medium.com/@100trillionUS…

A thread. 👇

medium.com/@100trillionUS…

1) medium.com/burgercrypto-c…

2) medium.com/@btconometrics…

3) medium.com/burgercrypto-c…

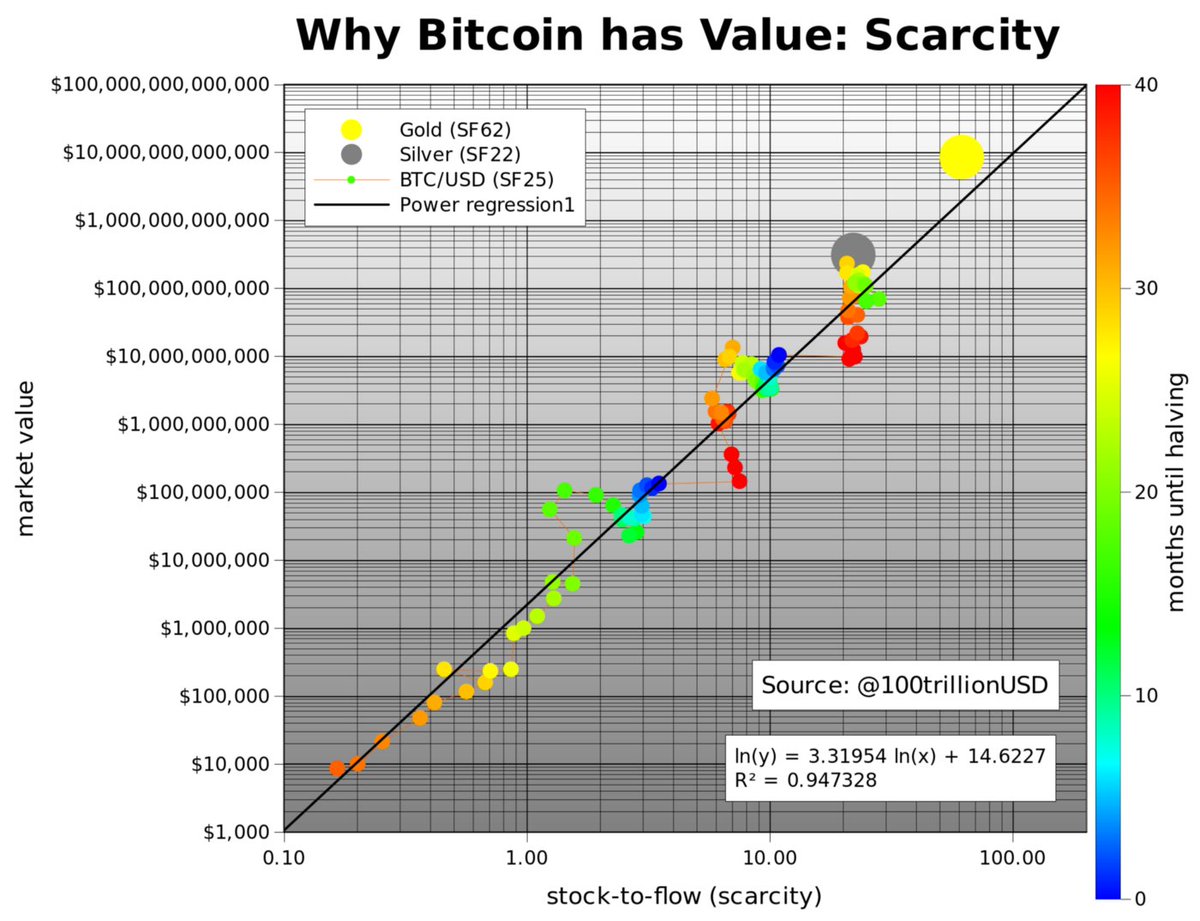

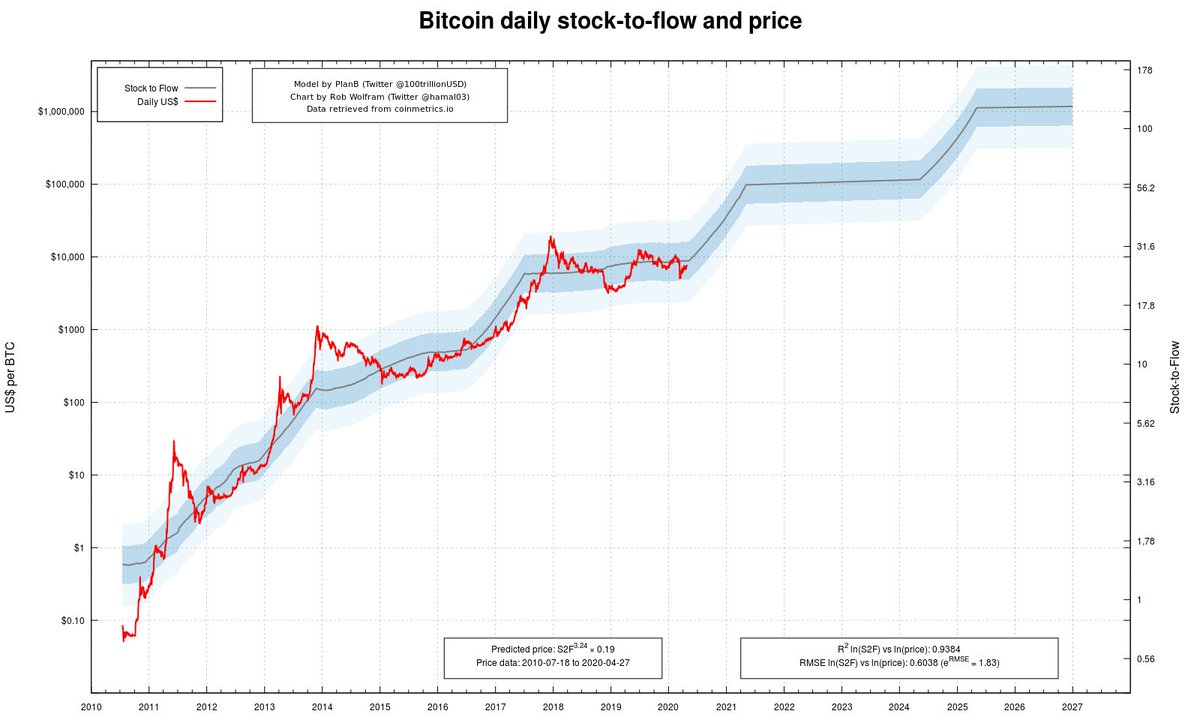

