1. Can family offices protect their legacy without #Bitcoin?

The looming “Great Monetary Inflation” hints at no.

Thread on the $5.9 trillion family offices asset manager category, which will have to share only 21 million bitcoins.

On @knoxcustody blog: blog.knoxcustody.com/legacy-bitcoin/

The looming “Great Monetary Inflation” hints at no.

Thread on the $5.9 trillion family offices asset manager category, which will have to share only 21 million bitcoins.

On @knoxcustody blog: blog.knoxcustody.com/legacy-bitcoin/

2. It is now irresponsible for fund managers with medium to long term investment horizons to have no allocations in scarce and non-debaseable assets.

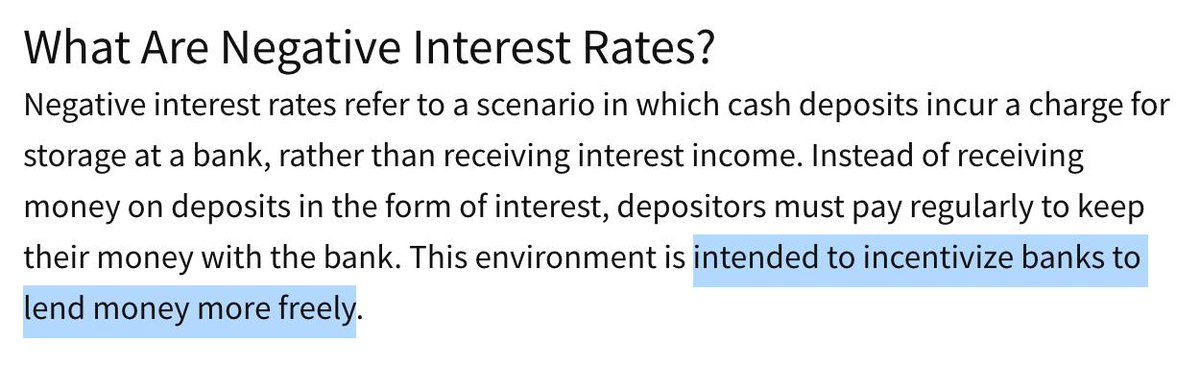

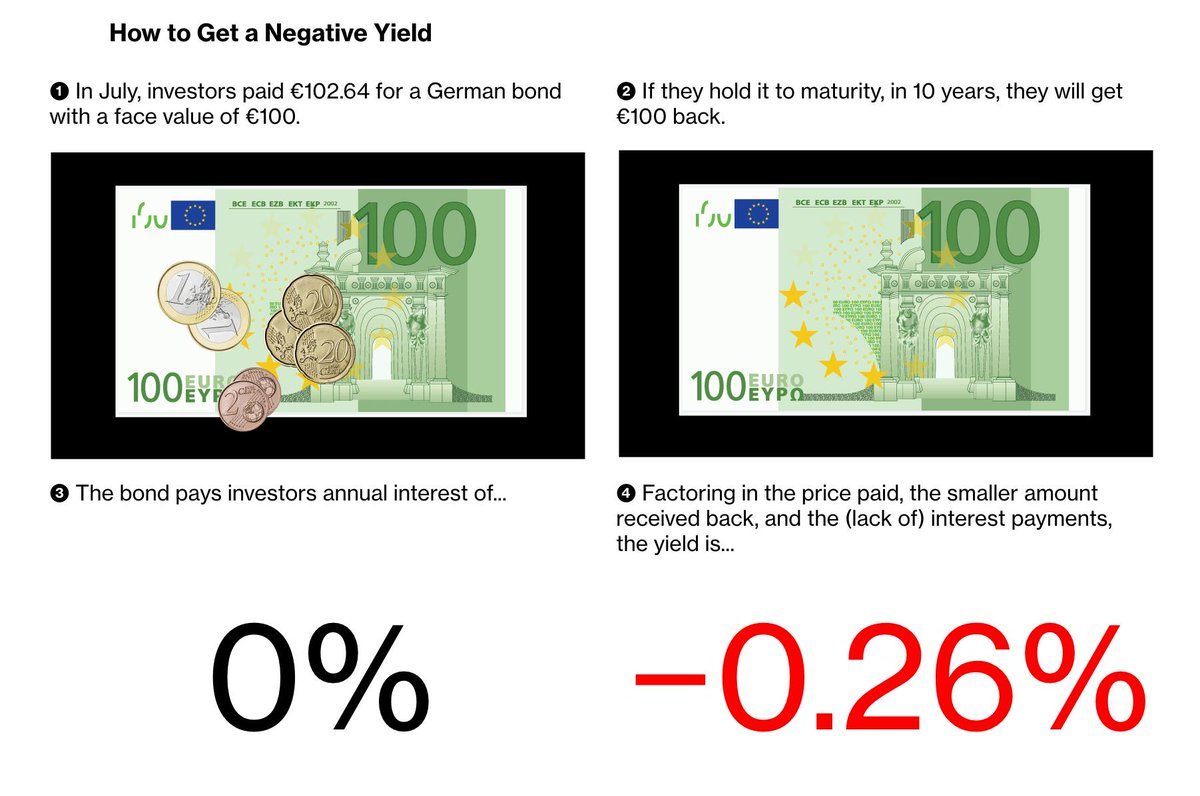

Bond yields have reached their lowest lows, real estate has recently hit all time highs, and an ounce of gold is now topping $2k.

