Spoiler: This is long-term extremely bullish.

(data @glassnode)

Let's dig in 👇

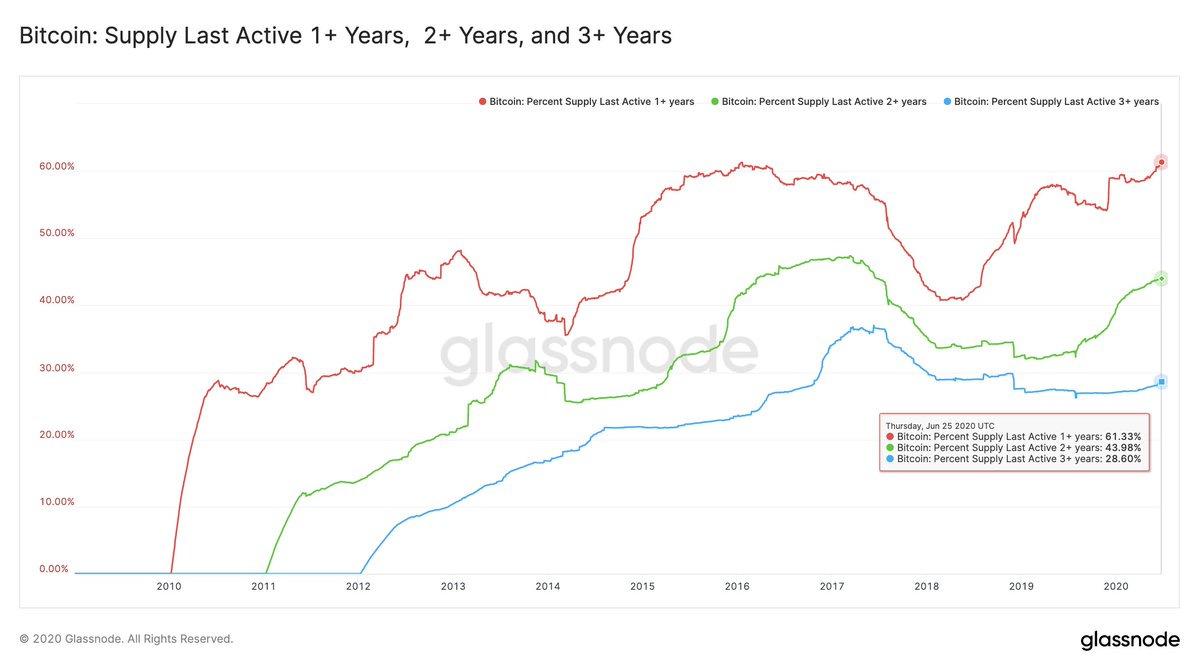

61% (!) of #Bitcoin supply that hasn't moved in over a year – that's an all-time high.

Moreover, 44% hasn't moved in 2+ years (approaching ATH), and almost 30% hasn't moved in 3+ years.

Loads of hodling here.

