India is cutting the corporate tax rate to 25.2% from 30%. This is to promote growth and investment.

India to allow local companies to pay income tax at 22% . The new effective rate on new manufacturing companies is 17.01%.

All part of the strategy to avoid the 5% growth trend

India to allow local companies to pay income tax at 22% . The new effective rate on new manufacturing companies is 17.01%.

All part of the strategy to avoid the 5% growth trend

Indonesia is planning to cut taxes to 20% from 25% starting 2021. Both Indonesia and India are slashing tax rates to be more competitive. This is in response to entice investors to come to those countries & also to stay. @Trinhnomics stated that US tax reform'll push for this too

👇🏻👇🏻👇🏻 #MakeinIndia #India

New domestic manufacturing companies incorporated after October 1, can pay income tax at a rate of 15%without any incentives.

Meaning, the effective tax rate for new manufacturing companies will be 17.01% inclusive of all surcharge and cess.

👏🏻👏🏻👏🏻

New domestic manufacturing companies incorporated after October 1, can pay income tax at a rate of 15%without any incentives.

Meaning, the effective tax rate for new manufacturing companies will be 17.01% inclusive of all surcharge and cess.

👏🏻👏🏻👏🏻

India is saying, come come QUICKLY!!! 🤗🤗🤗🇮🇳👏🏻🥁🤗

The Sensex is off the chart +3.4% today & since the news broke:

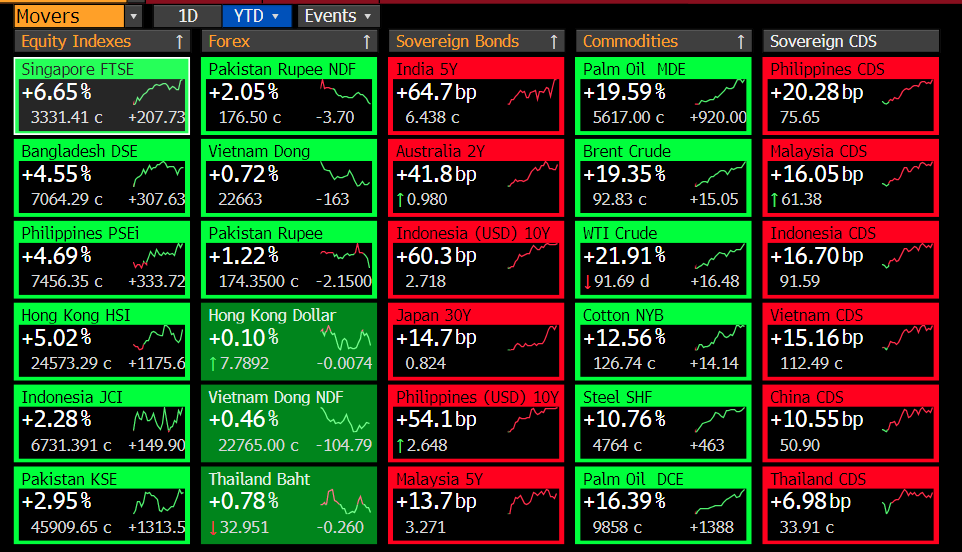

Equities RALLIED 👏🏻👏🏻👏🏻

Bonds FIZZLED (less revenue, more growth, etc so not good for bonds)

Equities RALLIED 👏🏻👏🏻👏🏻

Bonds FIZZLED (less revenue, more growth, etc so not good for bonds)

India decided that it is not going to be victims of trade-war but victors by putting targeted cut on manufacturing. The push by investors to diversify from higher wages and land, lower incentives, and now higher tariffs is finding a pull by the Indian government w/ the 15% tariff

This is a very targeted move by the Indian government and considered a very welcomed move by investors thirsting for diversification.

India is the only country comparable to China & its population will be #1 in the world in six years. That is a huge latent growth ingredient!!!

India is the only country comparable to China & its population will be #1 in the world in six years. That is a huge latent growth ingredient!!!

Just to clarify, the NOMINAL TAX CUTS ARE:

30% ✂️✂️✂️ to 22%

New manufacturing will be 15%.

But EFFECTIC tax rates of 30% to 22% is ~25% (with all the levies etc). The effective tax rate of new manufacturing is 17% (w/ other levies etc). This is about the same as Singapore!

30% ✂️✂️✂️ to 22%

New manufacturing will be 15%.

But EFFECTIC tax rates of 30% to 22% is ~25% (with all the levies etc). The effective tax rate of new manufacturing is 17% (w/ other levies etc). This is about the same as Singapore!

Should be EFFECTIVE not effectic. Wooops 🤦🏻♀️

This is a huge BIG BANG for India because it shows a commitment to PULL investors that it did not show before & the pace and scale of cut is a big signal for more to come.

Today is a big day. That is a big tax cut. India just slashed nominal tax by 8% & targeted manufacturing!!!

Today is a big day. That is a big tax cut. India just slashed nominal tax by 8% & targeted manufacturing!!!

@nsitharaman did a great job to awake the sleeping giant! She commented that she is working hard on fiscal measures to help growth regarding criticism on @Twitter on glacial pace of reform. Today she:

Lowered rates to 22% from 30%

Make a WELCOME TO INDIA SIGN w/ 15% manu rate👏🏻

Lowered rates to 22% from 30%

Make a WELCOME TO INDIA SIGN w/ 15% manu rate👏🏻

@nsitharaman @Twitter Have been leading the charge here regarding criticizing India's glacial pace of reform & potentially missed opportunity. And thank u! Excited to see more coming from India soon! India is the future but it needs to pave that road for itself w/ reforms & seems like it's doing it👏🏻!

@nsitharaman @Twitter Welcome to India 🇮🇳: Doors are open for investment. Come, come, quickly!!! Quickly!

Tax rates lower, esp for new manufacturing (only 15%) starting 1 October 2019!!!💥

🔥🔥🔥🇮🇳

Tax rates lower, esp for new manufacturing (only 15%) starting 1 October 2019!!!💥

🔥🔥🔥🇮🇳

@nsitharaman @Twitter Investors cheered this by pushing the Sensex off the chart at +6% - they are voting w/ their feet & they are buying!!!!👇🏻👇🏻👇🏻

• • •

Missing some Tweet in this thread? You can try to

force a refresh