A thread. 👇

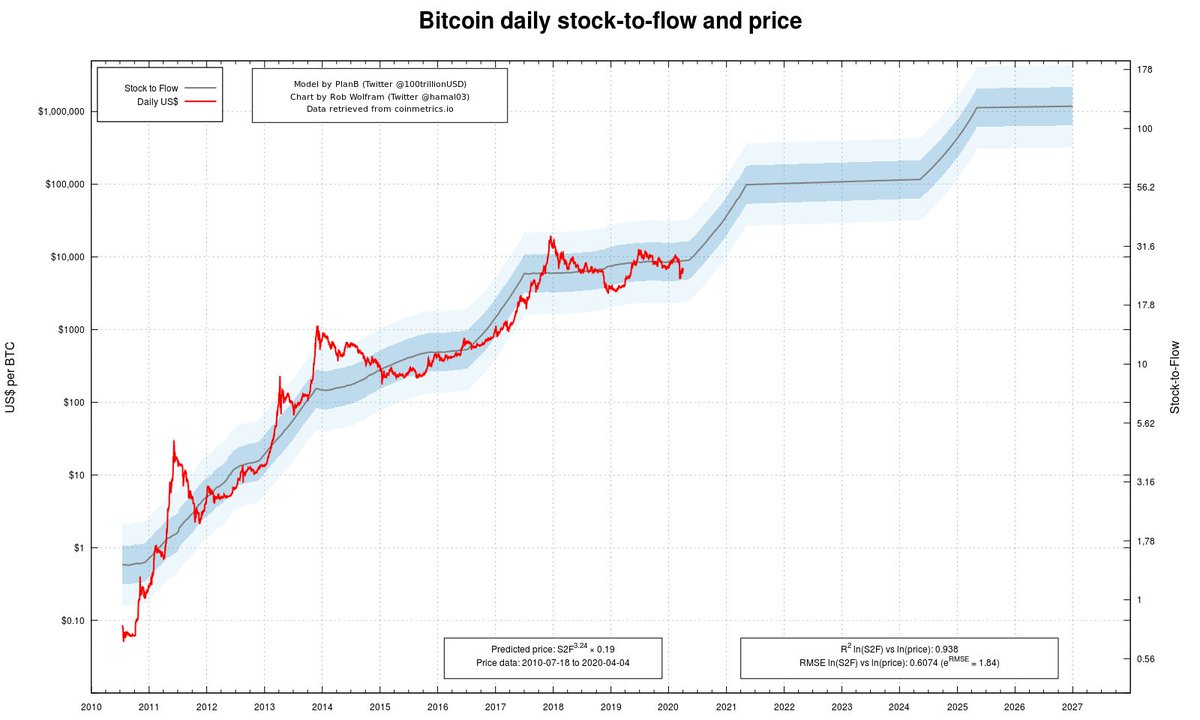

medium.com/burgercrypto-c…

sciencedirect.com/science/articl…

medium.com/swlh/falsifyin…

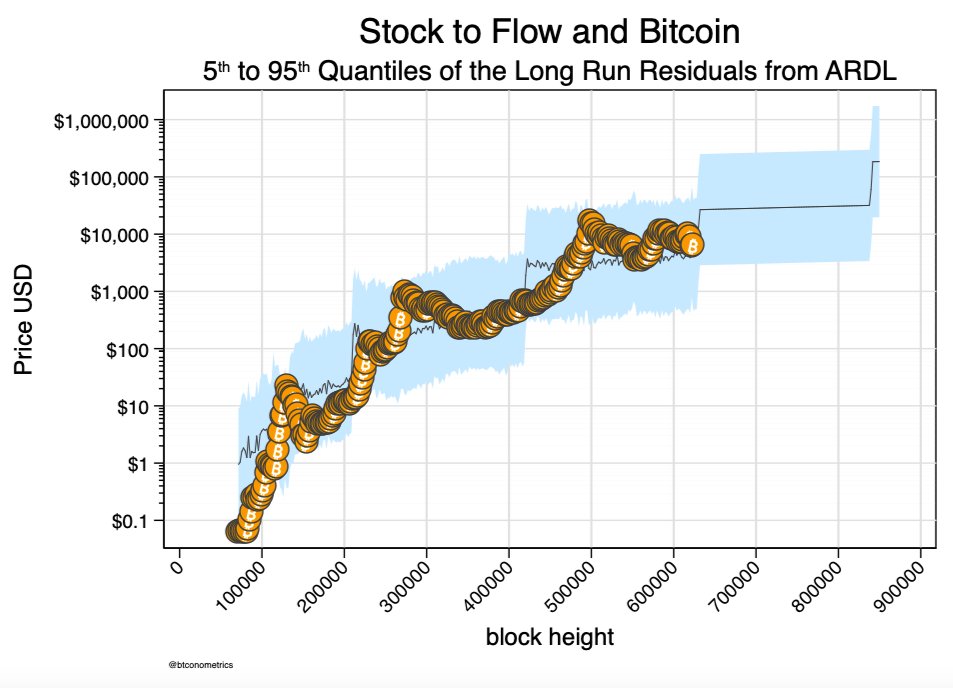

As @btconometrics concluded, #Bitcoin's price is not.

