1/ "Wholesale transfer pricing power" is a phenomenon I've written about often. If you don't understand this power, you can't understand something like a YouTube TV price increase. The best way to teach people about it is to tell a story about John Malone. techcrunch.com/2020/06/30/you…

2/ If I told the John Malone story how many people on Twitter would be willing to do the reading? The homework assignments would all be public documents available for free on the Internet. It's not even that much reading. But you would need to do the work to get the benefits.

3/ "Even if you ain't ready yet, all I gotta say is ready, set, let's go."

It is important to listen/read the links I post tomorrow in order to best understand the story. Watch for clues that help you understand why price was raised by YouTube.

Socratic dialogue comes next.

It is important to listen/read the links I post tomorrow in order to best understand the story. Watch for clues that help you understand why price was raised by YouTube.

Socratic dialogue comes next.

4/ John Malone homework:

Biographical John Malone interview - video and transcript: cablecenter.org/index.php?opti…

How John Malone interview invests and runs businesses:

Video:

Transcript: community.intelligentfanatics.com/t/john-malone-…

Please do the homework or don't participate

Biographical John Malone interview - video and transcript: cablecenter.org/index.php?opti…

How John Malone interview invests and runs businesses:

Video:

Transcript: community.intelligentfanatics.com/t/john-malone-…

Please do the homework or don't participate

5/ Three part John Malone interview about his businesses and investing:

bizjournals.com/denver/stories…

bizjournals.com/denver/stories…

bizjournals.com/denver/stories…

Extra credit John Malone homework:

bizjournals.com/denver/stories…

bizjournals.com/denver/stories…

bizjournals.com/denver/stories…

Extra credit John Malone homework:

5/ Is there material in the Cable Cowboy biography that's material to understanding wholesale transfer pricing power? Sure. But it's not essential. The John Malone interviews alone are sufficient. I actually often prefer raw interviews to a book format. books.google.com/books/about/Ca…

6/ If you have the Cable Cowboy biography of John Malone you might want to read these sections of the book and some material on pages to 86-88. This is not a about other aspects of what Malone did since the specific question to be answered is: Why did YouTube TV raise prices?

7/ Unpack tomorrow at noon: "Who's going to make money? It may be that the Disneys of the world make the money and cable and video continue to get squeezed. But I think at least for now they’ve got enough pricing power in broadband to make up for that.” multichannel.com/news/unleashin…

8/ If you read links I sent earlier you saw John Malone had more to deal with than competition in his industry (i.e., barriers to entry). He had to "consider the impact of customers, suppliers, potential entrants, and substitute products on his businesses."hbr.org/1979/03/how-co…

9/ I learned a lot about "supplier bargaining power" when I spent an intense period in 1997 working with a smart Malone lieutenant named Gary Howard on what the press called this: "Murdoch and Malone want to turn EchoStar into a self-styled ‘Death Star.’" afr.com/companies/medi…

10/ Murdoch didn’t feel he was being a fair price by companies that owned bandwidth to homes at that time. Since business that did own bandwidth had their own content, once a Death Star was in place the outcomes of transfer price negotiations would have more favorable outcomes.

11/ Porter believes relative position in a value chain has important impacts on firm strategy. "In addition to the firm's own value-creating activities, the firm operates in a value system of vertical activities including those of upstream suppliers and downstream channel."

12/ I wrote a thread previously about wholesale transfer pricing power: threadreaderapp.com/thread/1183035… The rest of this thread will focus on how John Malone’s success explains concepts like barriers to entry and wholesale transfer pricing power. What can you learn from his success?

13/ When John Malone left McKinsey to join General Instrument he was given the task of running a cable equipment and services subsidiary that had a pricing model common today: "Jerrold was paid $5 per connection and 25 cents per month per subscriber." cablecenter.org/programs/the-h…

14/ Jerrold would sometimes itself be in the cable business if a cable provider could pay its debts. Malone saw the elements of the value chain then:

a. content suppliers

b. bandwidth providers

c. equipment providers

These layers battle over their share of a profit pool.

a. content suppliers

b. bandwidth providers

c. equipment providers

These layers battle over their share of a profit pool.