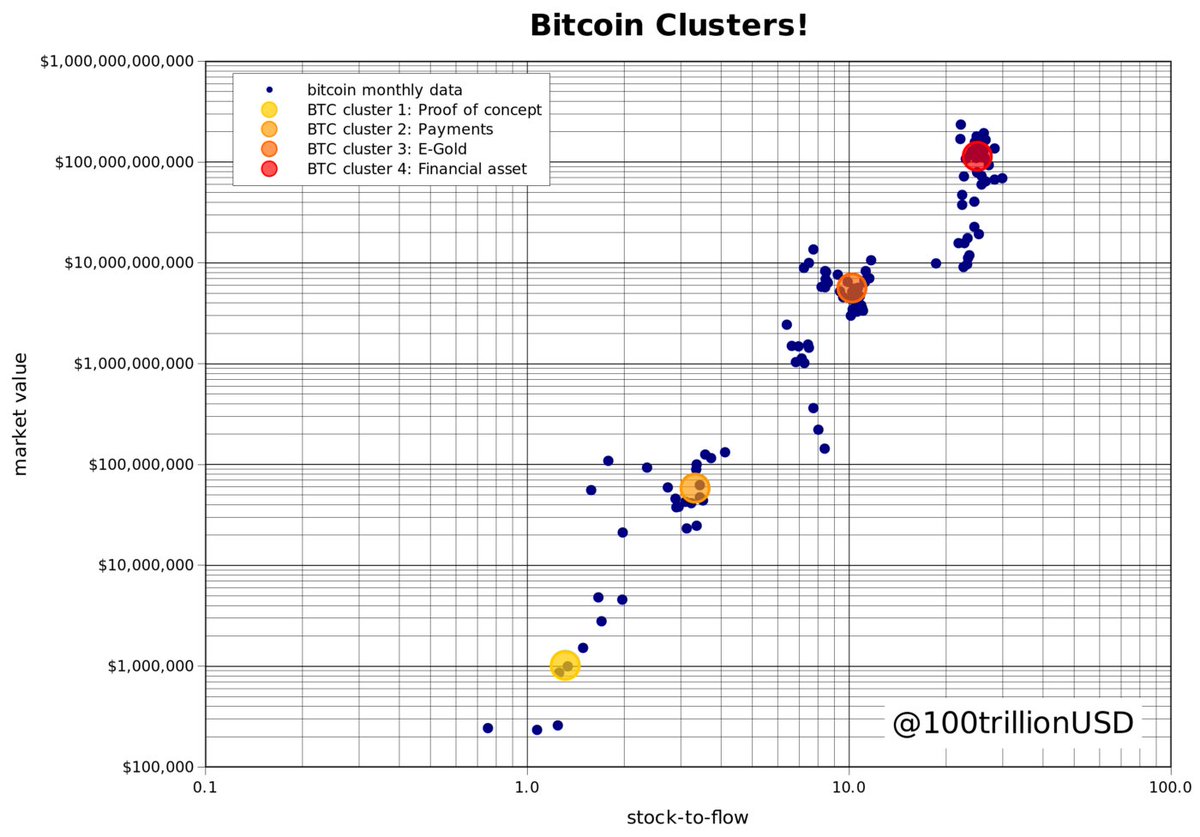

Chart by @hamal03 - available: s2f.hamal.nl/s2fcharts.html

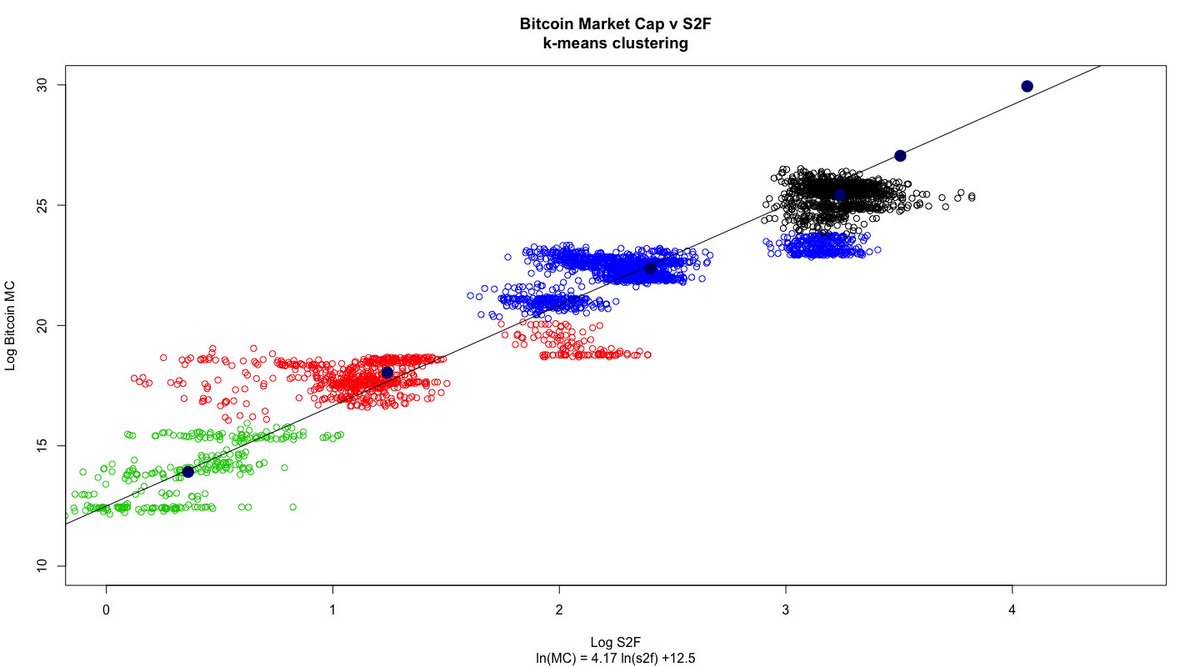

