$AR. Yesterday’s performance was downright rediculous. There is a fear from many on twitter who dont understand how converts work with many claiming that mgmt just diluted 69m shares at 4.32$. Firstly, the convert holder cant convert until 2026 and prior to that (from 3/24) the

Co can essentially pay the principal and accrued interest as long as the share px is 30% above 4.32 or $5.6. Now lets assume by 3/24 the share px is $10. The dilution calc is as follows- you pay back the 300m$ (assuming the greenshoe on this deal gets exercised) and the

Diln is 69m shares (300m issue/4.32) *10-300m which is paid of as principal. The diln is (690m-300m)/10$ share px or 39m shares. Not 69m shares. Mgmt said that they had purchased 50mn shares (30m this year at 1.28$) so they didnt pay for covered cap but would do so if stock diln

Was getting to the teen diln.Founders own 20% of the co and are very sensitive to the diln. So all the trolls telling me there is 22% diln that wont happen. And this assumes the co issues shares-they could easily just pay the excess with cash flow.

Secondly in march of this year everyone thought they were going bankrupt. Since then they’ve raised 1$bn , reduced debt, pretty much sorted out ‘21-23 maturities and with this convert have now opened a roadway to issuing unsecured debt down the road.

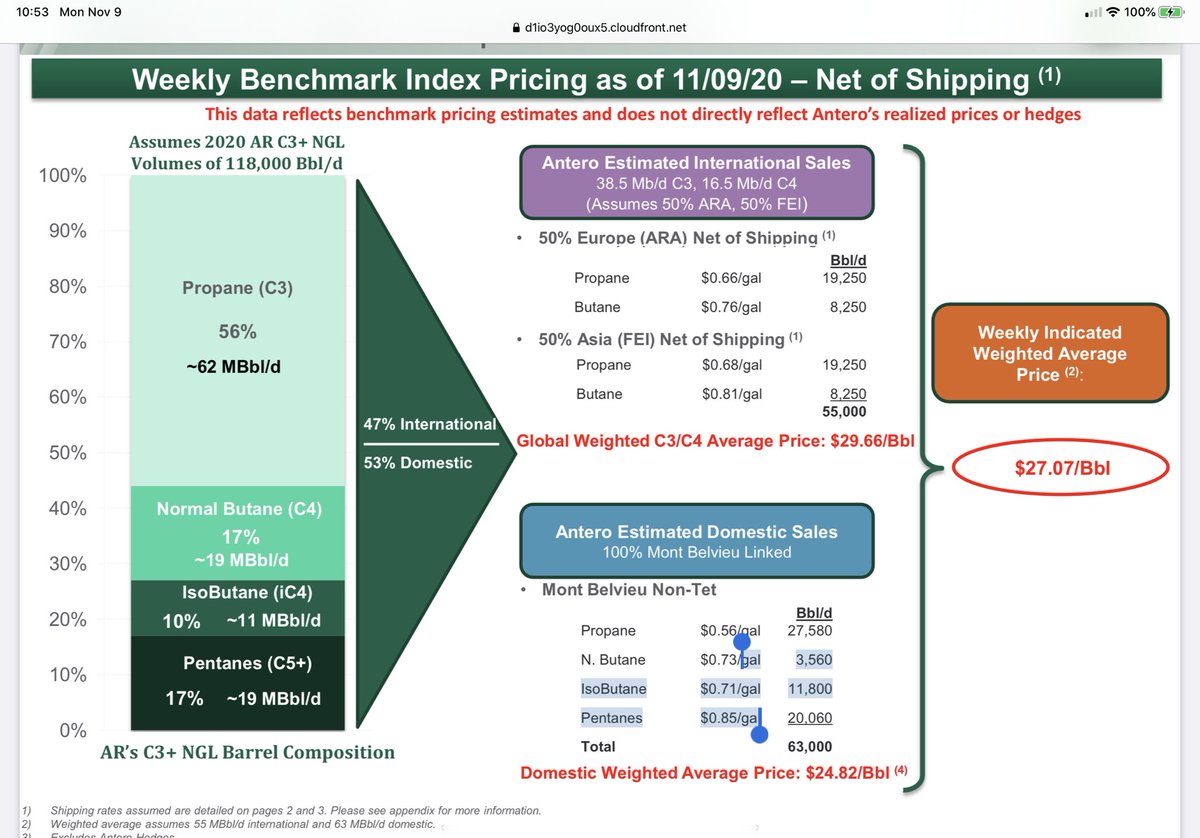

Finally with ngls ripping, 500m$ fcf next year is probably a given. 500m$!!!! And lets just take a step back and compare AR to rrc. In may 2019 rrc and AR were both around $9 and 8$ respectively. AR has bot 50m shares since then and even if they issue 39m

Shares if stock gets to 10$ , (and thats a big if), there is no net dilution and stock is sitting at 3.5 vs rrc which is at the same px as may 2019 (AR has gone from 8 to 3.5 same time frame) despite a huge improvement in b/s , 2 turns of leverage less and resolved their

Debt maturity issues. So bottom line, AR has now gotten access to the cap mkts, resolved their debt issues, will earn rocketing profits from ngls ripping and regional px differences (rrc/eqt/swn don’t benefit to that extent). So for all you shorters enjoy getting your face

Ripped off when market digests this news.

• • •

Missing some Tweet in this thread? You can try to

force a refresh