15/ Malone then left GI to join TCI. In 1984, he learned that ESPN wanted to charge 25 cents per subscriber.” He knew this was problematic.

“I had fought tooth and nail to prevent MTV from charging us for MTV. They were doing quite well without a subscription fee.” John Malone

“I had fought tooth and nail to prevent MTV from charging us for MTV. They were doing quite well without a subscription fee.” John Malone

16/ The cable industry had changed a lot from the days in which people put antennas on something high in the air and paid nothing for content they retransmitted through wires to homes in return for a fee. Malone knew that content would get what Buffett calls "pricing power."

17/ “Pricing power” determines who captures the greatest share of free cash flow in value chains. Pricing power applies not just to the retail price but all wholesale prices. Each of those prices is determined in a process best described by game theory, which is another topic.

18/ John Malone hedges his bet: "[Over time we became more] willing to entertain subscription fees for basic cable channels if we could see positive economics. We were willing to invest our capital in programming ideas that had this dual stream of income." webcache.googleusercontent.com/search?q=cache…

19/ "Malone knew it would be tough to resist the price demands of an established, popular brand. Rather than just owning the cable that delivered the new programming fare, TCI needed to own a piece of the channels themselves, thereby sharing in a whole extra upside." Cable Cowboy

20/ "A big operator like TCI could give a new network a big head start, and as valuable as its laid wires were, if the cable industry kept growing, the new networks now launching could be even more valuable." Cable Cowboy amazon.com/Cable-Cowboy-M…

To be continued later today.

To be continued later today.

21/ John Malone: "The fact that we have high-speed connection, having something like Netflix is good. From the video business point of view Reed Hasting’s taken a share of viewership, and that might not be good.” cnbc.com/2015/07/09/the…

22/ John Malone: "If you have a direct-to-consumer relationship, with scale, with growth, and you have pricing power...it's pretty powerful. [Disney has] a very powerful business model." google.com/amp/s/finance.… What's different about HBO Max? How does Roku change the game?

23/ John Malone: "My biggest investments were building a cable business and then selling a cable business and getting into a satellite business, and then when the internet became important, getting out of a satellite business and back into cable business. You have to be flexible"

24/ "The Five Forces determine the competitive structure of an industry, and its profitability. Industry structure, together with a company's relative position within the industry, are the two basic drivers of company profitability." isc.hbs.edu/strategy/busin…

25/iQuiz: In August of 2017 I wrote a post comparing Malone-controlled SIriusXM with Spotify. How is the analysis in that blog post holding up over time?

Would Malone approve of Spotify trying to obtain some pricing power in the podcasting business?

google.com/amp/s/25iq.com…

Would Malone approve of Spotify trying to obtain some pricing power in the podcasting business?

