Check out our new edition of Macroeconomics of Covid in India series with @tulsipriya_rk #EconTwitter #macroIndiaupdate

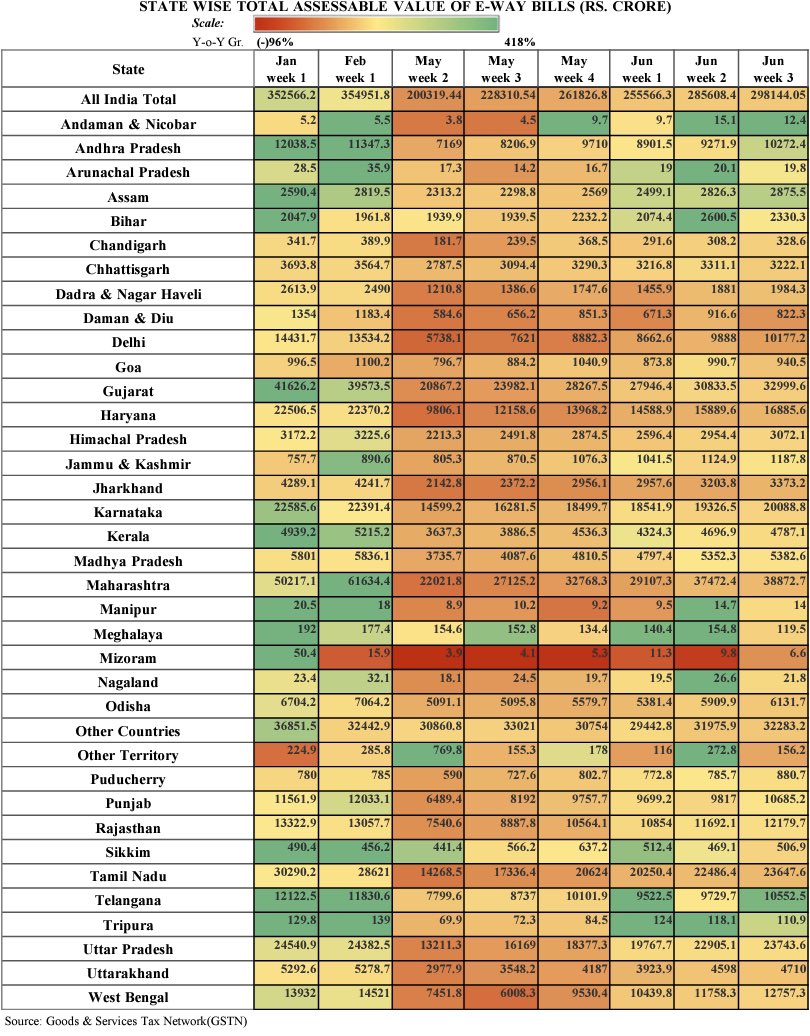

