Seagate STX is scheduled to report 3rd fiscal 2021 earnings on Apr 22

STX anticipates third-quarter fiscal 2021 non-GAAP earnings of $1.30 (+/-15 cents) per share.

Priced for perfection. over-valued.

yesterday, $STX put volume surged = 4x 30-day avg

Volume PCR = 5.42👌🧐

STX anticipates third-quarter fiscal 2021 non-GAAP earnings of $1.30 (+/-15 cents) per share.

Priced for perfection. over-valued.

yesterday, $STX put volume surged = 4x 30-day avg

Volume PCR = 5.42👌🧐

ORCL

Volume-PCR for $ORCL surged the last two days with analyst upgrades.🧐

Put volume surged BIGLY yesterday.

somebody always knew in advance

Today $ORCL down -2.3%

$SPX down 40 points.

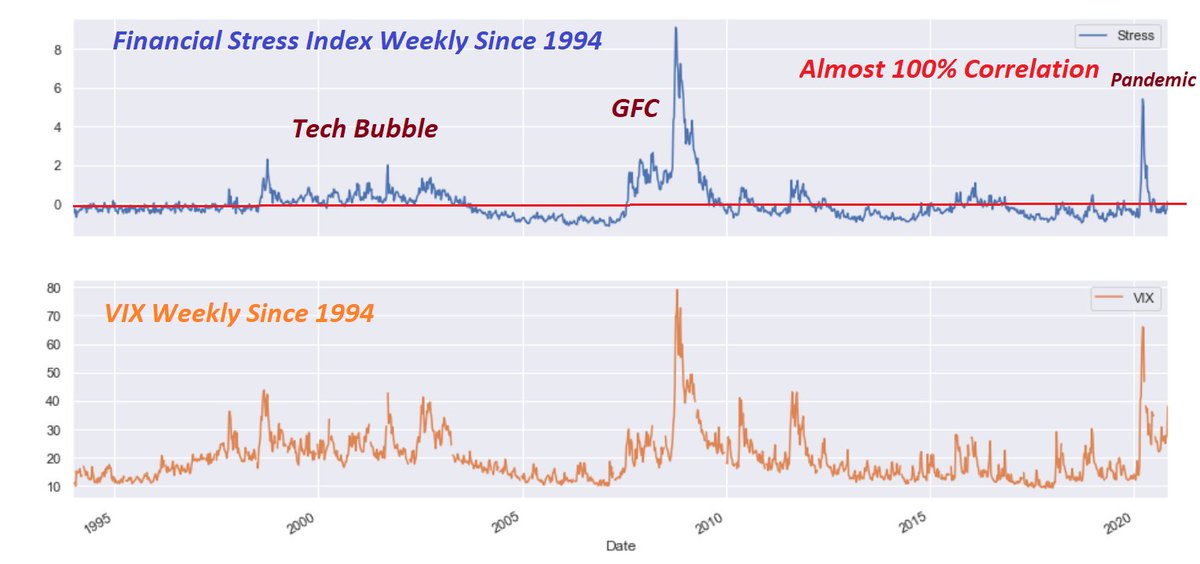

$VIX above 19 again.

Volume-PCR for $ORCL surged the last two days with analyst upgrades.🧐

Put volume surged BIGLY yesterday.

somebody always knew in advance

Today $ORCL down -2.3%

$SPX down 40 points.

$VIX above 19 again.

• • •

Missing some Tweet in this thread? You can try to

force a refresh