$BTC $SPY $JNK

"The S&P 500 is +22.4% from 3/23 lows, pushing P/E multiples to 19.0x forward earnings (based on fresh downwardly revised earnings estimates). This is the same P/E level as on Feb 19, the all-time high for stocks."

THUS - the next real important catalyst is NOT UNTIL JULY. That's a long time from now in trading terms.

a) Coupons still get paid on bonds (so fixed income funds will be flush with cash to redeploy)

c) 401ks will still auto-deploy to equities (for those that still have jobs)

You don't need inflows to support equity or debt prices. You just need to avoid outflows.

a) Cash on Exchanges -- all time highs viewbase.com/coin/tether

b) Sentiment -- still near all time lows alternative.me/crypto/fear-an…

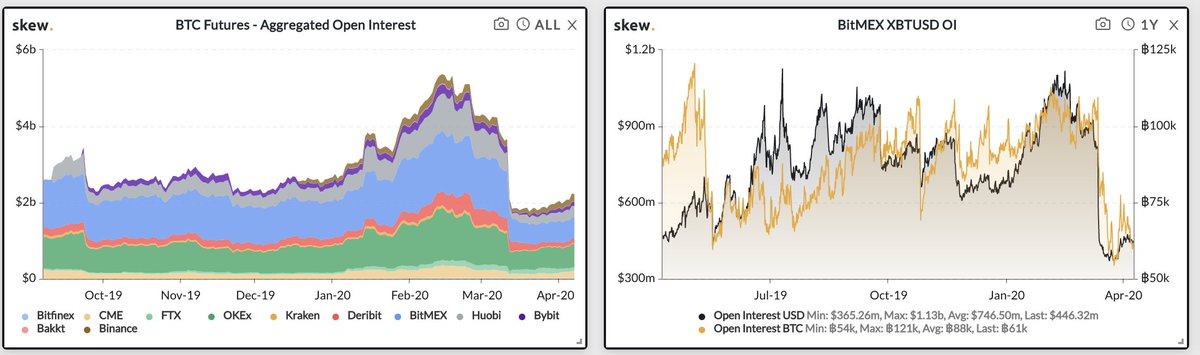

c) Leverage -- 2-year lows (as measured by @skewdotcom)

These metrics are very supportive of prices

Prices can certainly go down. But I wouldn't be surprised if they keep melting up, including stocks.

Longer-term: very bullish $BTC, very concerned $SPY and $JNK