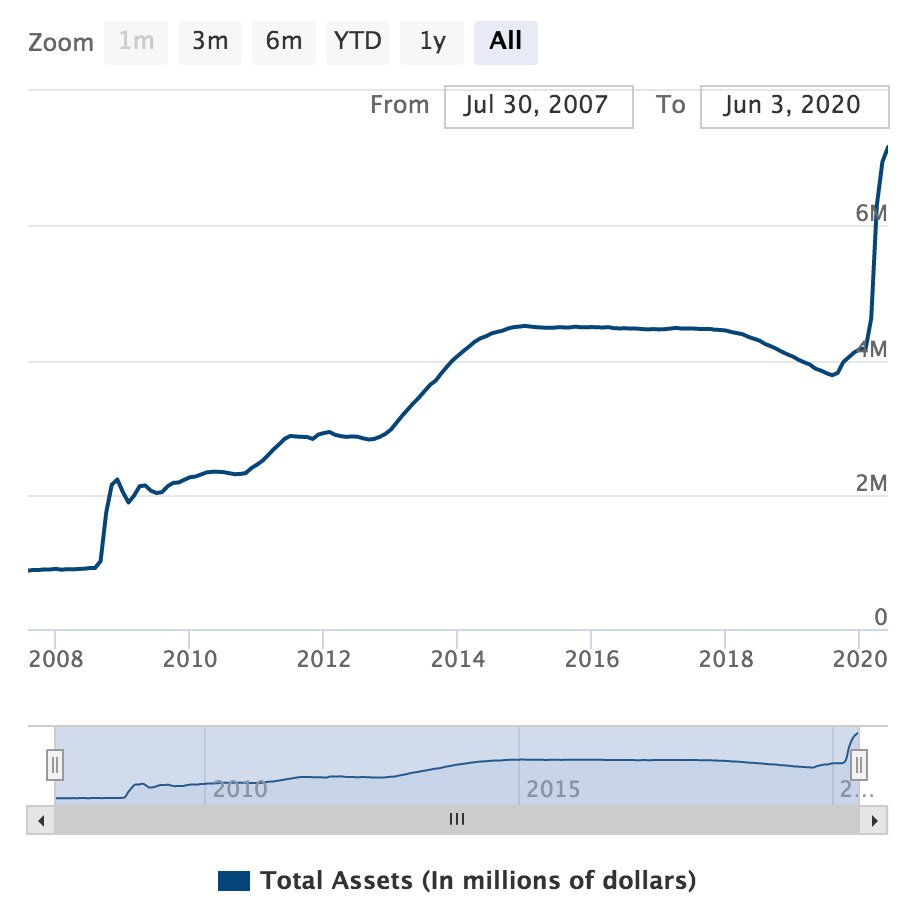

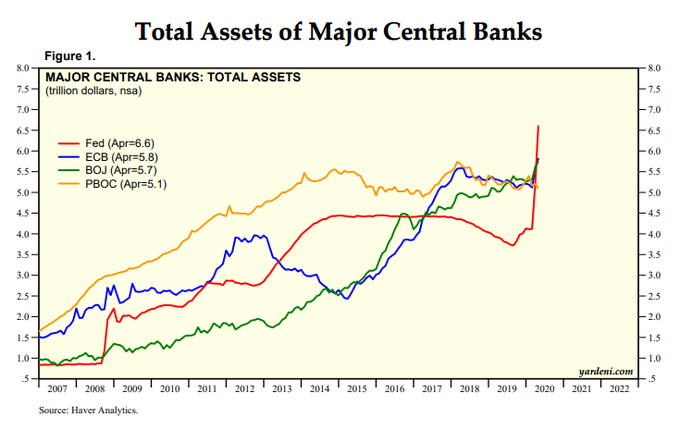

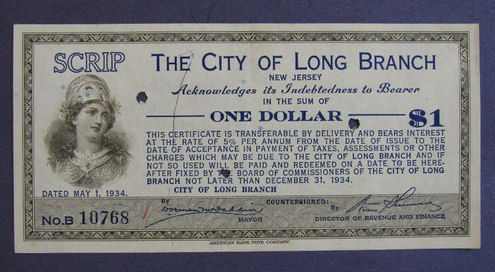

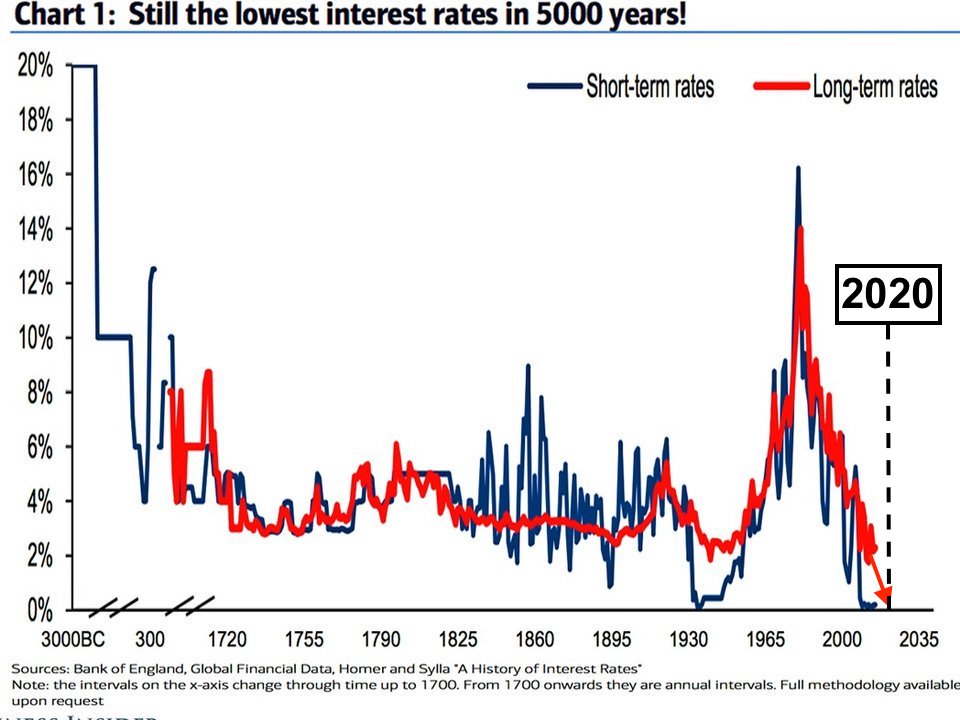

Next 10 yrs will be a telling & trying time. We’re entering the next phase of a crisis brewing since 2008. The root cause & solution lie in reforming & reversing the state’s role in money and markets.

A thread.