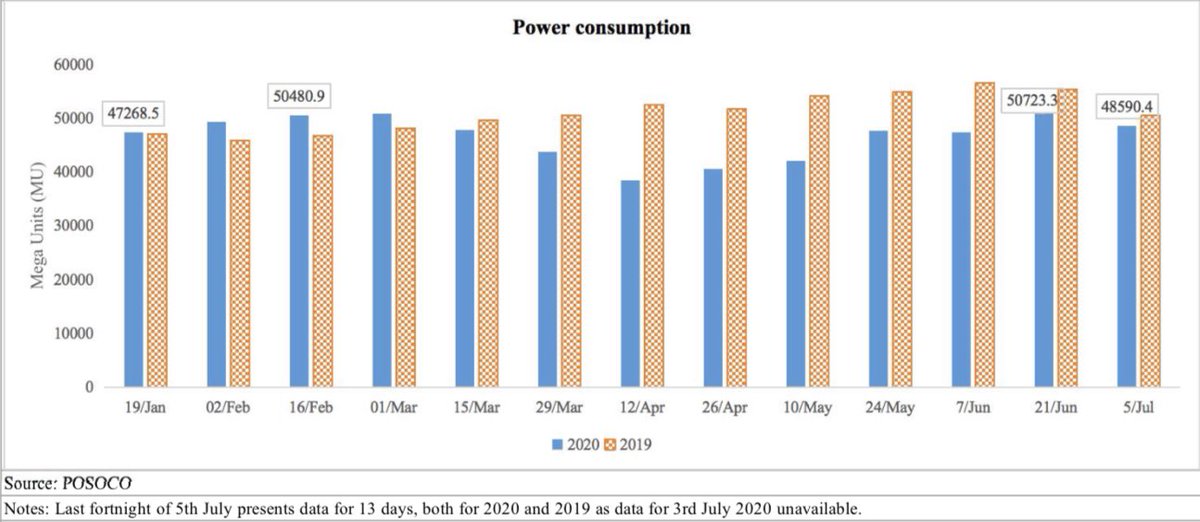

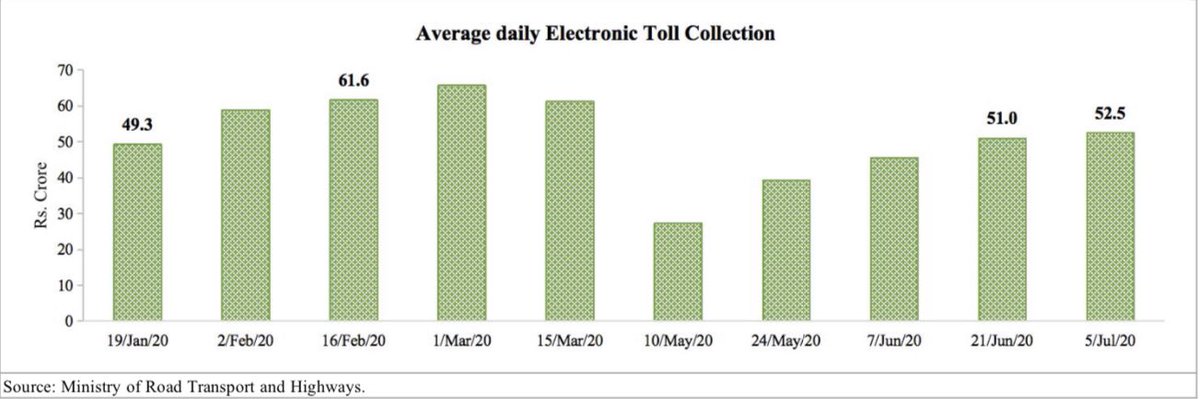

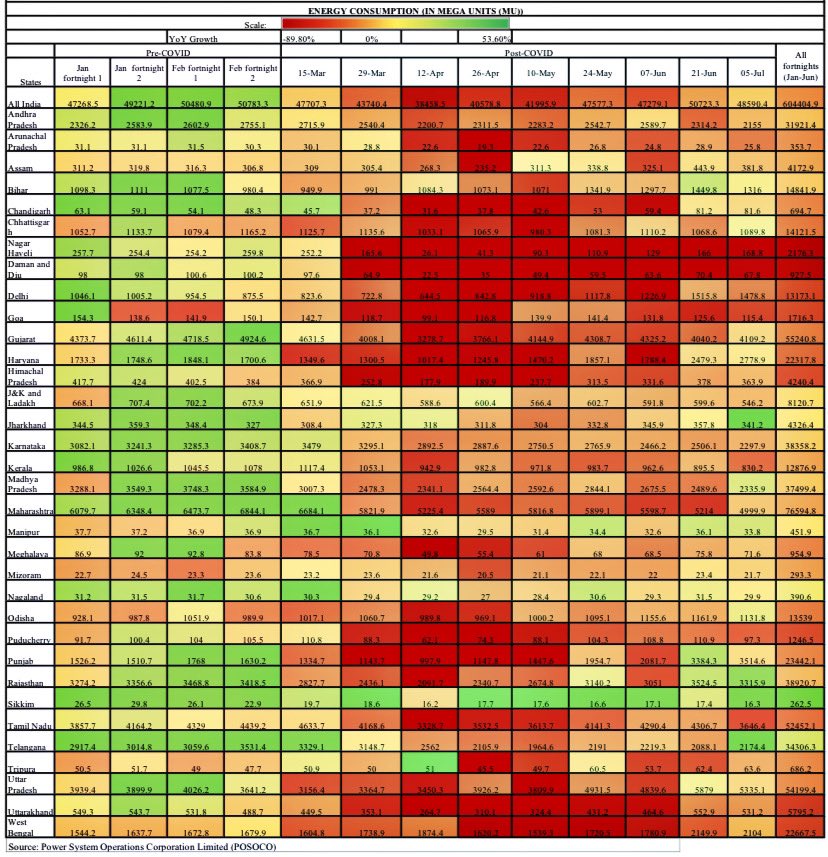

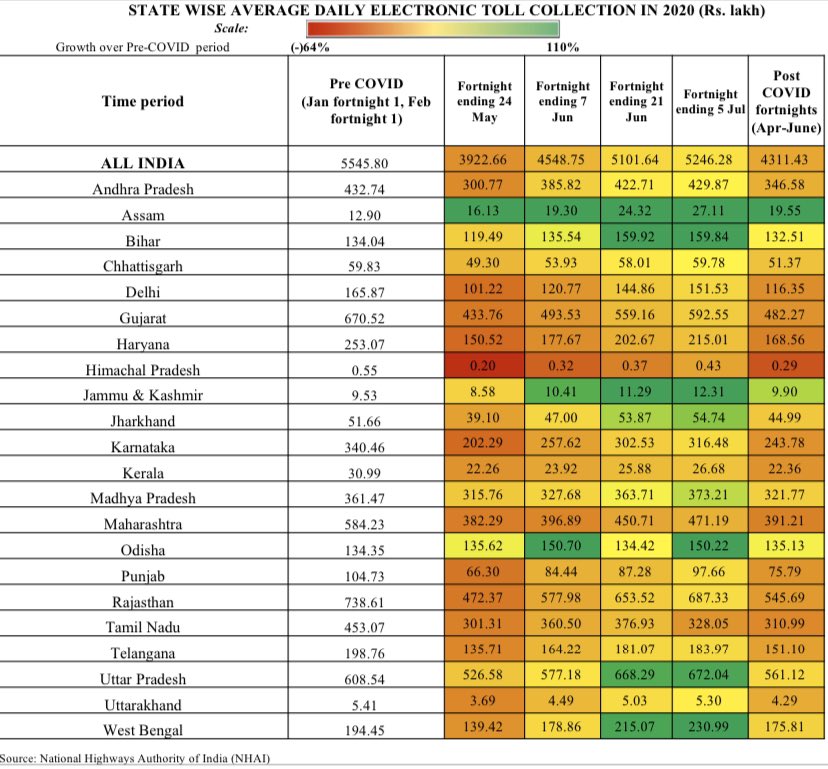

