#Quora Question: Why do some people prefer not trading on expiry days?

Because there is no set by the books way to do expiry day trading. See my screenshot of Intraday Net Positions from yesterday. After brokerage, I made a loss of ₹35k. Thread coming. #BankNifty #Nifty 1/n

Because there is no set by the books way to do expiry day trading. See my screenshot of Intraday Net Positions from yesterday. After brokerage, I made a loss of ₹35k. Thread coming. #BankNifty #Nifty 1/n

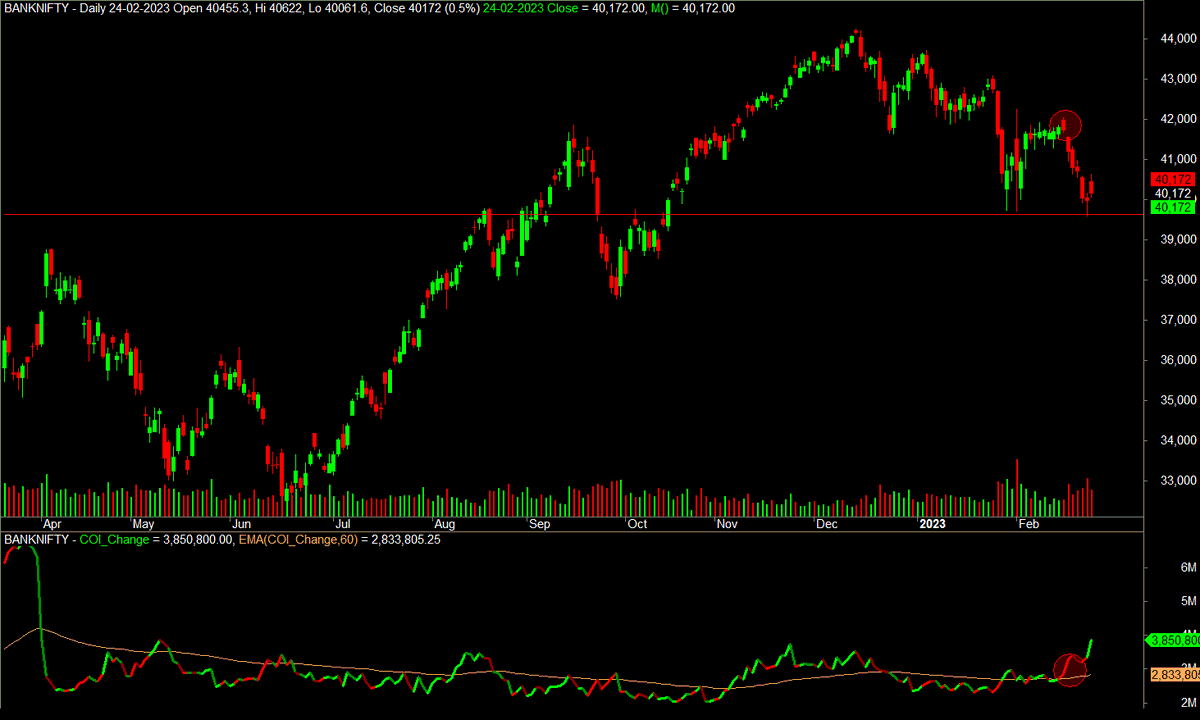

Retail participation through leverage has increased in Thursdays Expiry #OptionsTrading. Everybody cannot be a winner. One's gain is others loss. Hence market makers have made Thursdays #BankNifty move extremely volatile. It is normal for a ₹10 option to hit ₹200 & 0 again. 2/n

I have been trading options as bread and butter, despite the fact that OTM options goes to 0, I prefer not to indulge in Expiry trading. I have tried:

1. Selling Option with proper signal with SL almost always hitting 0. Probability because of Index Management and Volatility 3/n

1. Selling Option with proper signal with SL almost always hitting 0. Probability because of Index Management and Volatility 3/n

Bursts remain around 30%.

2. Only strategy that can be applied is Credit Spread with slight ITM options for atleast RR of 1:1 or Debit Spread of 2.5:1 or more. Its the only way I still find viable.

3. Selling OTM Cheap Options on Leverage for Rs. 3 - Rs. 10/-. Sadly, due to 4/n

2. Only strategy that can be applied is Credit Spread with slight ITM options for atleast RR of 1:1 or Debit Spread of 2.5:1 or more. Its the only way I still find viable.

3. Selling OTM Cheap Options on Leverage for Rs. 3 - Rs. 10/-. Sadly, due to 4/n

low #vix premiums have already reduced. So now cheap options are only 200 - 300 points away. When gamma explosion happens, then managing these options require extreme management skill alongside high capital. Not everyone can do it and not everyone has the temperament. 5/n

Beyond risk, its nerve tickling experience. I know options are going to 0, but you are on 10 times leverage and strangle is not going to provide you safety in such environment. Case being from personal example:

1. I have done expiry trading alot for a 1% gain and on many 6/n

1. I have done expiry trading alot for a 1% gain and on many 6/n

occasions, ended up making 2 to 5% loss. Yes, stoploss is there. I have seen a situation, where in 10 minutes after selling a Rs. 6 option, it was trading at Rs. 750/- without even giving a chance to exit at 1% stoploss. On fund of 1.5 Crore, I looked at a loss of 14-28 lakh 7/n

but still with management I managed to bring it in profit of 3 lakh by end of day. But I can't say I did not felt panic or some heart attacks during trading.

2. I have done the stoploss approach and seen a day where there was falls trend 5 times in a day. Total random moves 8/n

2. I have done the stoploss approach and seen a day where there was falls trend 5 times in a day. Total random moves 8/n

hitting stoploss 5/5 times.

So only thing that is left which can make profit is Selling cheap options and hold it by the end of day hoping it will go to 0. Before that where it will go, you must sit with Iron Heart for that. And that can be dangerous. 9/n

So only thing that is left which can make profit is Selling cheap options and hold it by the end of day hoping it will go to 0. Before that where it will go, you must sit with Iron Heart for that. And that can be dangerous. 9/n

You cannot survive with that kind of odds against you.

That is why I am one of those who try not to trade on expiry day apart from closing existing positions.

Now there are twitter traders with huge following who indulge their followers into #ExpiryTrading. Remember 10/n

That is why I am one of those who try not to trade on expiry day apart from closing existing positions.

Now there are twitter traders with huge following who indulge their followers into #ExpiryTrading. Remember 10/n

I have found that main bread and butter of these traders is #Training. With huge following and first movers advantage this is what happens:

1. The show mark to mark profit.

2. Lure Traders to expiry trading.

3. Train them for Expiry Trading.

4. Offer Broking Services post 11/n

1. The show mark to mark profit.

2. Lure Traders to expiry trading.

3. Train them for Expiry Trading.

4. Offer Broking Services post 11/n

-post training for cheap brokerage and high leverage. (This is bread and butter - Brokerage trainees generate and 5-6 lakh per training session). This is the recurring income making them rich.

5. And circle repeats by tagging similar other traders on weekend follow list.

12/n

5. And circle repeats by tagging similar other traders on weekend follow list.

12/n

So, when someone says that #ExpiryTrading is possible, it may be for 1% but for rest it is extremely dangerous. And that's the reason to avoid it. You are here for planned gains and not dangerous gambles. End of Thread.

Visit t.me/rkatwaltrading… to verify 26 Sep Trades.

Visit t.me/rkatwaltrading… to verify 26 Sep Trades.

• • •

Missing some Tweet in this thread? You can try to

force a refresh