@BurgerCryptoAM, Nov 2019: medium.com/burgercrypto-c…

@btconometrics, Jan 2020: medium.com/@btconometrics…

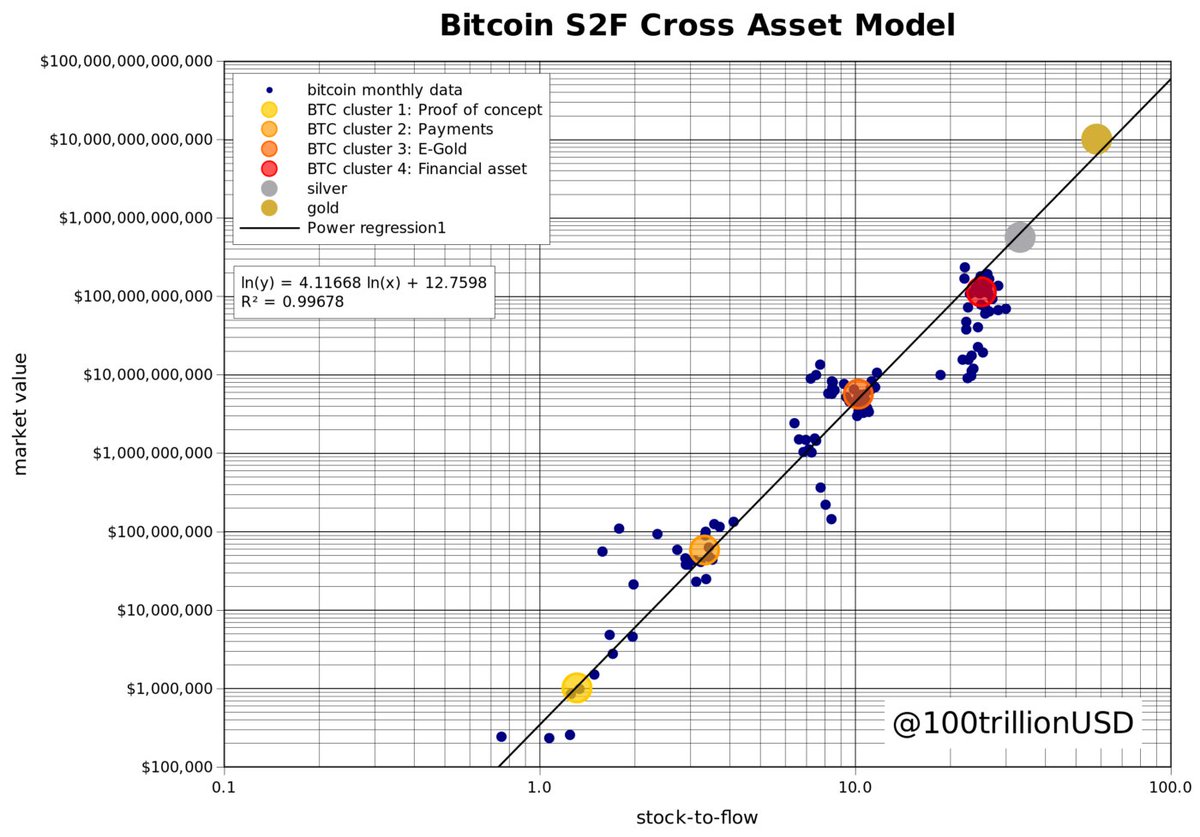

