Running [THREAD] of business frameworks w/ thoughts

#1-5: industries

#6-12: company strategy

#13-15: competitive advantages

Feel free to add any that I missed!

Thanks 😁

#1-5: industries

#6-12: company strategy

#13-15: competitive advantages

Feel free to add any that I missed!

Thanks 😁

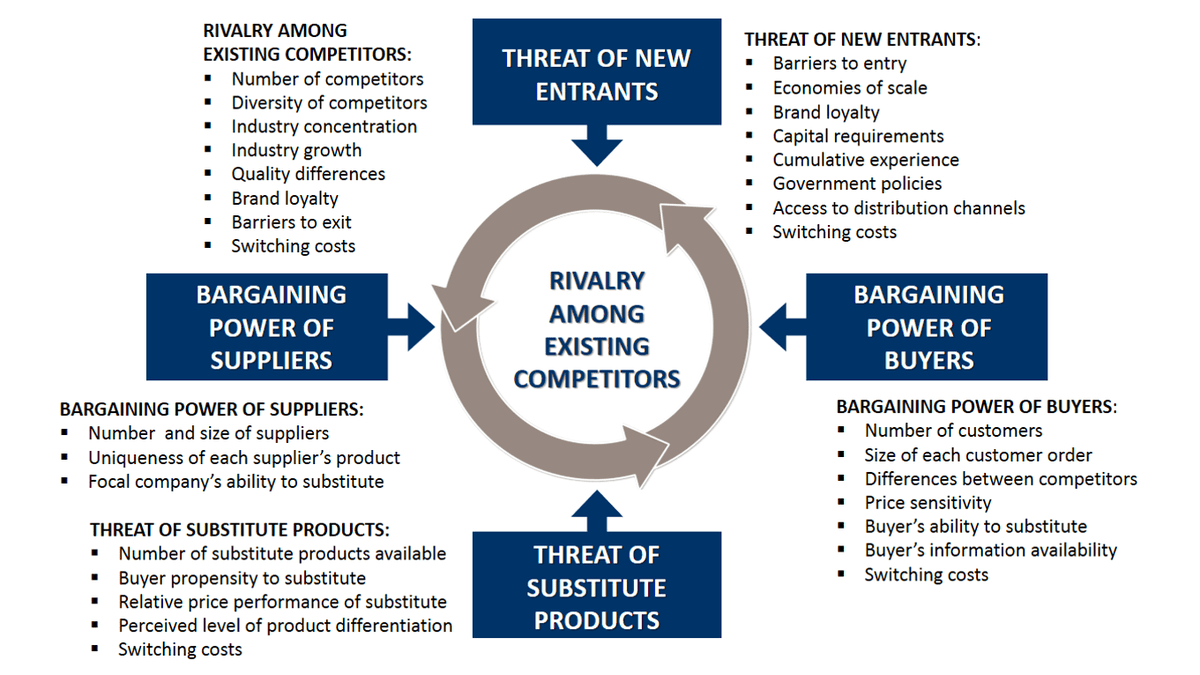

1/ The Classic Porter's 5 Forces

- All about numbers. If you have a lot of customers, you can leverage that against a fragmented supplier base.

- If you have small customer base w/ few suppliers, it's hard to have leverage.

- Same dynamic with # of companies competing w/ you

- All about numbers. If you have a lot of customers, you can leverage that against a fragmented supplier base.

- If you have small customer base w/ few suppliers, it's hard to have leverage.

- Same dynamic with # of companies competing w/ you

2/ Going off of that a little, we have @benthompson's Aggregation Theory.

3 parts to value chains: supplier, distributor, consumer.

If you can monopolize 1 of these or integrate 2, then you can create immense value.

3 parts to value chains: supplier, distributor, consumer.

If you can monopolize 1 of these or integrate 2, then you can create immense value.