google.com/amp/s/25iq.com…

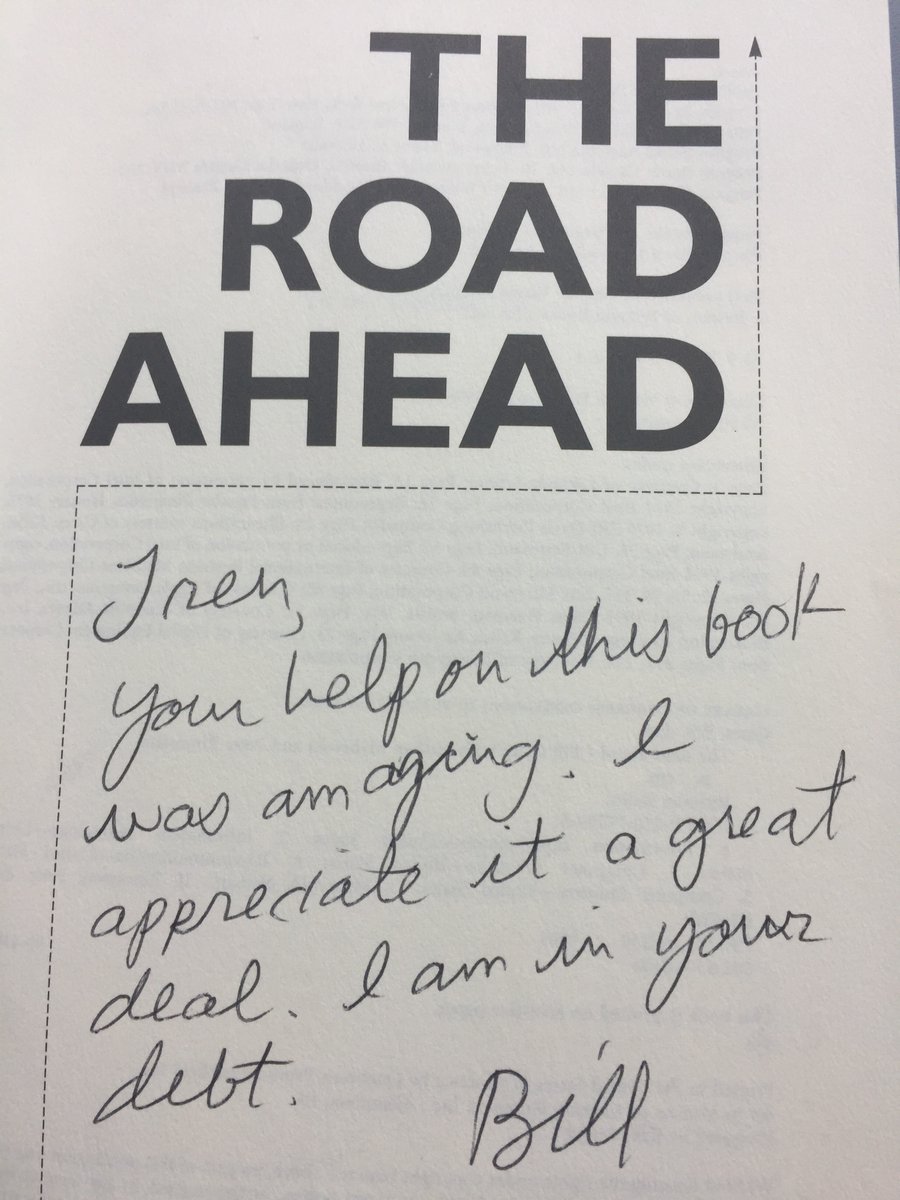

26/ "John Malone is straightforward in terms of talking about technology and strategy. He and I are damn similar. He worked at Bell Labs and understands both business and technology.”

Bill Gates, Playboy interview, July, 1994. thecorememory.com/The_Bill_Gates…

Bill Gates, Playboy interview, July, 1994. thecorememory.com/The_Bill_Gates…

27/ This 1994 Playboy interview took place at a time when "The Information Highway" vision which day access to data controlled by bandwidth providers was about to suffer an amazingly swift death as the Internet as a business phenomenon crushed it into the dustbin of history.

28/ Using the ideas in my John Malone tweetstorm (or your own ideas) how do you predict this will go:

"NBCU is not asking for carriage fees from any affiliates [and] open to revenue-sharing agreements, saying there are “different forms of value exchange.” news.google.com/articles/CAIiE…

"NBCU is not asking for carriage fees from any affiliates [and] open to revenue-sharing agreements, saying there are “different forms of value exchange.” news.google.com/articles/CAIiE…

29/ What are challenges here? How valuable is owning customer relationships?

"Peacock has not clinched distribution pacts with Roku or Amazon Fire, the two biggest over-the-top TV device makers (which also have been holdouts on HBO Max)."

> 300 US subscription-video platforms.

"Peacock has not clinched distribution pacts with Roku or Amazon Fire, the two biggest over-the-top TV device makers (which also have been holdouts on HBO Max)."

> 300 US subscription-video platforms.

30/ "Roku and Amazon would like to control a portion of Peacock’s advertising inventory. With no more than five minutes of ads per hour on Peacock NBC is unlikely to want to share its commercial time with Roku and Amazon." msn.com/en-us/finance/… Roku will get a rake. How much?

• • •

Missing some Tweet in this thread? You can try to

force a refresh