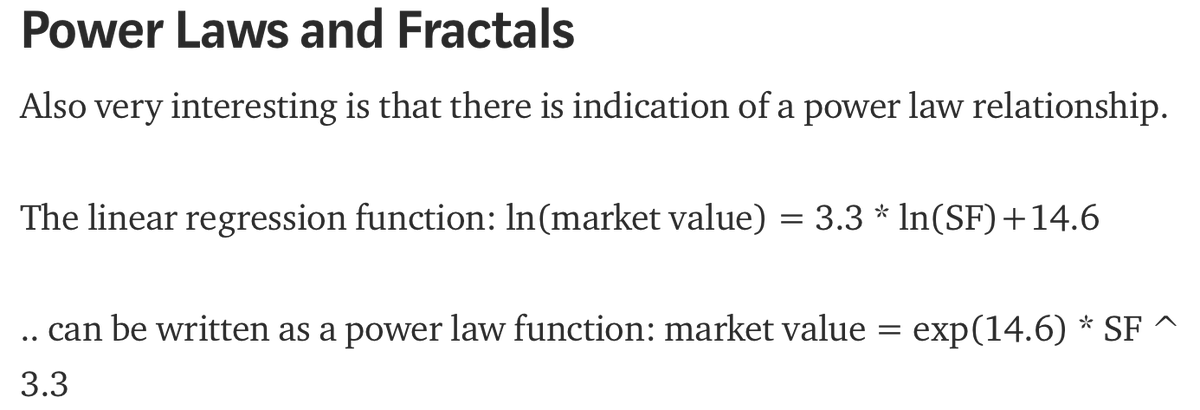

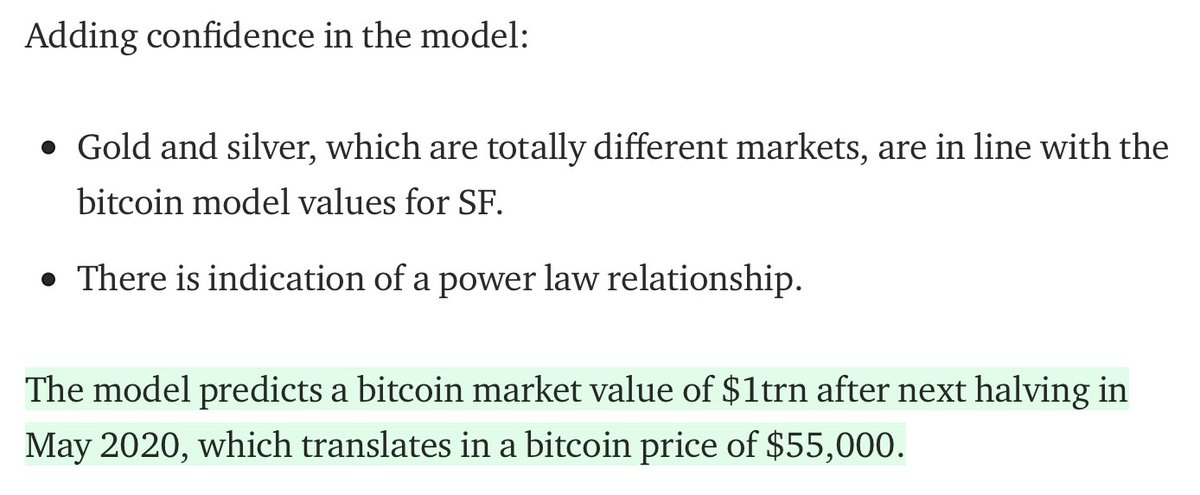

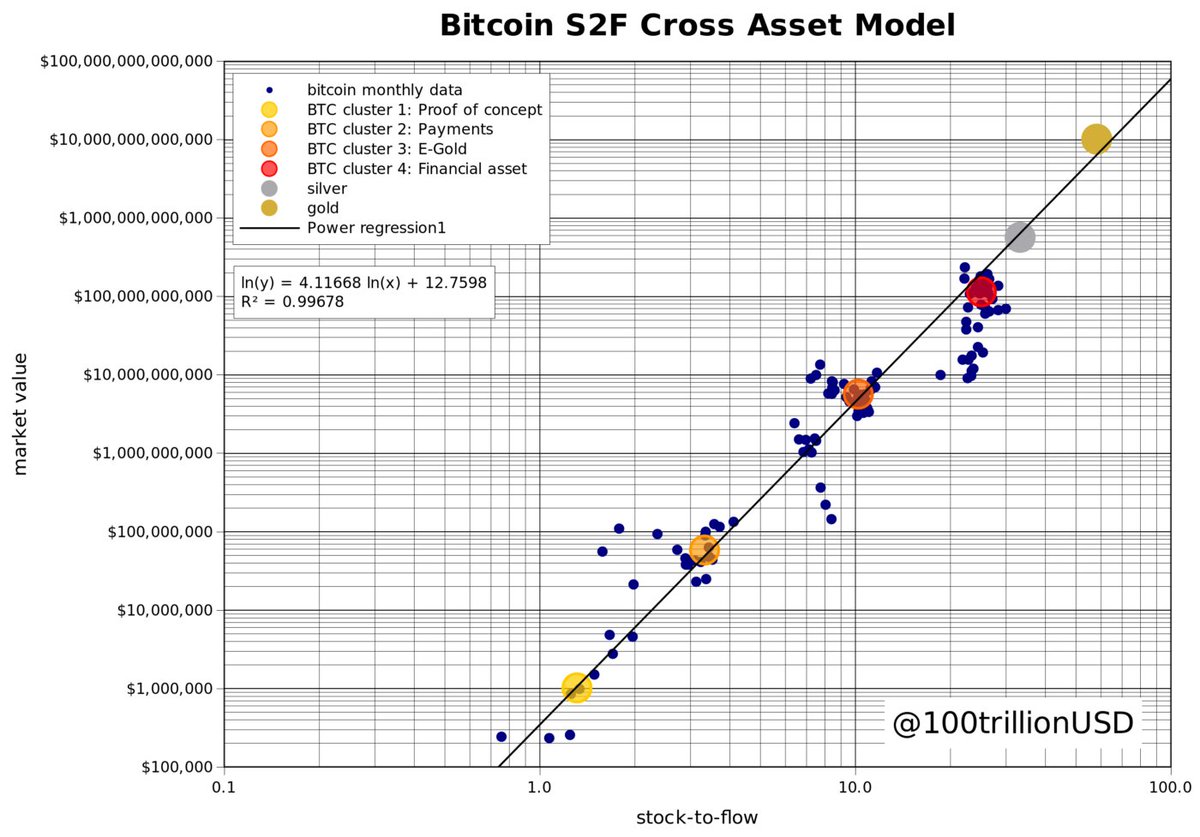