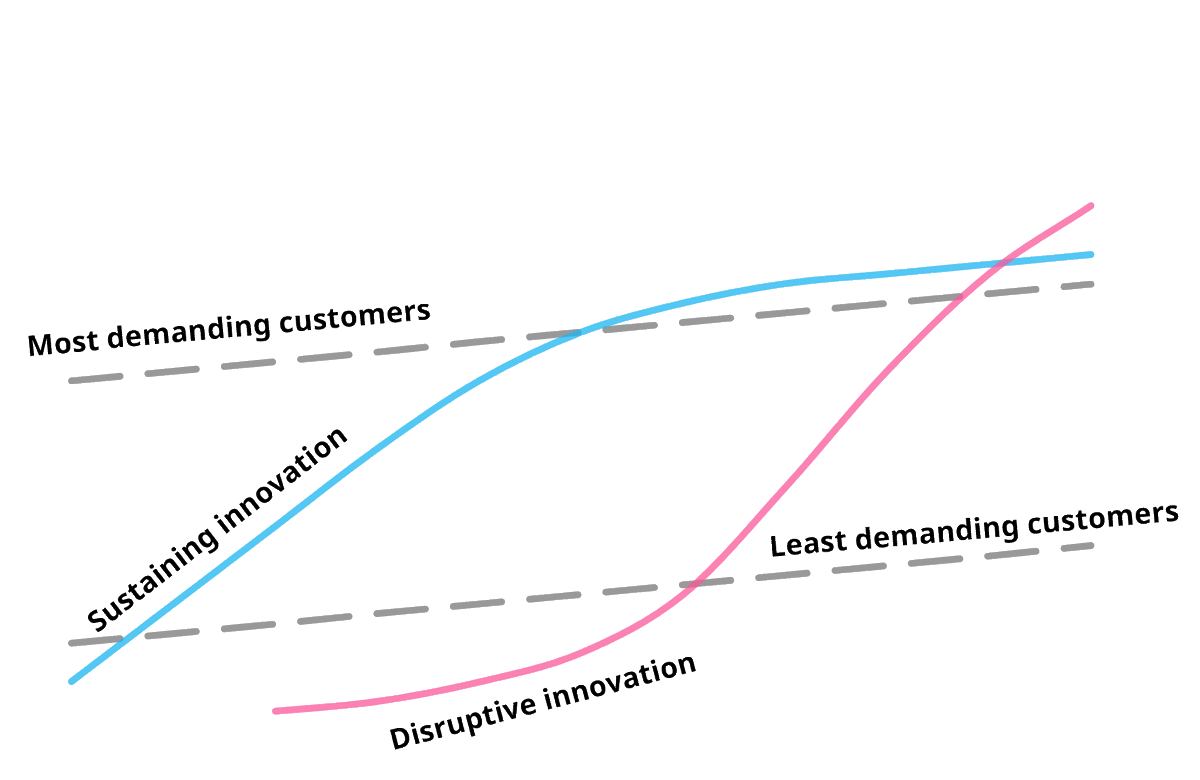

3/ Disruption Theory from Christensen

Disruptive companies come in from the bottom of a market so incumbents rationally don't move down-market.

2 types: low-end or new market disruption

Low-end: mini steel mills

New market: Netflix

Disruptive companies come in from the bottom of a market so incumbents rationally don't move down-market.

