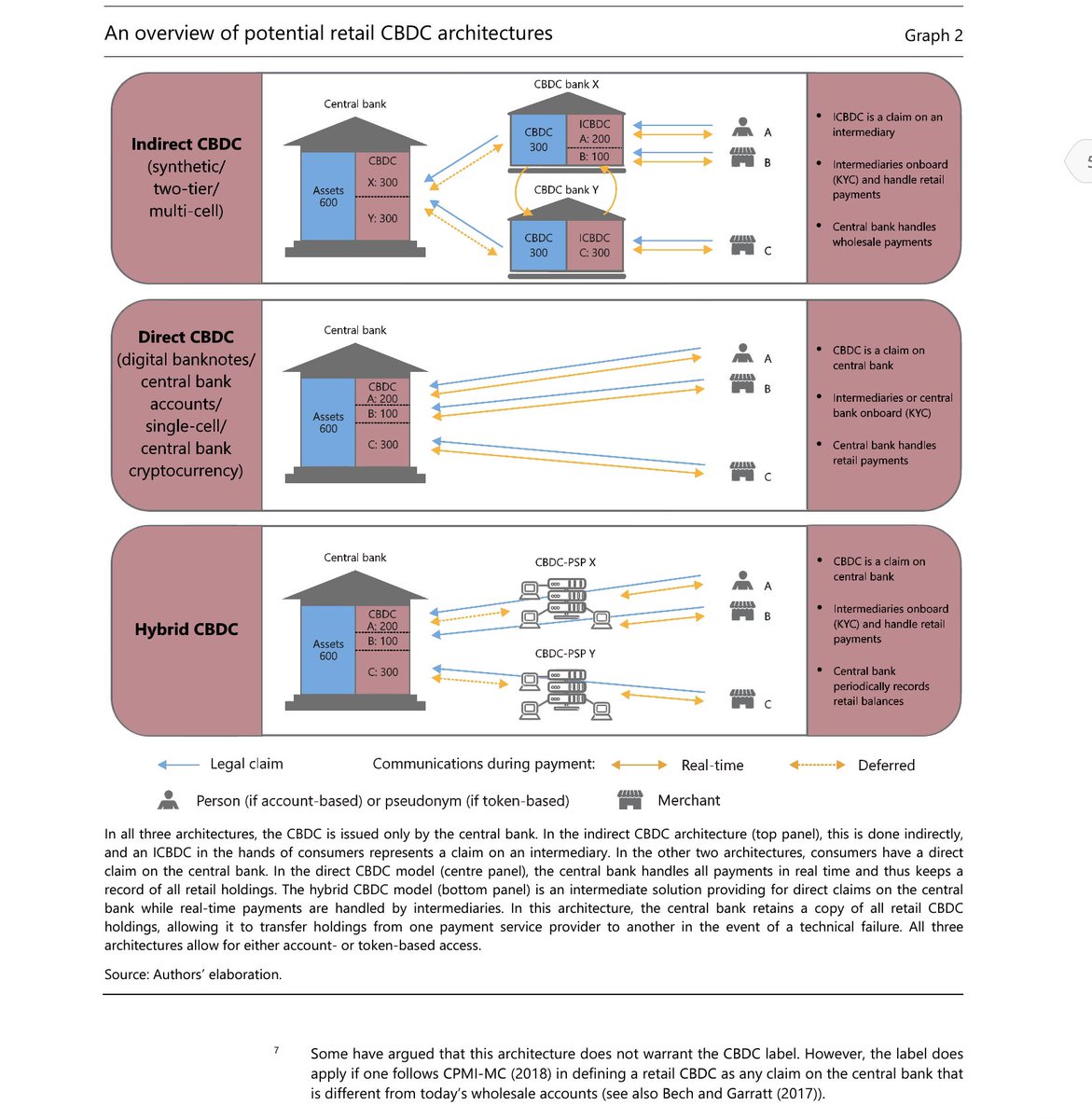

.@BIS_org CBDC architectures, the financial system, and the central bank of the future: voxeu.org/article/cbdc-a… #CBDC

.@bundesbank(German Central Bank) published a paper “Money in programmable applications” about how the programmable digital Euro is going to be used with smart contracts to automate processes, payments and have cyber resilience. bundesbank.de/resource/blob/… #CBDC

Switzerland’s Central Bank @SNB_BNS_it report “How to issue a central bank digital currency.” How to spend, deposit and withdraw CBDCs.