studio.glassnode.com/compare?a=BTC&…

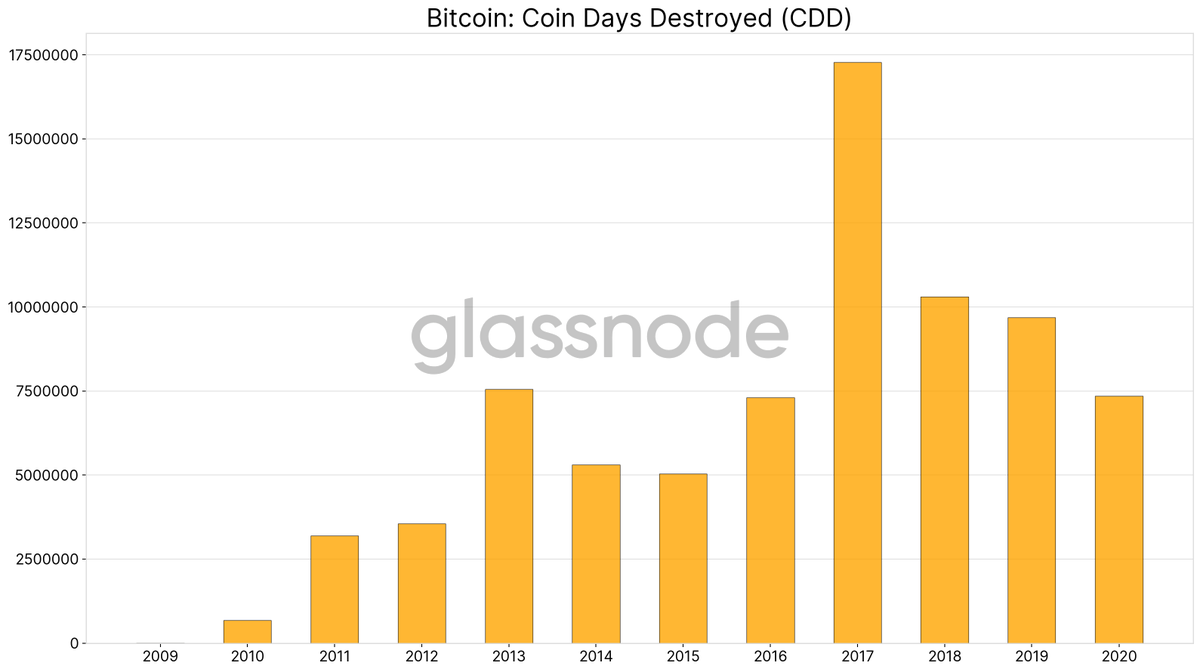

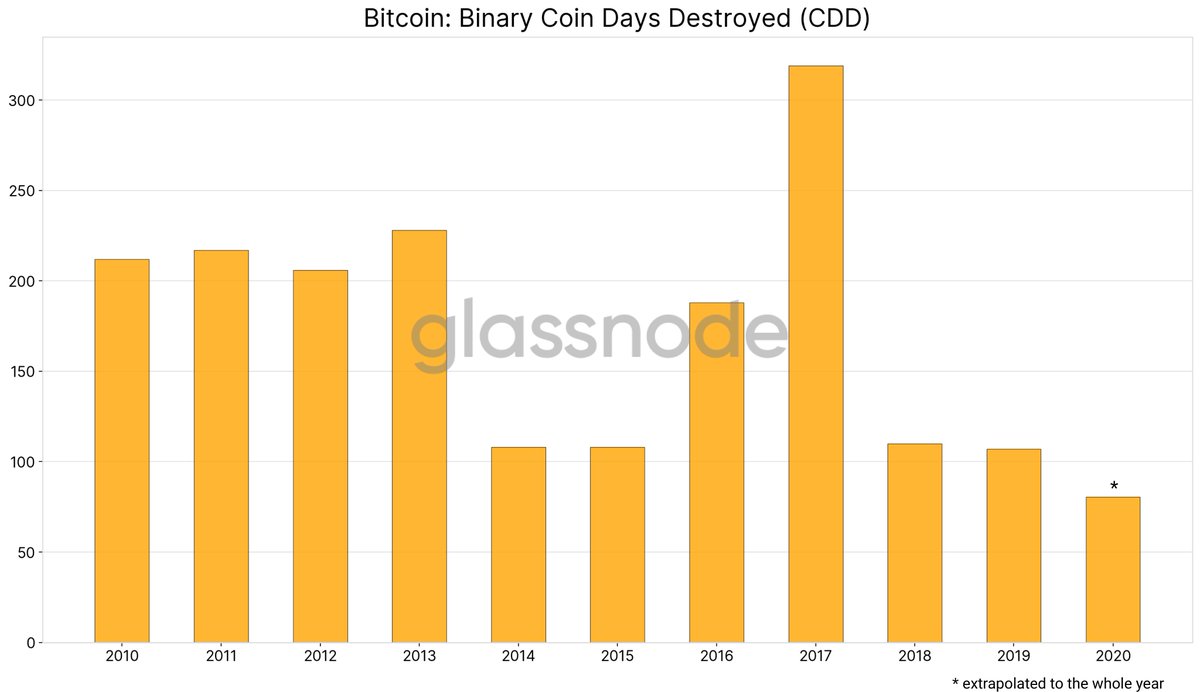

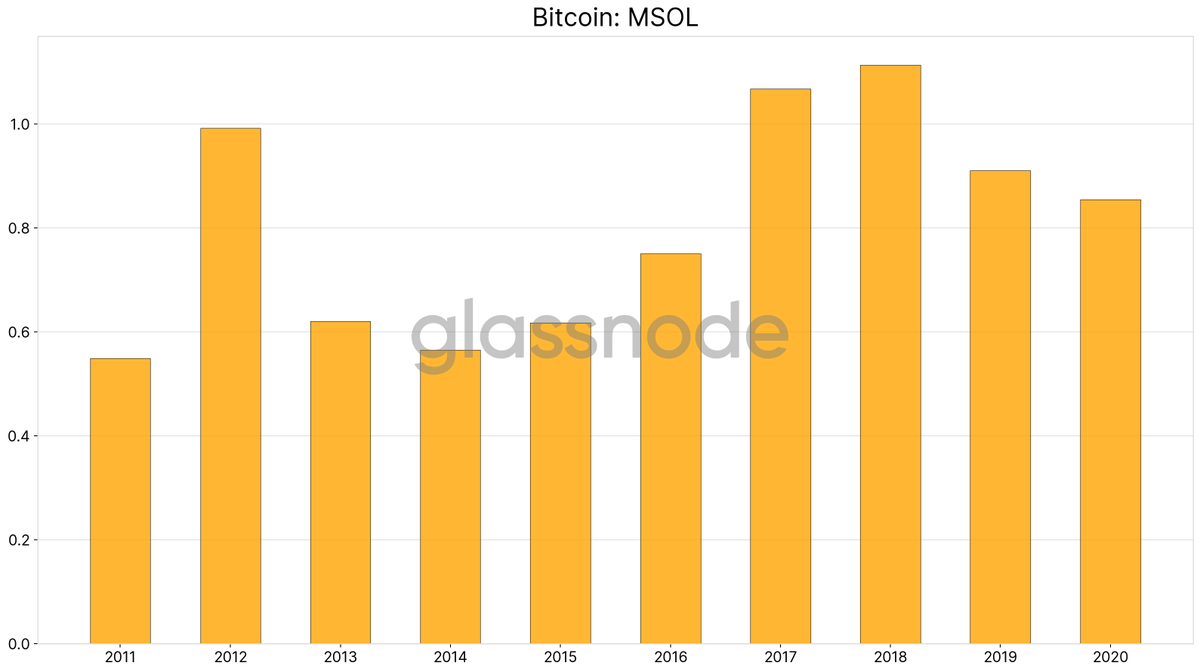

Lower CDD = more long-term hodlers.

studio.glassnode.com/metrics?a=BTC&…

(h/t @hansthered for this metric)

studio.glassnode.com/metrics?a=BTC&…

Reserve Risk at these levels indicates an attractive risk/reward ratio to invest.

