1/ A friend asked me to summarize factor investing in a simple way. I didn't do a good job of it over lunch, so here's a (hopefully) better attempt.

Context: He's a typical retail investor, so what I say about advisors doesn't necessarily apply to the knowledgable Fintwit ones.

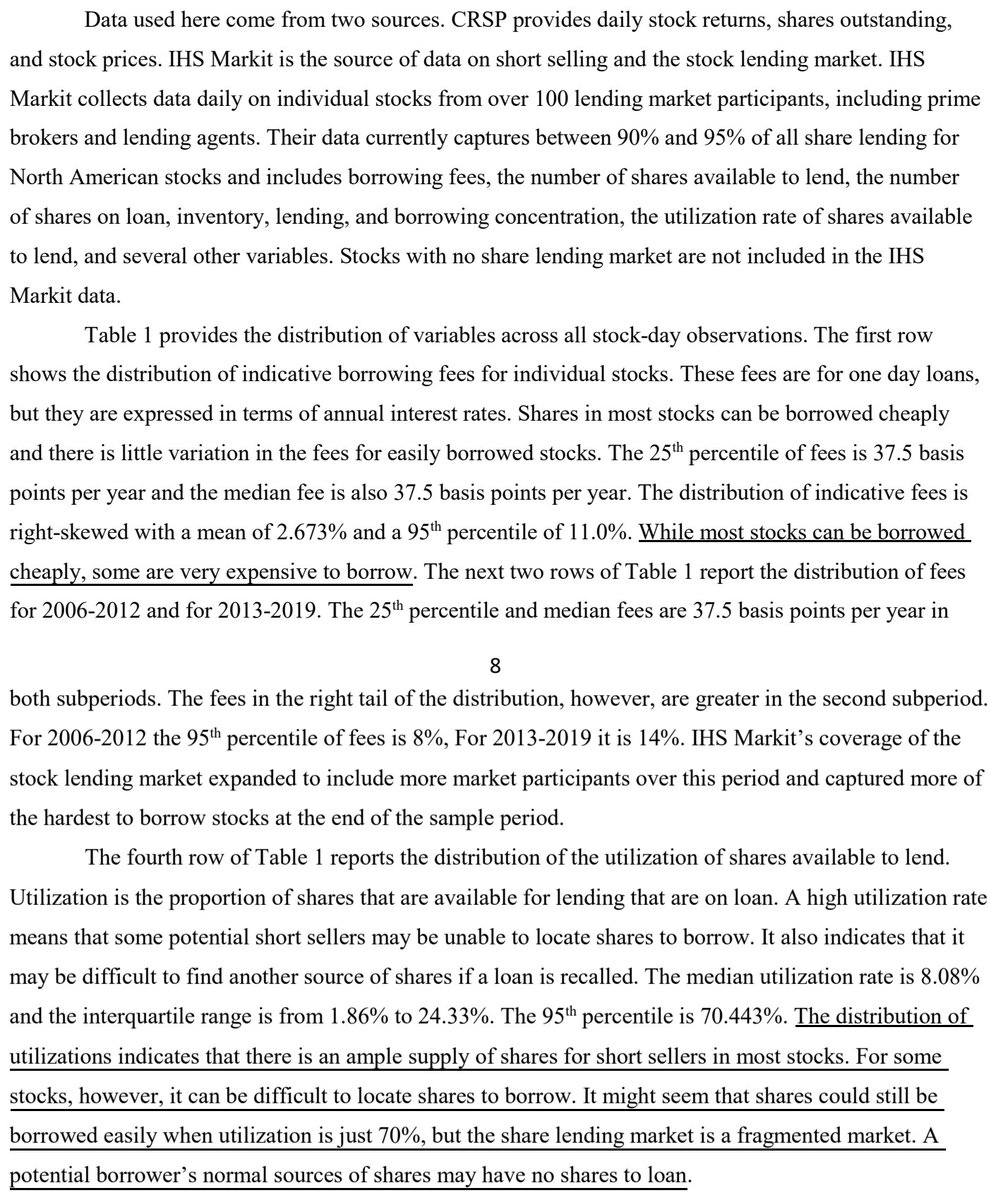

Context: He's a typical retail investor, so what I say about advisors doesn't necessarily apply to the knowledgable Fintwit ones.