2 types: low-end or new market disruption

Low-end: mini steel mills

New market: Netflix

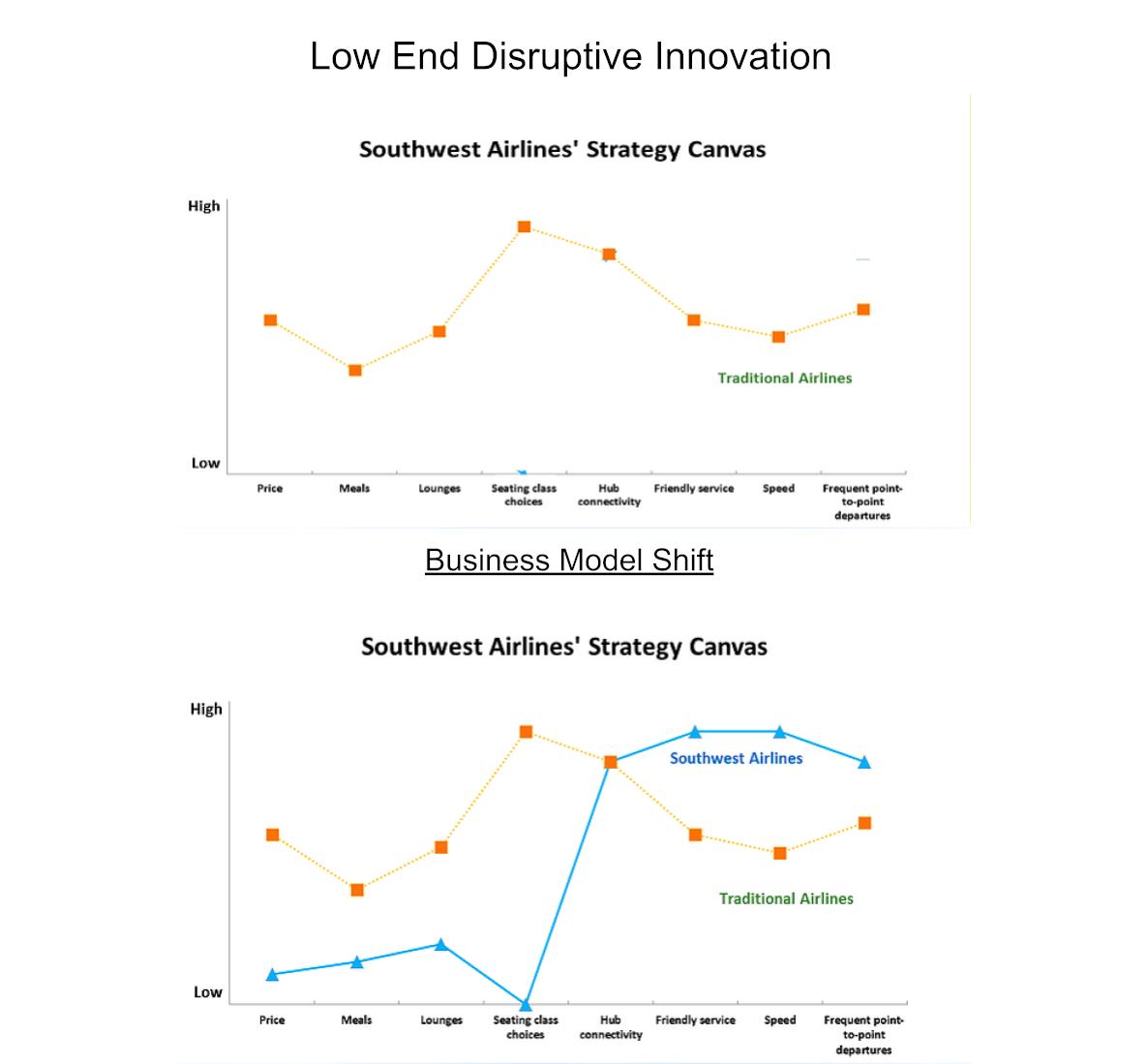

4/ Low-End Disruption

My own theory for why low-end disruption usually takes place:

business model shifts

Retailers, airlines, etc. Start with a fresh business model so they can structurally undercut incumbents.

My own theory for why low-end disruption usually takes place:

business model shifts

Retailers, airlines, etc. Start with a fresh business model so they can structurally undercut incumbents.