Liquidity crises

Equity/bond market dysfunction

USD duress

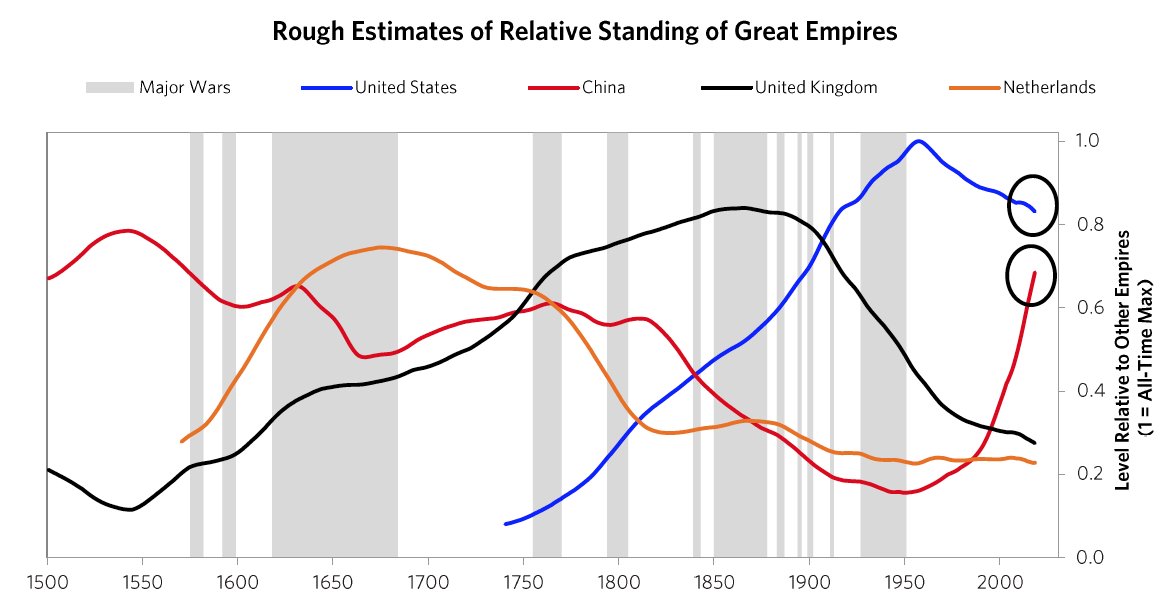

Globalisation muted

Supply chain stress

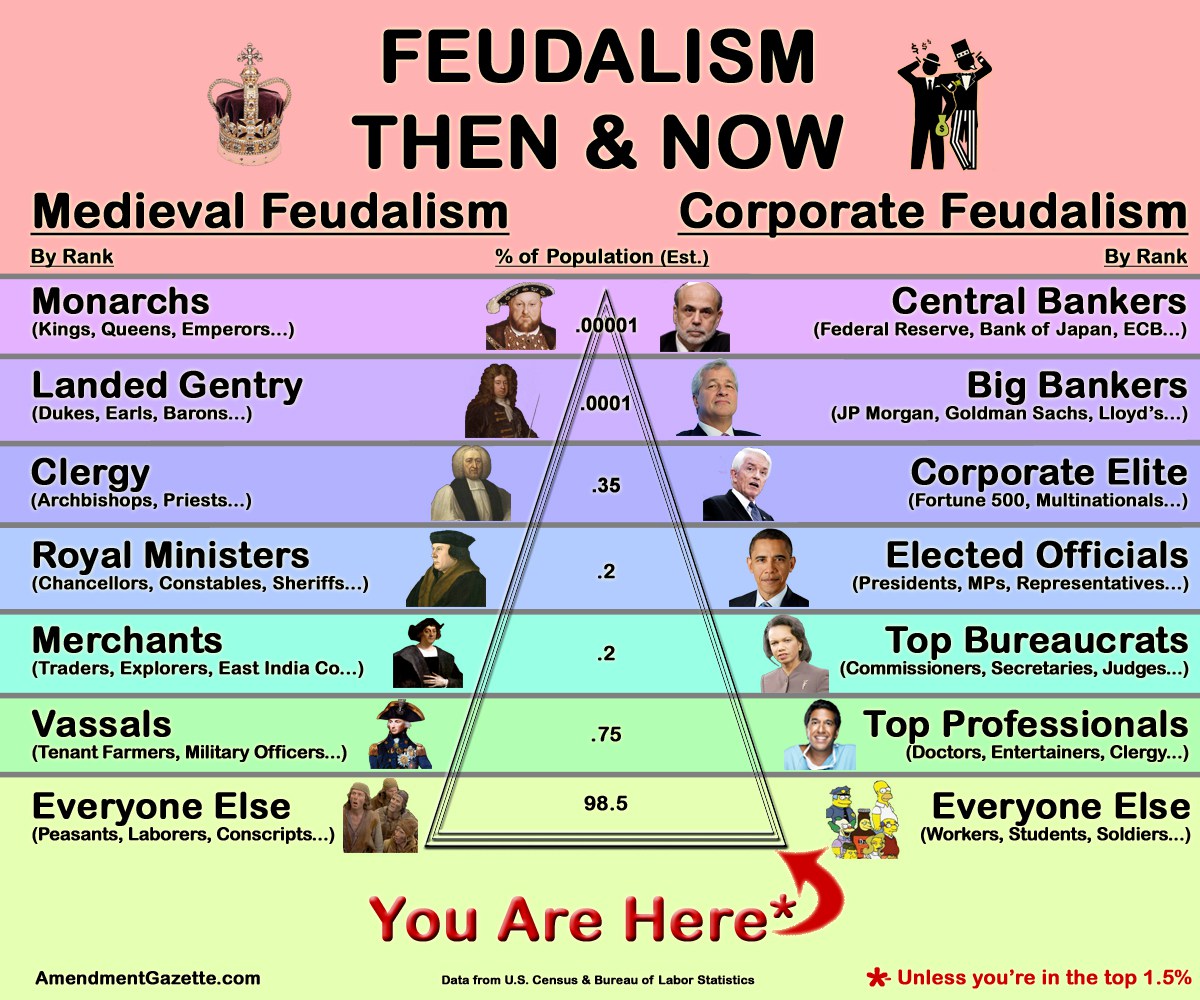

