1) A thread on why:

A) Undisputed leader

B) Clear-cut value proposition

C) Essential projects, but token has unclear value

D) Huge networks / communities -- may deliver massive value (or may not)

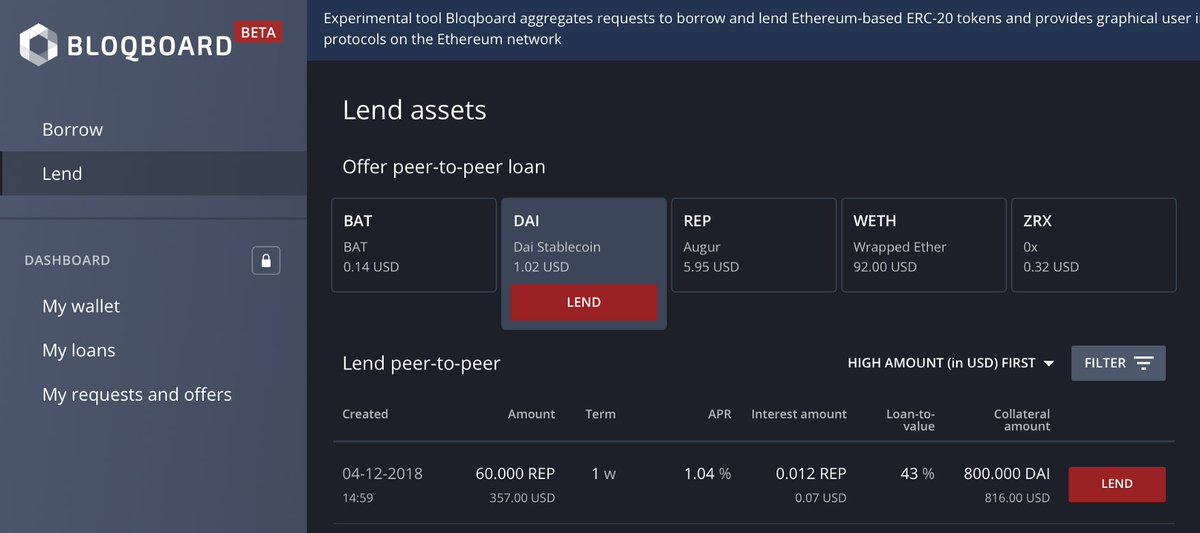

E) Live, working products but still speculative

F) Pure spec