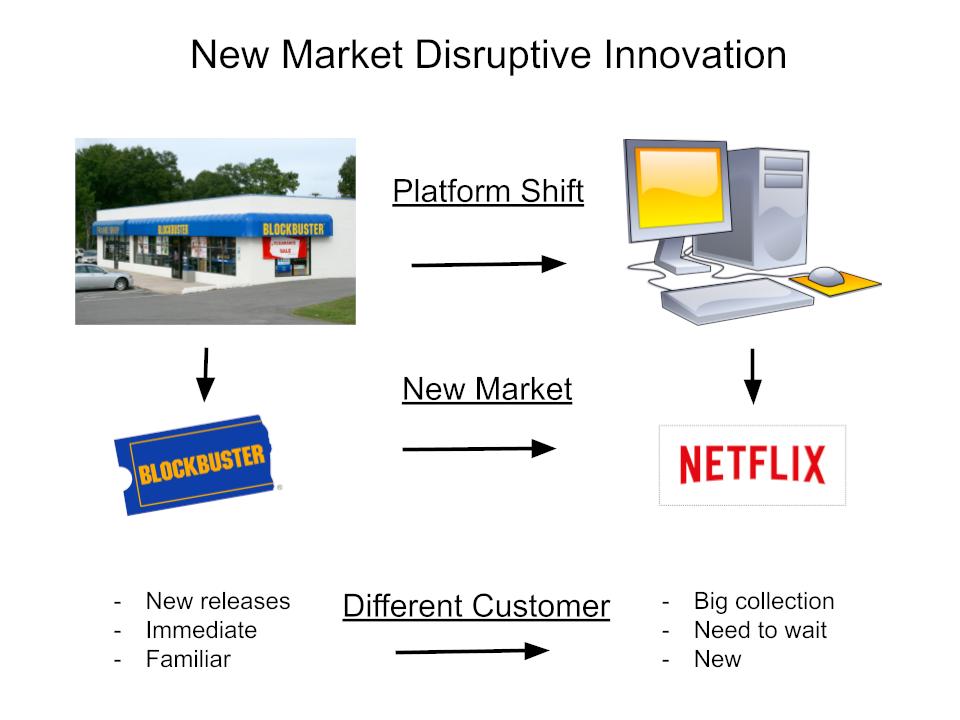

5/ New Market Disruption

My own theory for why new-market disruption usually takes place: platform shifts

New platforms enable companies to focus on specific vectors that create new markets. Then, as tech improves, the disruptor utilizes the new platform to move upmarket.

My own theory for why new-market disruption usually takes place: platform shifts

New platforms enable companies to focus on specific vectors that create new markets. Then, as tech improves, the disruptor utilizes the new platform to move upmarket.

