Following the government announcement that plans to allow fans to attend football matches from 1st October would not go ahead, I thought it might be interesting to see how this could impact the revenue of Premier League clubs this season via match day losses due to COVID-19.

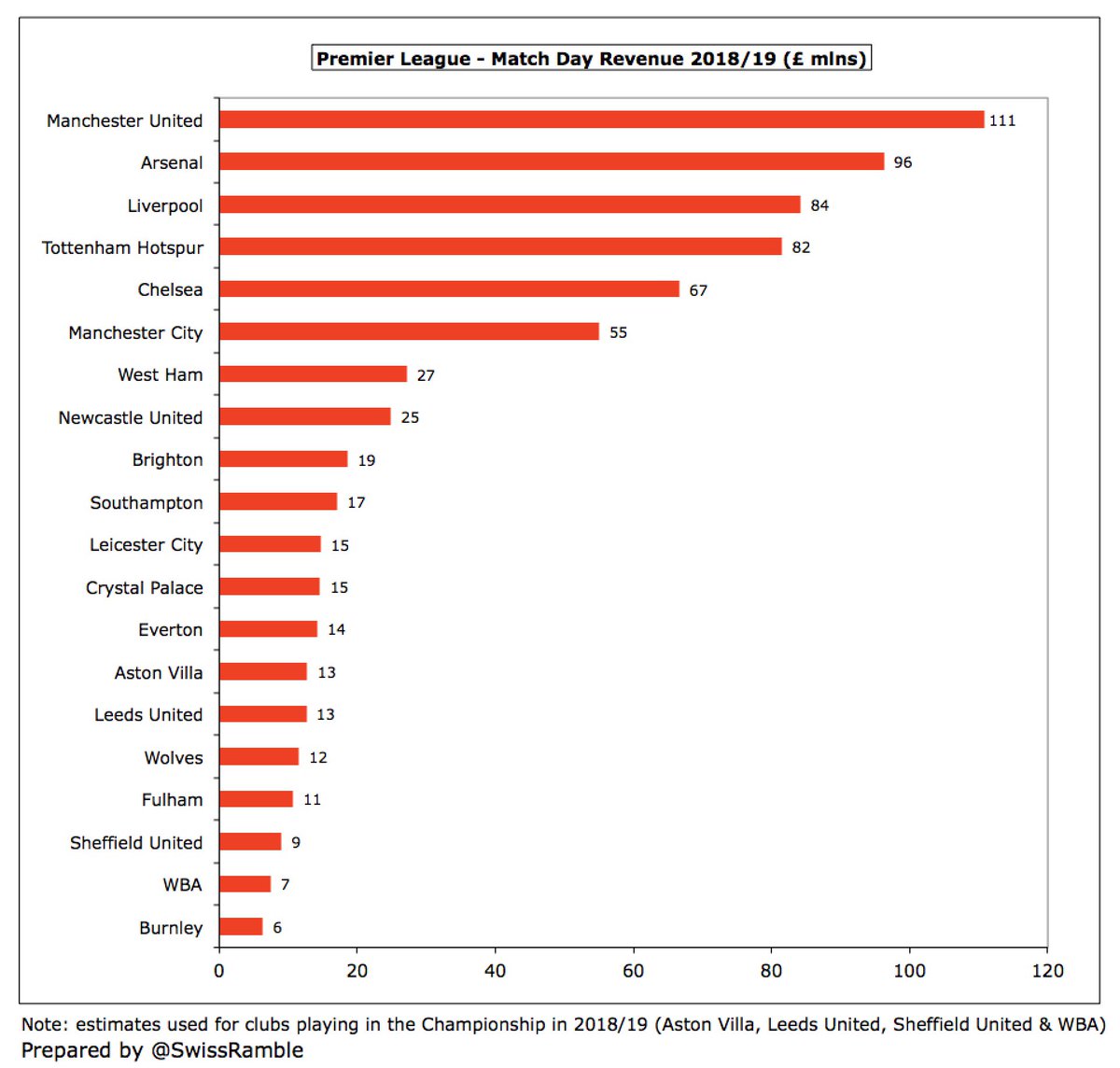

First of all, a reminder of how much match day income each Premier League club generated in 2018/19 (the season with the most recent published accounts), including estimates for clubs that have been promoted from the Championship since then.