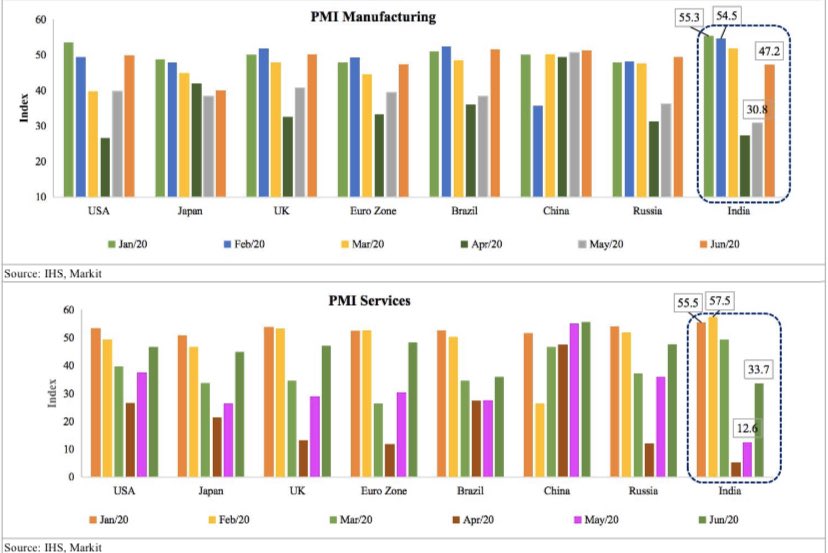

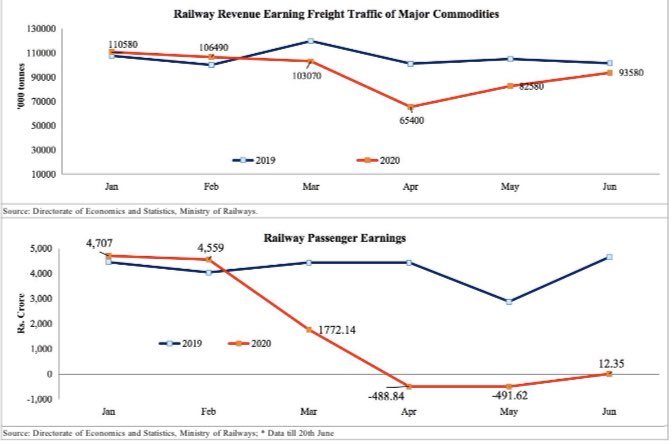

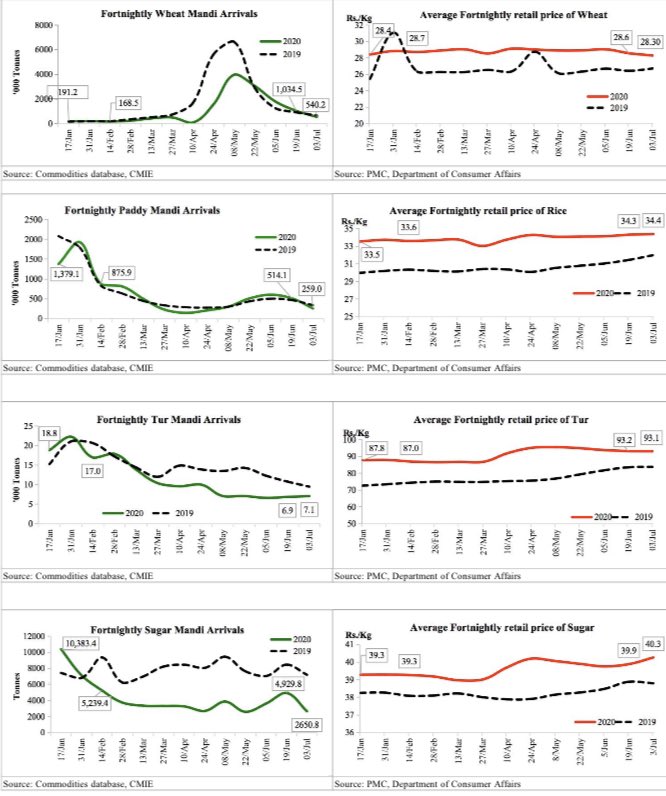

