Great thread on DeFi lending protocols.

I'm *very* long $AAVE $COMP and $ALPHA, but $COMP really stands out to me here.

Some observations👇

I'm *very* long $AAVE $COMP and $ALPHA, but $COMP really stands out to me here.

Some observations👇

https://twitter.com/asiahodl/status/1362079737795932160

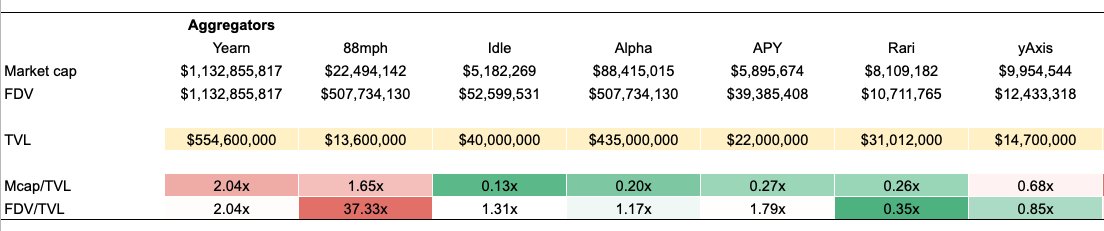

1/ @compoundfinance is the only lending protocol discussed without immediate plans for token fee capture, which leaves room for a value unlock event.

$COMP is underpricing its annualized interest by a factor of 10x relative to $AAVE!

$COMP is underpricing its annualized interest by a factor of 10x relative to $AAVE!

2/ Sure, @compoundfinance is the only protocol with liquidity mining, so volumes are incentivized.

But...

Even if we assume 90% of the volumes will go poof without LM (aggressive assumption), it is still cheaper than its main competitor on a per dollar volume basis.

But...

Even if we assume 90% of the volumes will go poof without LM (aggressive assumption), it is still cheaper than its main competitor on a per dollar volume basis.

3/ Catalyst wise - @compoundfinance also seems to have imminent cross-chain plans, with a debt-based stablecoin similar to @MakerDAO on the horizon at a time when demand for leverage is skyrocketing.

4/ The most likely candidates to benefit from the recent institutional awareness of DeFi are likely protocols that have a long history of stability.

$COMP is known for prioritizing stability over speed - though it's no secret $AAVE + $COMP both have institutional ambitions.

$COMP is known for prioritizing stability over speed - though it's no secret $AAVE + $COMP both have institutional ambitions.

5/ One comment on @AlphaFinanceLab - it shouldn't be priced as a lending protocol (despite having the highest growth in that domain).

As we will soon see, it's one brick in a whole stack. I don't expect lending to be the primary driver of fees 👀

As we will soon see, it's one brick in a whole stack. I don't expect lending to be the primary driver of fees 👀

ps/ Mira is hands down one of my favorite follows on crpypto twitter.

If you want to see where crypto investing is heading (more fundamentals), follow @asiahodl (and @RyanWatkins_)

If you want to see where crypto investing is heading (more fundamentals), follow @asiahodl (and @RyanWatkins_)

• • •

Missing some Tweet in this thread? You can try to

force a refresh