A lot has happened in the past 2 months. I will try to give a complete overview with implications and consequences for one of the largest #taxhavens in the world.

Enjoy! 👇🇳🇱

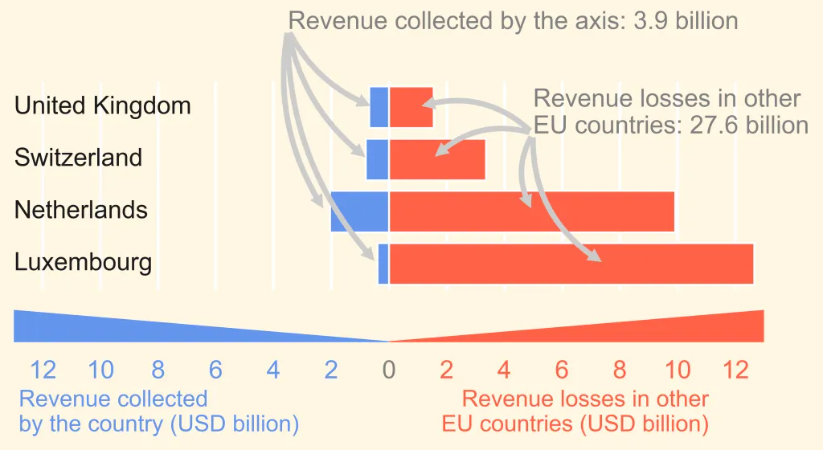

Over the past weeks the Netherlands has been extensively portrayed as a harmful tax haven in the EU, especially by southern European countries.

Many numbers circulate about the Netherlands but missingprofits.world sums it up pretty well.

(1) The long-awaited report of an independent commission (known as Adviescommissie ter Haar) on how the NL should reform its laws to make multinationals pay their fair share. 👉rijksoverheid.nl/documenten/rap…

(3) A note by the government announcing a withholding tax on dividends to low tax jurisdictions (from 2024 onwards) 👉rijksoverheid.nl/actueel/nieuws…

YES, all of this in the last 2 months. Why now? Well elections first half 2021. This is the moment to set the agenda of the elections and the next government.

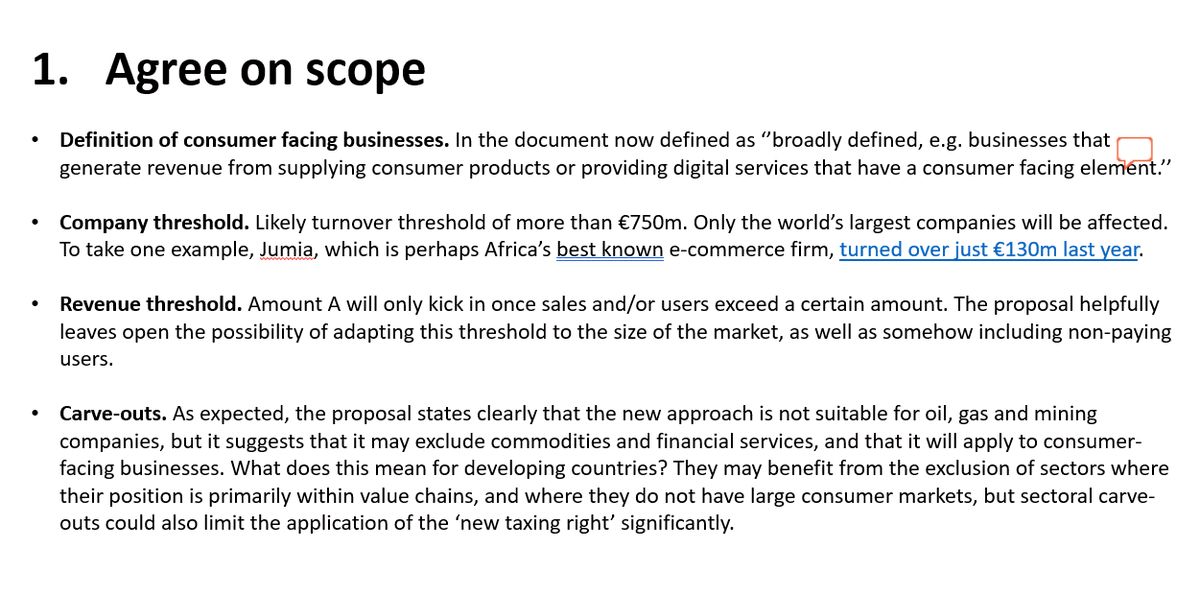

The main recommendations:

1. A capped carry forward losses rule (50% of the losses).

2. CFC rules need to be strengthened.

3. No more informal capital deduction if no correction in other country.

In particular the point of informal capital is crucial. One of the biggest remaining loopholes used by many US MNEs and tech giants.

Oxfam estimated it is worth 5-10 billion in tax avoidance annually from 2020 onwards.

1. Stronger interest limitation rule.

2. Limitations to deduction of royalties.

3. CFC rule on active income.

4. A general withholding tax on interests and royalties.

It proposes to allow developing countries some advantages from the UN model like PE & technical services.

Interestingly, the Netherlands will also re-negotiate certain treaties in order to implement its new WHT on interests and royalties to low tax jurisdictions.

The story of the WHT on dividends is quite a thriller in the NL. Over a year ago the government wanted to get rid of it but that idea faced major opposition. A complete opposite scenario now.

Exciting times ahead in the NL, with potentially many policy changes.

It is clear the NL prefers international reforms over unilateral measures that could effect its investment climate.

Unilaterally, the top priority is to stop the passive income flows.

END