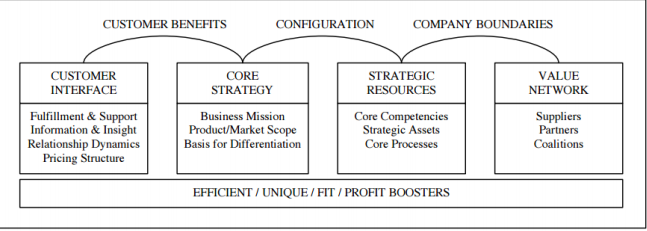

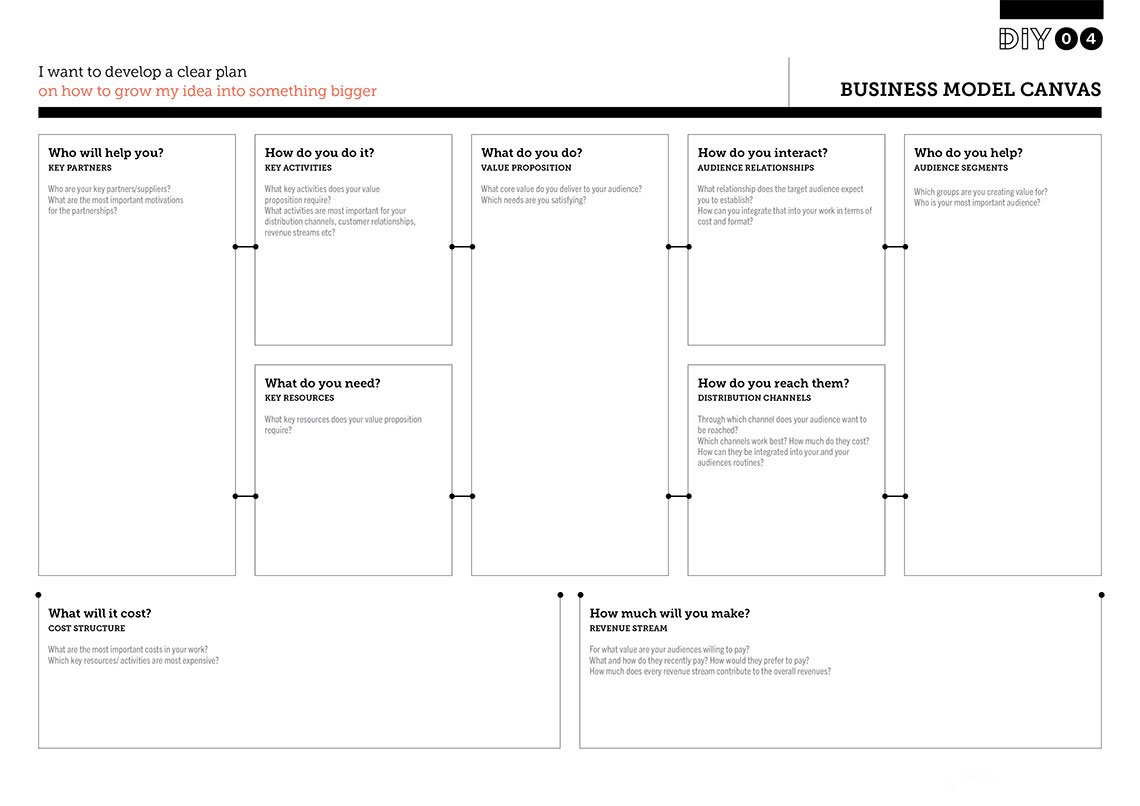

6/ Business Model Canvas

I interviewed @fourweekmba today and we talked about this.

Episode will be released on Monday.

1) Key partners

2) Key activities

3) Key resources

4) Value prop

5) Channels

6) Relationships

7) Segments

8) Cost structure

9) Sales

I interviewed @fourweekmba today and we talked about this.

Episode will be released on Monday.

