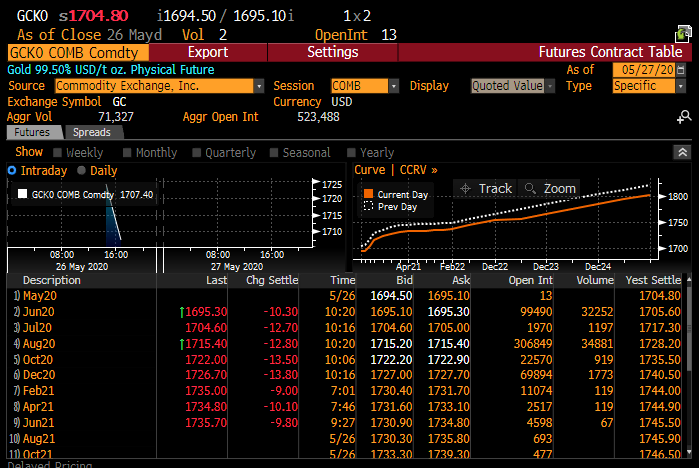

One month ago it was trading at a $15/oz premium to the spot gold price.

Now it's trading at a $10/oz discount.

(short thread)

“why is the Comex future trading at a discount to spot”

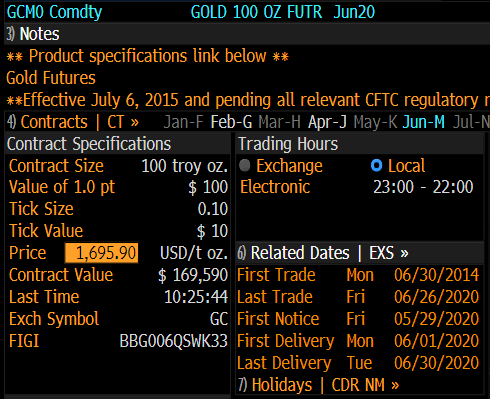

The short answer is that we are nearing first notice for Jun, so specs and investors are selling Jun and buying August.

This is pushing the Jun lower, hence the discount.

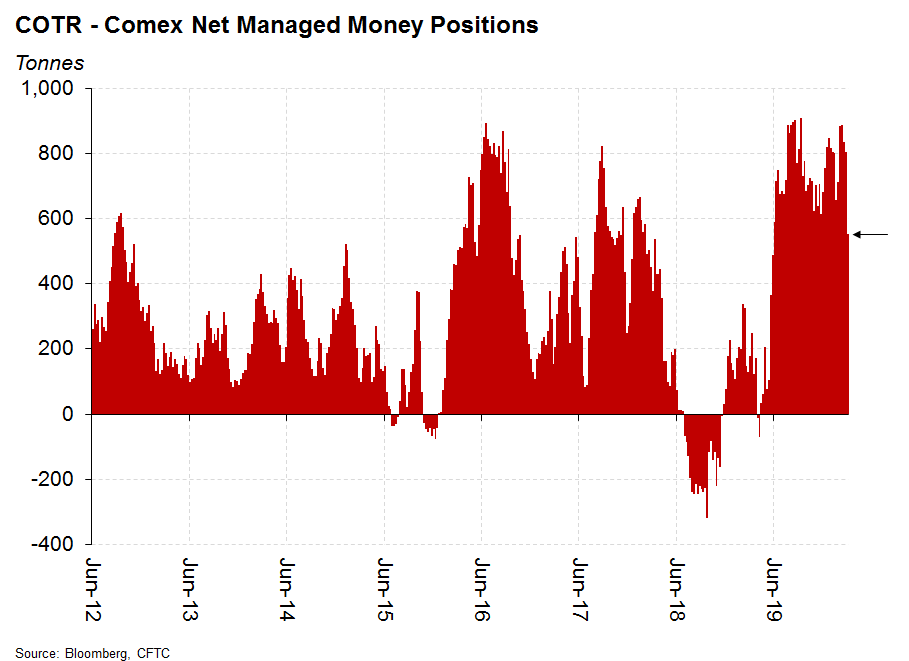

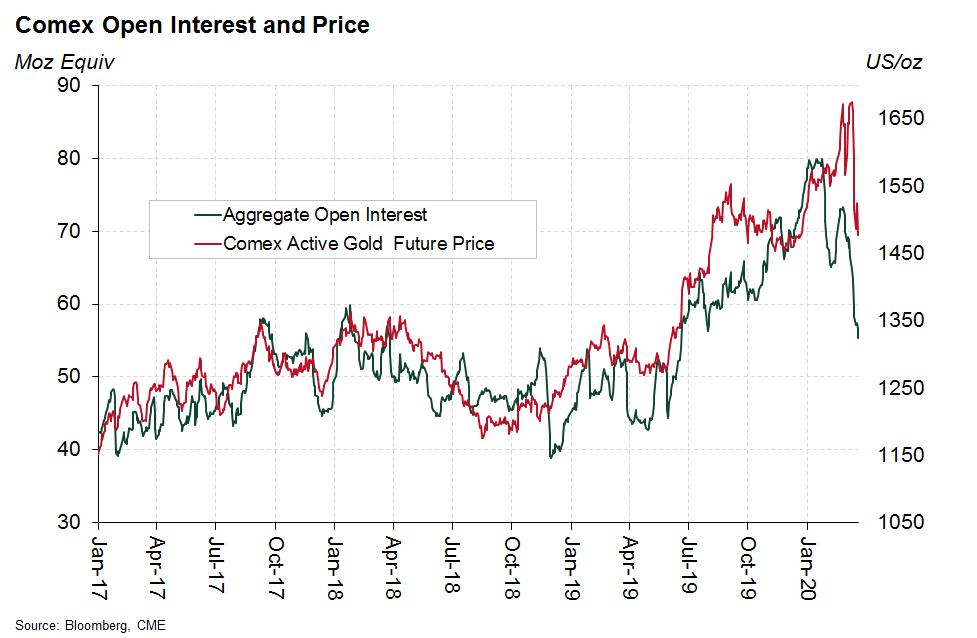

I think the problem comes from a lack of risk appetite from banks that are normally very active in arbitraging this market against the OTC price.

The blow out in the EFP in March has reduced risk appetite.

(graph of Comex #gold stocks in millions of ounces).

gold.org/goldhub