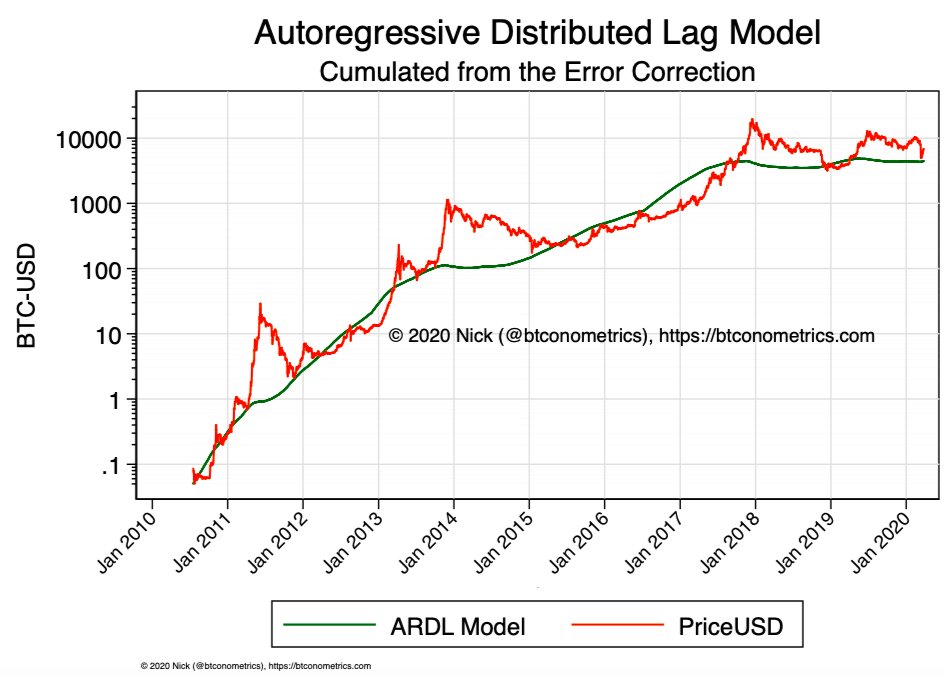

His latest findings are in his March 27th article: medium.com/@btconometrics…