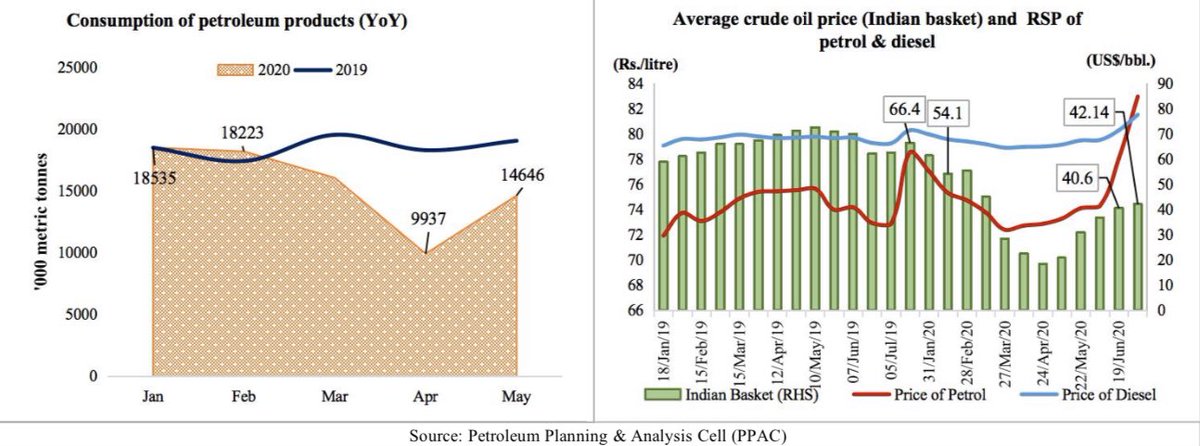

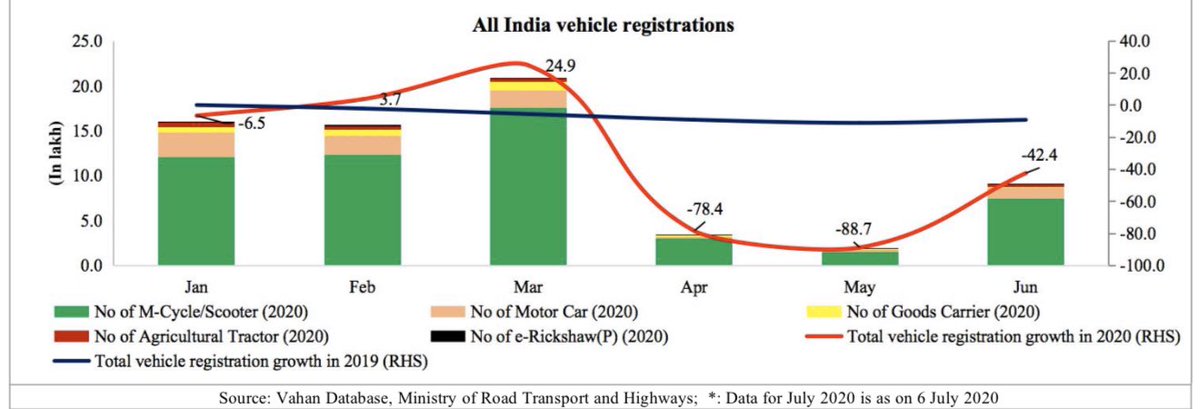

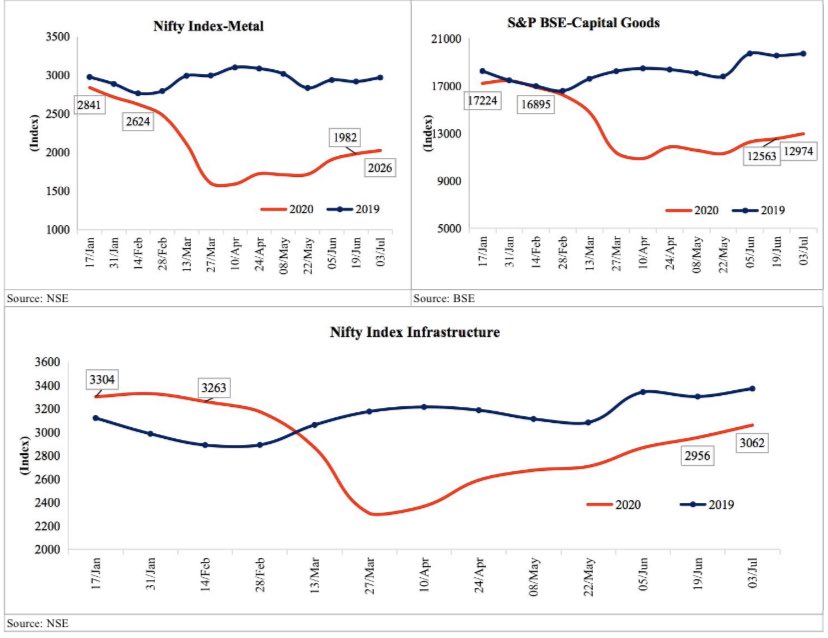

Real activity inching to preCovid levels.