medium.com/@100trillionUS…

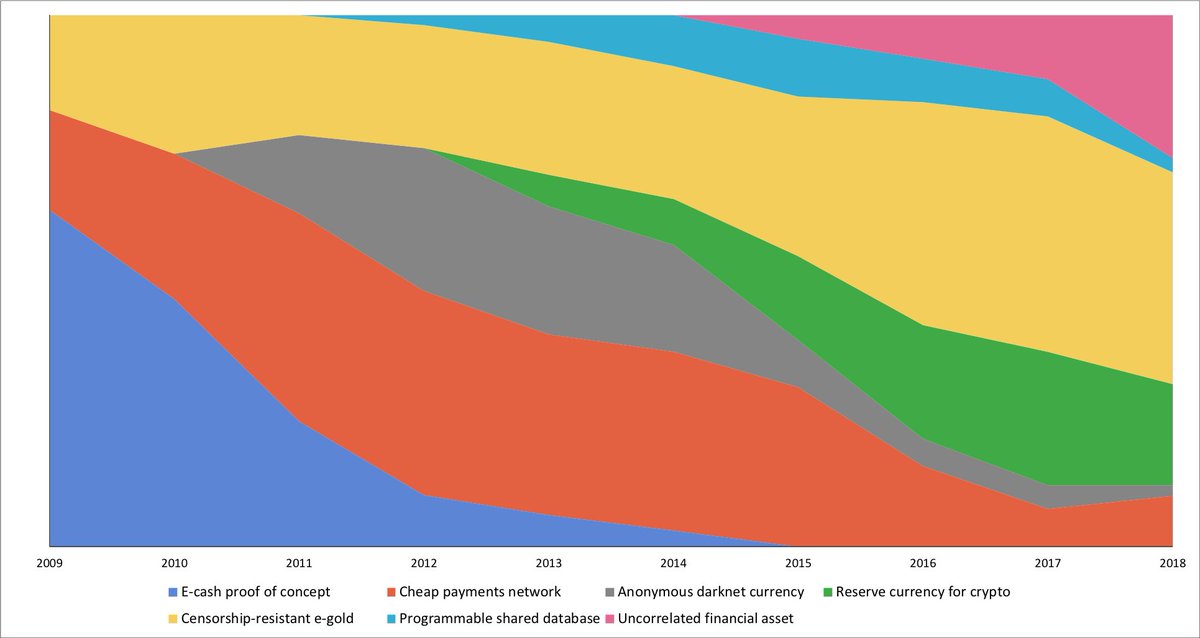

medium.com/@nic__carter/v…