“Neither monetary policy nor financial stability would be materially affected because a CBDC…[will] replicate physical cash, not deposits”

“Neither monetary policy nor financial stability would be materially affected because a CBDC…[will] replicate physical cash, not deposits”

.@federalreserve Preconditions for a general-purpose central bank digital currency

"CBDC must be supported by robust technology that ensures its safety and efficiency. Lastly, market readiness is needed for widespread acceptance and adoption”

#CBDC #Interoperability

"CBDC must be supported by robust technology that ensures its safety and efficiency. Lastly, market readiness is needed for widespread acceptance and adoption”

#CBDC #Interoperability

.@BIS_org Interoperate, interlink, or integrate? Three different models for #mCBDC arrangements could help to improve #CrossBorderPayments #multiCBDC #CBDC

bis.org/publ/bppdf/bis…

bis.org/publ/bppdf/bis…

.@riksbanken E-Krona pilot Phase 1 report

DLTs can be used for CBDCs. More work is to be done on retail CBDCs. Good progress and way forward.

PDF: riksbank.se/globalassets/m…

#CBDC

DLTs can be used for CBDCs. More work is to be done on retail CBDCs. Good progress and way forward.

PDF: riksbank.se/globalassets/m…

#CBDC

.@BIS_org latest report from April 2021 on the #CBDC activities in Central Banks.

