COVID-19 is an unparalleled economic crisis in modern history. My colleague @tulsipriya_rk and I have been tracking the macroeconomic effects of it on India’s economy on a weekly basis. Sharing some of the visualisations here in this thread.

#MacroOfCovidIndia

#MacroOfCovidIndia

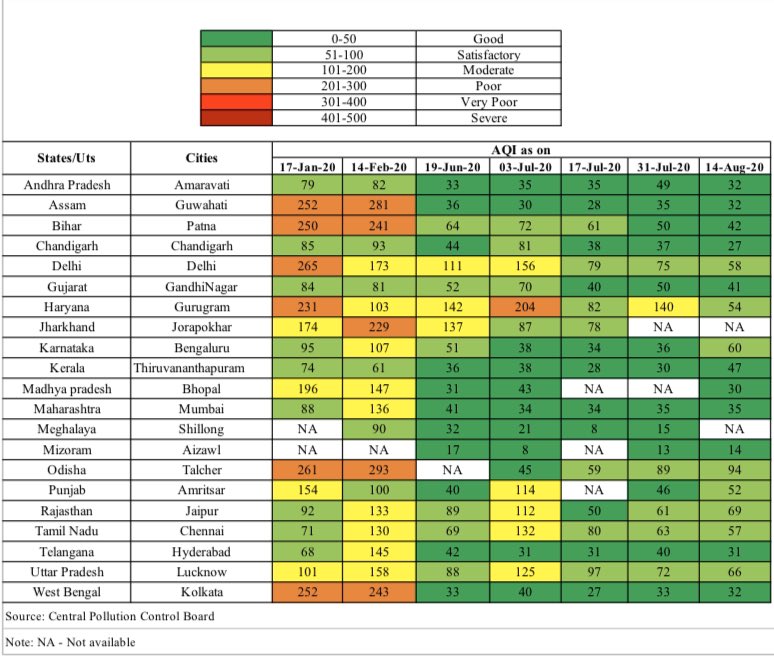

Globally, India’s workplace mobility rising relatively faster from a low base since Lockdown 3.0. Mobility levels to retail and recreation still 70% below baseline. #MacroOfCovidIndia @tulsipriya_rk

India's mobility to work places, grocery, pharmacy and transit stations picking up since 3rd May while visits to parks, retail and recreation spots remain low. @tulsipriya_rk

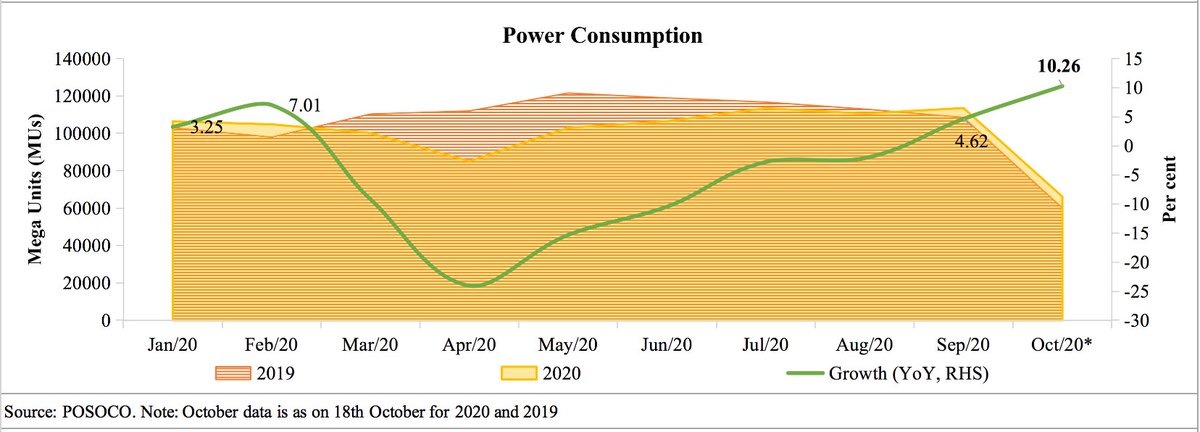

Electricity generation grew by 10.5% in the week gone by, yet to reach pre-COVID levels. Similar trend for carbon emissions. @tulsipriya_rk

