A quick personal take in this thread. #Oxfam reaction will come in the next hours.

What does this mean for the EU? Is the USA all bad?

👇👇👇

news.bloombergtax.com/daily-tax-repo…

Pillar 1 = digital economy. Pillar 2 = minimum tax.

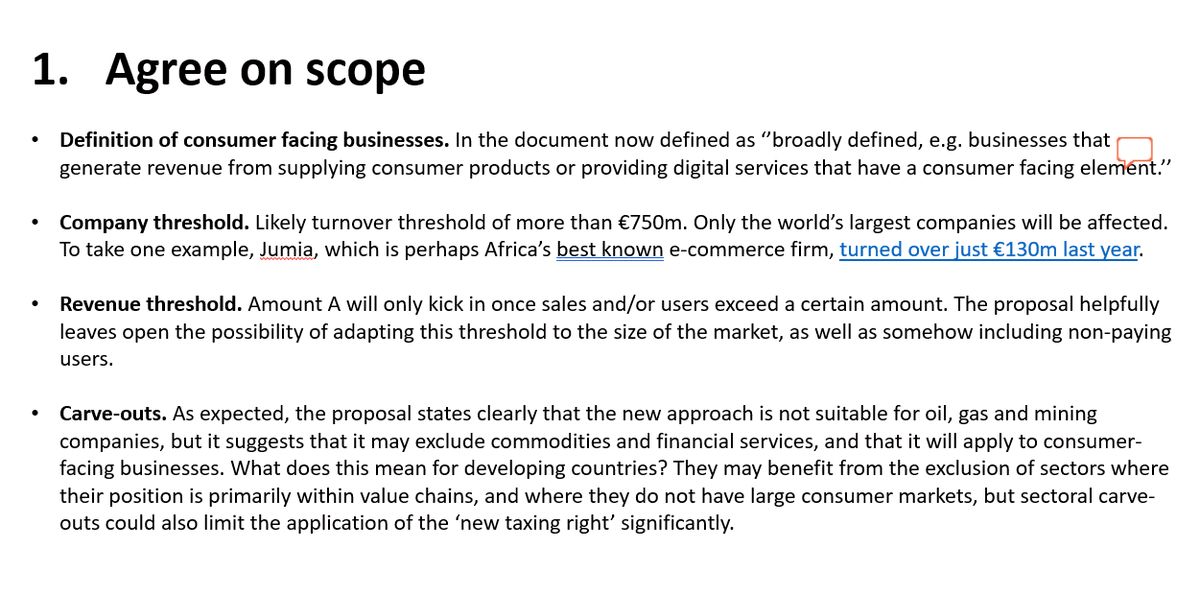

Pillar 1 divided countries from the very start. Some countries wanted a very limited focus (only techgiants) and others wanted to broaden the scope.

Actually the USA wanted a broad scope.

Also the USA was very aggressive in its response to unilateral digital taxes with trade retaliations and threats.

And who knows we could potentially expect a breakthrough in October 2020 in Berlin when Inclusive Framework meets.

Although important to note the US has been very stiff on this and wants to impose its own system (i.e. GILTI).

A strong pillar 2 would be fundamental, in particular now with large budgetary deficits with COVID-19. But not just a pillar 2 based income inclusion rule.

The German presidency is starting in July and Germany has been very vocal on wanting a minimum tax.

The European Commission has also been very vocal on going unilateral if no deal is reached.

So perhaps these two forces could join.

The EU can (!) play a very positive role if it wants.

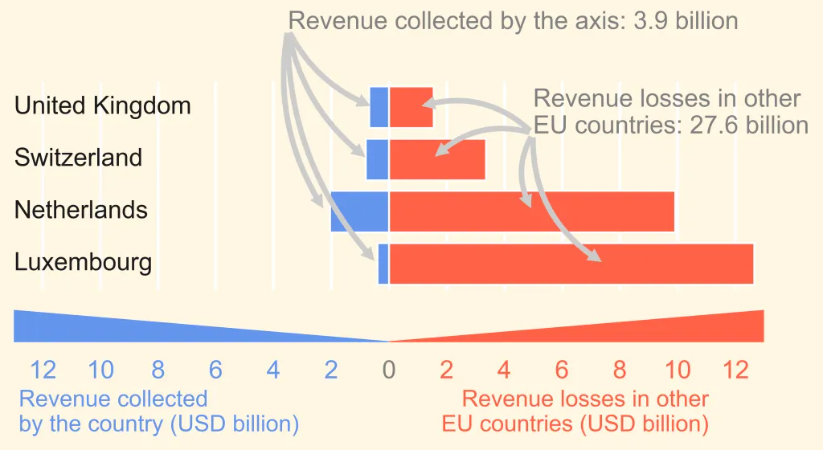

As the IMF pointed out in March 2019, low income countries are in particularly harmed. We need to stop the race to the bottom. Only tax havens win if no action is taken.

So losing pillar 1 means losing:

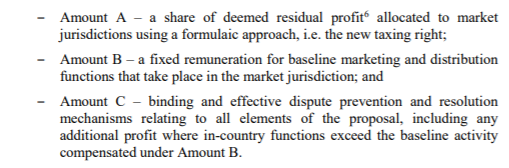

- an overly complex amount A - but moving a bit away of arm's length.

- a potentially interesting but limited solution for Transfer Pricing in developing countries.

- mandatory arbitration

Does a pause of pillar 1, mean the end of the negotiations as such?

The world needs to reform the international tax framework and needs to agree on a minimum tax to stop the race to the bottom.