The idea of negotiations of A is to come up with a fixed formula per industry that can be applied on the global profit margin of each company.

This would be the formula: (Z% - X%) x V% = W% / sales per country.

Easy and simple? No!

And a thread about unilateral measures by @Hamza_M_Ali

ictd.ac/blog/the-oecds…

and alexandrareadhead.com/blog

Last week's study of the IMF also crucial! imf.org/en/Publication…

(1) the very important step B for developing countries 👉 a fixed return for distribution and marketing activities in countries.

(2) the very contentious step C for a mandatory binding arbitration.

1. A should take employment into account in allocation key.

2. A should cover enough profits to be meaningful.

3. High fixed return in B

4. No mandatory binding arbitration

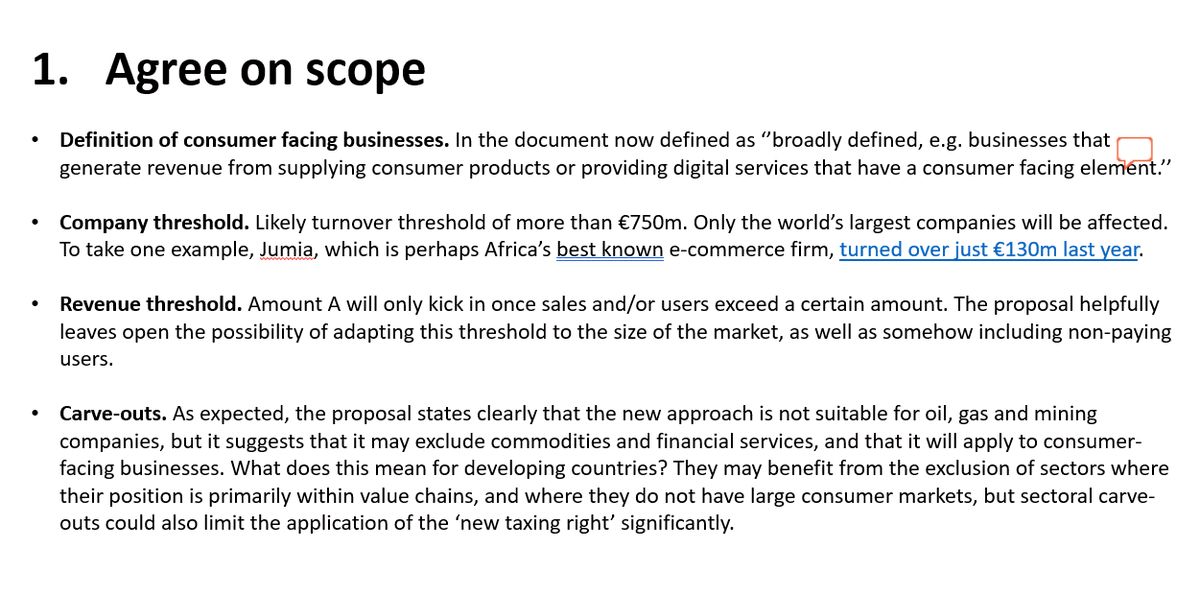

5. Scope of reform is not clear!

6. Fear for extra complexities & new grey zones

Still under negotiation and this is the actual revolution if well designed and ambitious!

Also the reforms are far from being finalized. This is just the beginning.