While global aviation activity stays muted, India has witnessed revival of domestic flights since 4th May. Retail payments declined sharply in April, both in value and volume terms. @tulsipriya_rk #MacroOfCovidIndia #COVID19India #CoronavirusIndia #economy

Household demand for MGNREGA work stronger than ever at 3.5 crore, person days generated rise to 27.6 crore in May. @tulsipriya_rk #MacroOfCovidIndia #COVID19India #economy

Early signs of revival of global economic activity coupled with stimulus packages across countries drove the bullish performance of India’s equity markets in the week gone by, led by financial, metal and auto sector. @tulsipriya_rk #COVID19India #economy

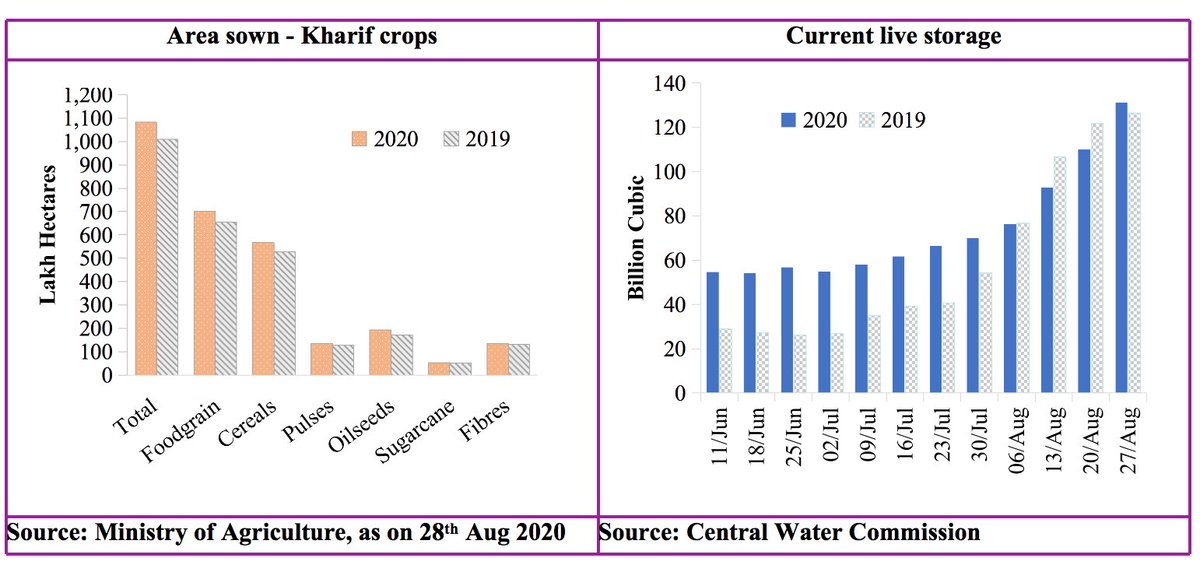

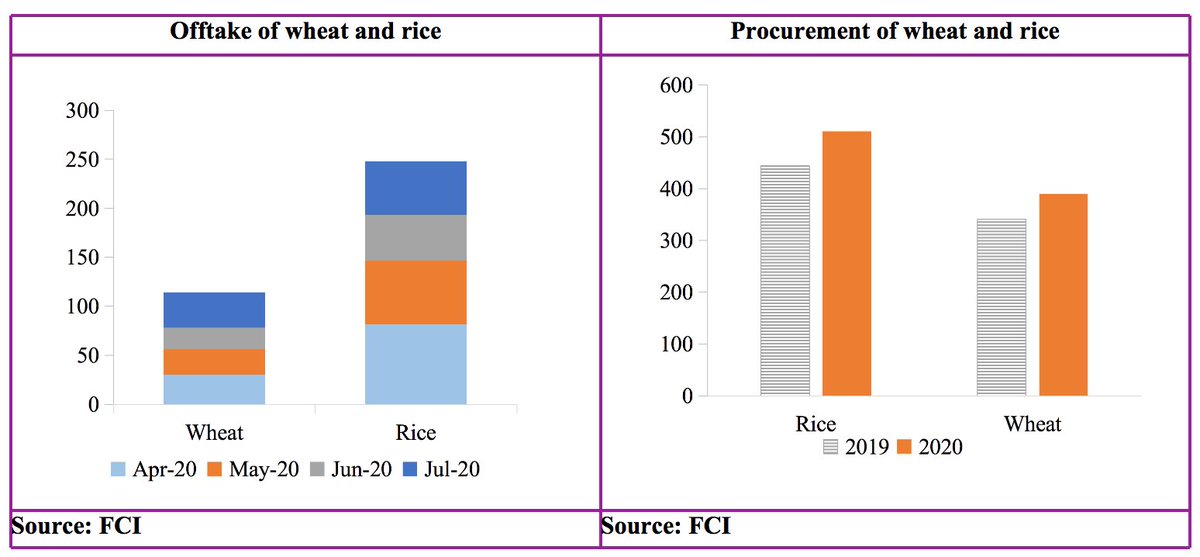

India’s mandi arrivals of several essential commodities edged closer to previous year levels in the week ending 29th May. Food prices still elevated relative to last year, except for onion and tomato #economy #COVID19 #Macron @tulsipriya_rk