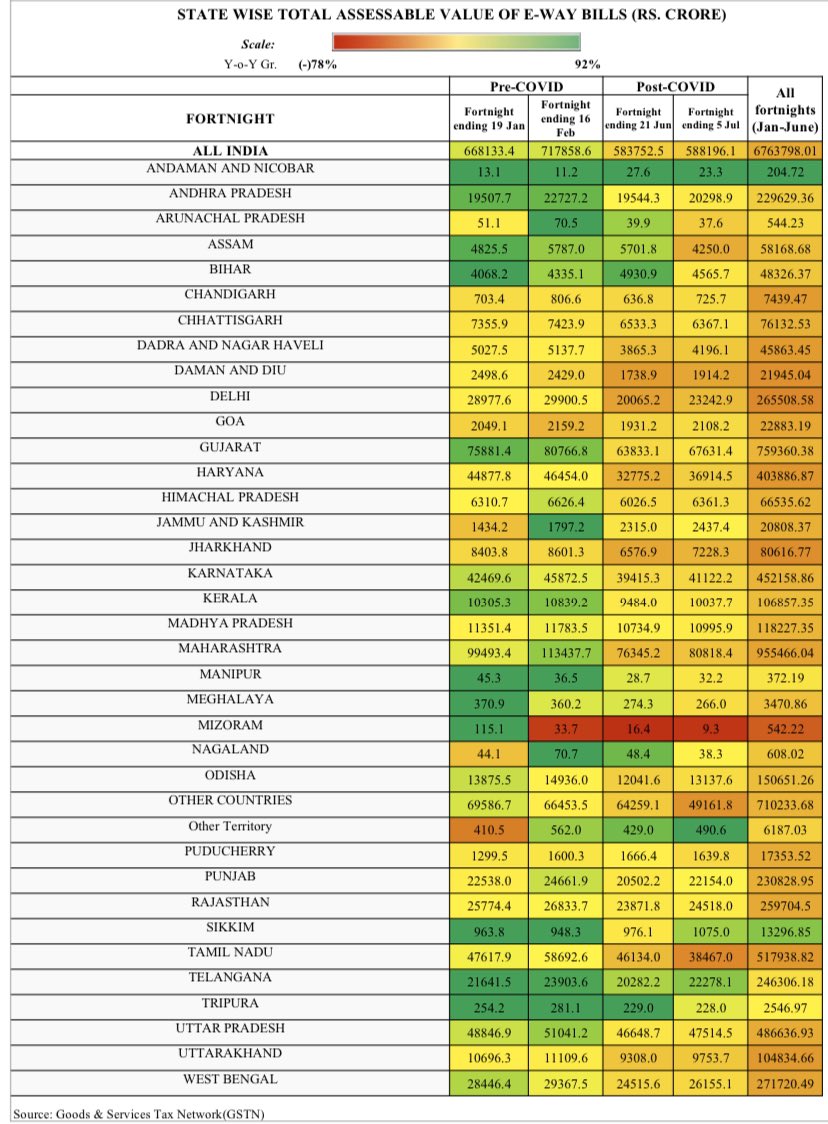

YoY contraction in power consumption relatively eased since mid-June across most states including Covid hotspots like DL, MH, WB and UP. JH, SKM, TLG and RJ showed greatest improvement in the fortnight ending 5th July. @tulsipriya_rk

