#OptionTrading #tradingsignals #Nifty50 #BankNifty

This is a two part post on how trading psychology and direction bias affects #Intraday and #Positional trader.

I was bearish with:

1. Tight range of bearish position for extra hedging.

2. Stoploss at 12320.

1/n

This is a two part post on how trading psychology and direction bias affects #Intraday and #Positional trader.

I was bearish with:

1. Tight range of bearish position for extra hedging.

2. Stoploss at 12320.

1/n

I could have easily managed the position of 12350, 12400 Spread without loss, but lately I found hitting a stop loss much better than managing a position. Minor loss then gives higher probability trade. 2/n

Second, this is why carrying two mindset is practically troublesome (Intraday and Positional).

I was bearish, so I was comfortable doing 12300 Put which I bought at 36 and exit at 44. Although second lot was to trail which stopped out at 41. See traded area in rectangle. 3/n

I was bearish, so I was comfortable doing 12300 Put which I bought at 36 and exit at 44. Although second lot was to trail which stopped out at 41. See traded area in rectangle. 3/n

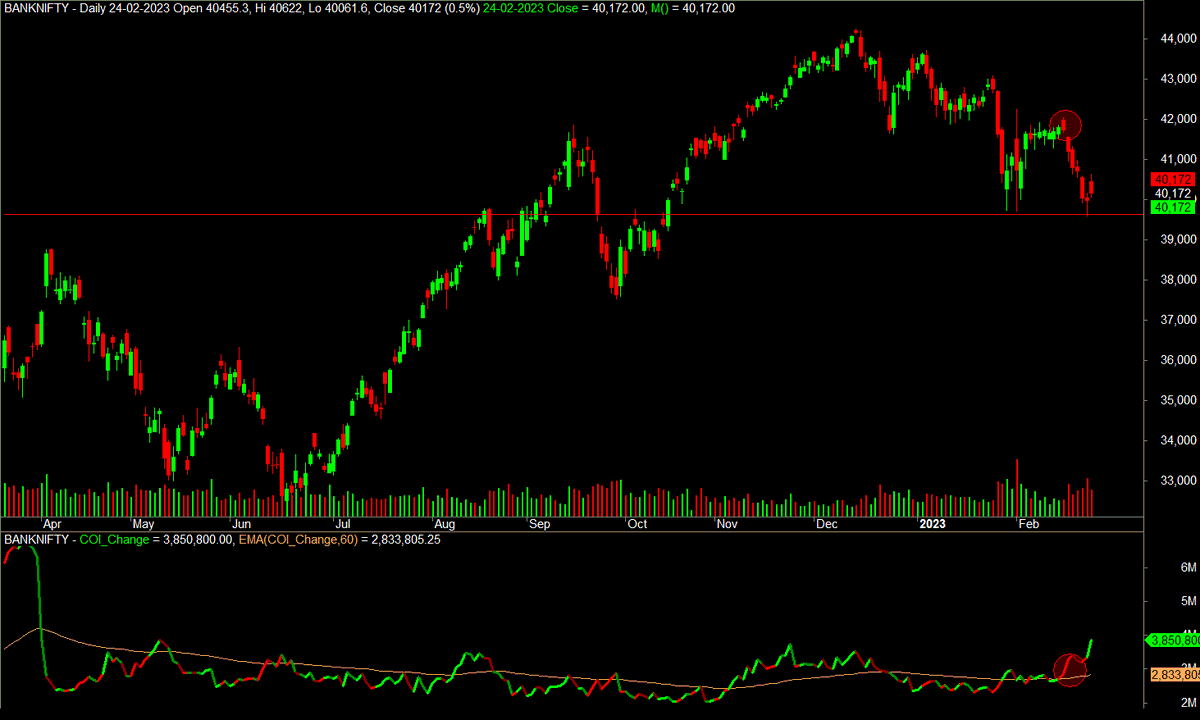

The same system of mine triggered a buy on 12300 CE also. See the pic. Circle would have been the stoploss. But since on daily charts, I found weakness, I did not execute this trade because all the time I was praying for market to fall because I had slight bearish positions. 4/n

That is why it is difficult to trade with two mindsets. If one adds investment into it or add another instruments like stock options, things get a lot difficult to manage mentally.

• • •

Missing some Tweet in this thread? You can try to

force a refresh