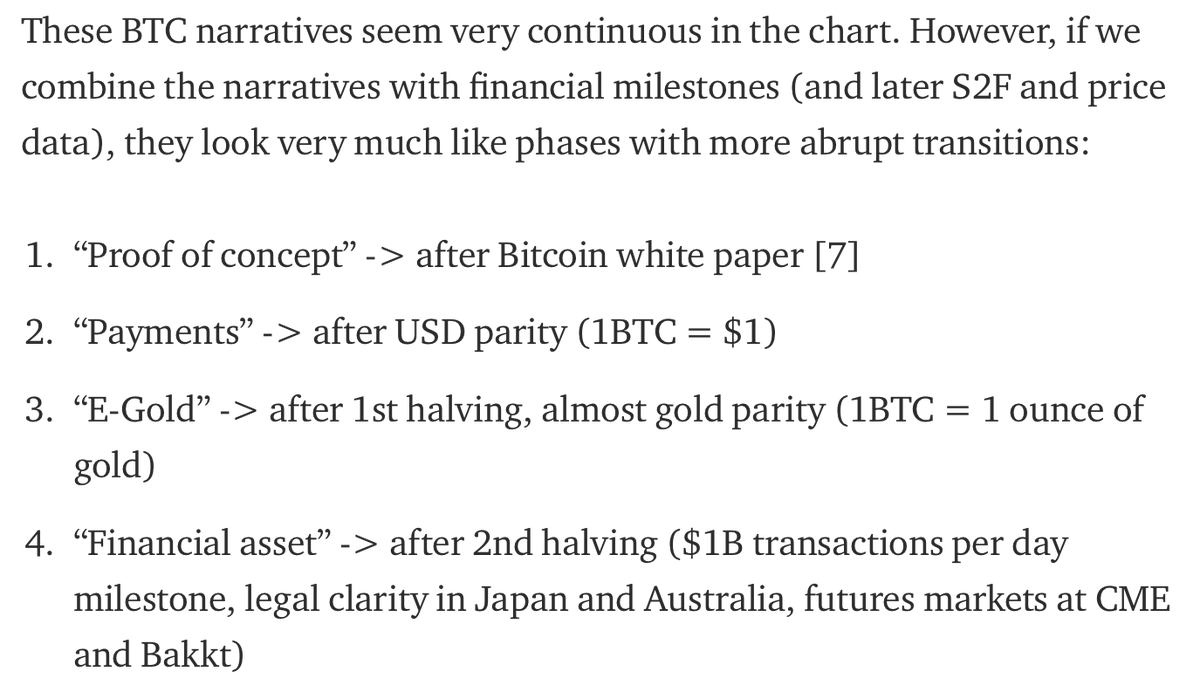

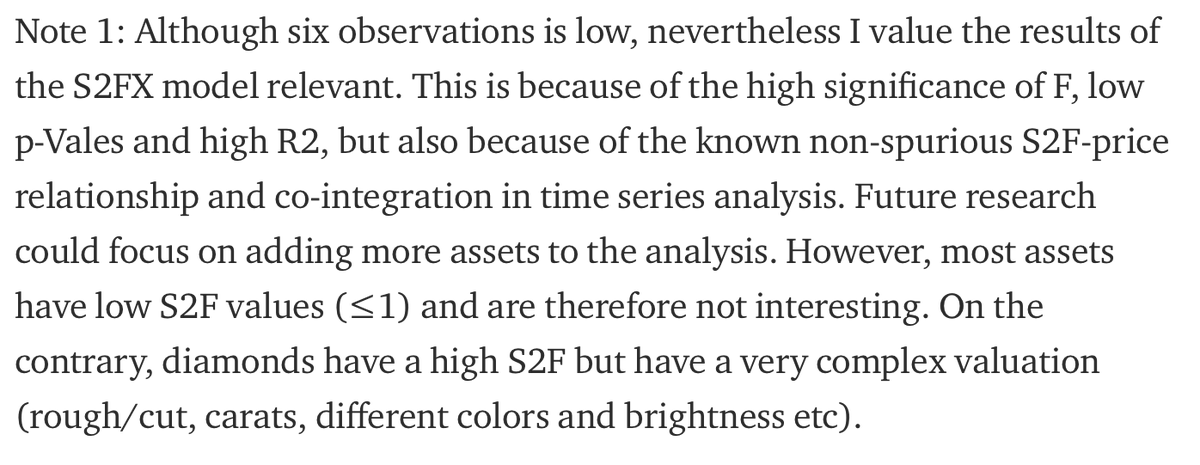

However, I do have some critical remarks.

digitalik.net/btc/s2fx