@tulsipriya_rk

@tulsipriya_rk

@tulsipriya_rk

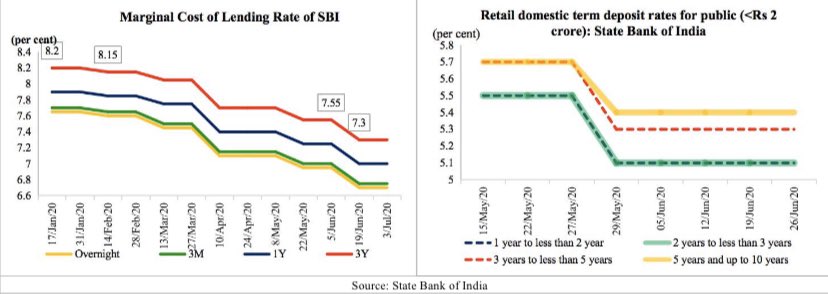

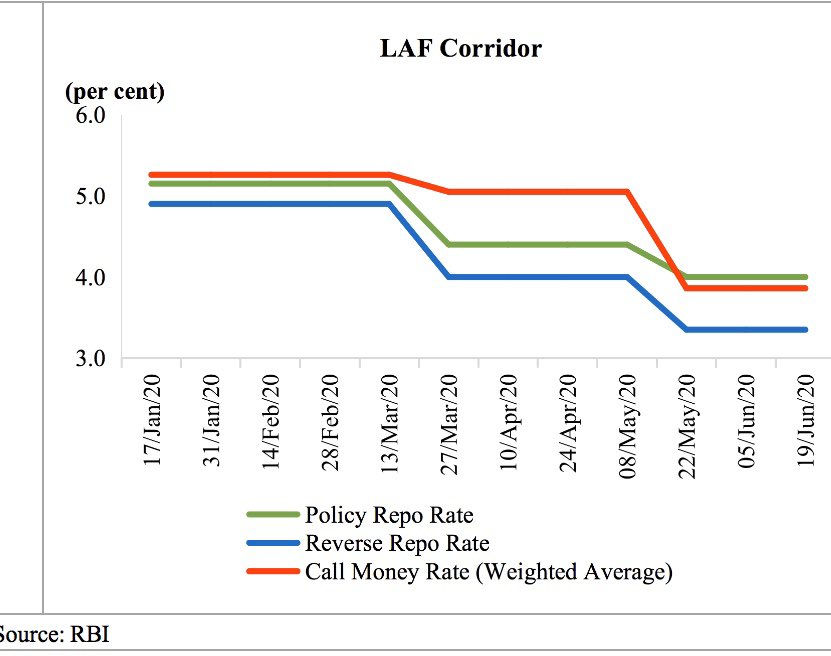

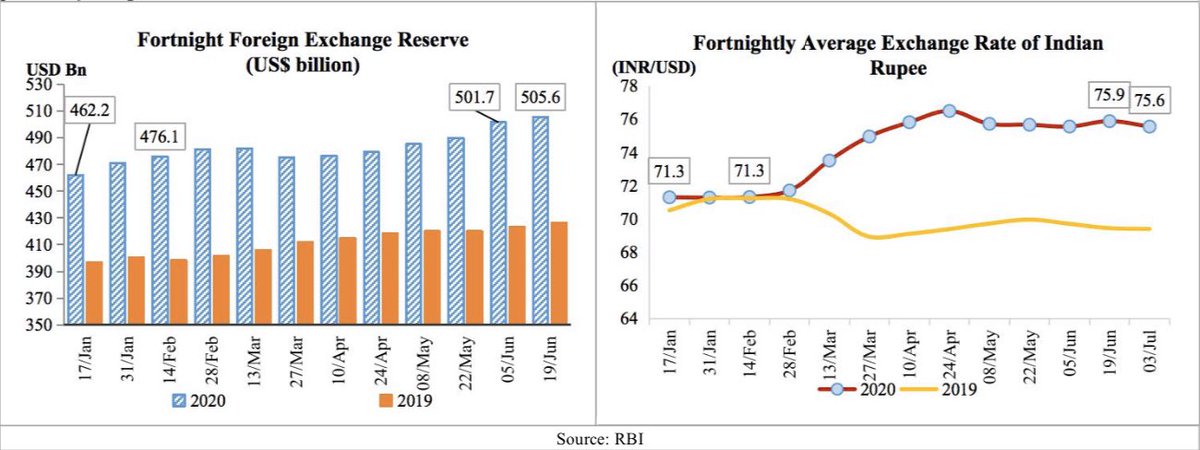