In 2018/19 Premier League clubs had around £700m of match day revenue with #MUFC leading the way with £111m, followed by #AFC £96m, #LFC £84m, #THFC £82m, #CFC £676m and #MCFC £55m. At the other end of the spectrum, clubs like Burnley, #WBA and #SUFC had less than £10m.

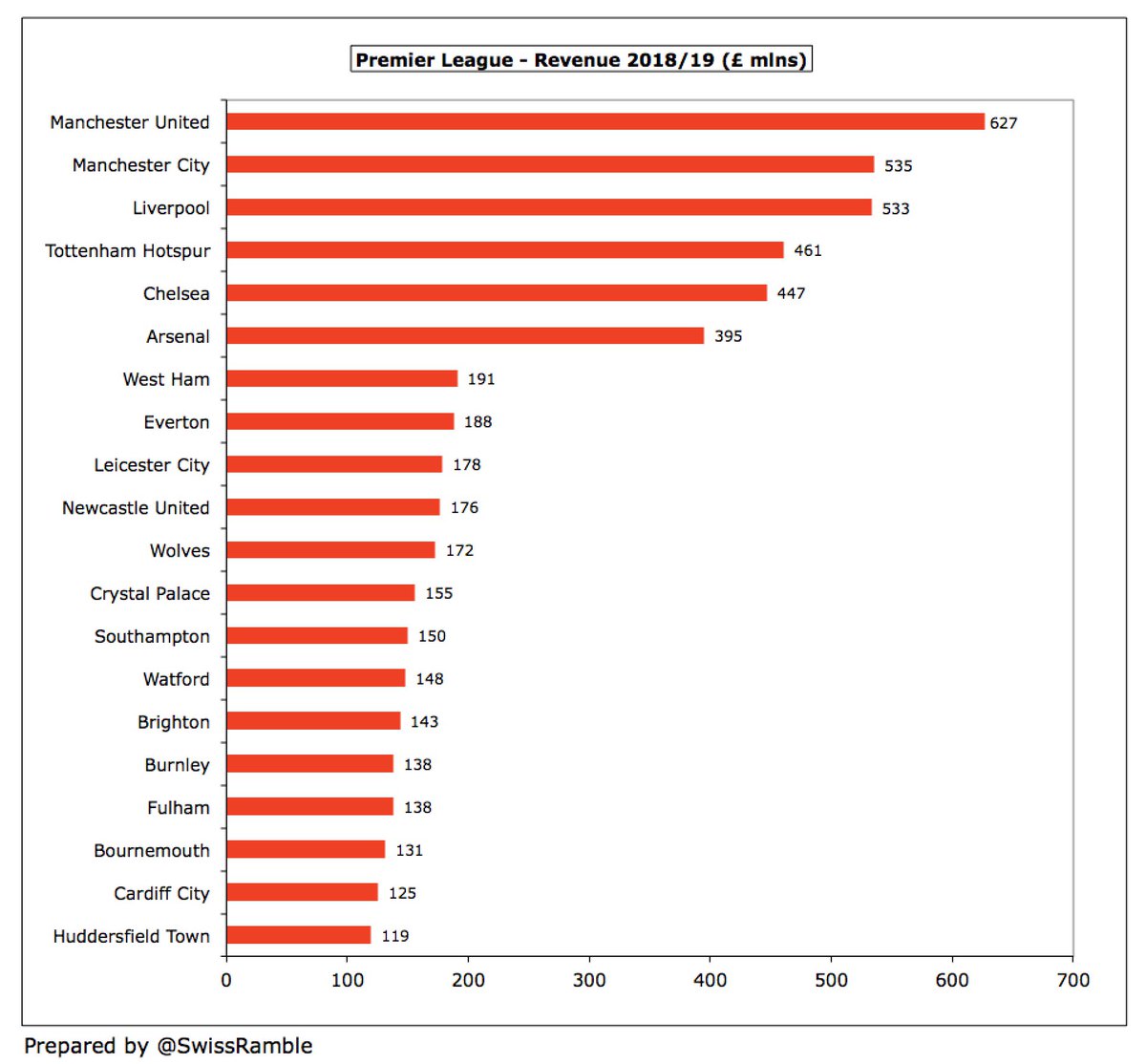

Even though #AFC revenue was not the largest in the Premier League, it was by far the highest as a percentage of total revenue at 25%, much more than #THFC and #MUFC, both 18%. In fact, Arsenal are more reliant on this revenue stream than any other leading European club.

Based on the number of matches played in 2018/19, we can calculate the average revenue per match, ranging from #MUFC £4.3m to Burnley £0.3m. This is a little simplistic as clubs earn more from, say, a Premier League match than an EFL cup-tie, but it’s good enough for an estimate.

If we assume that all matches are played behind closed doors until the end of the year, I estimate that Premier League clubs would lose a total of £288m. The largest losses would be #MUFC £47m, #THFC £36m, #LFC £36m, #AFC £35m, #CFC £25m and #MCFC £24m.

This estimate is based on 8 Premier League home games plus the guaranteed home ties in the EFL Cup and Europe (group stage completed this year). I have further assumed that #THFC qualify for the Europa League group stage.

There has been some talk that fans would not be allowed back into stadiums until end-March next year. In that case, the total Premier League loss would increase to £451m. By club, the largest losses would be #MUFC £72m, #LFC £55m, #AFC £55m, #THFC £54m, #CFC £37m and #MCFC £35m.

This is the minimum that would be lost, as this estimate only includes guaranteed cup games. If clubs progressed further, then they would lose even more gate receipts, though would be compensated by additional prize money (especially in the Champions League).

If all matches in the 2020/21 season were to be played behind closed doors, the total Premier League loss would rise to £586m. Largest losses at #MUFC £94m, #LFC £71m, #AFC £71m, #THFC £69m, #CFC £48m and #MCFC £45m, though would be higher with progress in cup competitions.