2/ Financial professionals, generally speaking, do not do a good job of picking stocks. For example, financial advisors as a group don't add any value before fees, and they strongly underperform index funds after fees:

https://twitter.com/ReformedTrader/status/1122643718631092224

3/ But randomly picking stocks beats index funds (because indexes like the S&P 500 are badly constructed). So it's not that it's impossible to beat the market, it's just that most financial advisors aren't very good at building portfolios.

https://twitter.com/ReformedTrader/status/1122644037368815622

4/ To me, this comes down to an issue of honesty. Are advisors saying that they are charging % of AUM to save you time, or are they saying that they have in-depth knowledge that will make you money?

In order to outperform, it seems important do independent research.

In order to outperform, it seems important do independent research.

5/ Another example: stock analysts forecast in the wrong direction. Stocks with "buy" recs perform worse than those with "sell" recs.

I tested a strategy that buys the "sells" and short the "buys," and it has made money over the past fifteen years.

I tested a strategy that buys the "sells" and short the "buys," and it has made money over the past fifteen years.

https://twitter.com/ReformedTrader/status/1182308282062393346

6/ This provides a clue regarding what actually does make money in markets: a trader has to develop strategies that exploit the behavioral mistakes that other investors, including professional analysts, make as a group.

https://twitter.com/ReformedTrader/status/1163209969577017344

7/ We can look at diversifying into asset classes strategies besides just stocks and bonds. With that diversification comes more predictable performance, and if higher raw performance is desired, leverage can be used.

8/ Most people have the majority of their risk in the stock market ("Beta"), which does not provide very consistent performance. The stock market has an 24% chance of negative returns over a typical 3-year period.

(Caveat: normally distributed returns)

(Caveat: normally distributed returns)

https://twitter.com/ReformedTrader/status/1061019257696178176

9/ If we add size (long small companies and short big), value (long cheap companies and short expensive), momentum (long stocks that are up and short the down), and quality (long safe stocks and short risky), the odds of negative returns over three years drops from 24% to 2%...

10/ a twelve-fold improvement in performance consistency. All of that comes from diversification.

The table does not include the additional diversification available from adding bonds, precious metals, agricultural commodities, and energy-related commodities.

The table does not include the additional diversification available from adding bonds, precious metals, agricultural commodities, and energy-related commodities.

11/ It also doesn't add other strategies that have been shown to work, such as trend following, carry, and sentiment. (Trading against analyst recommendations, something I mentioned earlier, is an example of profiting from market sentiment.)

12/ Now, instead of diversifying into lots of strategies, let's take only two (value and momentum) but in lots of asset classes: stocks and bonds in every country, currencies, precious metals, agriculture and energy futures.

We see a similar consistency:

We see a similar consistency:

https://twitter.com/ReformedTrader/status/1190266505620910080

13/ There's no reason we couldn't combine use all of the strategies and asset classes simulaneously (and we should). The idea is to get massive amounts of diversification so that any risk from the U.S. stock market is only a tiny portion of the overall risk of the portfolio.

14/ Both the up *and* down moves of the portfolio will be more predictable than that of the S&P 500.

But when the stock market is up a lot (2017), consistency-seeking strategies are going to look bad because they are purposefully designed to have moves that are less "crazy"...

But when the stock market is up a lot (2017), consistency-seeking strategies are going to look bad because they are purposefully designed to have moves that are less "crazy"...

15/ than that of the stock market itself.

(We can use leverage to make the strategy as volatile as the stock market, but the strategy is still going to have its ups and downs at different times than the stock market does.)

(We can use leverage to make the strategy as volatile as the stock market, but the strategy is still going to have its ups and downs at different times than the stock market does.)

16/ Most investors find this nearly impossible to stick with because their eyes are glued to the S&P 500, and they can't stand those years when the S&P 500 is up a lot but these strategies aren't.

17/ Only investors who have looked carefully at the research can force themselves to hang on to a "weird" strategy like this and not give up when the S&P 500 is having a monster year.

This may even explain why randomly picking stocks works: because it doesn't work all the time.

This may even explain why randomly picking stocks works: because it doesn't work all the time.

• • •

Missing some Tweet in this thread? You can try to

force a refresh