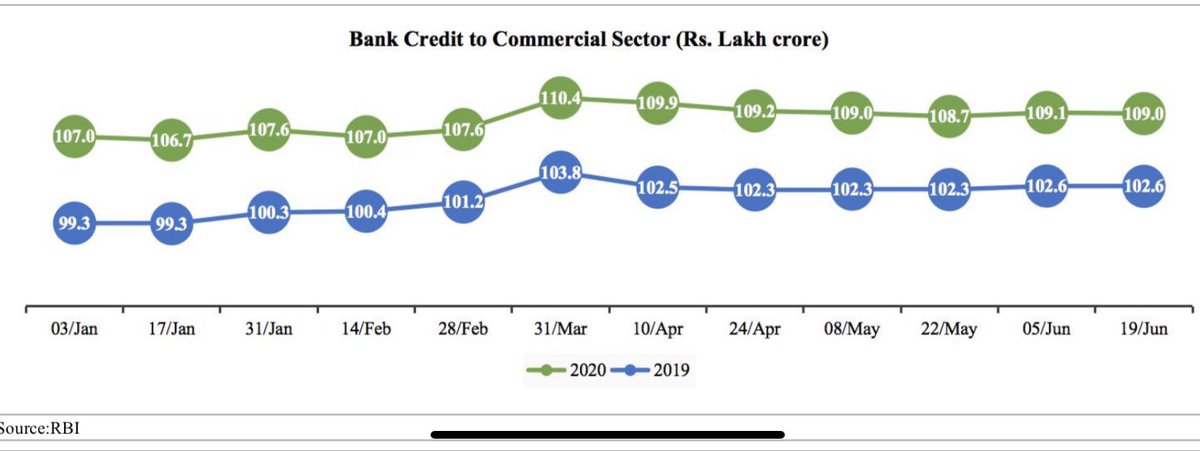

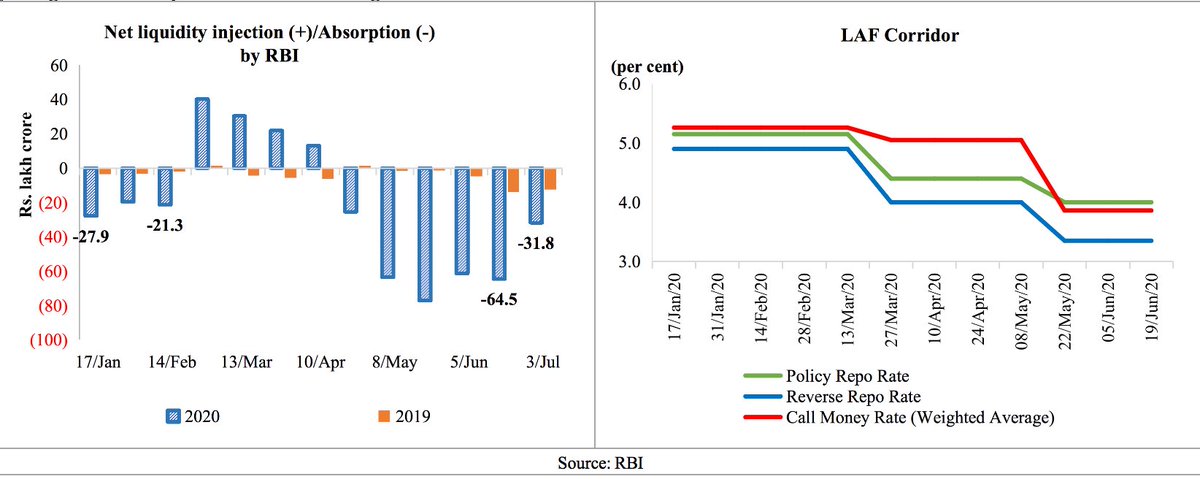

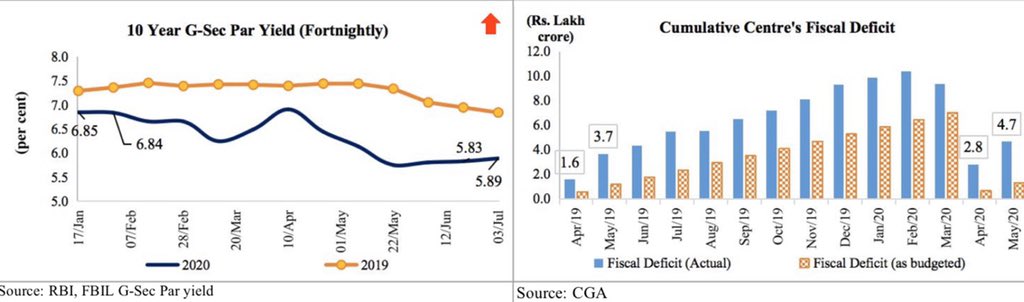

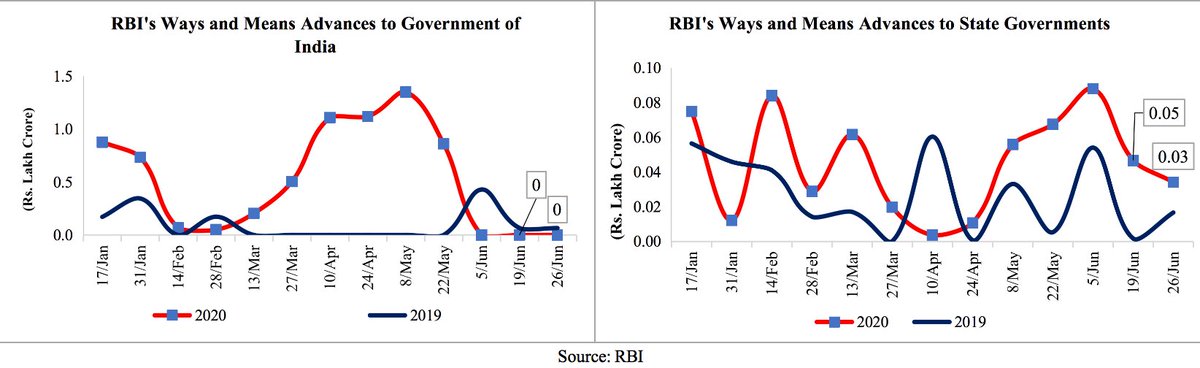

