When gold approached this level in 2007 many wondered about its significance. But gold went on to trade to a high more than double the prior ATH. (#NotAForecast)

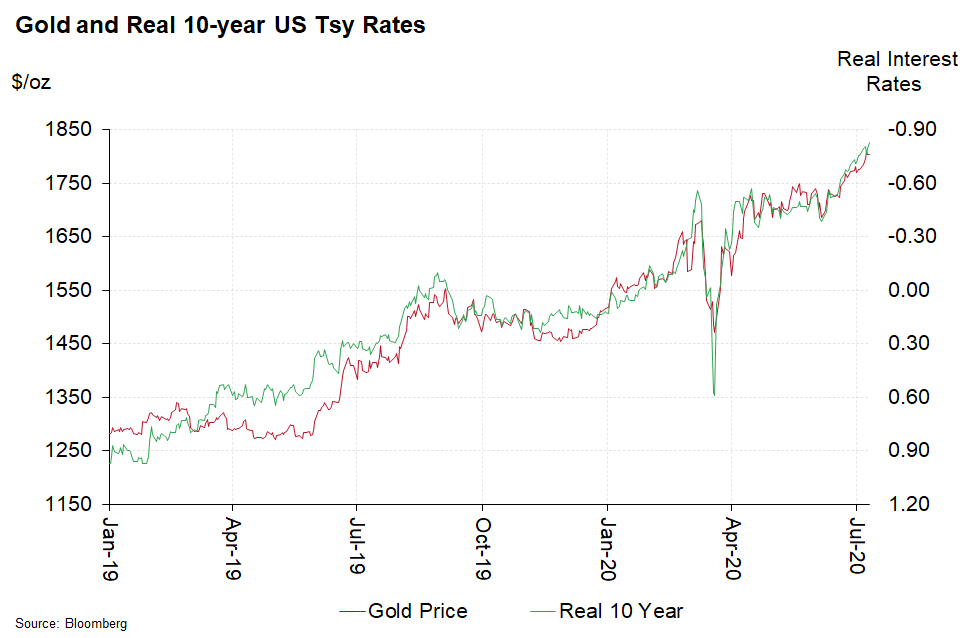

A weak US dollar has also helped gold over the past two months.

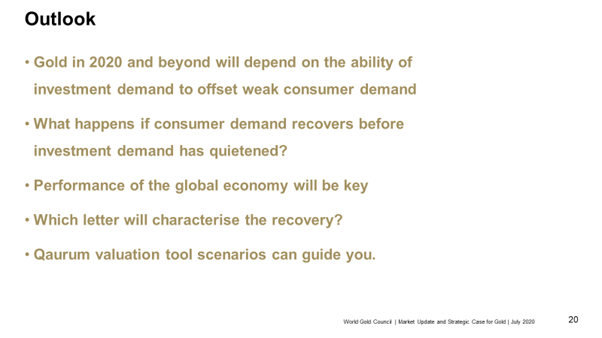

Q1-20 jewellery demand was the weakest we've seen on record, for example.

gold.org/goldhub/resear…

For everyone else, #gold has shown why it is a mainstream asset and that you should spend time understanding the arguments about why you should own some.

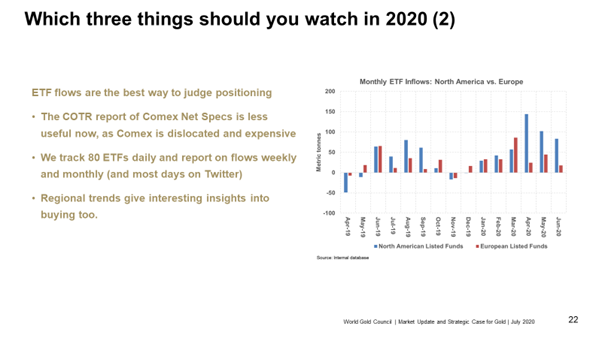

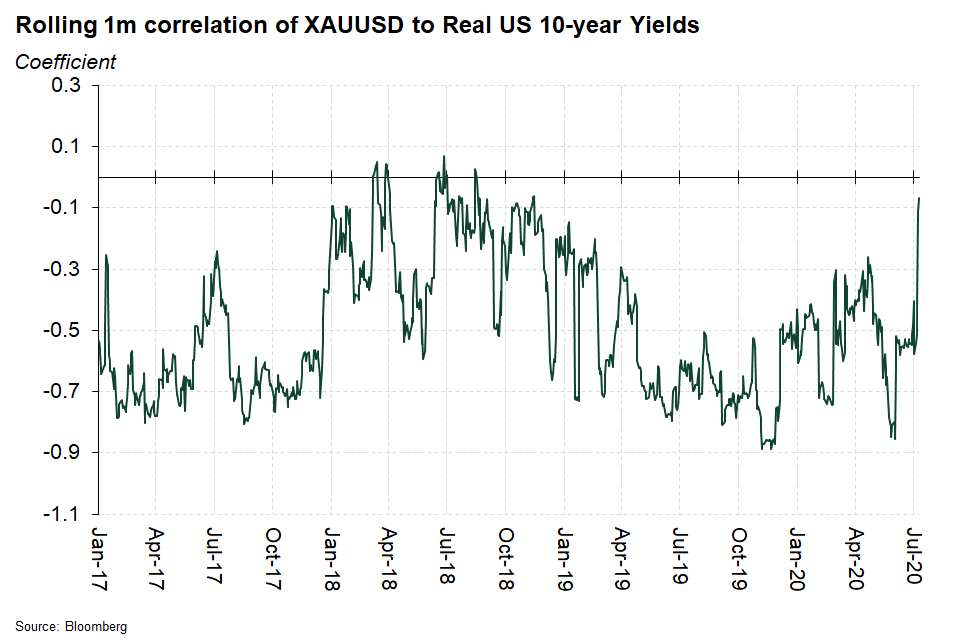

I was asked recently by @JGCCrawley for the three most important things to watch in #gold for the balance of the year. I have hundreds of spreadsheets and market data feeds, but these three are key (at least for now).

And do watch out for #GoldDemandTrends on Thursday!