Dataset: bis.org/publ/work880_d…

Report: bis.org/publ/work880.h…

@RaphAuer

Dataset: bis.org/publ/work880_d…

Report: bis.org/publ/work880.h…

https://twitter.com/RaphAuer/status/1381540291363094532?s=20

@RaphAuer

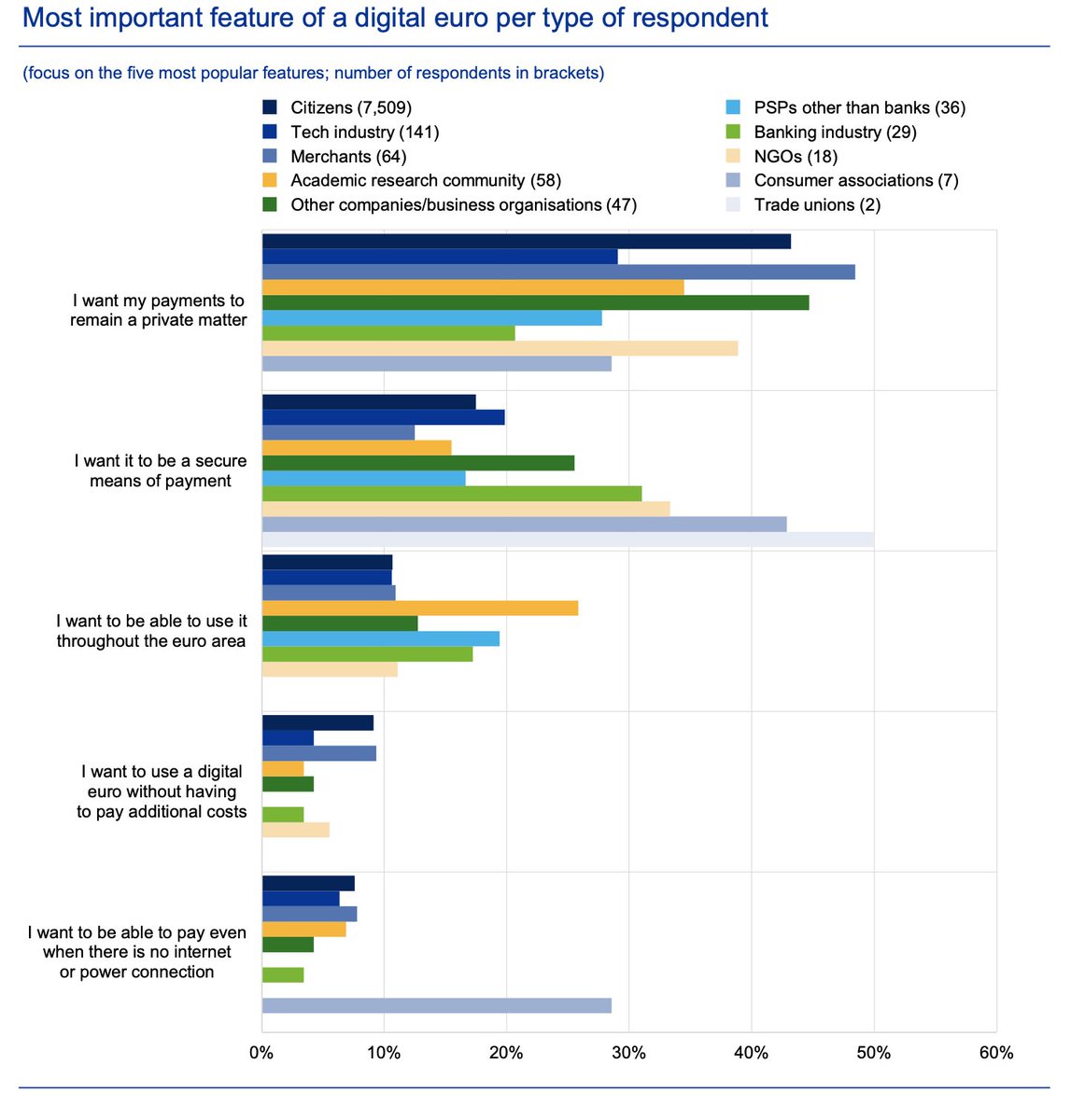

.@ecb #DigitalEuro consultation results published today. Citizens and businesses want:

- Privacy and Security

- Acceptance across EU

- Digital wallet transactions

- Interoperability for cross-border

PDF: ecb.europa.eu/pub/pdf/other/…

#SecureDigitalEuro #CBDC

- Privacy and Security

- Acceptance across EU

- Digital wallet transactions

- Interoperability for cross-border

PDF: ecb.europa.eu/pub/pdf/other/…

#SecureDigitalEuro #CBDC

@bankofengland statement on Central Bank Digital Currency

BoE and @hmtreasury have today announced the joint creation of a Central Bank Digital Currency (CBDC) Taskforce to coordinate the exploration of a potential UK CBDC.

bankofengland.co.uk/news/2021/apri…

BoE and @hmtreasury have today announced the joint creation of a Central Bank Digital Currency (CBDC) Taskforce to coordinate the exploration of a potential UK CBDC.

bankofengland.co.uk/news/2021/apri…

gov.uk/government/new…

•New FCA ‘scale box’ and Centre for Finance, Innovation and Technology to boost growth

•UK to lead digitisation of finance with CBDC taskforce and support for new technologies and infrastructures

•Additional plans for capital markets reform

#UKFW21

•New FCA ‘scale box’ and Centre for Finance, Innovation and Technology to boost growth

•UK to lead digitisation of finance with CBDC taskforce and support for new technologies and infrastructures

•Additional plans for capital markets reform

#UKFW21

.@SIA_pressoffice Whitepaper for a retail DLT-based CBDC

Covering the Money Ecosystem, CBDC Features, Architecture, Use cases, considerations and challenges.

sia.eu/en/media-event…

#CBDC

Covering the Money Ecosystem, CBDC Features, Architecture, Use cases, considerations and challenges.

sia.eu/en/media-event…

#CBDC

.@BIS_org Central bank digital currency: the quest for minimally invasive technology (Retail)

A CBDC should let central banks provide a universal means of payment for the digital era, while at the same time safeguarding consumer privacy.

PDF: bis.org/publ/work948.p…

#CBDC

A CBDC should let central banks provide a universal means of payment for the digital era, while at the same time safeguarding consumer privacy.