Credit limited to HNWI

Political divides deepen

Social unrest/riots

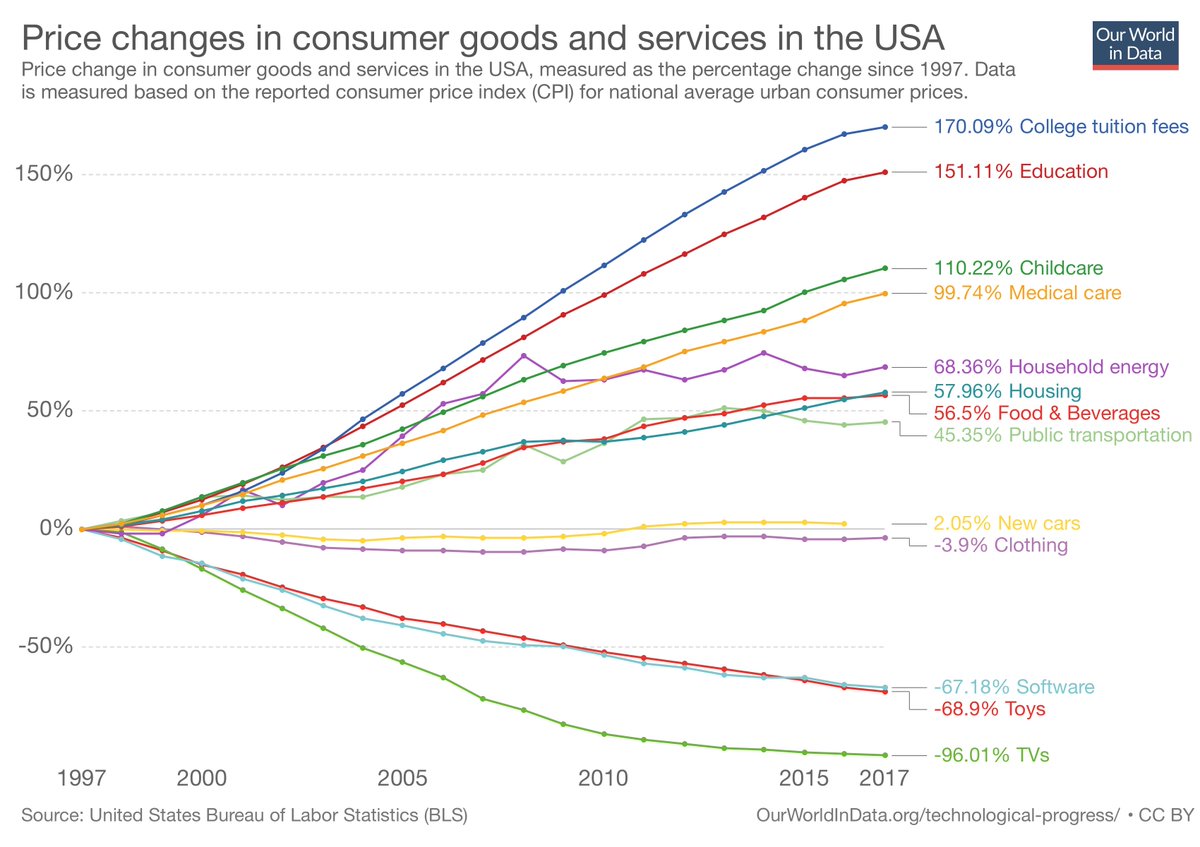

Local inflation/deflation

Food & personal insecurity

Wealth hatred

linkedin.com/pulse/big-cycl…