Highly recommended read by @hansthered & @Ikigai_fund – kanaandkatana.com/valuation-depo…

studio.glassnode.com/metrics?a=BTC&…

Liveliness increases as long-term holders liquidate positions, and decreases as long-term investors accumulate to HODL.

studio.glassnode.com/metrics?a=BTC&…

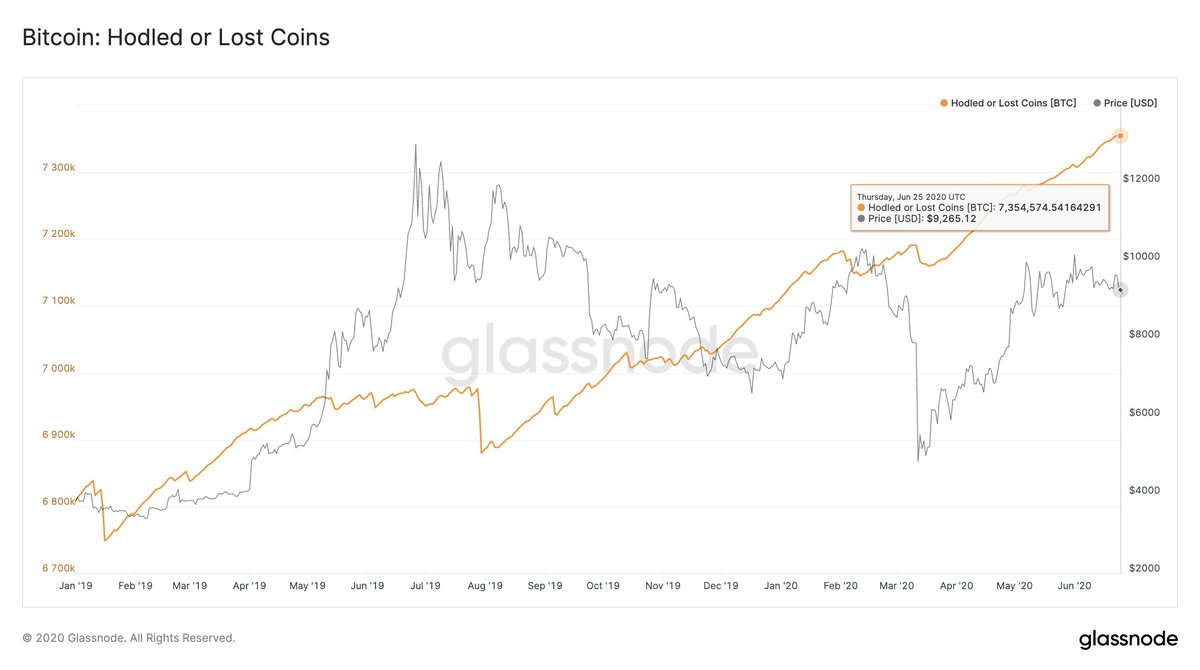

It is currently sitting at more than 7.3 million $BTC – that is 40% of the circulating #Bitcoin supply.

(h/t @TuurDemeester & @Adamant_Capital for this metric)