Mandi arrivals of potato and onions below last year levels. Onion prices descending for the past four weeks @tulsipriya_rk #COVID19 #Macron

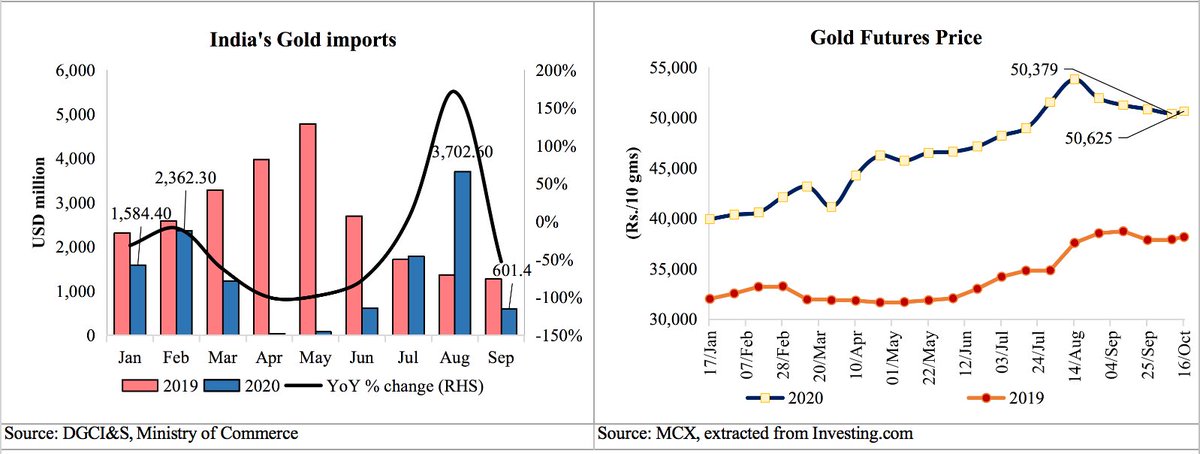

Forex reserves soared to record high in the week gone by driven by rising FDI, FPI and equities and sharp decline in crude and gold import bill. Rupee marginally appreciated in the week gone by. Debt outflow spree continued @tulsipriya_rk #economy #COVID19

FPI utilisation in Central G-Secs remained low ar 47.8%. No net purchase/sale of dollar in the week ending May 22 after 2 consecutive weeks of dollar purchase @tulsipriya_rk #COVID19India #MacroOfCovidIndia #economy

Petroleum products consumption at record low or 99.29 lakh metric tonnes in April. Crude price rising since early May tracking global cues of demand revival, decreased by 2.5% in week gone by @tulsipriya_rk #MacroOfCovidIndia #COVID19India #economy