So the timing of the return of fans is obviously hugely important for Premier League clubs. If we take #MUFC as an example, they would lose £47m if games are played behind closed doors until end year; £72m end-March; £94m whole season; £111m with progress in the cups.

These match day losses are in addition to those already incurred by clubs in the 2019/20 season. Using a similar model, I estimate this was worth £141m. Highest losses #MUFC £30m, #MCFC £16m, #THFC £15m, #LFC £13m and #AFC £13m.

Taking a full season’s match day income for 2020/21, assuming similar cup progress to 2018/19, the combined losses over the two seasons would be £837m. Highest at #MUFC £141m, #AFC £109m, #LFC £97m, #THFC £97m, #CFC £75m and #MCFC £71m.

This analysis is based on some simple assumptions, so some clubs could easily lose a different amount. For example, #THFC only moved into their new stadium for the last 5 games of the 2018/19 season, so their match day revenue (and consequent loss) will certainly be higher now.

In addition, clubs earn a fair amount from merchandising sales on match day, which would be reflected in commercial income, so there will be additional losses in that revenue stream, particularly at the elite clubs.

It is also possible that TV companies will push for rebates, as their “product” is devalued by the adverse impact from no spectators on the match day experience for armchair fans. This could be offset by televising more games, but this did not prevent a £330m rebate in 2019/20.

All that said, Premier League clubs still generate a huge amount of income even without match day revenue. As an example, if 100% of match day were lost in 2018/19, six clubs would still have earned more than £300m with #MUFC leading the way with £516m, down from £627m total.

Even though broadcasting income is still the most important revenue stream for Premier League clubs, followed by commercial, it is clear that match day money will be sorely missed. Maybe those fans who have been messed around so much by changing schedules are valuable after all?

• • •

Missing some Tweet in this thread? You can try to

force a refresh