1) Key partners

2) Key activities

3) Key resources

4) Value prop

5) Channels

6) Relationships

7) Segments

8) Cost structure

9) Sales

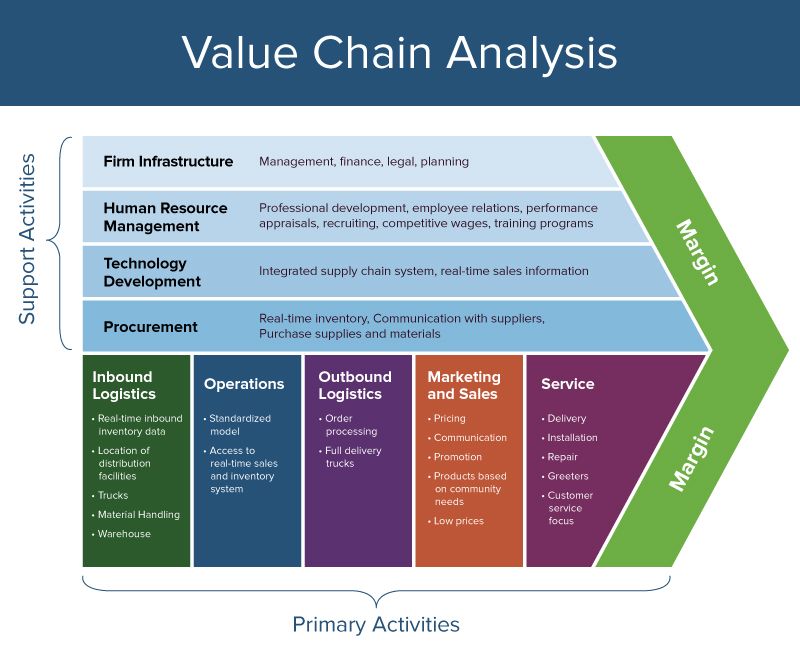

7/ Value Chain from Porter

Can be broken into the 3 parts Ben Thompson talks about: suppliers, distributors, consumers

The support activities involve suppliers (employees are suppliers of work)

Logistics & operations = distribution

S&M and service are consumer-facing

Can be broken into the 3 parts Ben Thompson talks about: suppliers, distributors, consumers

The support activities involve suppliers (employees are suppliers of work)

Logistics & operations = distribution

S&M and service are consumer-facing

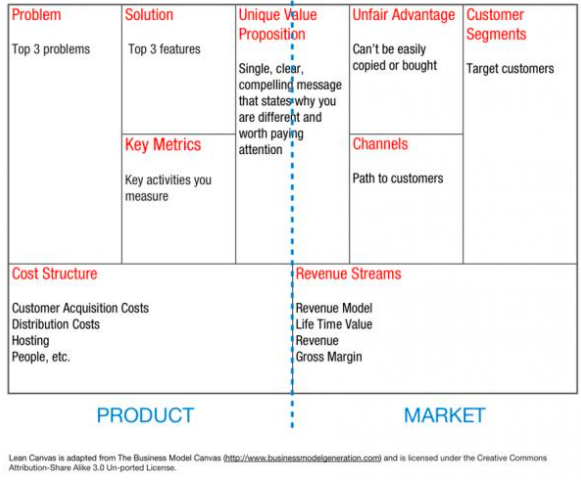

8/ Lean start-up canvas

This is geared toward entrepreneurs rather than business analysts

Differences:

1) problem vs. key partners

2) solution vs. key activities

3) key resources vs. key metrics

4) advantages vs. customer relationships

This is geared toward entrepreneurs rather than business analysts

Differences:

1) problem vs. key partners

2) solution vs. key activities

3) key resources vs. key metrics

4) advantages vs. customer relationships

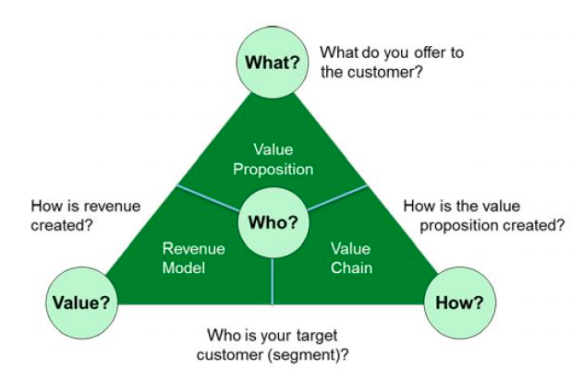

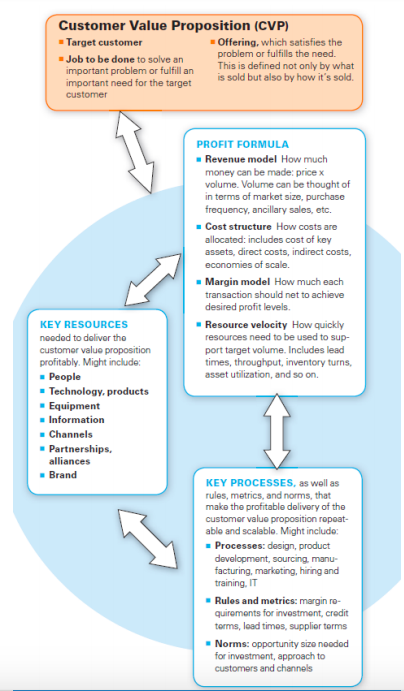

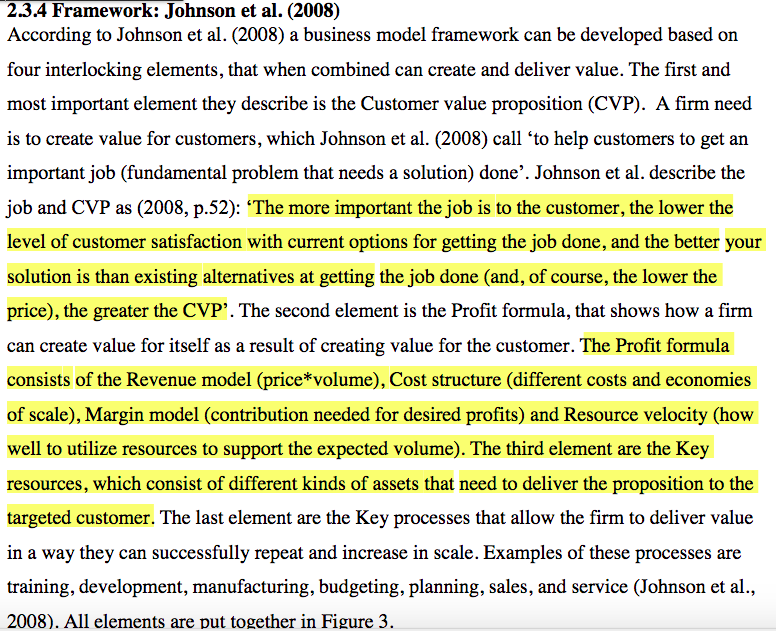

9/ Customer Value Prop framework (CVP)

I like this one a lot. Some more refinement from the business model canvas.

Note: #9-12 are found in this paper: essay.utwente.nl/70784/1/Aarntz…

I like this one a lot. Some more refinement from the business model canvas.

