Million $ strategy for free👌

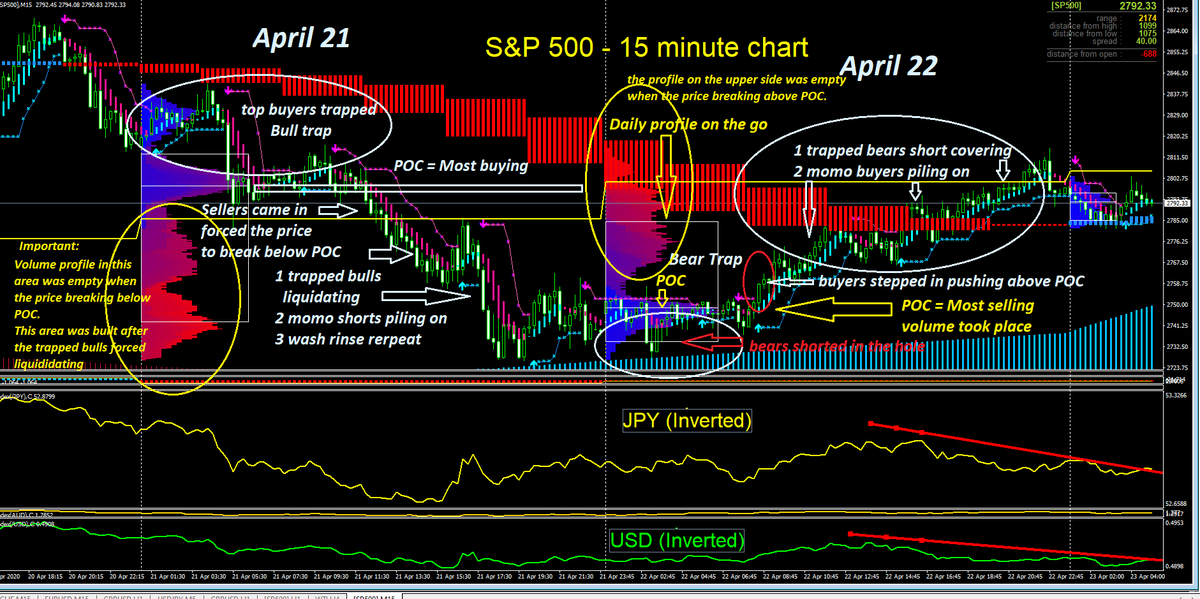

The "bear trap" & "bull trap" concept using the volume profile POC is very useful in intra-day trading also

Especially in the futures where the buyer & sellers are zero-sum game, for every long there is a short

We had two-days in a row in #ES

The "bear trap" & "bull trap" concept using the volume profile POC is very useful in intra-day trading also

Especially in the futures where the buyer & sellers are zero-sum game, for every long there is a short

We had two-days in a row in #ES

https://twitter.com/kerberos007/status/1253044050778828800

Million $ strategy for free:

If you can understand the below chart and practice everyday with position sizing & risk mgmt, you will be a successful day traders:

1 April 21 - perfect Bull Trap set up

2 April 22 - perfect Bear trap set up

study it and comprehend

very important

If you can understand the below chart and practice everyday with position sizing & risk mgmt, you will be a successful day traders:

1 April 21 - perfect Bull Trap set up

2 April 22 - perfect Bear trap set up

study it and comprehend

very important

Below thread covered some basics

The above "bear & bull trap" set-up is part of the 5-dimensional day trading system mentioned below

Never published anywhere, now you have it for free

Supply & demand balances at major sup/res zone is KEY to any trading

The above "bear & bull trap" set-up is part of the 5-dimensional day trading system mentioned below

Never published anywhere, now you have it for free

Supply & demand balances at major sup/res zone is KEY to any trading

https://twitter.com/kerberos007/status/1119739192383295489

Important concept

The above volume profiles were built on the fly

On April 21:

the upper POC profile was built before the breakdown in price; the lower part was empty

The lower part was built after the liquidation

On April 22:

the lower POC was built before the breaking out

The above volume profiles were built on the fly

On April 21:

the upper POC profile was built before the breakdown in price; the lower part was empty

The lower part was built after the liquidation

On April 22:

the lower POC was built before the breaking out

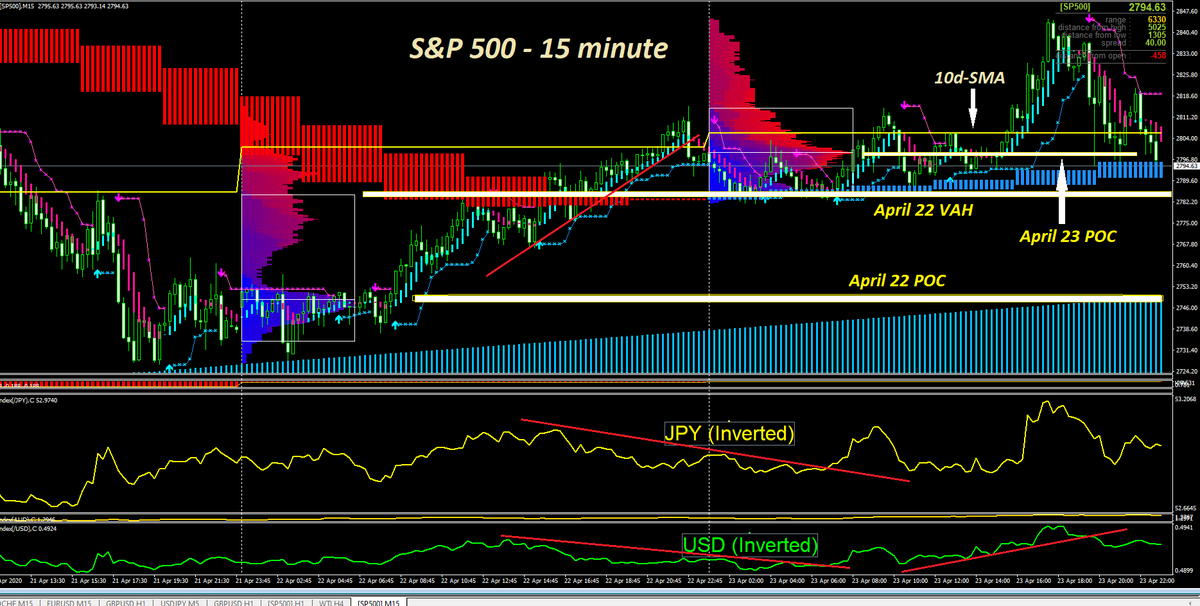

April 23 - Close

Perfect text book support held right at Today's POC.

#ES_F Line in the sand = 2780 for AH overnight session

I marked all the important levels:

Yesterday POC

Yesterday VAH

Today's POC

10day SMA

You might have a different POC dependent on your start time

Perfect text book support held right at Today's POC.

#ES_F Line in the sand = 2780 for AH overnight session

I marked all the important levels:

Yesterday POC

Yesterday VAH

Today's POC

10day SMA

You might have a different POC dependent on your start time

• • •

Missing some Tweet in this thread? You can try to

force a refresh