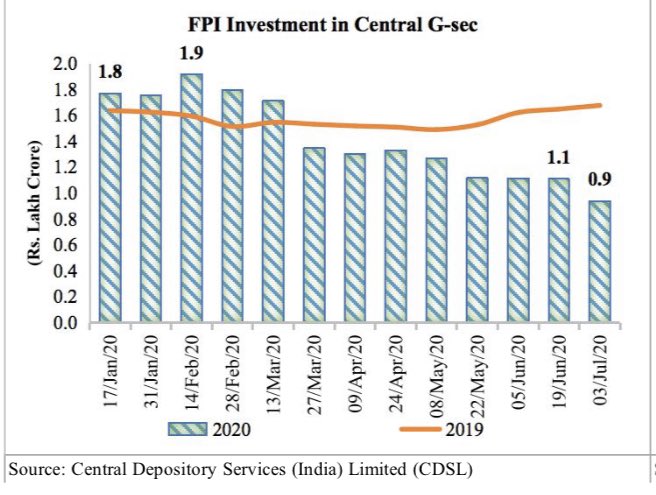

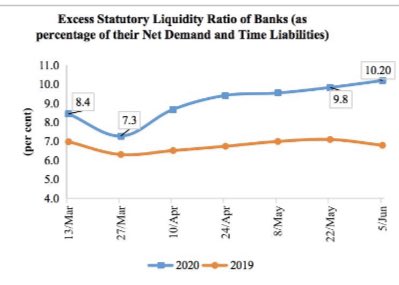

Monetary policy transmssn improving gradually @tulsipriya_rk