1. Siyaram Silk Mills is engaged in the business of Fabrics, Readymade Garments. It has a 5% branded fabrics market share. With revenue mix as 74% fabrics, 23% Garments. India comprises of 91.5% of revenue and the rest is from exports.

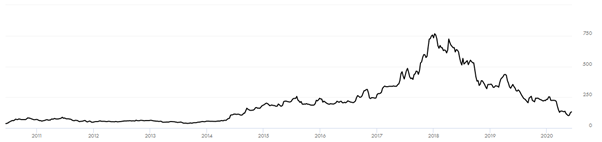

#MutualFunds have been continuously increasing shareholding from 5% to 10.5% in 10 years.

8. Account receivables are 393 Cr. Which is 90days of receivables which is ok.

The company is good it's just that you have to be patient. @GicGupta @CA_ShivamSG