studio.glassnode.com/metrics?a=BTC&…

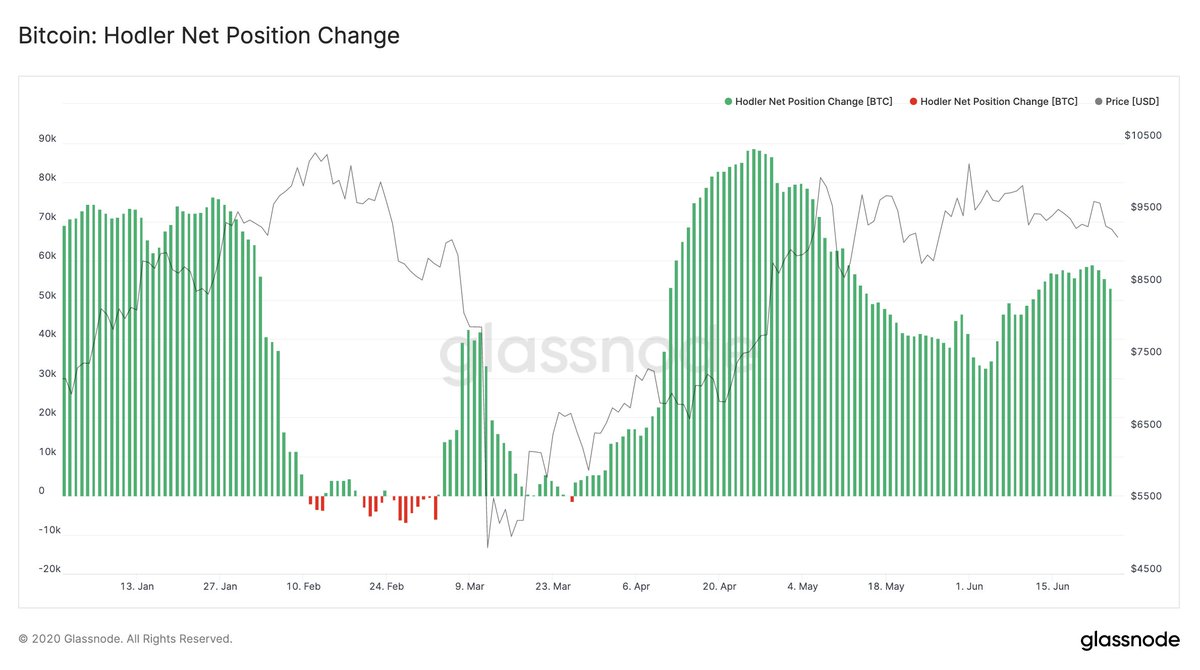

HODLers doing what they do best.

(again h/t @TuurDemeester and @Adamant_Capital for the metric)

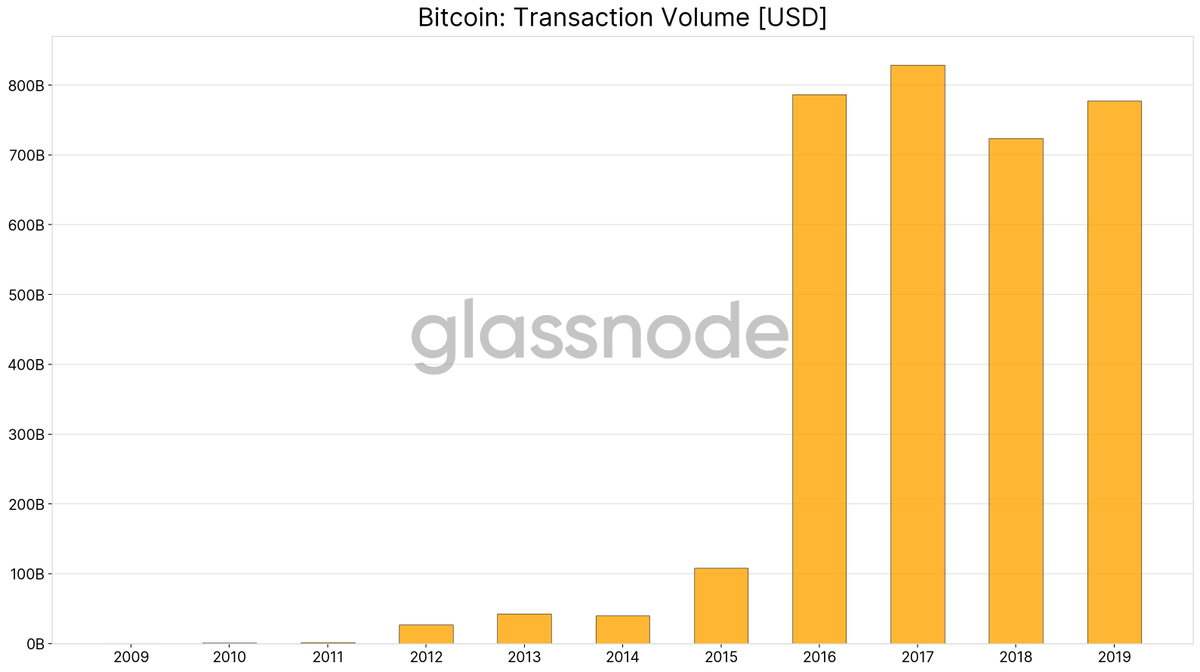

This shows that on average the age of #bitcoins being moved on-chain is constantly decreasing in the recent years.