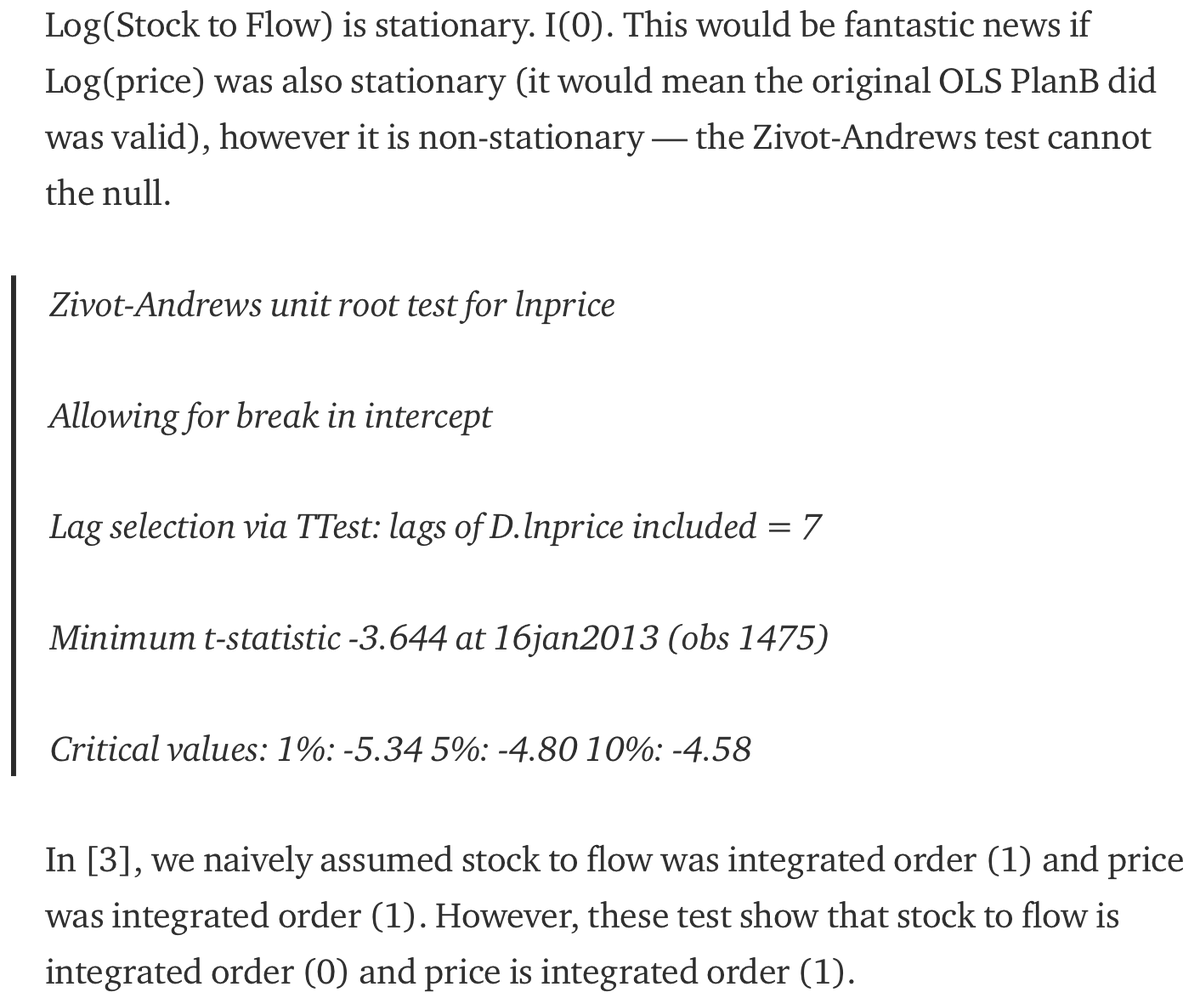

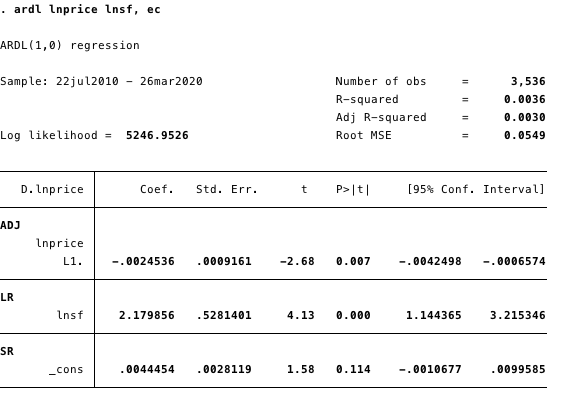

- #Bitcoin's (logarithmic) price is indeed not stationary

