One step closer to an international agreement on new rules to tax multinationals in a digital world!

The OECD has just published the first building blocks of these rules👉bit.ly/2IBPXyp

A lot still needs to be negotiated.

My take? A thread!

#TaxTwitter

BUT BUT BUT

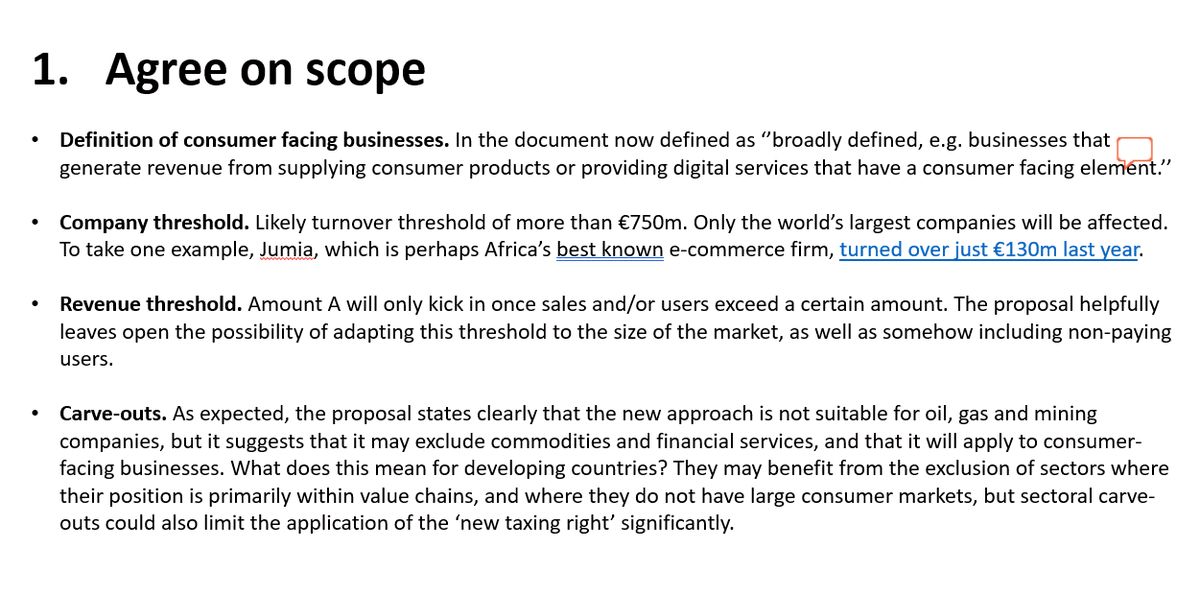

- narrow scope

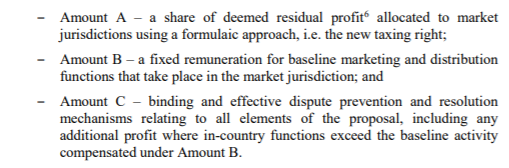

- likely only a very small share of profits will be allocated to market jurisdictions

- artificial and complex divide between routine/non-routine profits

- segmentation to be expected (per activity, business line or sector)

A lot to be decided still, perhaps technical but all crucial.

(1) G20 Finance Ministers meeting on 17 October

(2) The public consultation on 21 and 22 November

(3) Economic Impact assessments by OECD

(4) Update on pillar 2

(5) January plenary meeting of all 134 countries

...

(6) Final agreement by end 2020

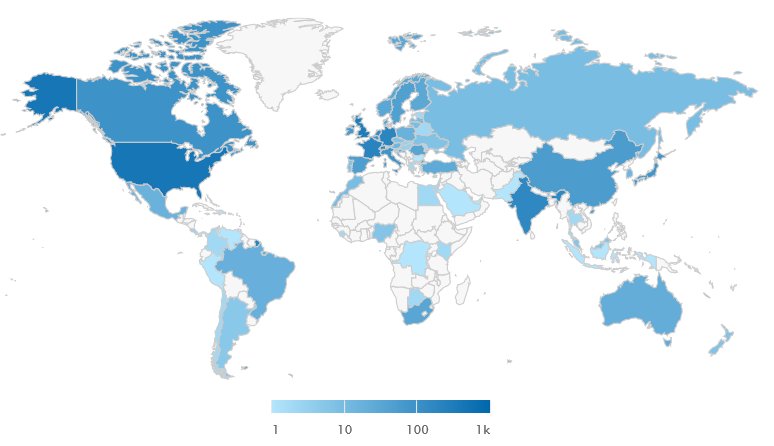

India, US, France and Germany colour dark blue. No surprise.