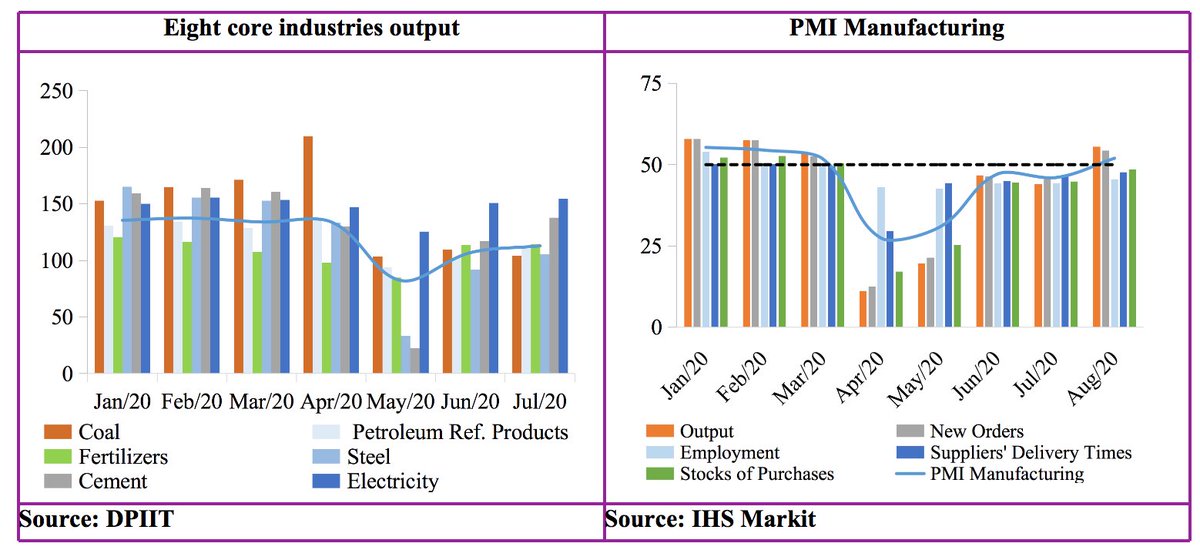

Global PMI fell to staggering low of 26.5 in April. However, provisional PMI data for advanced countries showed signs of reduced pessimism in May @tulsipriya_rk #MacroofCovidIndia #PMI