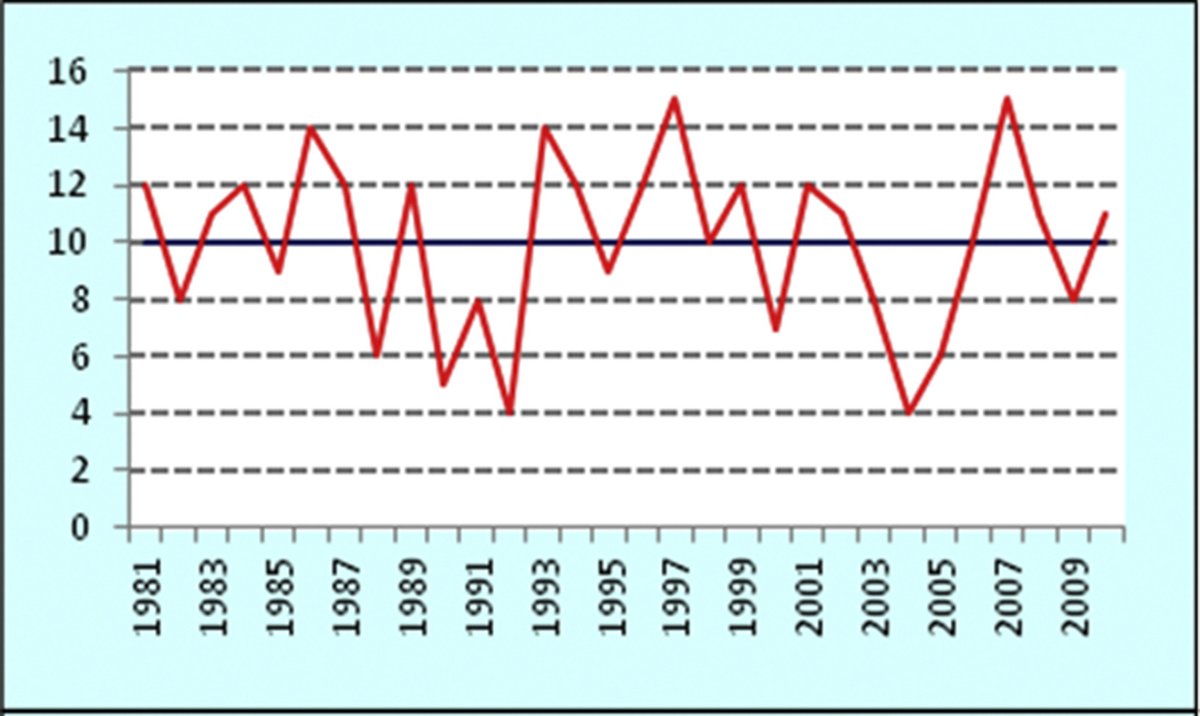

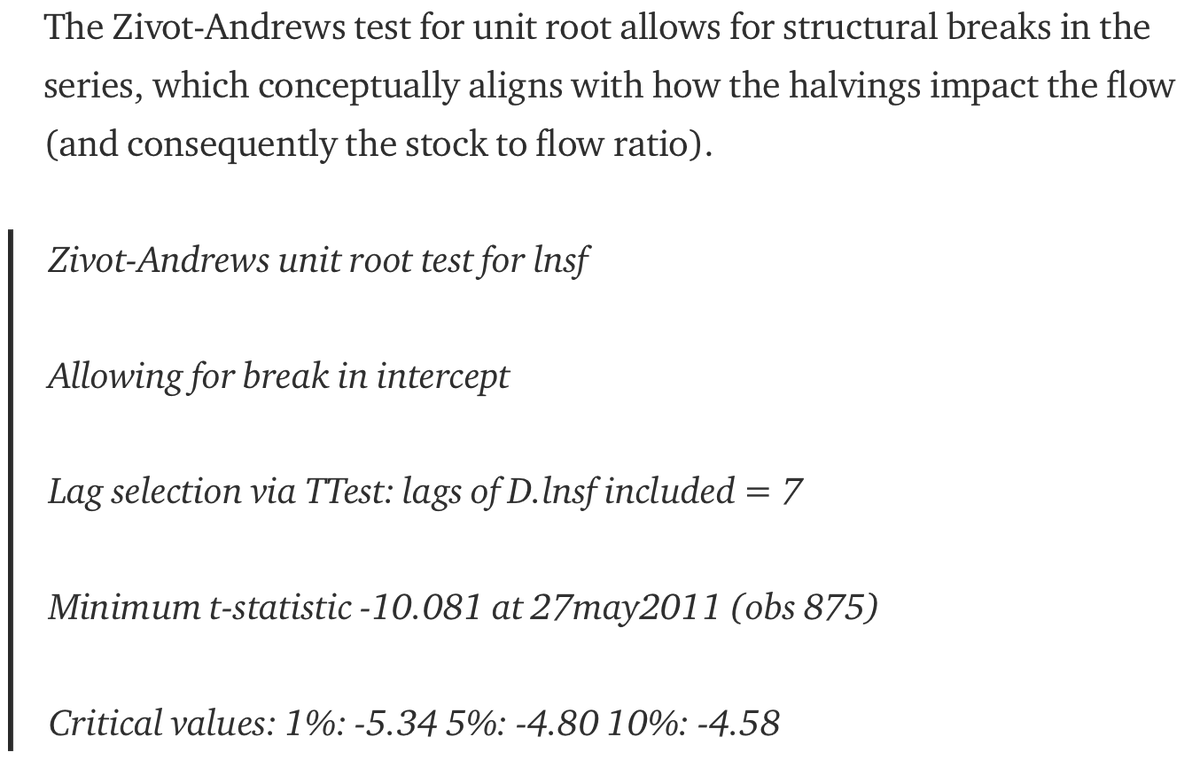

- ... but its (logarithmic) S/F ratio over time actually is!