Bond yields have reached their lowest lows, real estate has recently hit all time highs, and an ounce of gold is now topping $2k.

3. Even risk-on assets such as stocks have been surging since the global monetary printing presses went full blast, with over $6 trillion of QE.

Fundamentals such as corporate earnings are weak have stayed flat if not worsened.

Wealth inequality is further polarizing society.

Fundamentals such as corporate earnings are weak have stayed flat if not worsened.

Wealth inequality is further polarizing society.

4. Rich asset owners are richer, while poor workers keep spinning on the hamster wheel.

The Cantillon Effect—where monetary inflation favours entities that are the closest to the source of money production—is leading to political extremism and global social unrest.

The Cantillon Effect—where monetary inflation favours entities that are the closest to the source of money production—is leading to political extremism and global social unrest.

5. Global monetary printing presses are legitimized by populist politicians preaching universal basic income and helicopter money to cool down social tensions.

Most market price signals are distorted by QE and stimulus programs.

Most market price signals are distorted by QE and stimulus programs.

6. With global currency manipulations, how do individuals and families make sound investments to preserve wealth and capture value for the next 20–30 years?

Can family offices afford to not hold an apolitical and scarce asset such as Bitcoin?

Can family offices afford to not hold an apolitical and scarce asset such as Bitcoin?

7. The contemporary concept of family offices was established in the 19th century by J.P. Morgan followed by the Rockefellers.

Today family offices (both single and multi) make up for $5.9 trillion of AUM across 7,300 offices, a rise of 38% in the number of distinct families.

Today family offices (both single and multi) make up for $5.9 trillion of AUM across 7,300 offices, a rise of 38% in the number of distinct families.

8. Equities markets are manipulated by currency devaluations (H/t @PrestonPysh). While US stock markets such as the DOW had its best week since 1938, US unemployment filings had reached all-time highs at 16M people.

May be the start of a US currency failure (h/t @Timmay4Life)

May be the start of a US currency failure (h/t @Timmay4Life)