PDF: bis.org/publ/work948.p…

#CBDC

.@bankofengland Speech by Christina Segal-Knowles.

“Stablecoins. A new form of private money. Provide:

- faster, cheaper and more efficient payments with greater functionality.

- increase resilience

- long-term benefits for financial stability.”

bankofengland.co.uk/-/media/boe/fi… #CBDC

“Stablecoins. A new form of private money. Provide:

- faster, cheaper and more efficient payments with greater functionality.

- increase resilience

- long-term benefits for financial stability.”

bankofengland.co.uk/-/media/boe/fi… #CBDC

.@federalreserve and @Yale staff’s paper on Stablecoins.

Outlining the foundation for the USD CBDC backed by public money as opposed to private money, which shares similarities of the “Free Banking Era, the consequences of porous regulation”

Paper: poseidon01.ssrn.com/delivery.php?I… #CBDC

Outlining the foundation for the USD CBDC backed by public money as opposed to private money, which shares similarities of the “Free Banking Era, the consequences of porous regulation”

Paper: poseidon01.ssrn.com/delivery.php?I… #CBDC

.@BankofAmerica

Report:

“Digital Asset Primer in Brief: Only the first inning”

- CBDCs - when, not if

- Regulation is here

- Corporations aren't risking being left behind

- Interoperability is a challenge that needs a solution

rsch.baml.com/access?q=o1xIN…

#CBDC #Overledger #OVN

Report:

“Digital Asset Primer in Brief: Only the first inning”

- CBDCs - when, not if

- Regulation is here

- Corporations aren't risking being left behind

- Interoperability is a challenge that needs a solution

rsch.baml.com/access?q=o1xIN…

#CBDC #Overledger #OVN

.@hmtreasury report from @G7 CBDC principles:

- Stability

- Legal

- Privacy

- Resilience & Security

- Competition

- Illicit Finance

- Spillovers

- Energy

- Innovation

- Inclusion

- Payments

- Cross Border

- Int’l Dev

PDF: assets.publishing.service.gov.uk/government/upl…

#CBDC https://t.co/YPPPSzgh56

- Stability

- Legal

- Privacy

- Resilience & Security

- Competition

- Illicit Finance

- Spillovers

- Energy

- Innovation

- Inclusion

- Payments

- Cross Border

- Int’l Dev

https://twitter.com/hmtreasury/status/1448589590999281668?s=21

PDF: assets.publishing.service.gov.uk/government/upl…

#CBDC https://t.co/YPPPSzgh56

.@ecb Occasional Paper on CBDC scope, pricing and controls

- Private sector participants and innovation - eg Payment Service Provider (PSP)

- CBDCs will eventually play as a store of value and means of payments. A key challenge is to balance these.

PDF: ecb.europa.eu/pub/pdf/scpops…

- Private sector participants and innovation - eg Payment Service Provider (PSP)

- CBDCs will eventually play as a store of value and means of payments. A key challenge is to balance these.

PDF: ecb.europa.eu/pub/pdf/scpops…

Responses to the @bankofengland Discussion Paper on new forms of digital money: bankofengland.co.uk/paper/2022/res… #CBDC

Today @hmtreasury and @bankofengland released the consultation for a Digital Pound by 2030.

Our current form of "binary money" is no longer fit for purpose, able to meet business needs or cater for a digital society. We need smarter forms of money.

#CBDC

bbc.co.uk/news/technolog…

Our current form of "binary money" is no longer fit for purpose, able to meet business needs or cater for a digital society. We need smarter forms of money.

#CBDC

bbc.co.uk/news/technolog…

Smart Money provides:

- Roaming bank accounts like roaming mobile phones

- Programmability to automate complex business workflows

- Businesses and consumers the ability to add transaction rules when you pay -eg split payments, automate VAT

- Safe - 100% backed by the central bank

- Roaming bank accounts like roaming mobile phones

- Programmability to automate complex business workflows

- Businesses and consumers the ability to add transaction rules when you pay -eg split payments, automate VAT

- Safe - 100% backed by the central bank

• • •

Missing some Tweet in this thread? You can try to

force a refresh