Note: #9-12 are found in this paper: essay.utwente.nl/70784/1/Aarntz…

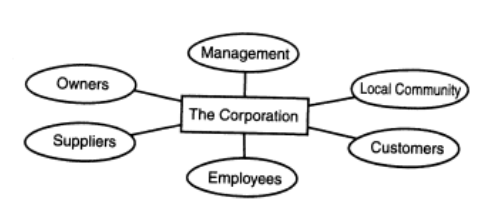

12/ Stakeholder Model of Cooperation

6 Key Parties

1) Employees

2) Customers

3) Management

4) Owners

5) Suppliers

6) Communities

Very difficult to balance all 6 parties

6 Key Parties

1) Employees

2) Customers

3) Management

4) Owners

5) Suppliers

6) Communities

Very difficult to balance all 6 parties

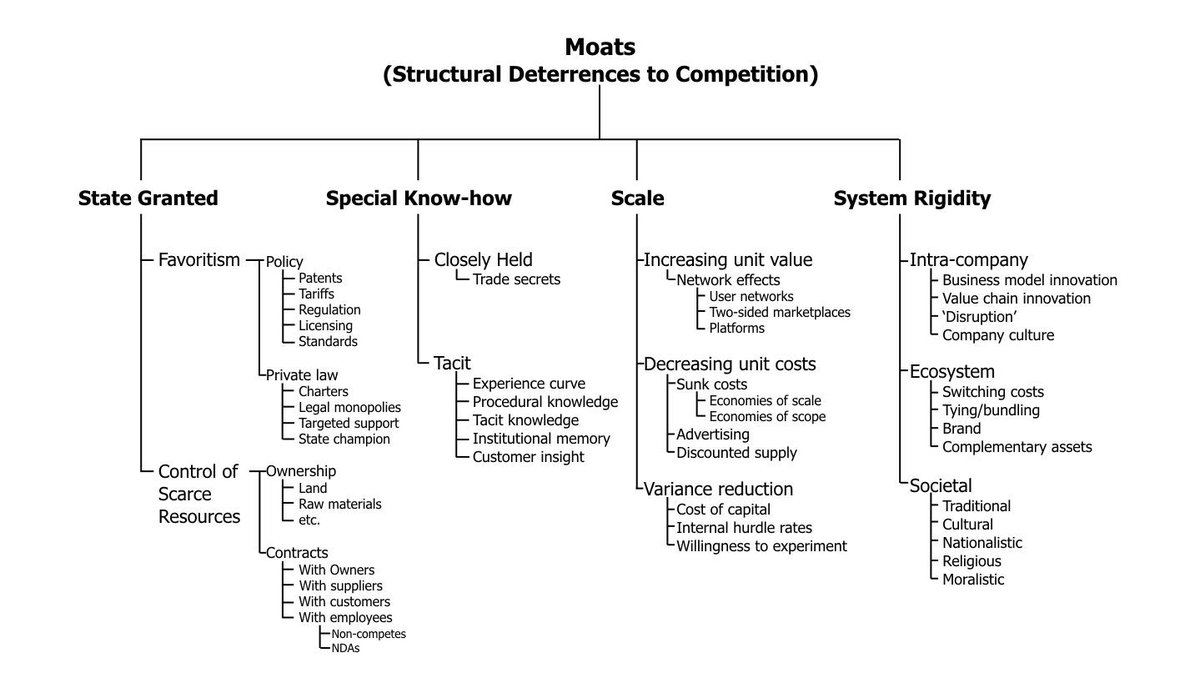

13/ This is @ganeumann's taxonomy of moats framework

The 4 S's

1) State

2) Special Know-How

3) Scale

4) System Rigidity

#13-15 are competitive advantage frameworks

The 4 S's

1) State

2) Special Know-How

3) Scale

4) System Rigidity

#13-15 are competitive advantage frameworks

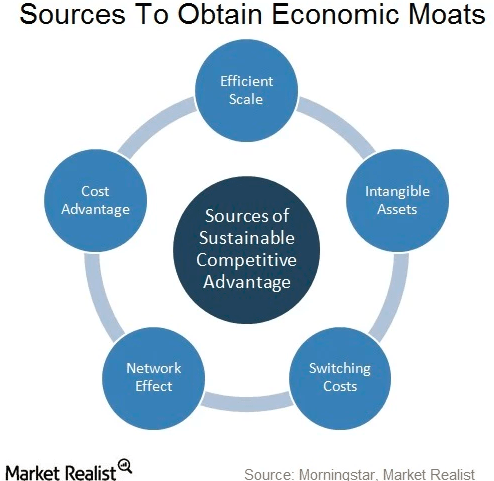

15/ Morningstar moat framework (@ToddWenning and Pat Dorsey, two people who think very clearly about moats both came from Morningstar)

1) Scale

2) Cost Advantage

3) Intangible Assets

4) Network Effects

5) Switching Costs

1) Scale

2) Cost Advantage

3) Intangible Assets

4) Network Effects

5) Switching Costs

@ToddWenning 16/ Fin!

Please add more frameworks if you have them!

Sources:

stratechery.com/2015/aggregati…

essay.utwente.nl/70784/1/Aarntz…

hbr.org/2015/12/what-i…

intrinsicinvesting.com/2018/04/11/evo…

reactionwheel.net/2019/09/a-taxo…

Please add more frameworks if you have them!

Sources:

stratechery.com/2015/aggregati…

essay.utwente.nl/70784/1/Aarntz…

hbr.org/2015/12/what-i…

intrinsicinvesting.com/2018/04/11/evo…

reactionwheel.net/2019/09/a-taxo…

• • •

Missing some Tweet in this thread? You can try to

force a refresh