Let’s see how Modern banking system actually works

#Banking is all about lending activities, if they practise good lending via various advances methods

modern banking system is based on the fractional reserve system

What does fractional reserve means

1) People deposit their savings in the bank in the hopes of earning #interest rates

In other words, banks keep only a small fraction of depositors

Banks, therefore, rely on the statistical probability that their depositors won’t all show up at once and demand their money back

We have to look into “conservative liquidity”

conservative liquidity is the bank’s cash held in their own in-house accounts, plus all its cash held at the country’s Central Bank (mandatorily or voluntarily),

What makes a good, sound Bank

A healthy bank should have a high capitalization, or solvency, ratio, so that if some of its assets go bad and become unrecoverable, the bank still has enough funds to cover its

We should look at total assets and the bank’s equity

By dividing a bank’s equity by total assets, we can determine its solvency, or capital ratio

The higher the ratio, the safer the bank

The total assets of the bank include cash, financial instruments,

The total equity of bank represents what the bank is really worth. Equity equals the bank’s assets minus all of its liabilities, and it generally includes the banks share and paid-up capital, its reserves and its retained earning

A liquid bank is able to honor all withdrawal requests without delay, because it has the available funds on

Generally speaking, loans (mortgages, car loans, etc.) are much less liquid than, say, 3-month government bonds.

Loans, on the other hand, need to be recalled or collateralized in complicated transactions. They are very much NOT liquid... especially if everyone else is selling at the same time.

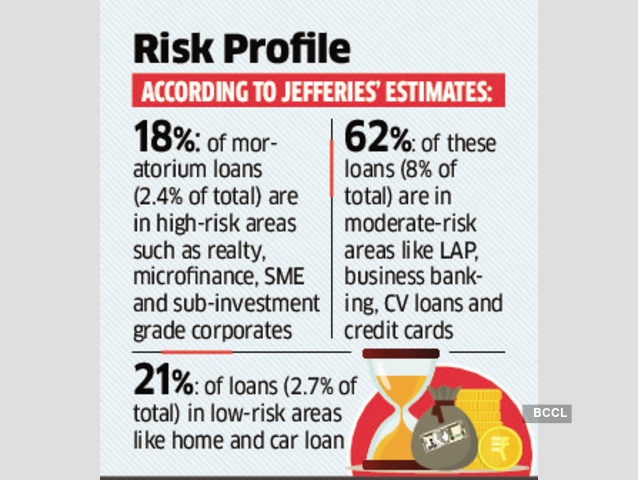

A healthy bank doesn’t engage in excessively risky lending

A good way to check for this is to look at the bank’s “non-performing loan (NPL) ratio

Banks should not engage in reporting and accounting tricks

There are all sorts of regulatory and prudential supervision standards that banks around the world have to follow

Credits

@thesovereignman

Unroll