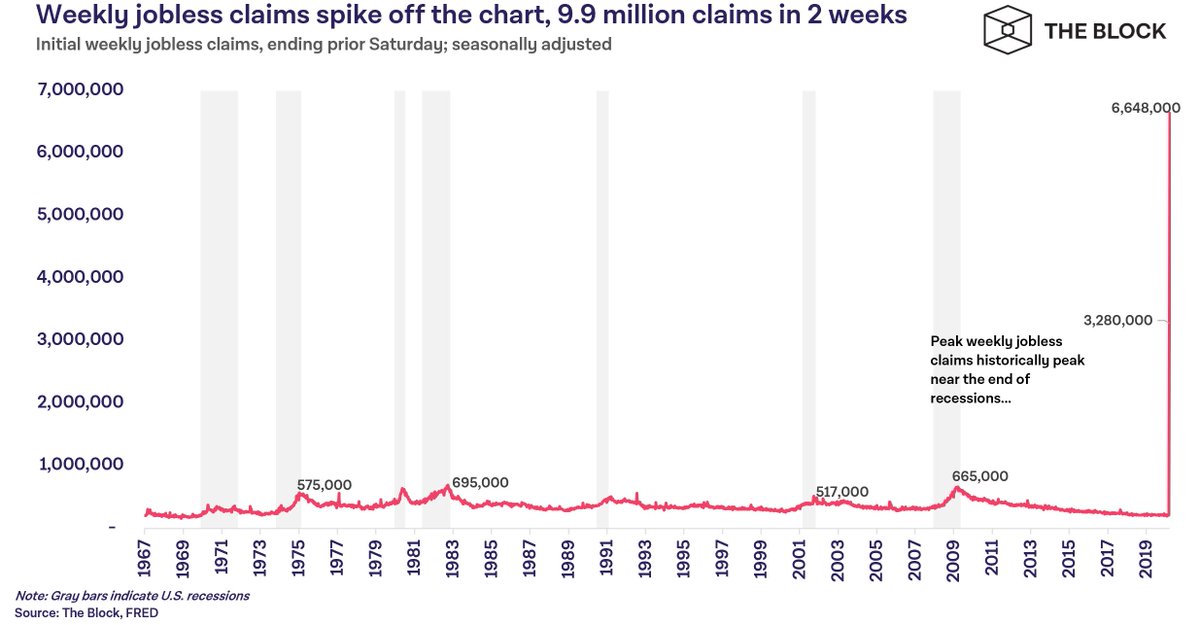

It's unprecedented.

In short, lenders have been stressed due to high demand, and lag times are hurting those waiting for their refinancing loans to close.

I remember hearing that Bank of American and Wells Fargo had mandatory 120 rate locks just because they couldn't keep up with demand.

It was a refi boom...

My heart goes out to anyone in this scenario.

Say it with me: Low rates mean nothing if you can't qualify for them!

On FHA loans (least strict requirements) max DTI is between 40-50%.

Even if you managed to keep your job, if you go over 50% your loan is in trouble!

Servicing companies need that liquidity to pay MBS investors. It could all come crashing down.

bloomberg.com/news/articles/…

At this scale, foreclosures will tank the housing market, evaporating people's equity and making refinancing a nightmare for some time. The reason for that is due to LTV. More below

For an FHA cash out refi you'll need at least 80% LTV, so if your home depreciates significantly you may no longer be access your equity.

Borrowers with Gov backed loans can ask to skip payments for up to 180 days. Helps in a pinch, but it's kicking the can down the road.

The effects will be lasting, and thats worrying

The trend toward universal government intervention in all markets continues.

Low rates aren't enough.

End thread