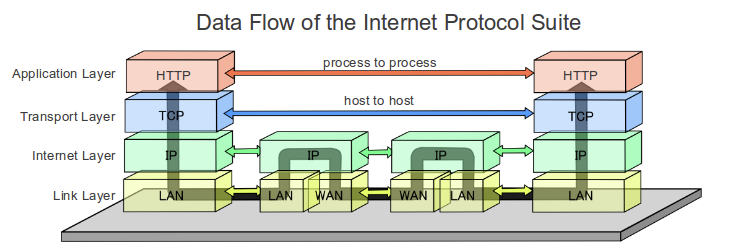

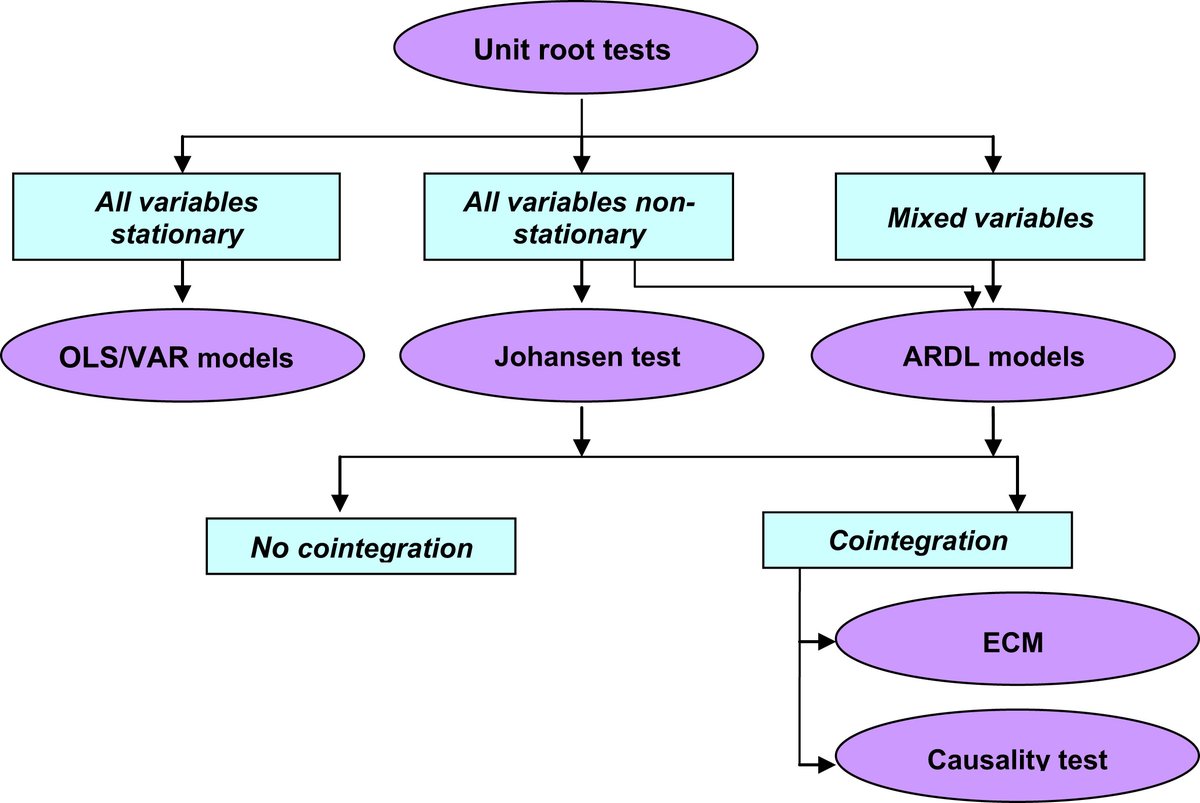

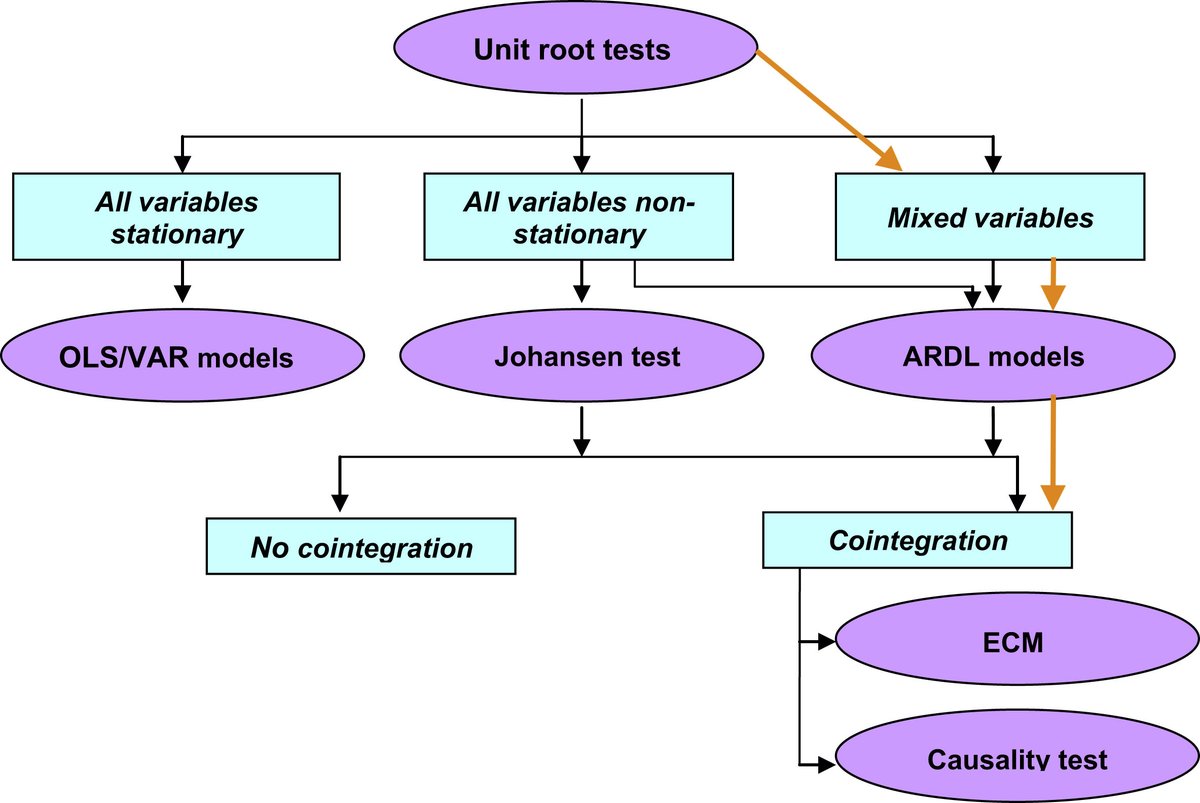

From the framework-article: "An autoregressive distributed lag (ARDL) model is an ordinary least square (OLS) based model which is applicable for both non-stationary time series as well as for times series with mixed order of integration."

- Based on the Zivot-Andrews test, #Bitcoin's S/F ratio is a stationary variable, while price is not.

- Therefore, ARDL models that can account for mixed stationarity need to be used.

- The ARDL model suggests that Bitcoin's price and S/F are indeed cointegrated. 🔥