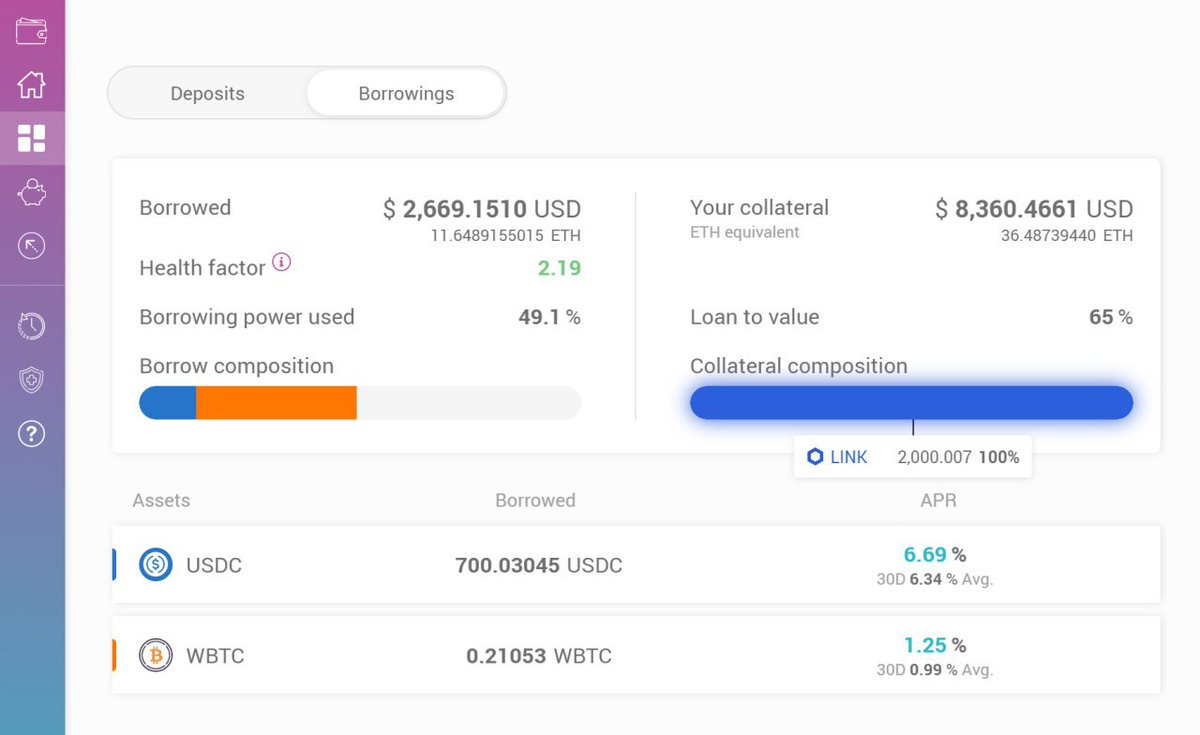

Deposit $LINK to @AaveAave

Use as collateral to borrow $WBTC

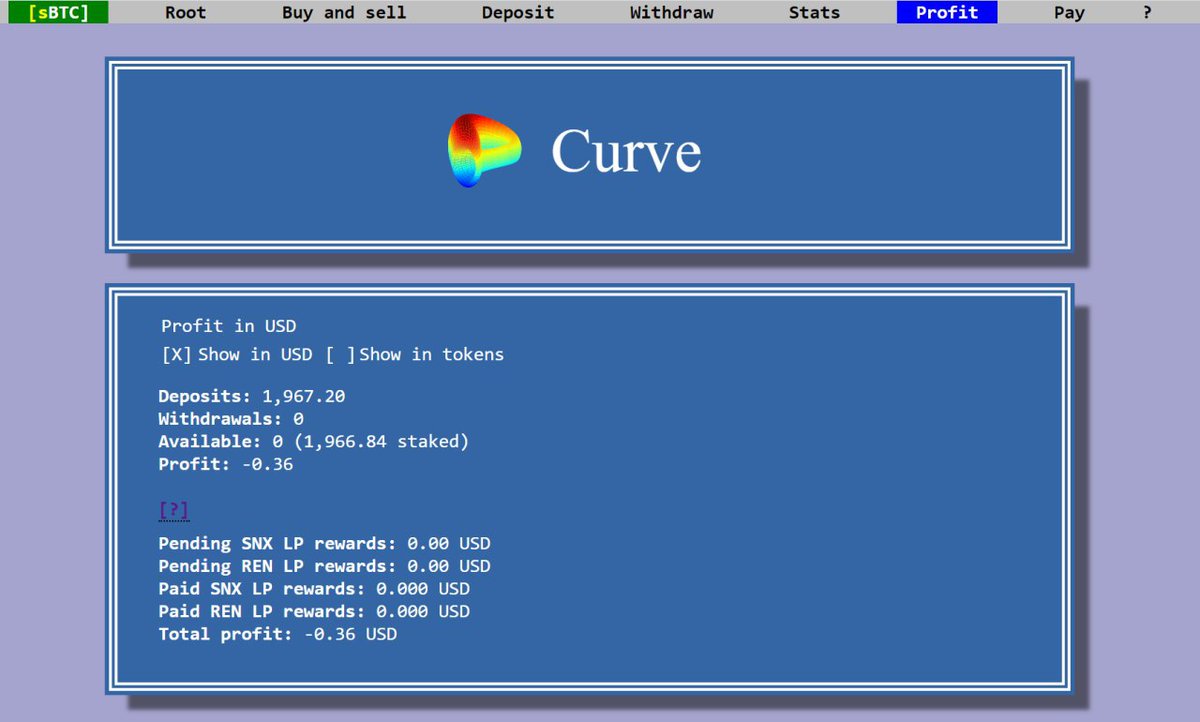

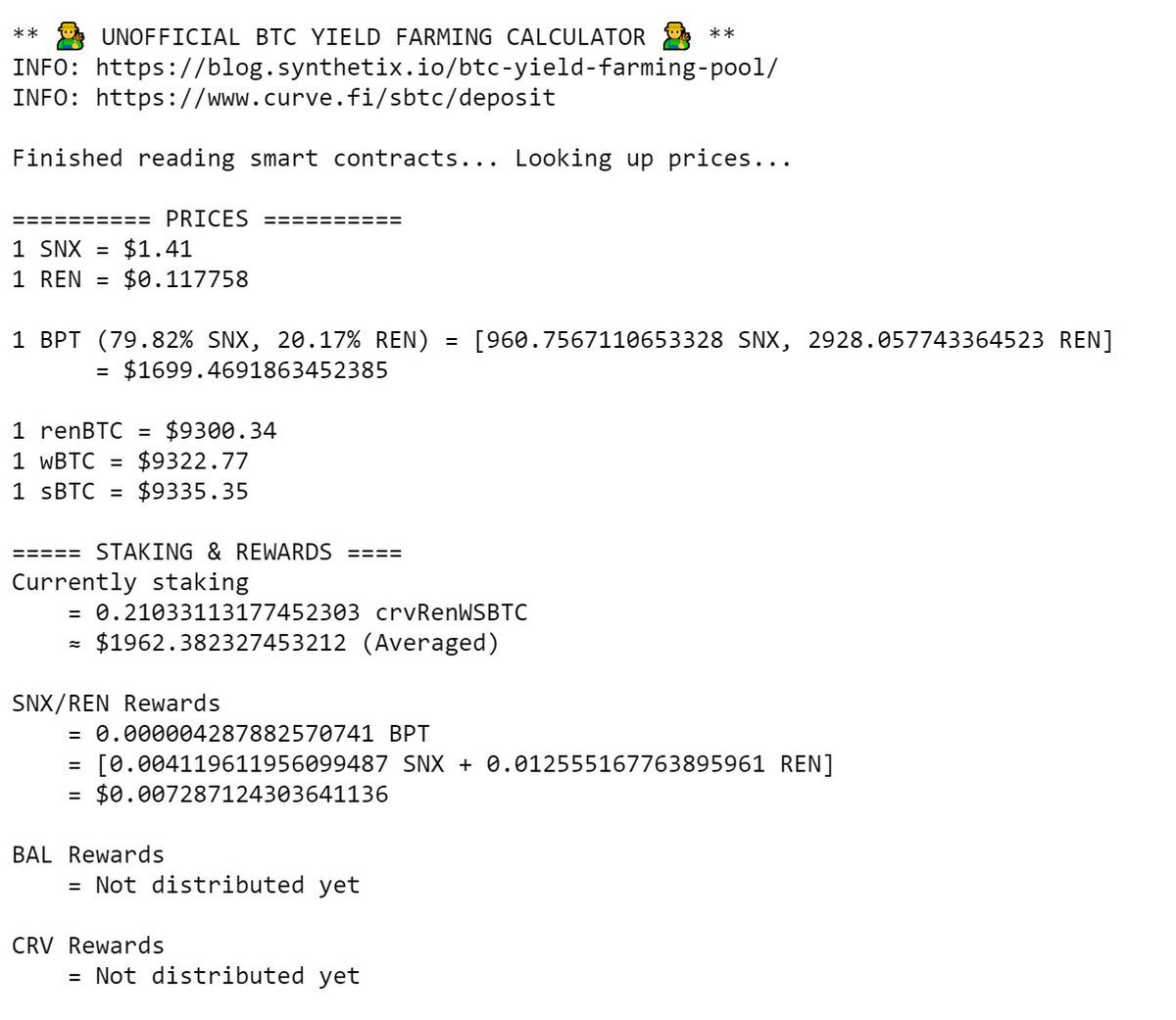

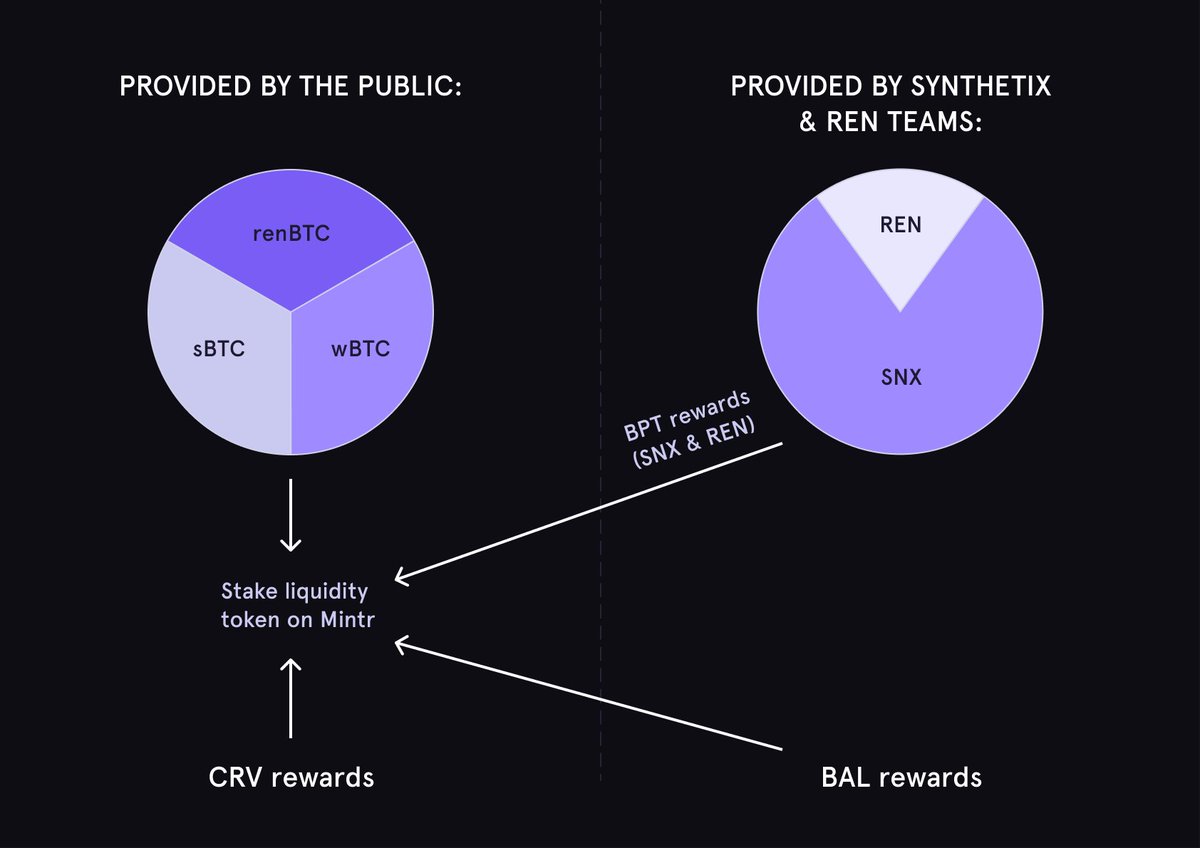

Deposit $WBTC to @CurveFinance

Recieve $crvRenWSBTC LP token

This LP token is 36% $renBTC, 25% $wBTC, 39% $sBTC

Stake pool token on @synthetix_io

Farm $SNX $REN $BAL & $CRV 🤯

Through this, I have 100% exposure to $LINK, 0% exposure to $BTC, just farming the profits 👨🌾

More information on what makes this wizardry possible below

blog.synthetix.io/btc-yield-farm…