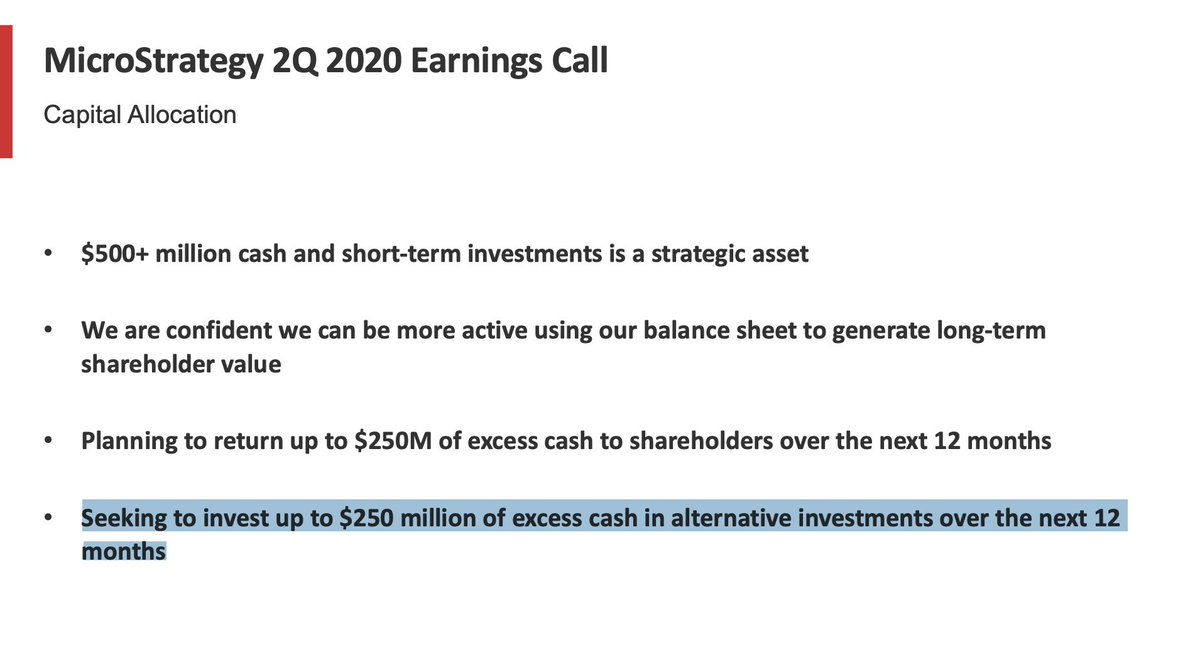

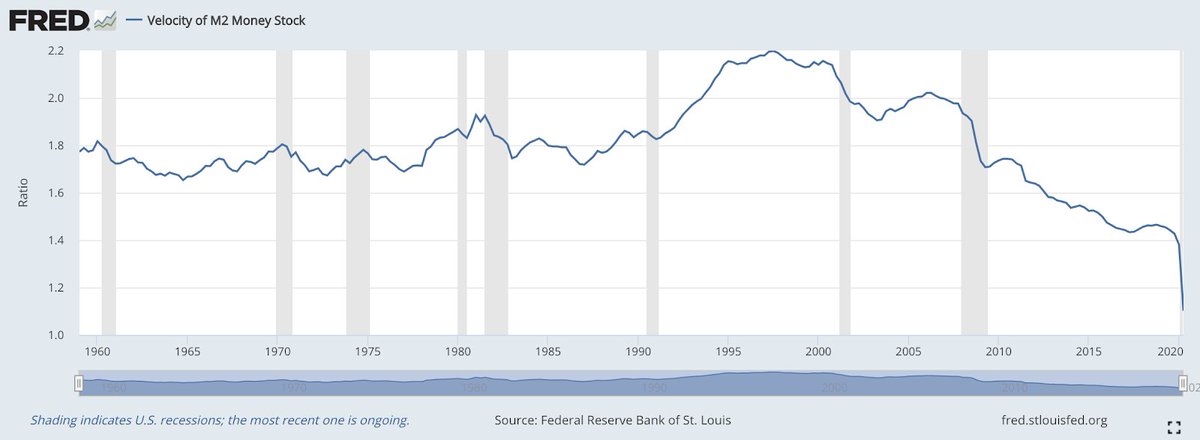

9. In times of uncertainty, wealth managers increased cash holdings.

The velocity of M2 money, which is a measure of how quickly money changes hands in an economy, is at all time low.

Individuals and businesses are holding onto their cash or nest it into inflated asset classes.

The velocity of M2 money, which is a measure of how quickly money changes hands in an economy, is at all time low.

Individuals and businesses are holding onto their cash or nest it into inflated asset classes.

10. Cash is king, but for how long?

With aggressive QE, the new injections of liquidity could deteriorate the value of cash, which may not lead to inflation in the short term, but certainly will devalue cash over a longer time horizon.

With aggressive QE, the new injections of liquidity could deteriorate the value of cash, which may not lead to inflation in the short term, but certainly will devalue cash over a longer time horizon.

11. While gold has earned a good track record for holding value, it has suffered from price suppression w/ “paper gold”.

Gold also has political risk as it has been seized or censored in the past.

But holding physical gold in vaults is costly w/ high storage and insurance fees

Gold also has political risk as it has been seized or censored in the past.

But holding physical gold in vaults is costly w/ high storage and insurance fees

12. A neutral store of value is being monetized.

Compared to gold’s 5,000 years of track record and roughly $9 trillion of market value, Bitcoin is only worth $200 billion after only 11 years of existence on the Internet.

Compared to gold’s 5,000 years of track record and roughly $9 trillion of market value, Bitcoin is only worth $200 billion after only 11 years of existence on the Internet.

13. Lots of literature was published on #Bitcoin, notably The Bullish Case for Bitcoin by @real_vijay and The Bitcoin Standard by @saifedean as two seminal pieces, though many others were released. medium.com/@vijayboyapati…

14. Since its inception, #Bitcoin has been in a process of monetization, accruing a monetary premium for the properties of its protocol that makes it useful as money.

It started as a scarce digital collectible that early adopters were curious about, and grew from there.

It started as a scarce digital collectible that early adopters were curious about, and grew from there.

15. Akin to a digital estate, Bitcoin is a grid of 21 million units that can each be subdivided into 100,000,000 floors. Nothing more, nothing less.

Read more on @knoxcustody's blog to learn about #Bitcoin as a wealth preservation instrument: blog.knoxcustody.com/legacy-bitcoin/

Read more on @knoxcustody's blog to learn about #Bitcoin as a wealth preservation instrument: blog.knoxcustody.com/legacy-bitcoin/

16/16. You can also DM me or @knoxcustody if you have further questions, or if you want to discuss how to buy and store it securely with insured custody and best execution.

Fin/ As always thanks to @daskalov for reviewing this article, with valuable comments and suggestions from @ArthurCSalzer, @eprefon and @louishliu.

#bitcoin

#bitcoin

• • •

Missing some Tweet in this thread? You can try to

force a refresh