(h/t @renato_shira for this metric)

studio.glassnode.com/metrics?a=BTC&…

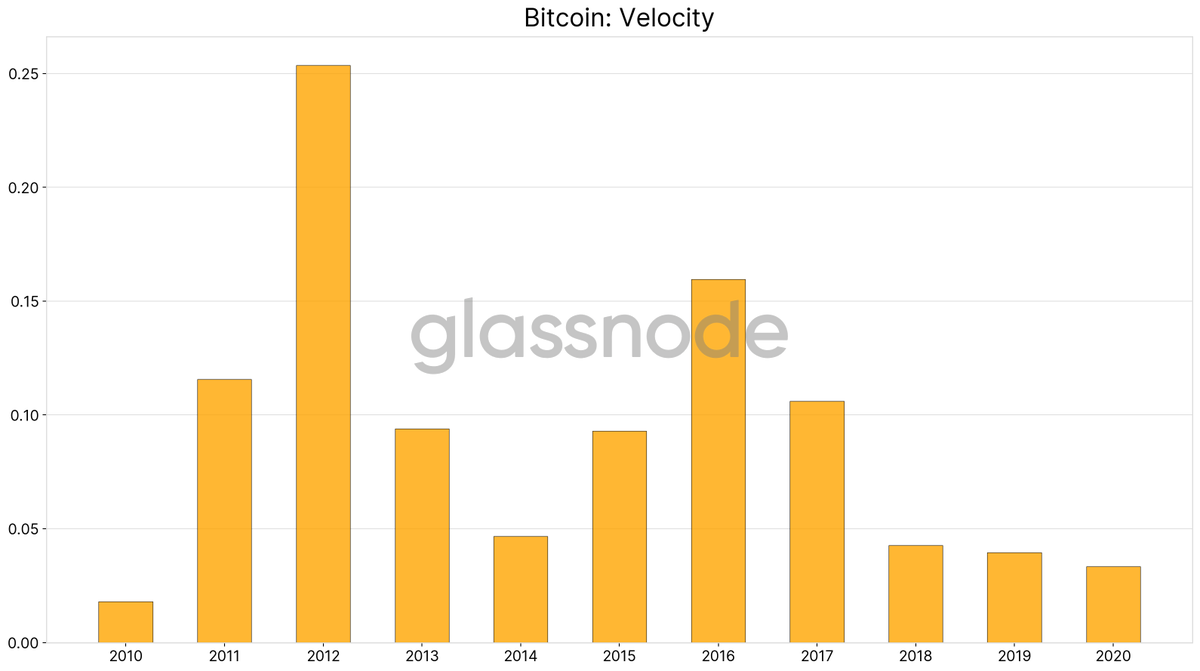

This is a clear indication of Bitcoin's SoV narrative.

Investors are simply not willing to spend their bitcoins.

studio.glassnode.com/metrics?a=BTC&…

LTH-MVRV usually only drops below 1 after prolonged #Bitcoin bear markets. Imo, current values indicate long-term investor confidence in higher $BTC prices from here.

studio.glassnode.com/metrics?a=BTC&…

Once again this is strong support for investors' unwillingness to spent $BTC and the store-of-value narrative.

studio.glassnode.com/metrics?a=BTC&…

While there are a variety of factors that contribute to this decrease, a portion of this is potentially due to investors' taking custody of their $BTC.

studio.glassnode.com/metrics?a=BTC&…

Much hodling going on. I'm extremely long-term bullish on #Bitcoin. Don't let yourself get distracted by short-term price action – and always remember to zoom out and look at the bigger picture.

(Obviously nothing here is investment advice.)