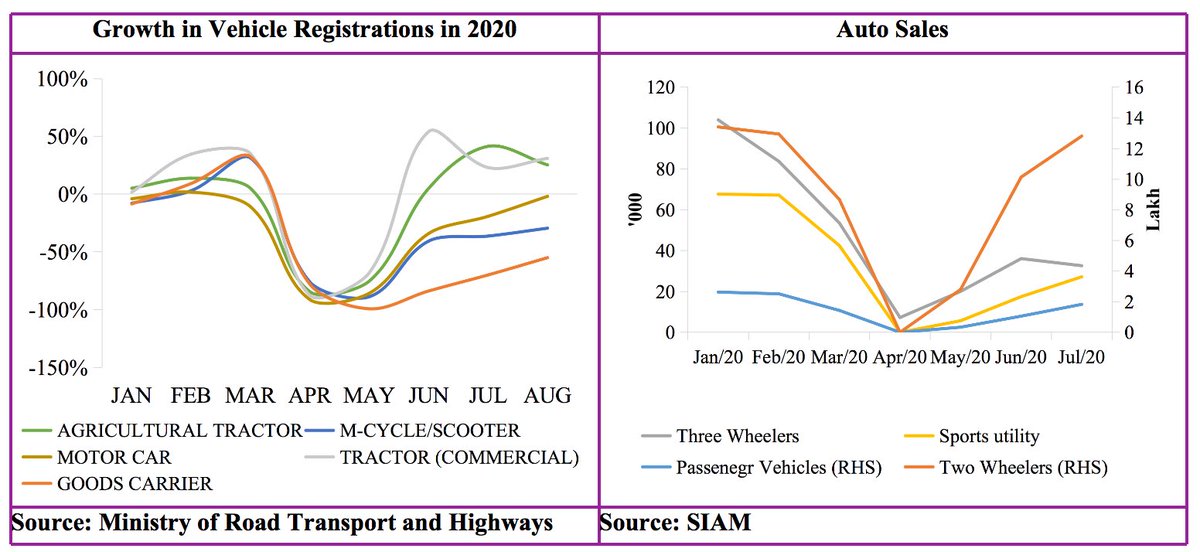

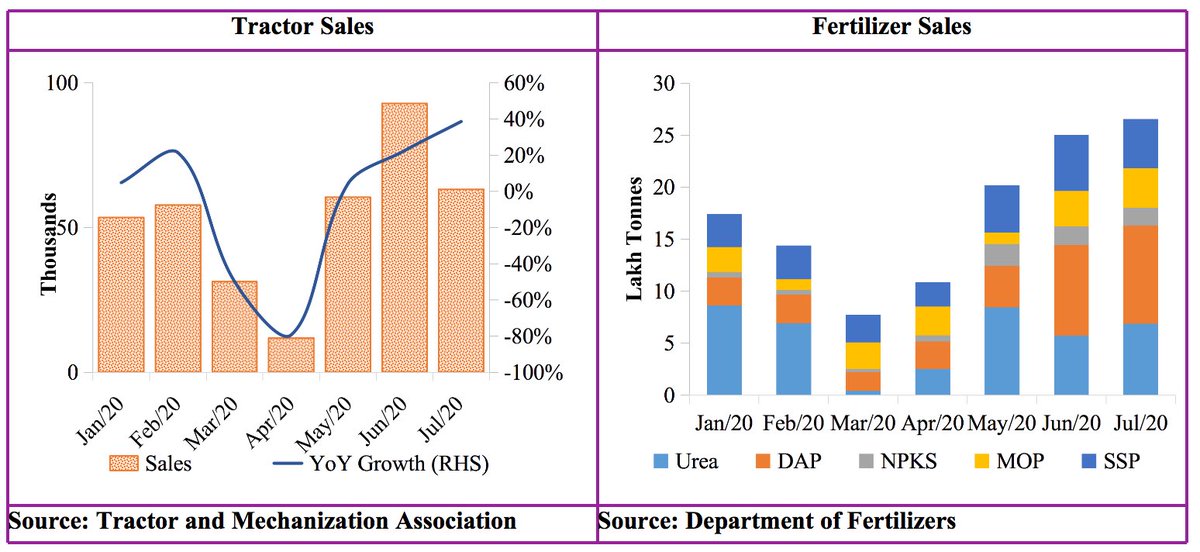

Subdued consumption demand in April and May witnessed in sharp contraction in vehicle registrations across all vehicle classes @tulsipriya_rk #vahan #economics #COVID19India

Bank aversion to lend to commercial sector continued in fortnight ending 8th May @tulsipriya_rk #MacroOfCovid #credit #covid19

Liquidity in surplus with RBI’s array of unconventional and conventional measures like policy rate cuts. Call money rate remained 14 bps below repo on 22nd May @tulsipriya_rk #monetaryPolicy #covid19india

Financial conditions eased with corporate yield softening to 7.2% in week gone by. Banks preferred to hold G-Secs with excess SLR standing at 9.6% in fortnight ending 8 May. @tulsipriya_rk #covid19india #monetaryPolicy #economy

Centre’s fiscal deficit for FY 2019-20 (PE) increased to Rs. 9.6 lakh crore (4.6% of GDP) largely driven by almost 10% decline in tax revenue compared to last fiscal. G-Sec yields, though low, marginally increased in week gone by. @tulsipriya_rk #fiscal

While Centre's gross market borrowings in the week ending 22nd May stood at 1.2 times the amount borrowed last year, net borrowings were half of last year levels. States borrowed more on gross and net basis relative to last year. @tulsipriya_rk #fiscalpolicy

Centre has been showing greater reliance on WMA window vis-a-vis states. While Centre's short term borrowings declined in the week ending 22nd May, States increased WMA utilisation. @tulsipriya_rk #fiscalpolicy

In response to Covid, Centre’s Aadhaar based direct benefit transfers rose sharply in April 2020, 36.4% higher than last year, to support the vulnerable sections. @tulsipriya_rk #DBT #fiscalpackage

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh