#Juventus 2019/20 accounts cover a COVID impacted season when they won the league (for the 9th year in a row), but were eliminated in the Champions League last 16 by Lyon. Head coach Max Allegri was replaced by Andrea Pirlo after the season ended. Some thoughts follow.

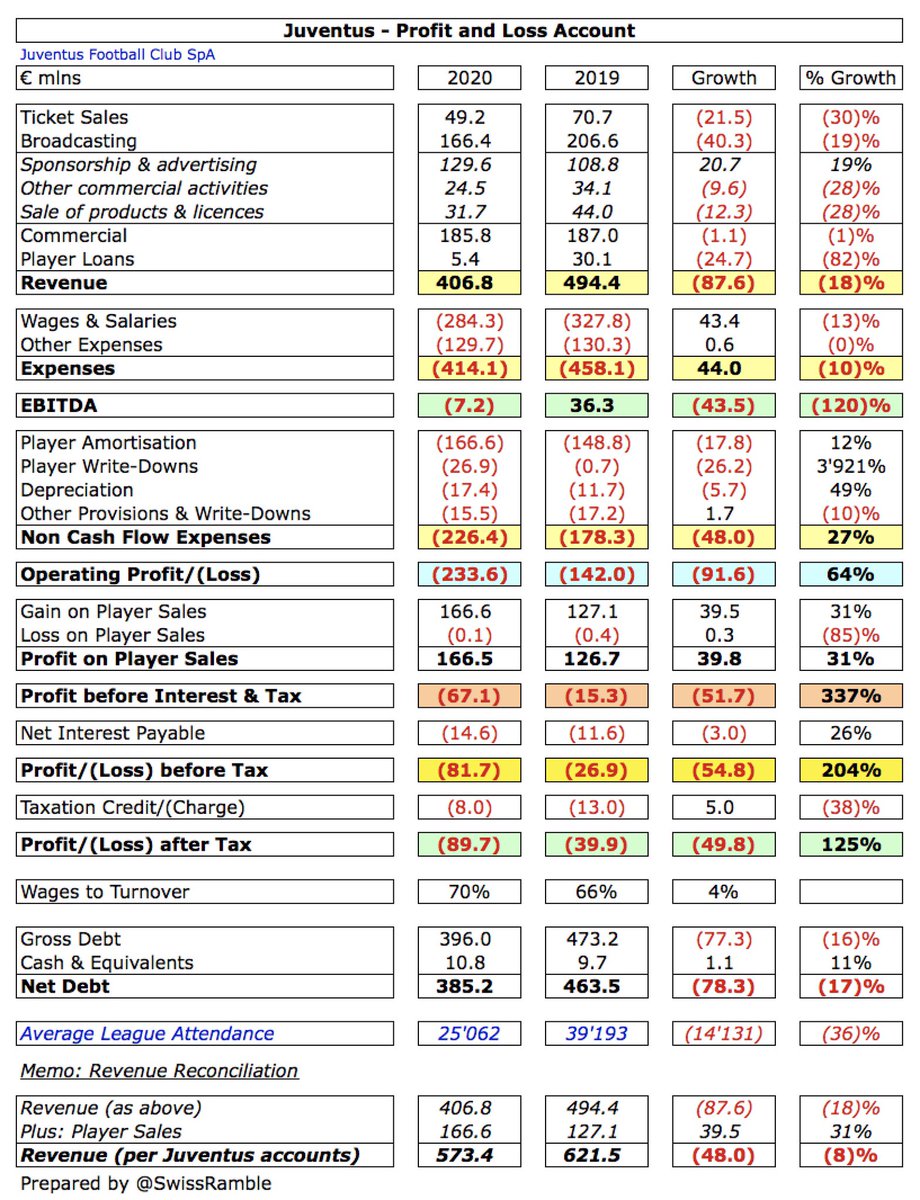

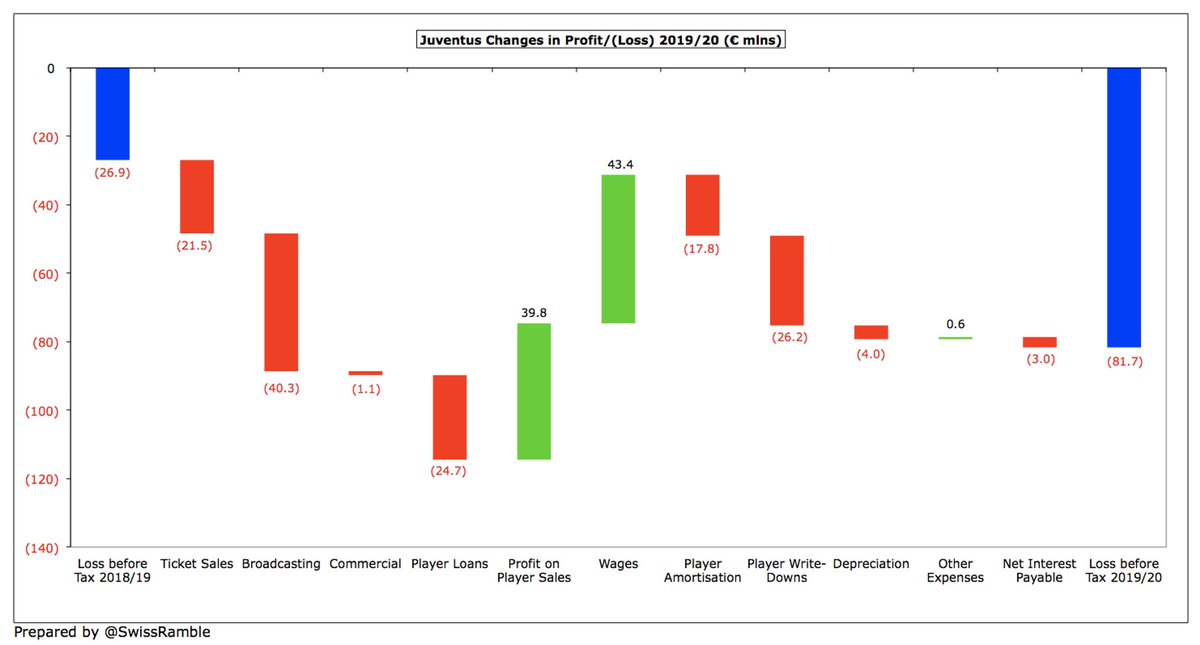

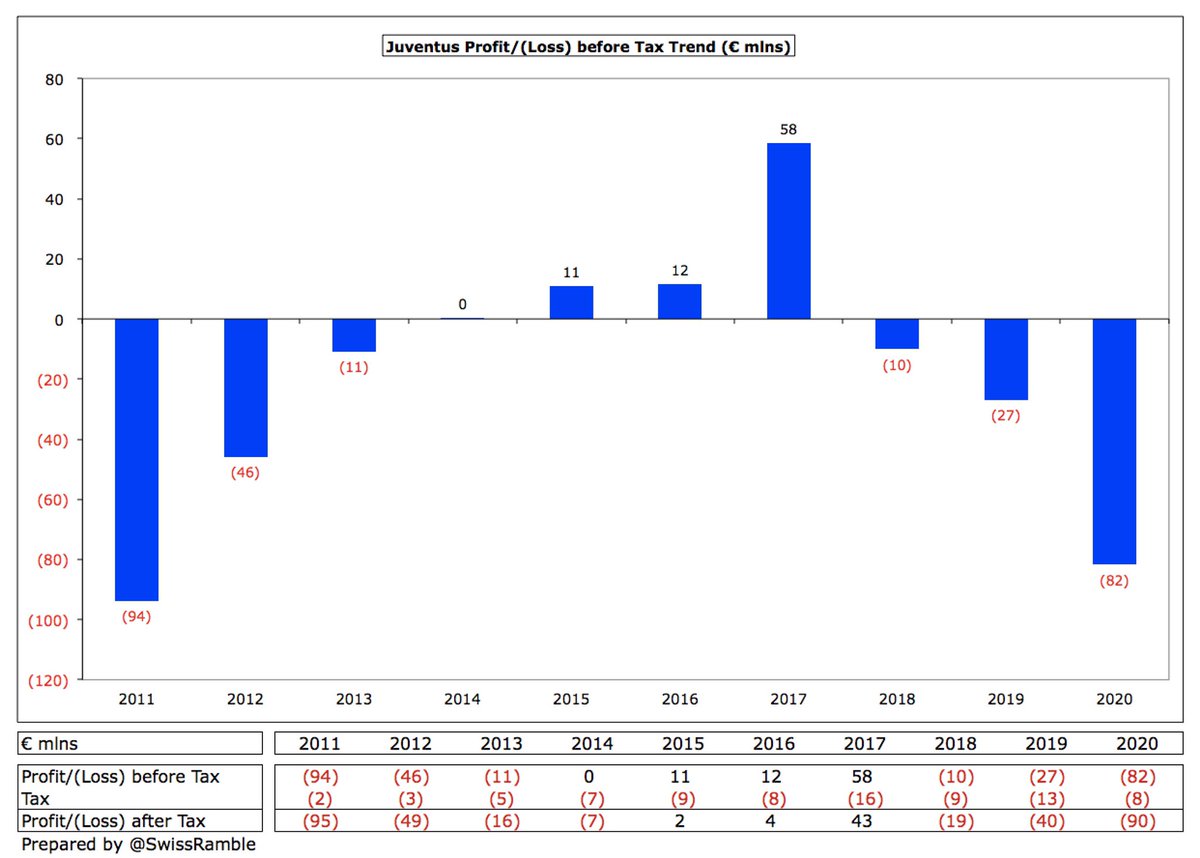

#Juventus loss before tax widened from €27m to €82m (€90m after tax), as revenue fell €88m (18%) from €494m to €407m, partly offset by €43m (13%) wages cut from €328m to €284m and profit on player sales rising €40m to €167m, though non cash flow expenses were up €48m.

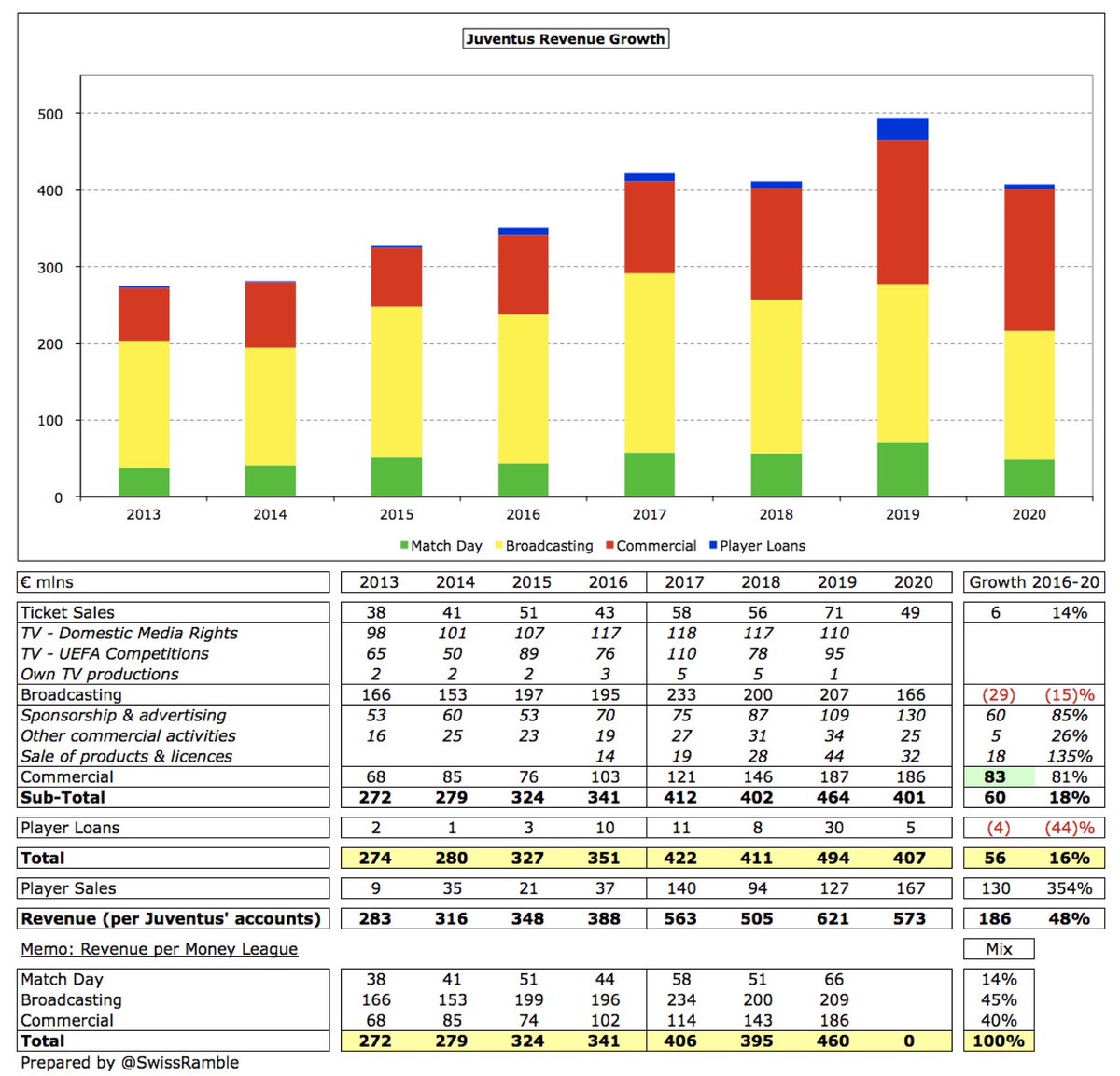

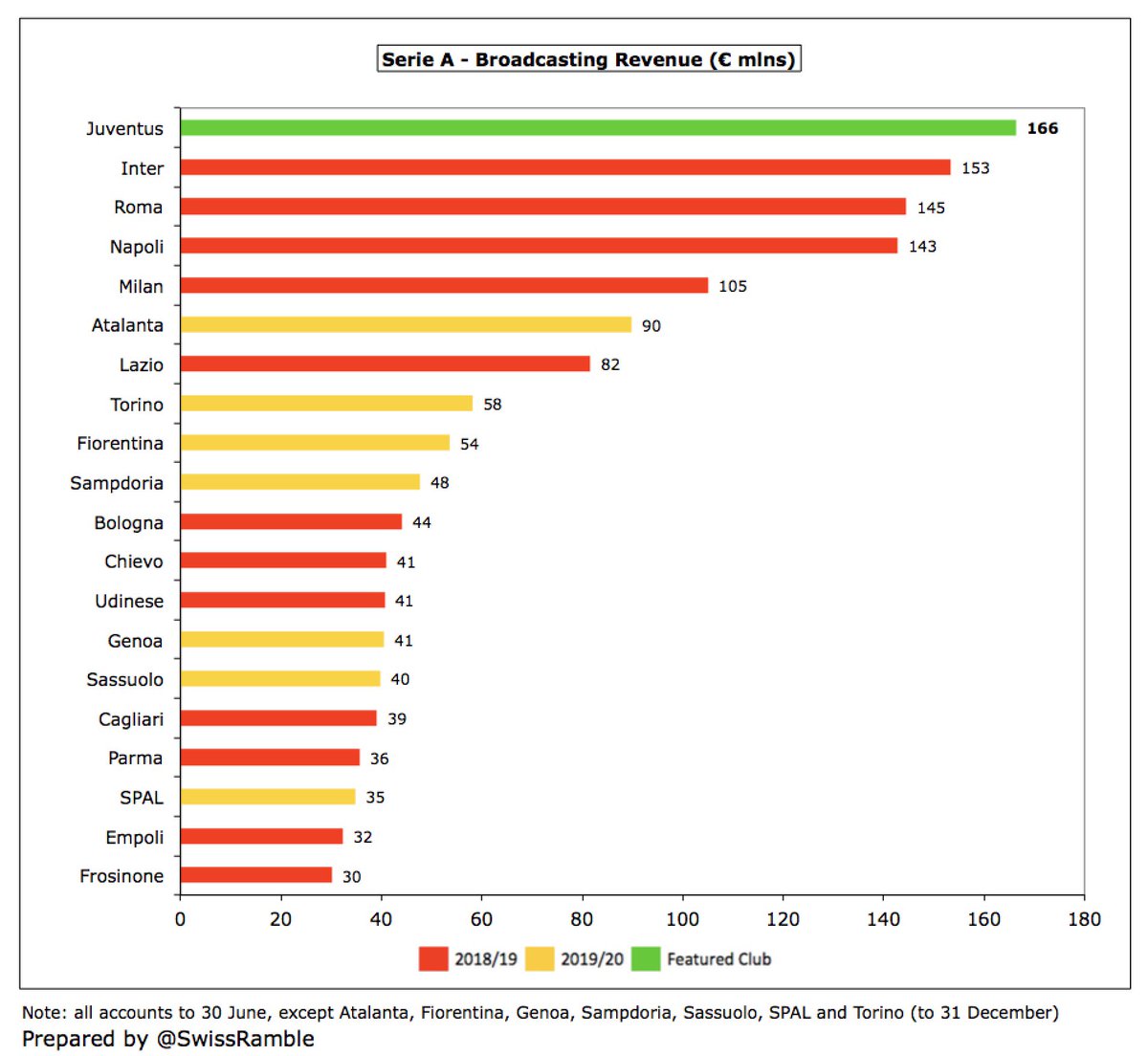

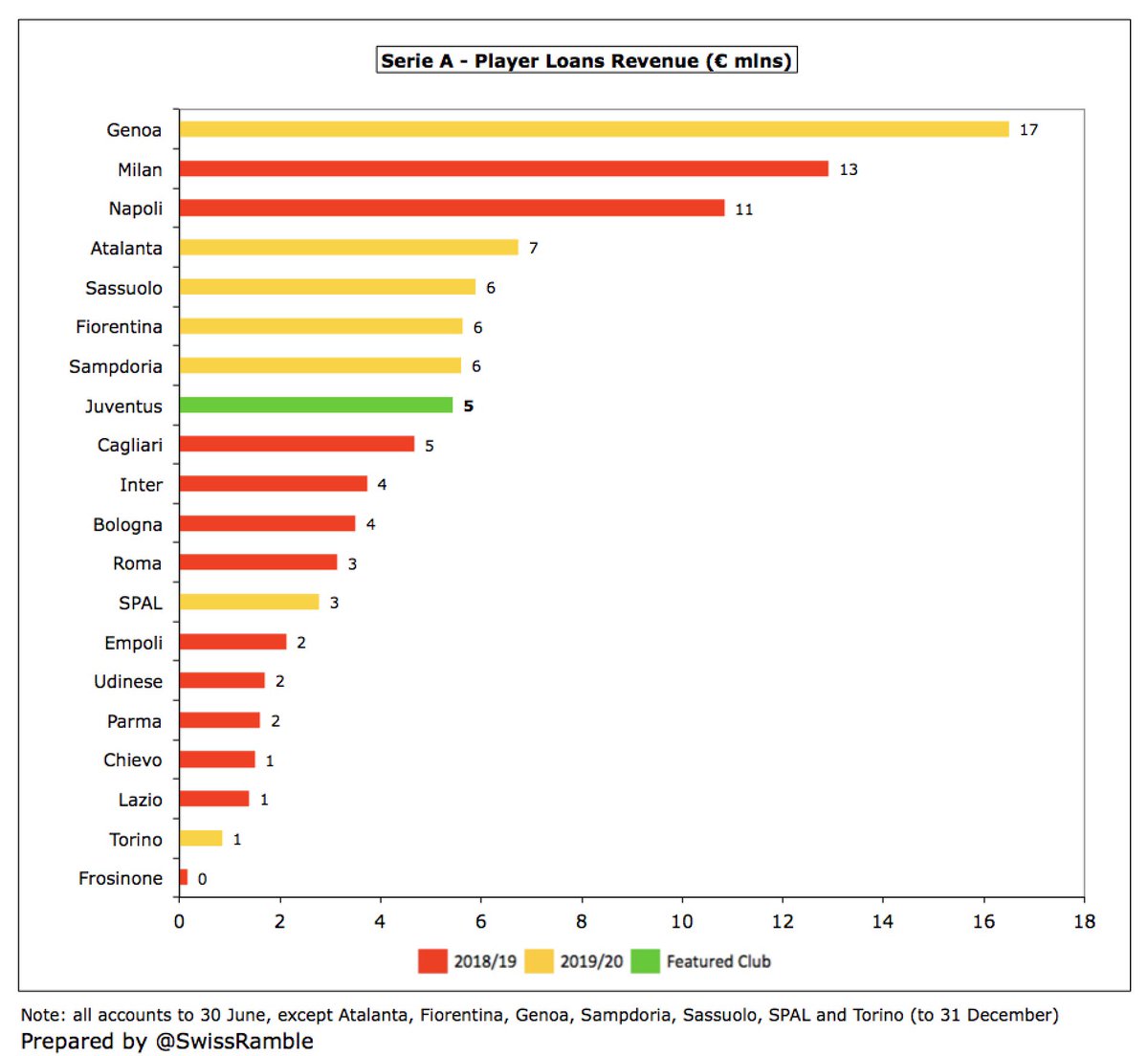

Driven by COVID, all #Juventus revenue streams fell, including broadcasting, down €40m (19%) to €166m, and match day, down €21m (30%) to €49m. Commercial only fell €1m to €186m, as new sponsorships compensated for lower merchandising sales. Player loans down €25m to €5m.

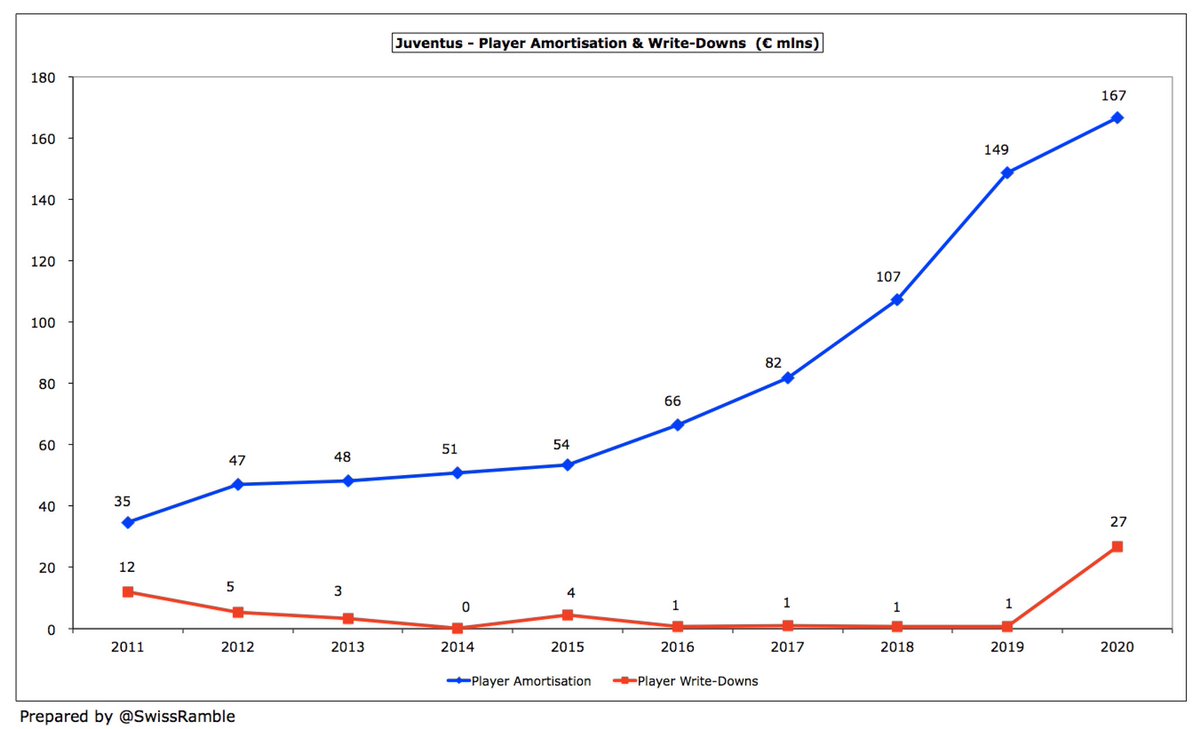

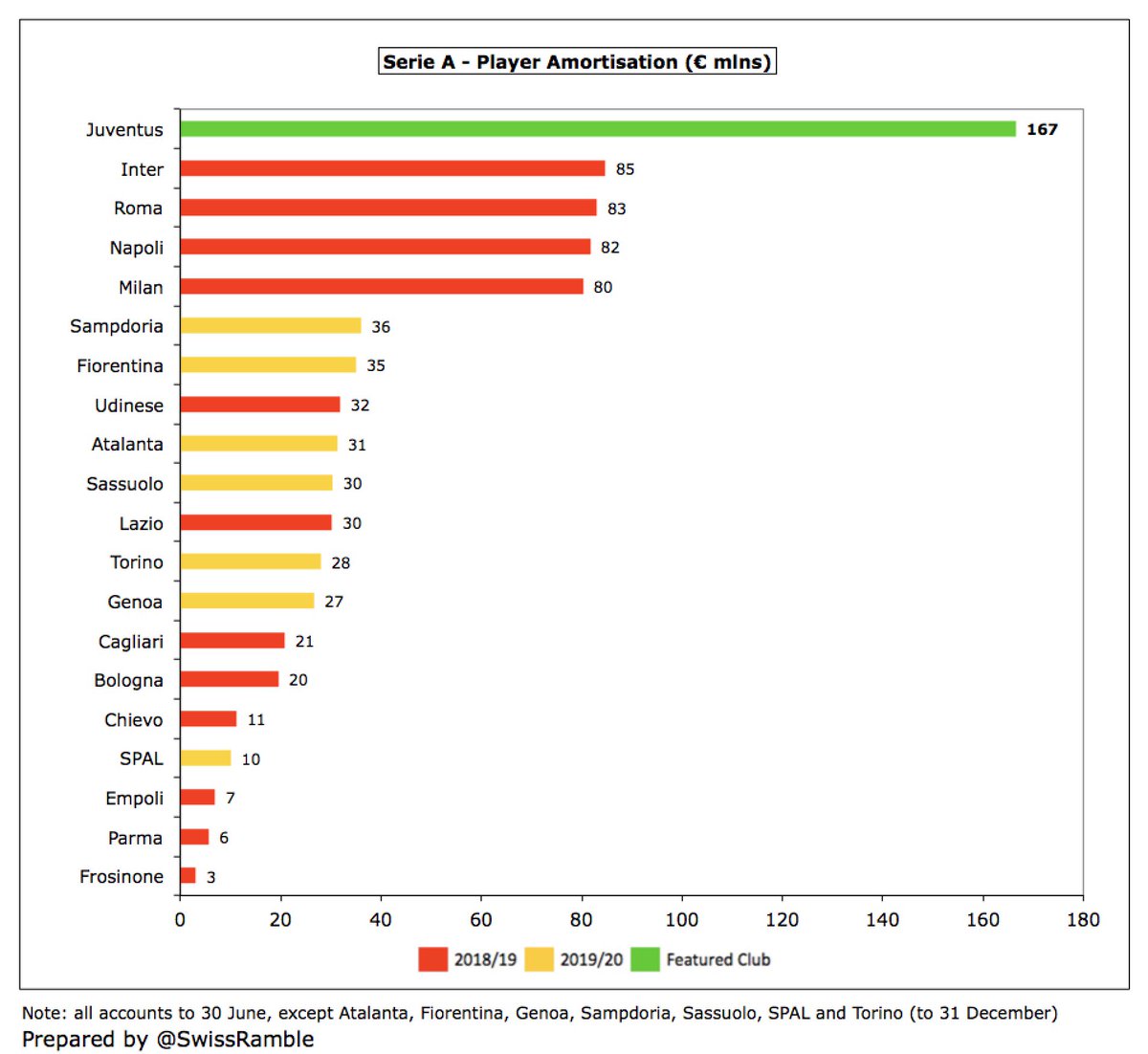

#Juventus reacted to revenue decrease from the pandemic with €43m lower wages, though player amortisation grew €18m (12%) from €149m to €167m, while there were €27m write-downs in player values (mainly Higuain). Depreciation and interest payable up €6m & €3m respectively.

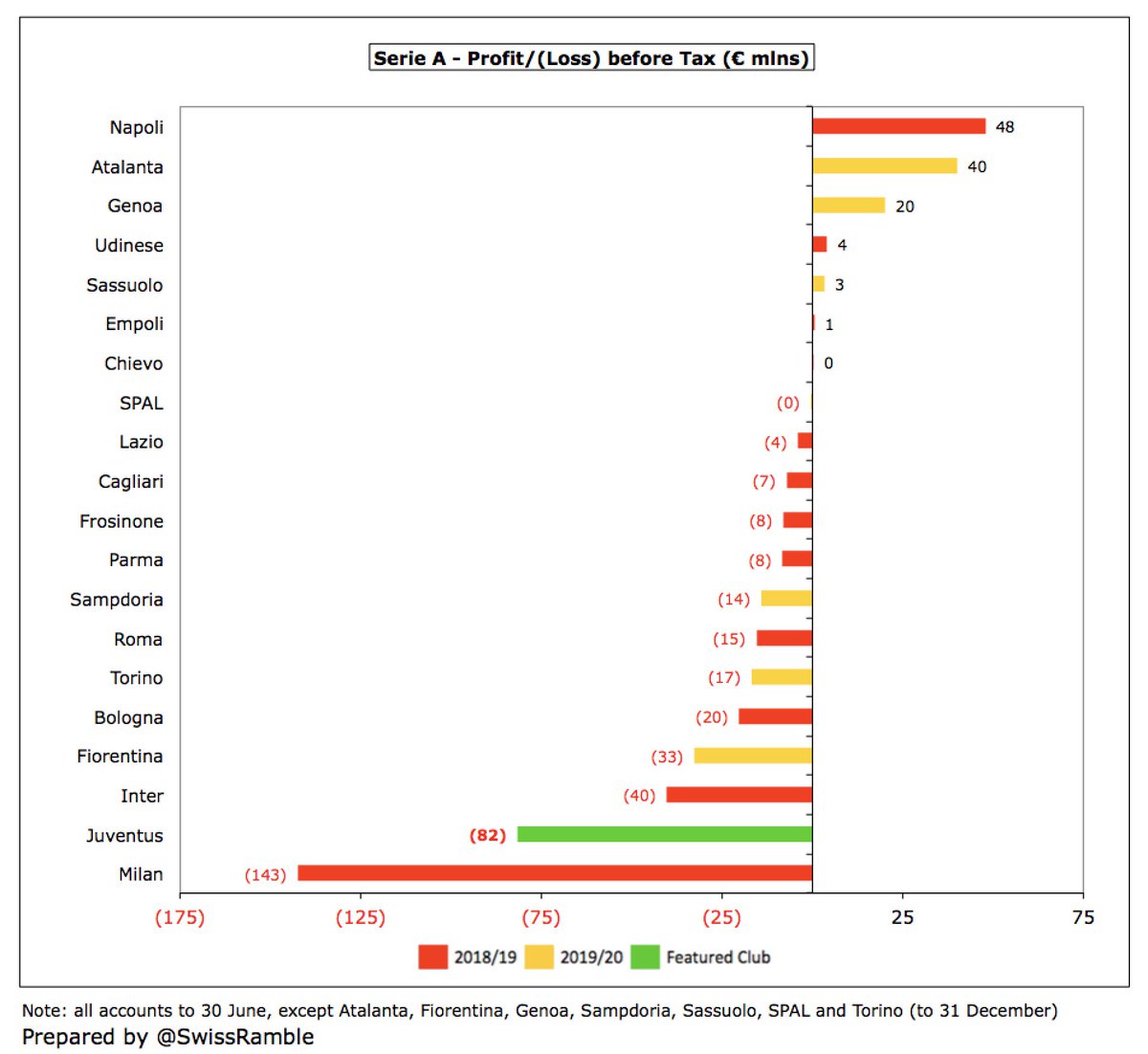

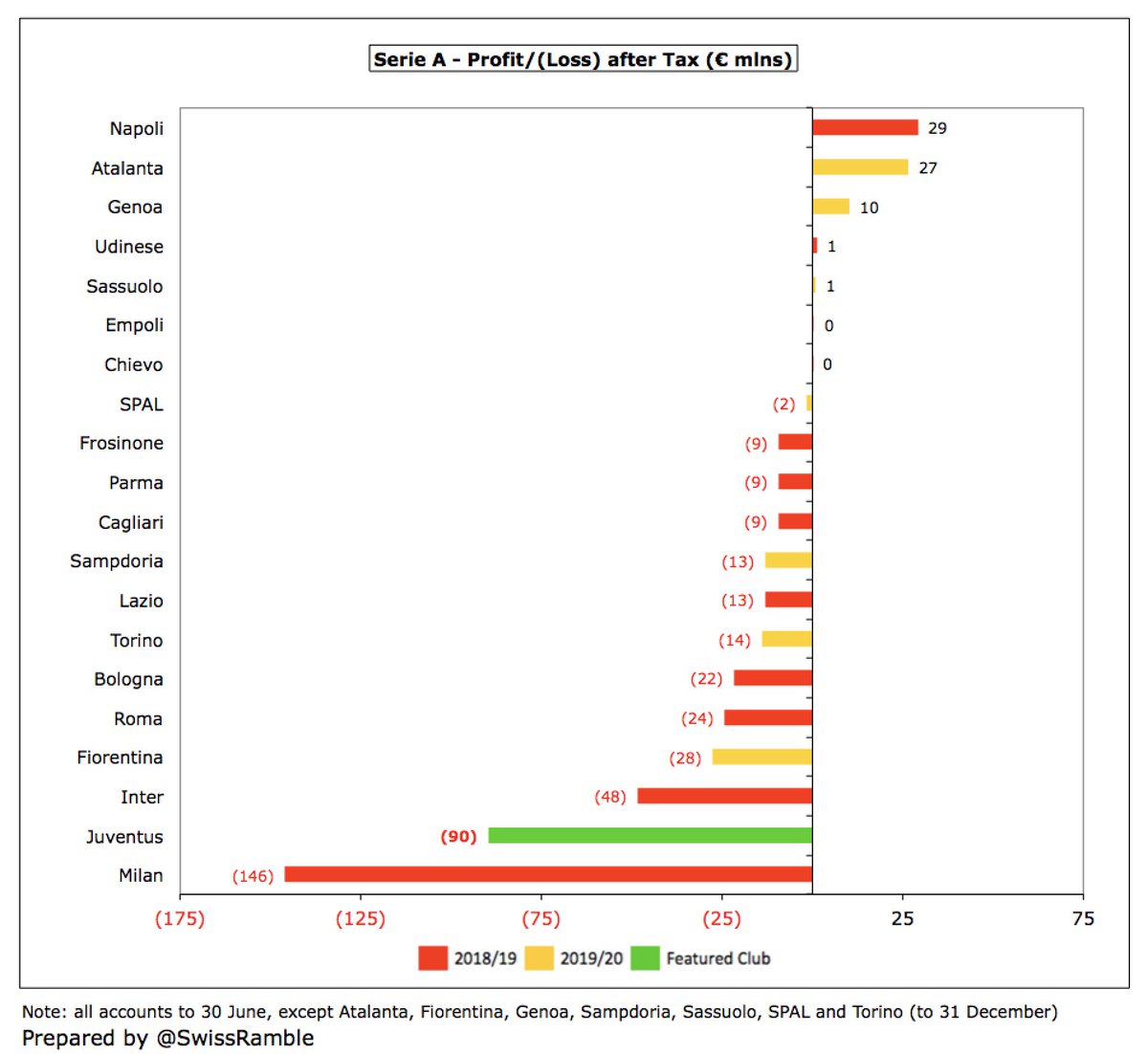

#Juventus €82m loss before tax is 2nd highest in Italy, only surpassed by Milan’s €143m, though this is a bit misleading, as other clubs’ results are from the previous season, so unaffected by COVID. Similar story after tax, where Juve again have 2nd largest loss with €90m.

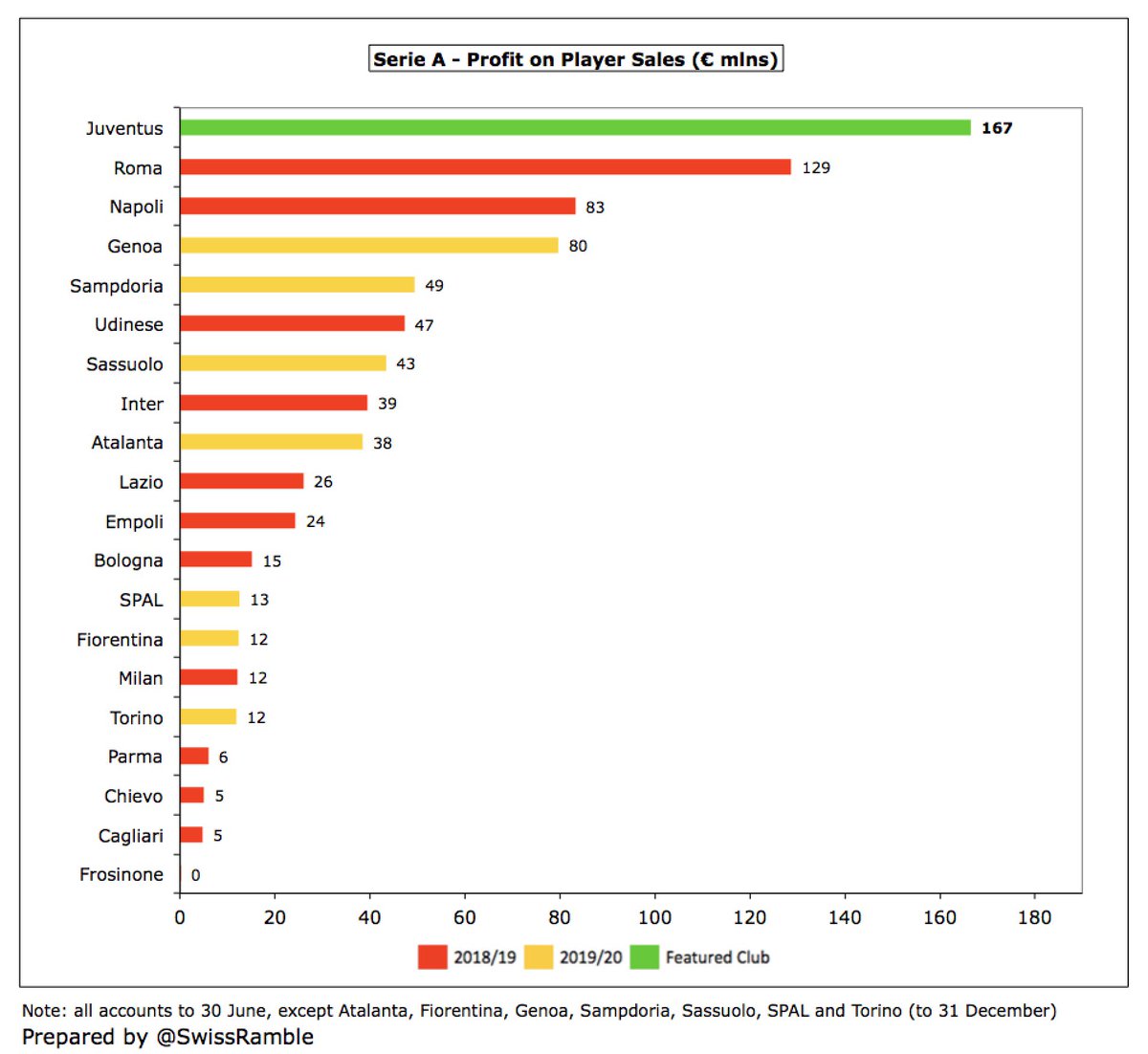

#Juventus profit on player sales increased from €127m to €167m, the highest in Italy by far, largely from the sales of Pjanic to Barcelona, Cancelo to Manchester City, Kean to Everton, Can to Dortmund, Muratore to Atalanta and Mancuso to Empoli.

So after four years of profits, #Juventus have now reported losses three years in a row, aggregating a €119m deficit over that period. However, the club is no stranger to losses, having racked up €151m between 2011 and 2013. They forecast that 2020/21 will end in another loss.

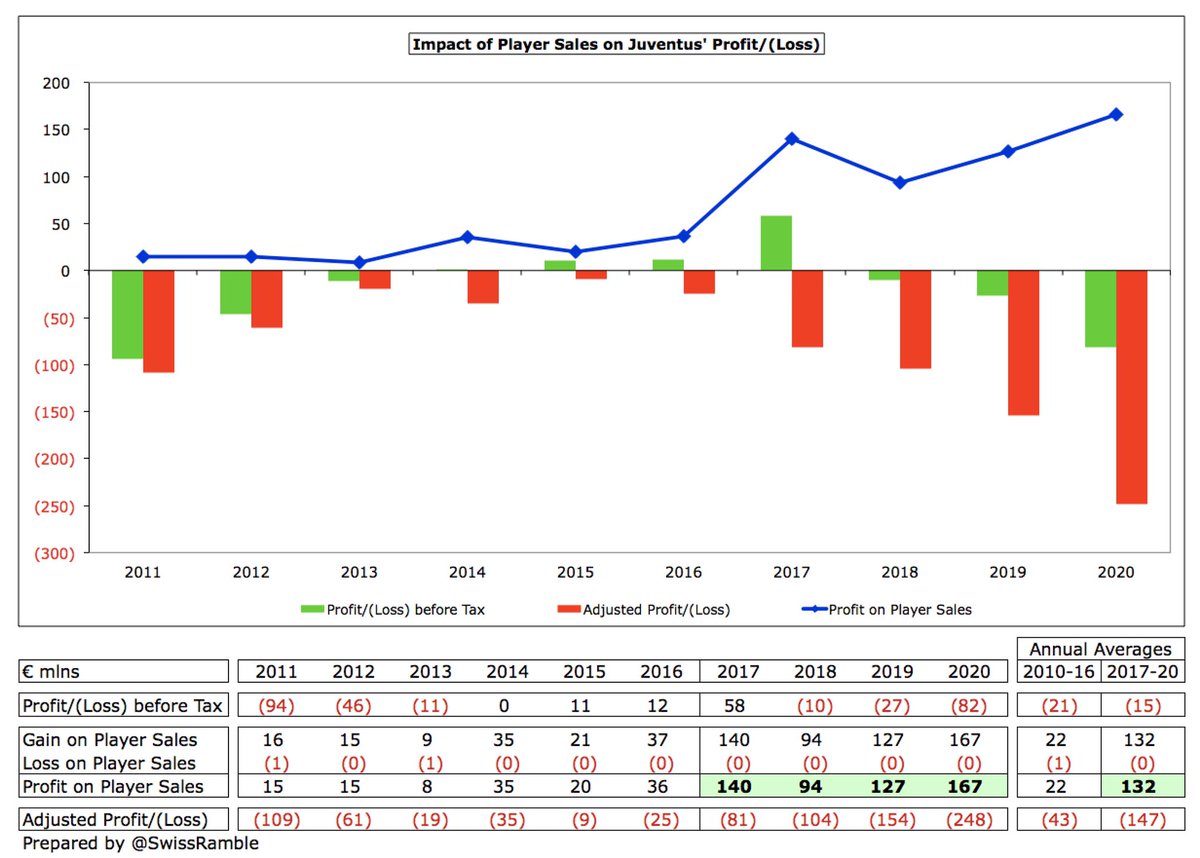

Profit on player sales is increasingly important for #Juventus averaging €132m a year over last 4 years, compared to only €22m in the preceding 6 years. No major sales to date in 2020/21, though summer window runs to 5th October this season and January window still to come.

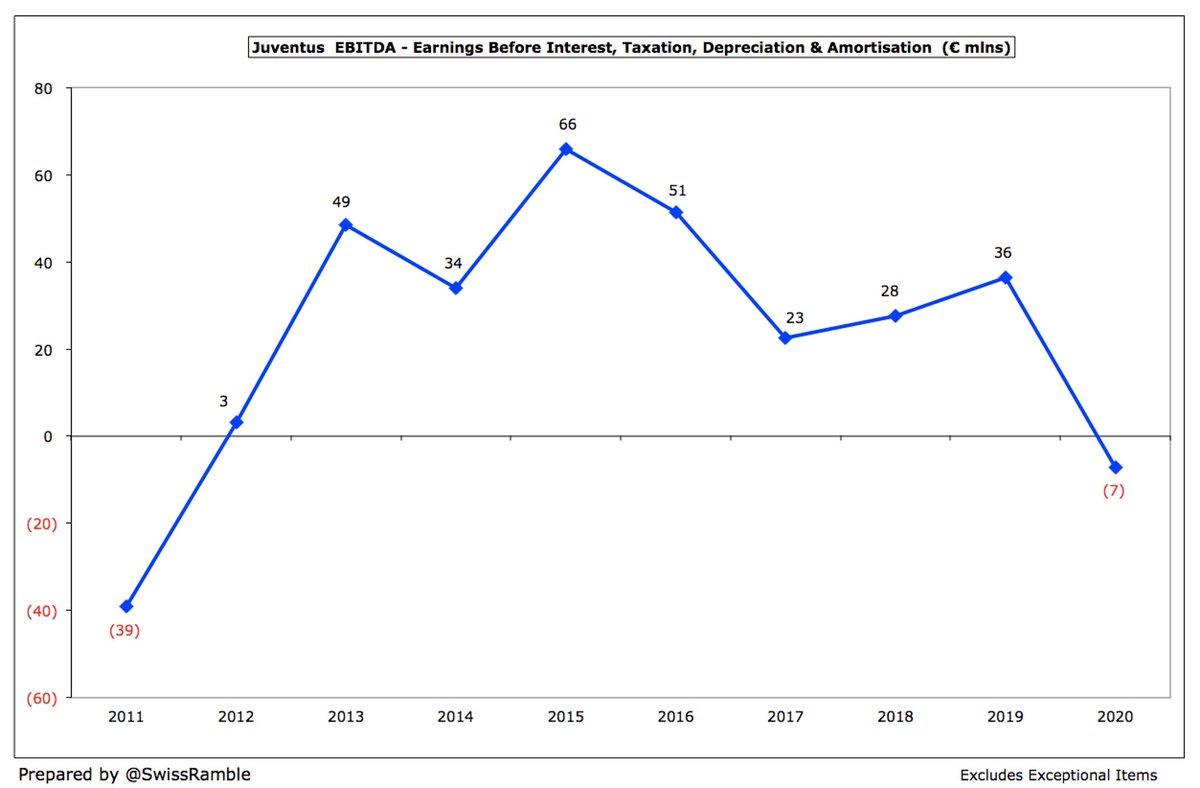

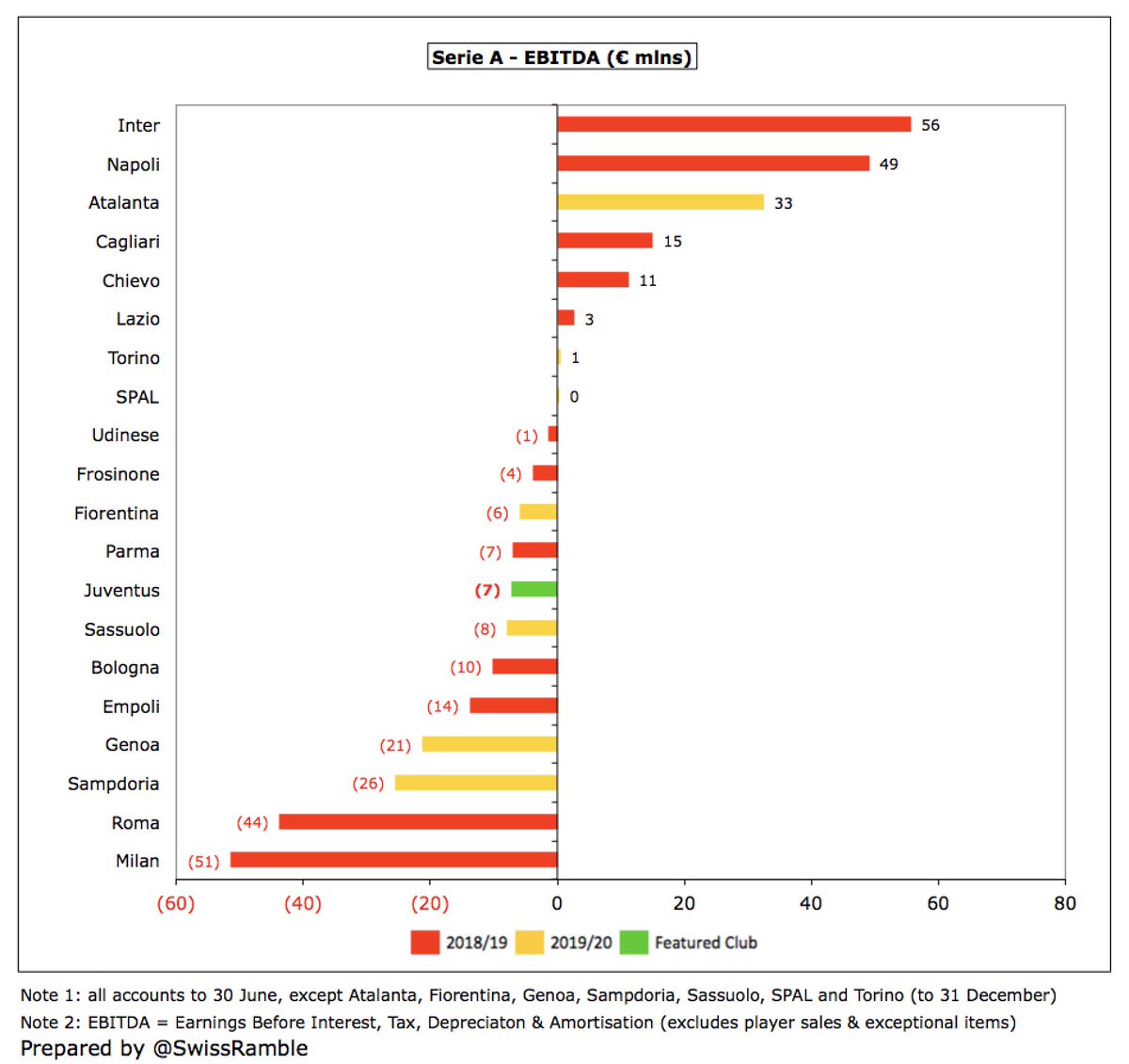

#Juventus EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), considered as cash operating profit, as it excludes once-off items like player sales and exceptional items, fell from €36m to €(7)m, the first negative since 2011 and now in bottom half in Italy.

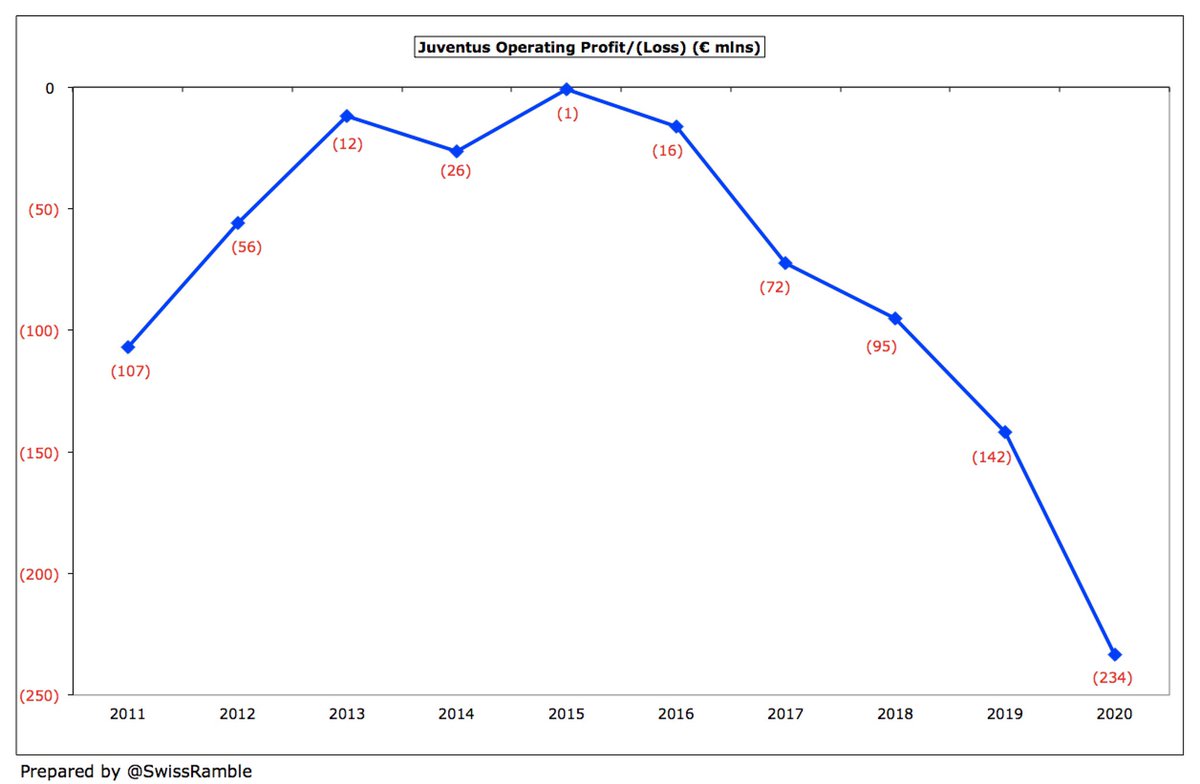

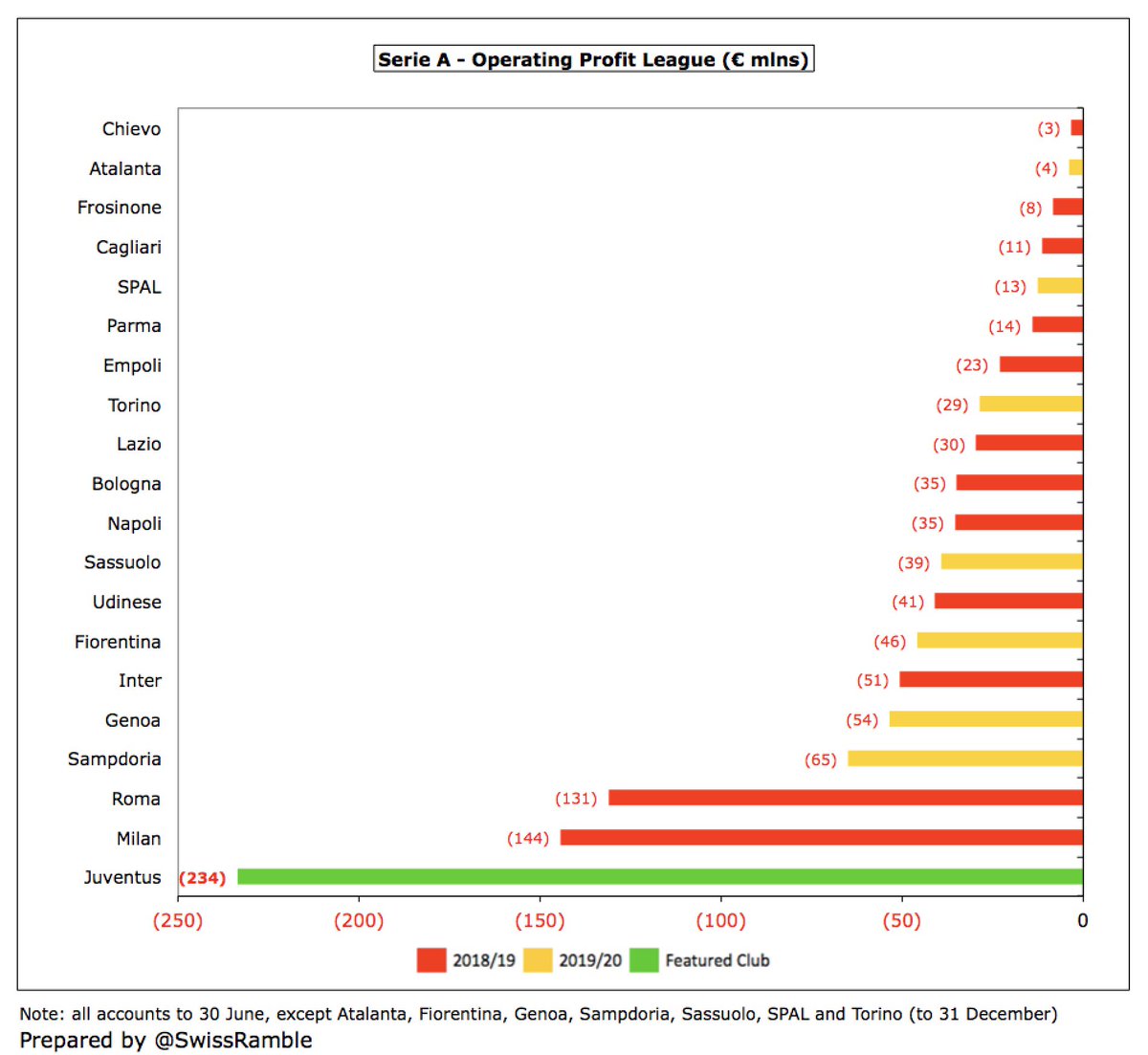

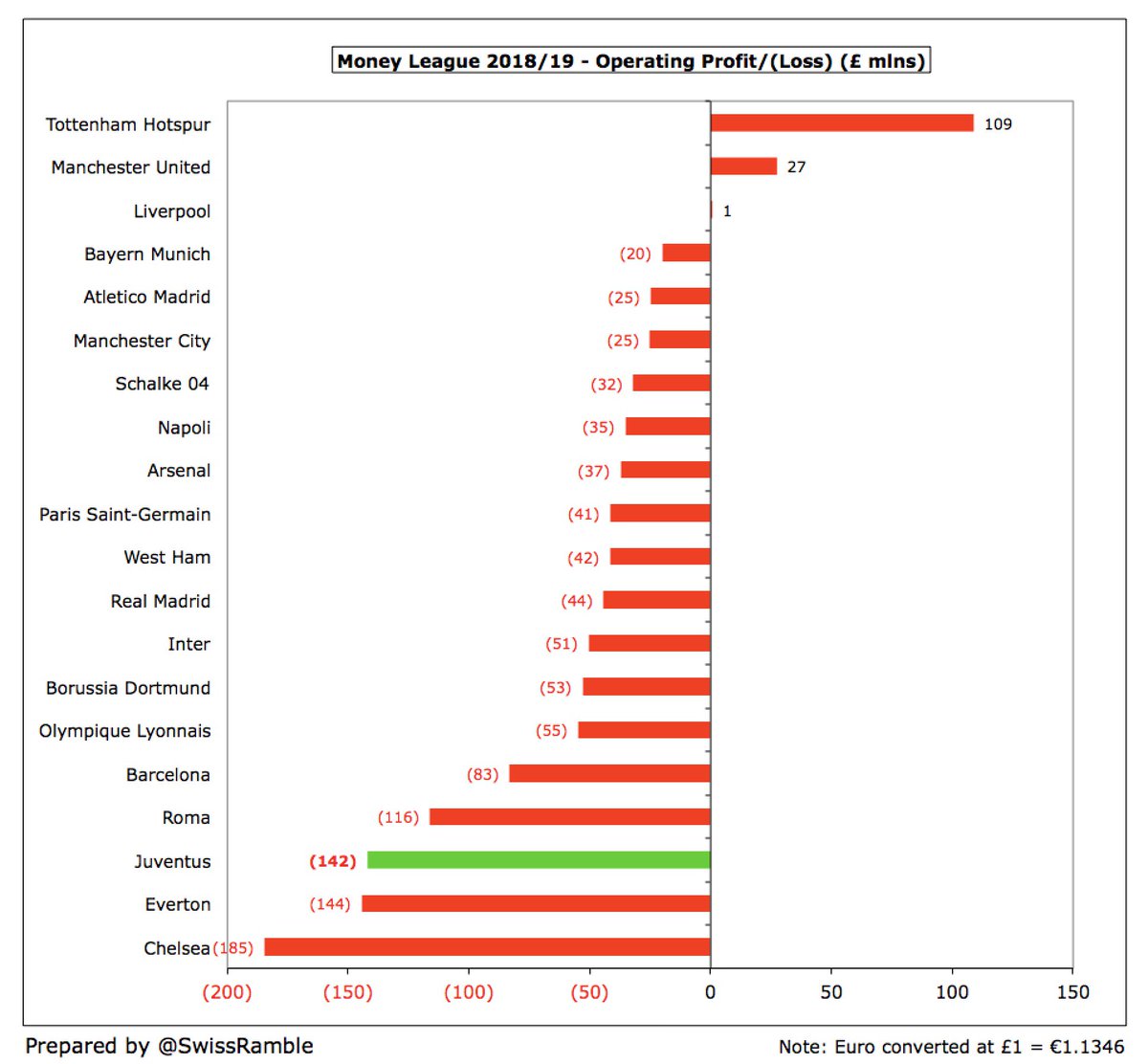

#Juventus €234m is the worst operating loss in Italy. It is true that their accounts are the only ones impacted by COVID to date, but this had already been on a steady downward trend from €(1)m in 2015. The €142m loss in 2019 was the 3rd highest in the Money League top 20.

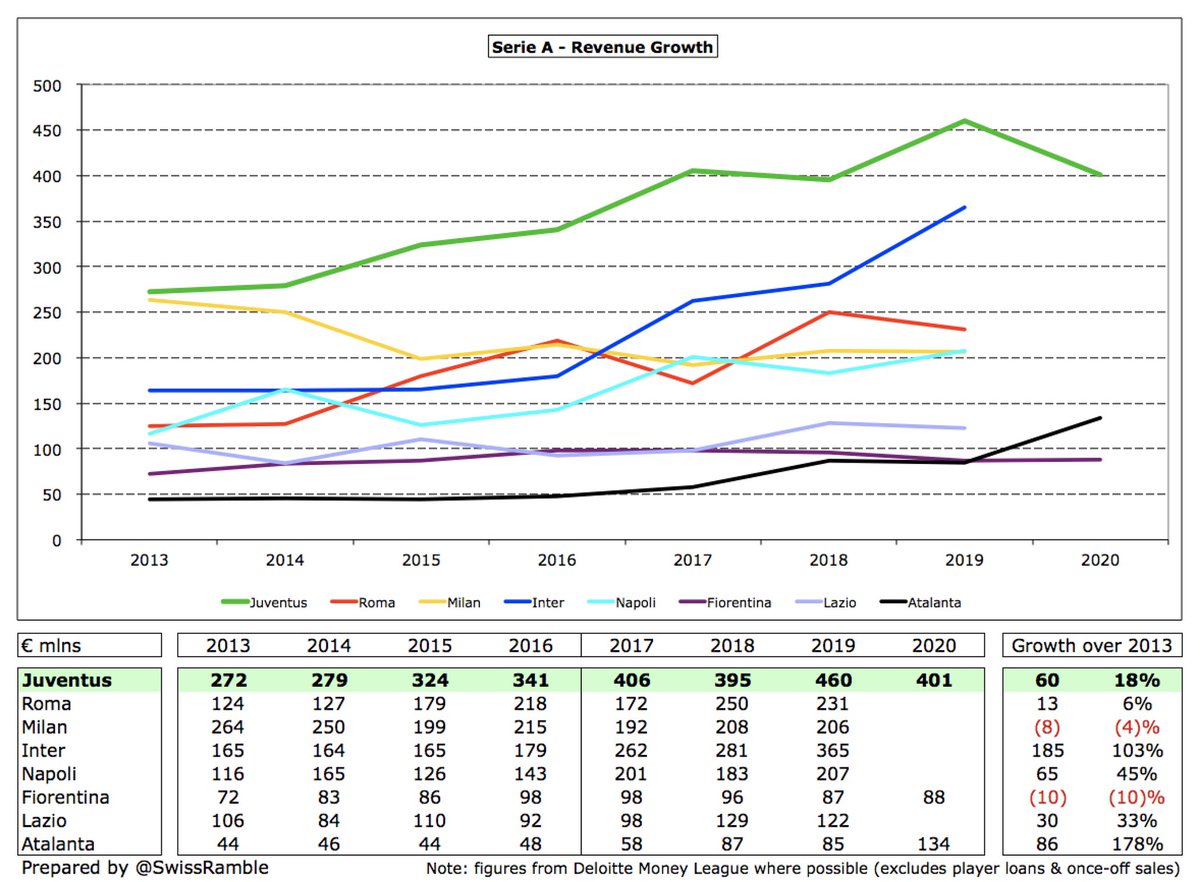

Excluding player sales, #Juventus revenue fell €88m (18%) from €494m to €407m in 2020. Despite last season’s decrease, revenue has still grown by €56m (16%) in the last four years, almost entirely on the commercial side €83m, though broadcasting is down €29m.

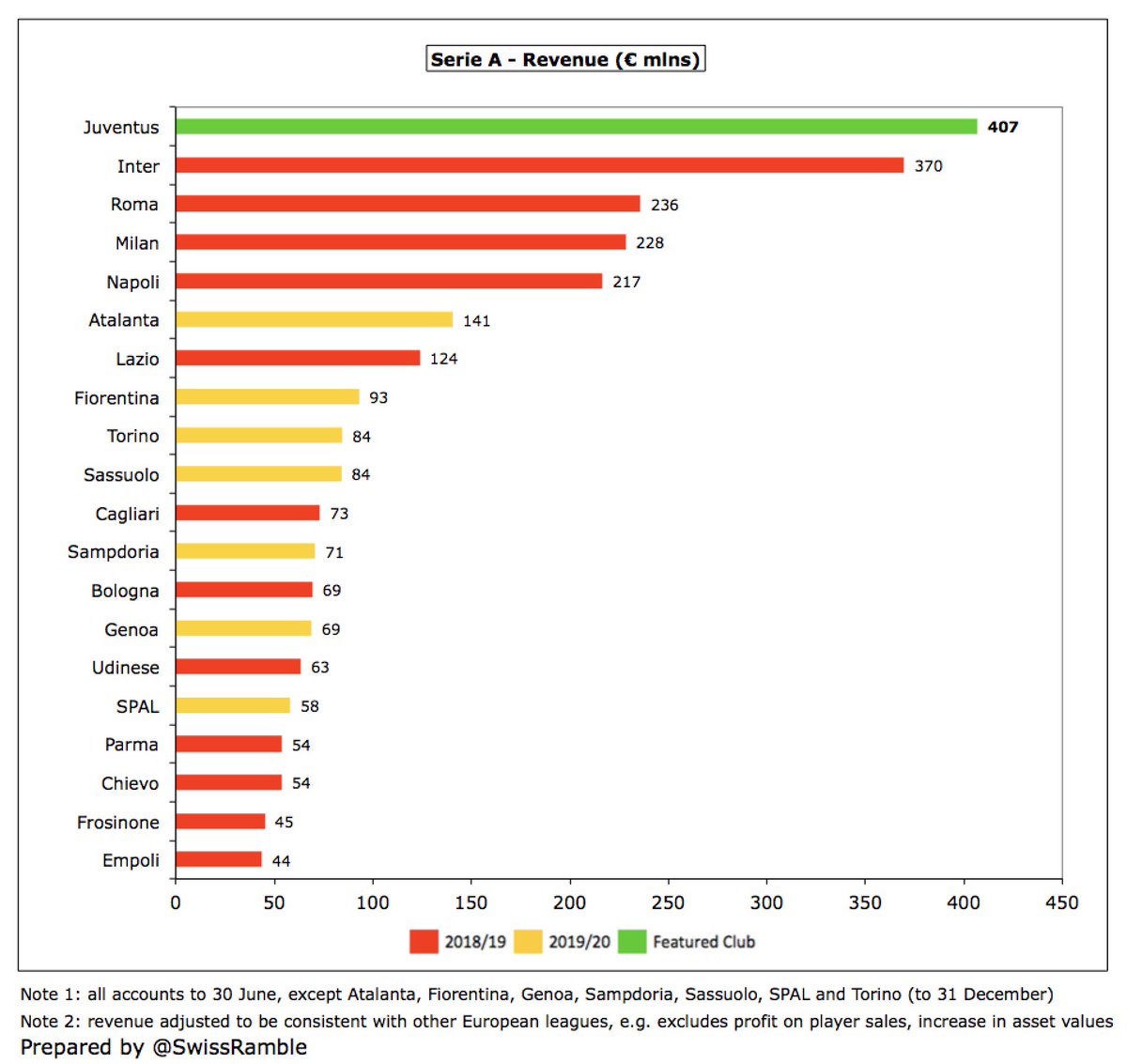

#Juventus €407m revenue is highest in Italy, €37m more than closest challenger Inter €377m, followed by Roma €236m, Milan €228m, Napoli €217m, Atalanta €141m & Lazio €124m. All other Serie A clubs are below €100m. Gap will grow as others release COVID impacted accounts.

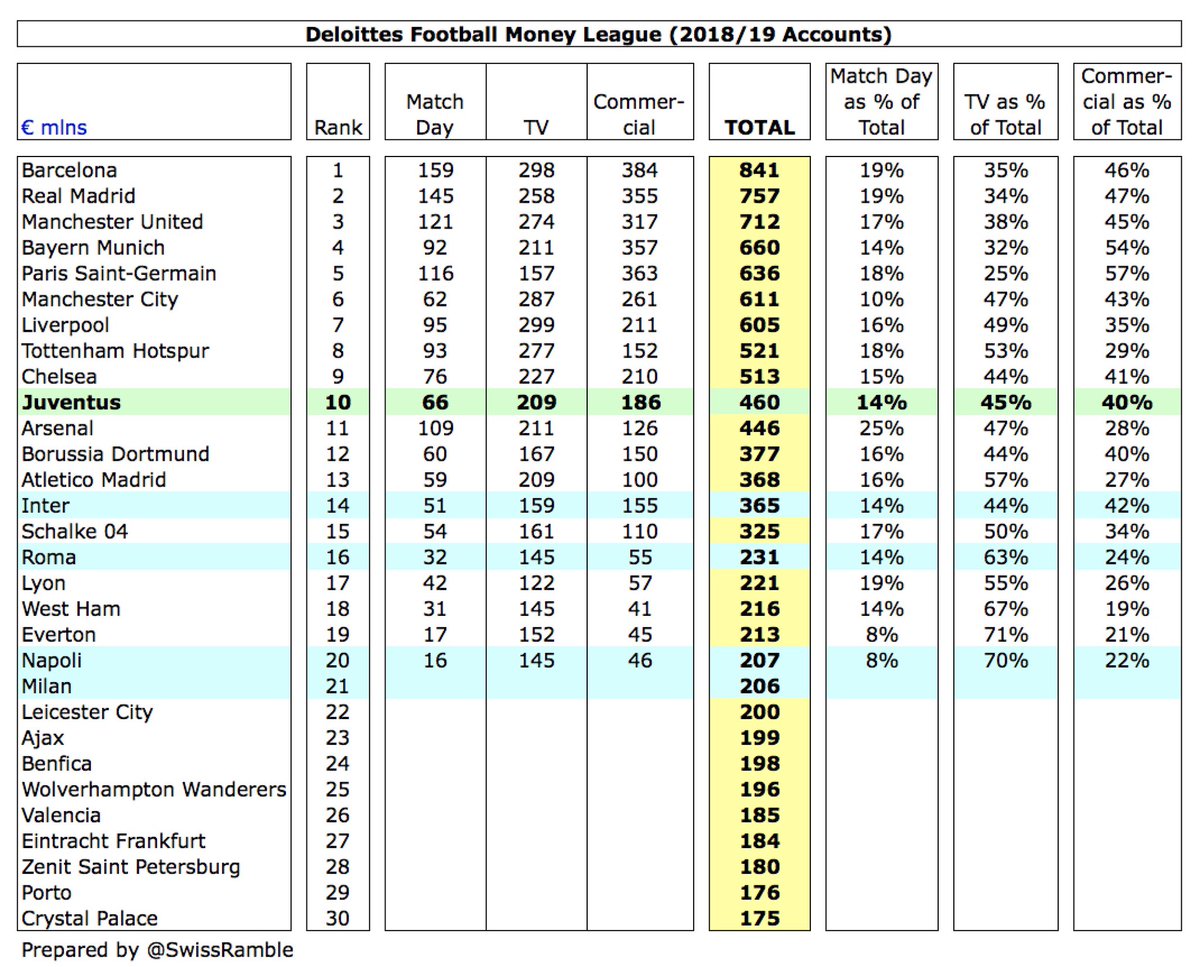

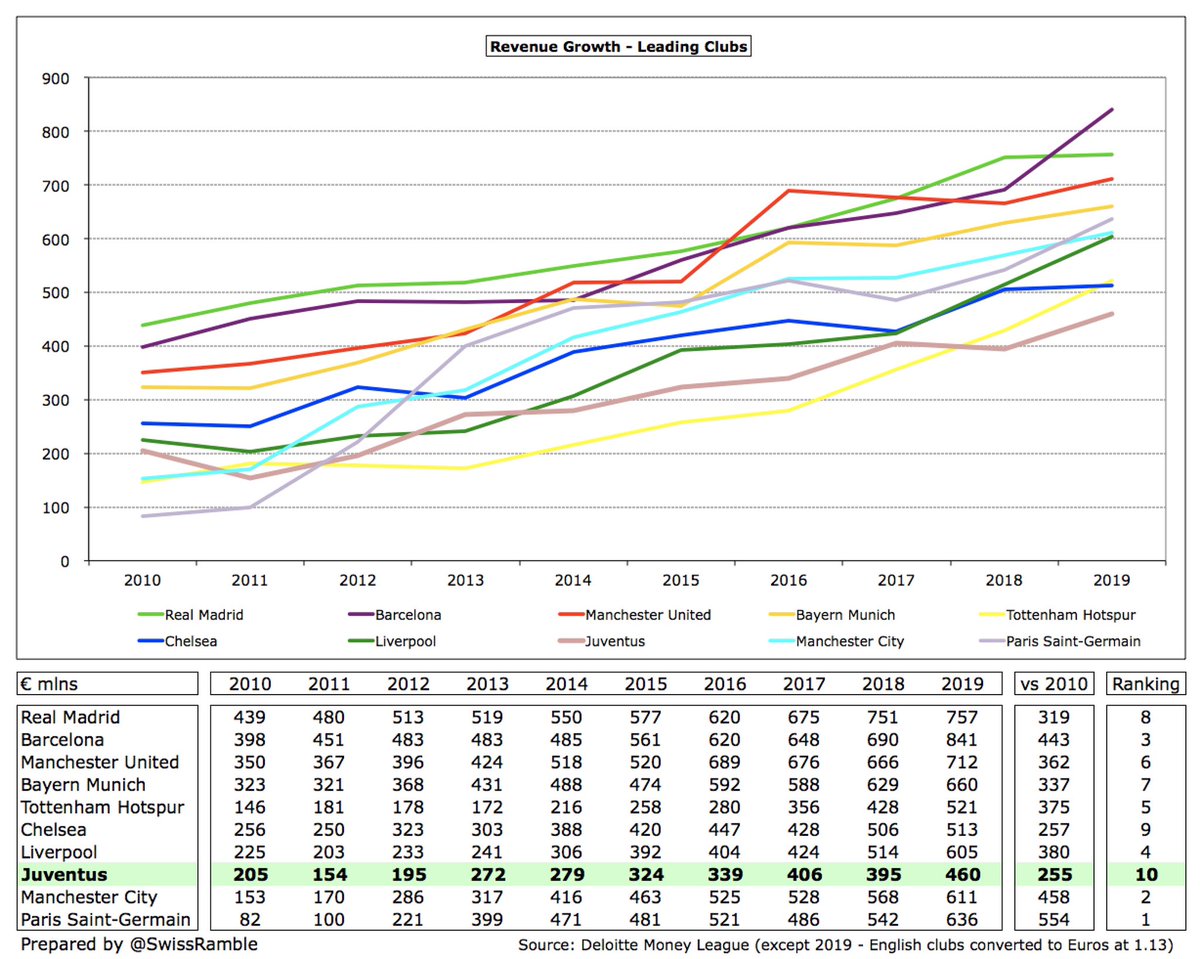

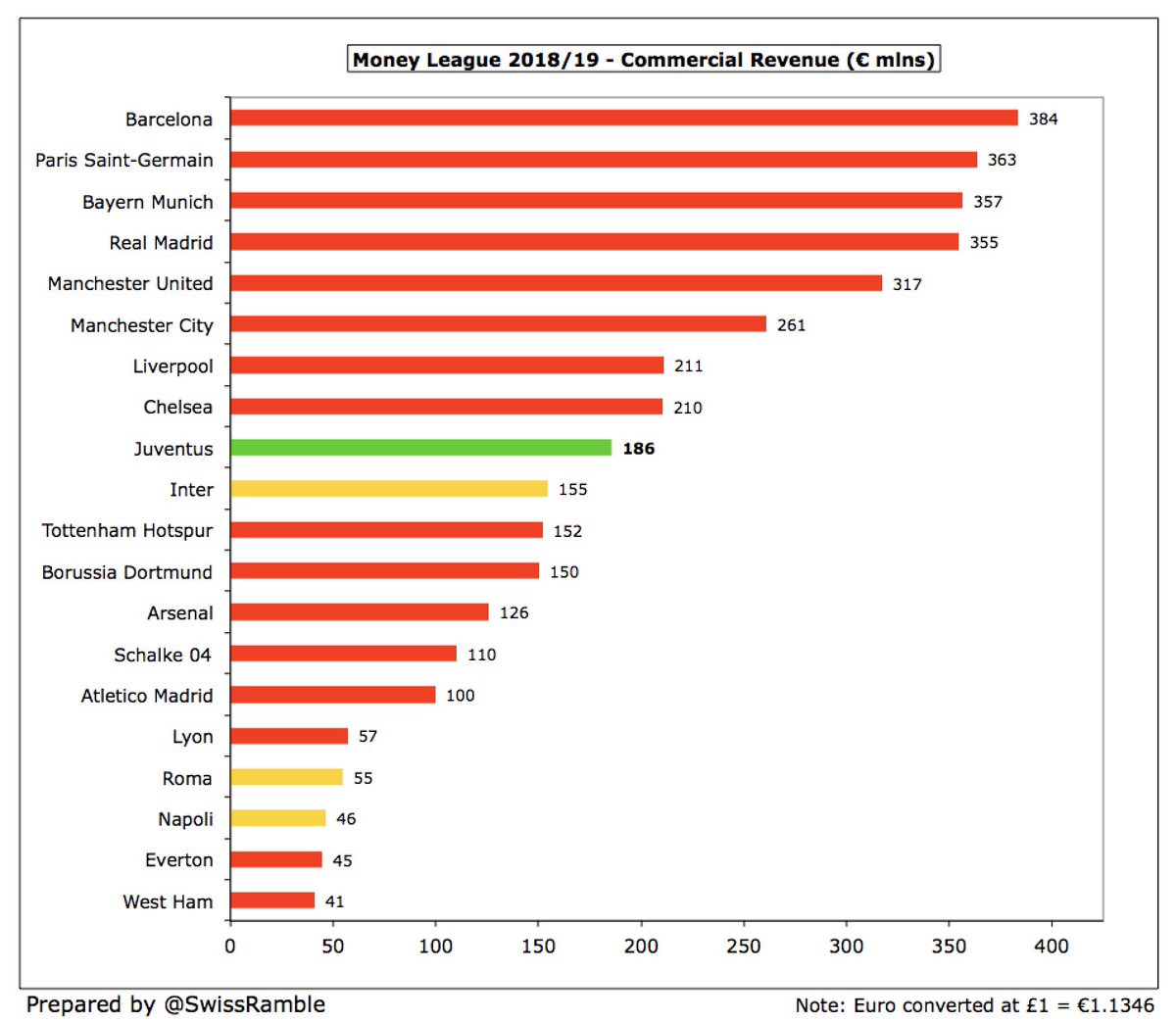

#Juventus climbed a place to 10th in the Deloitte Money League, based on 2018/19 revenue, as they overtook Arsenal. However, their €255m revenue growth since 2010 is the lowest in the top 10, miles below the likes of #PSG, #MCFC, Barcelona, #LFC and #THFC.

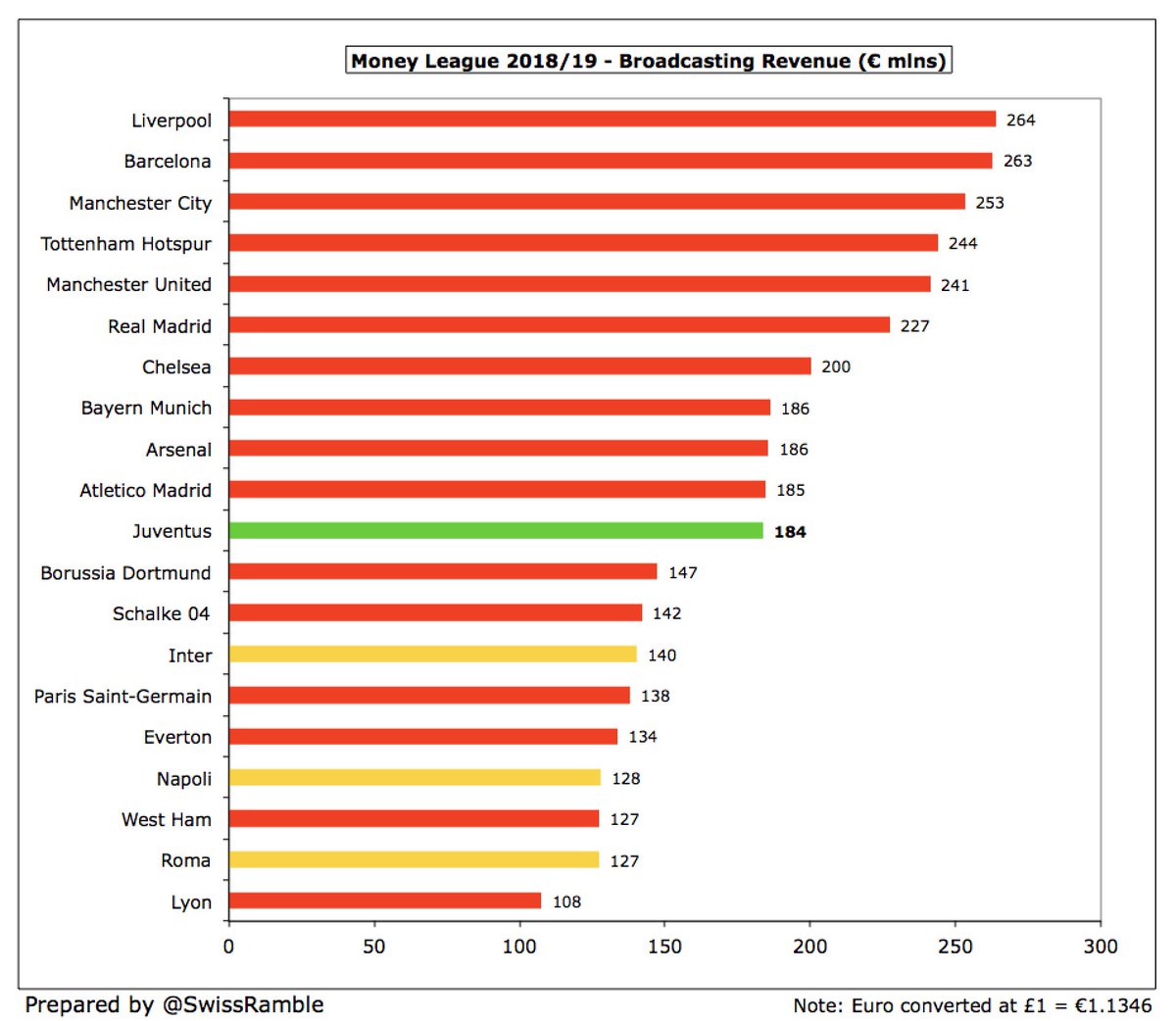

#Juventus TV revenue dropped €40m (19%) to €166m, partly due to reduction in Serie A money, presumably due to COVID rebate, and lower Champions League TV money, due to only reaching last 16. Highest in Italy, ahead of Inter €153m (pre-COVID), but only mid-table in Europe.

The last available Italian TV revenue details are from 2018/19. Distribution mechanism is: 50% equal share; 30% performance (15% last season, 10% last 5 years, 5% historical); and 20% supporters. New method is less favourable to #Juventus with equal share up from 40%.

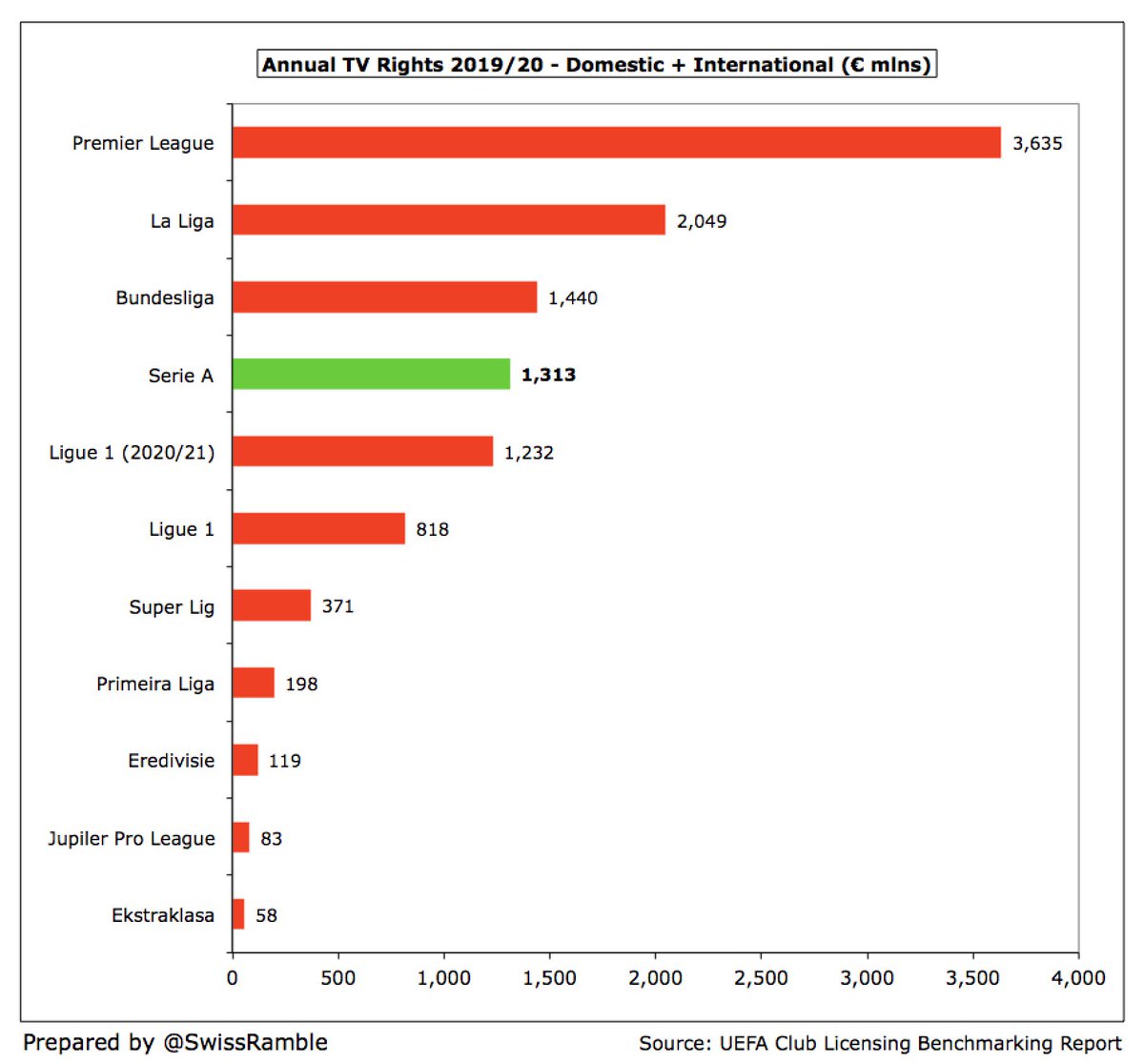

It is imperative that #Juventus do well in the Champions League to boost their broadcasting income, as the TV rights in Serie A are relatively low. Indeed, there were big increases in England and Spain in 2019/20, and France to come in 2020/21, while Italy is unchanged.

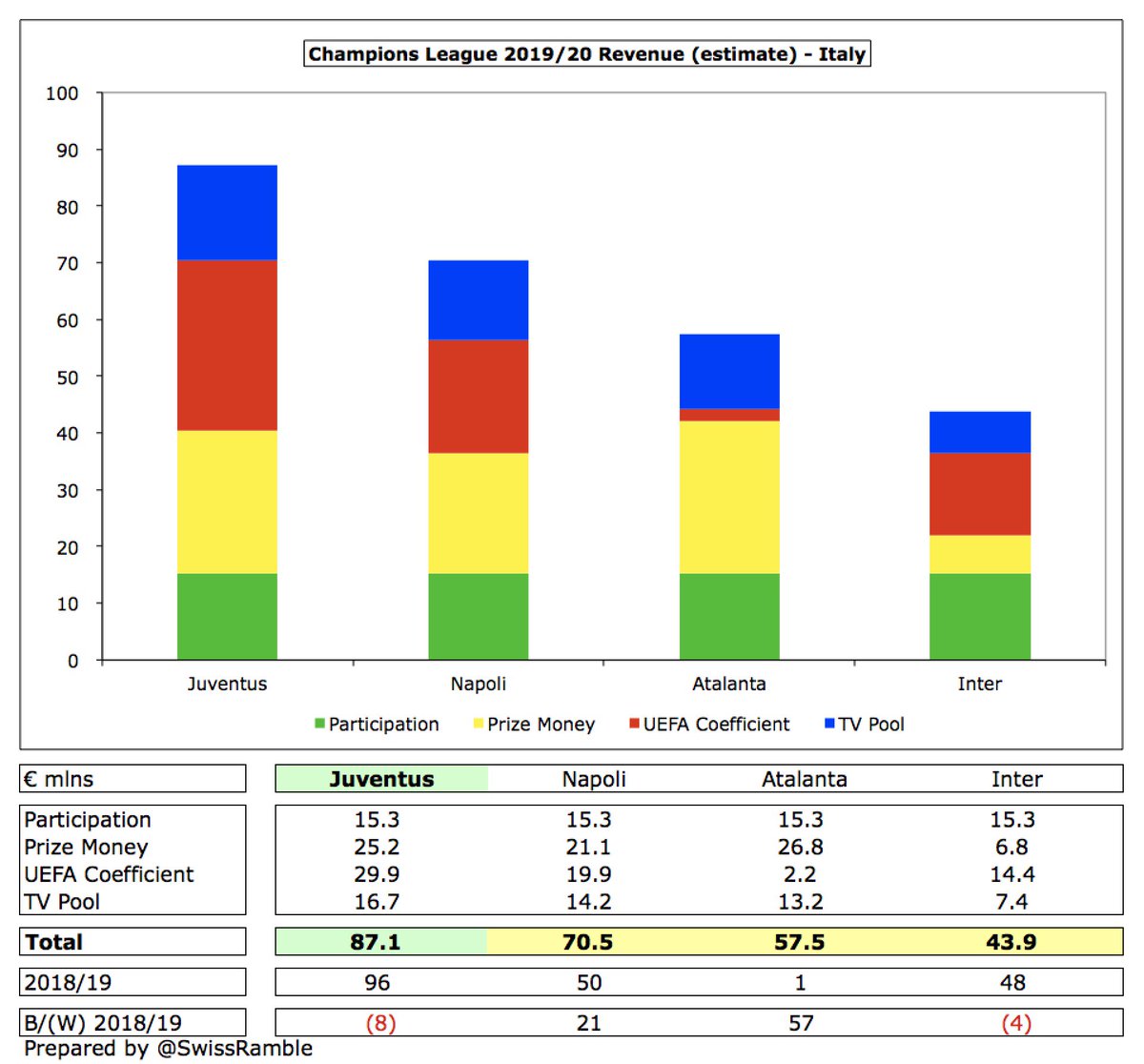

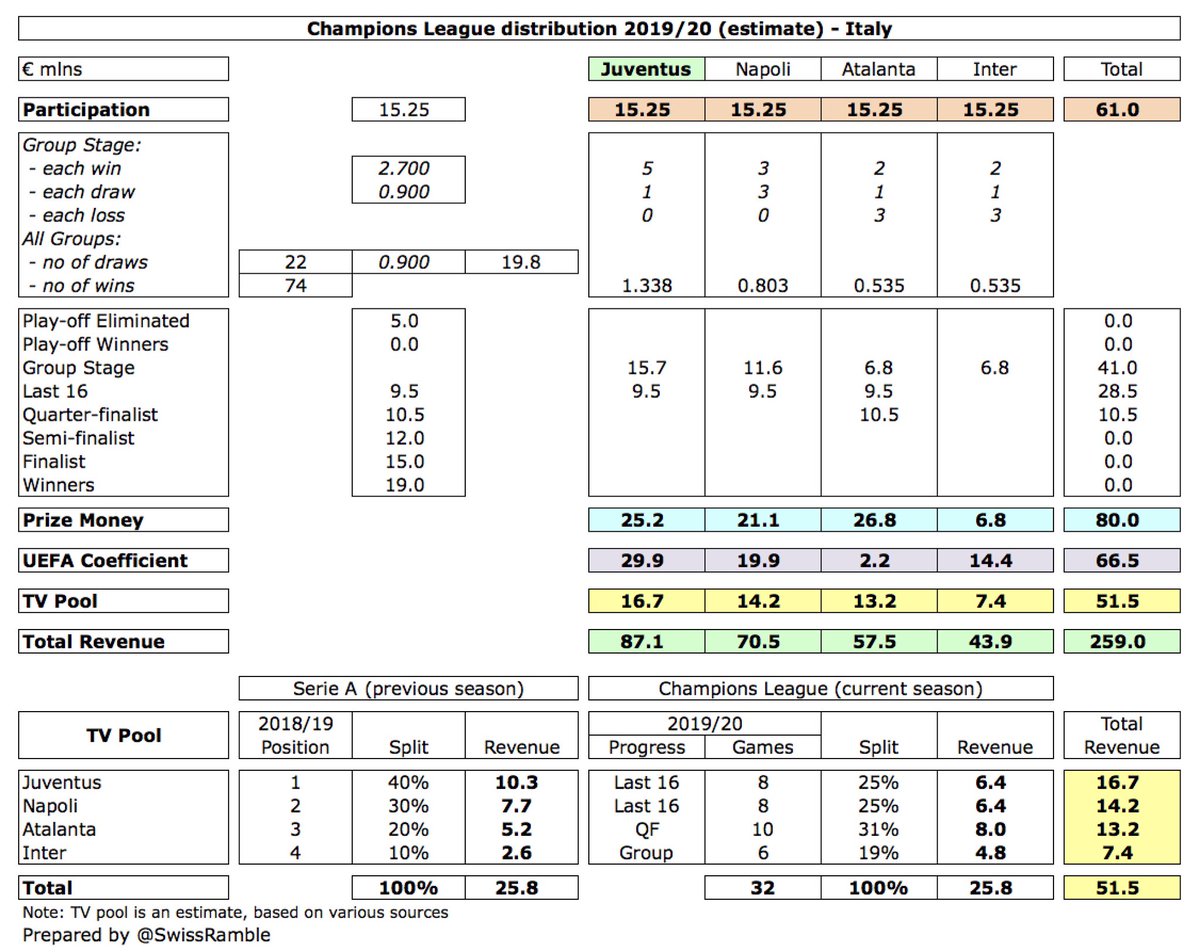

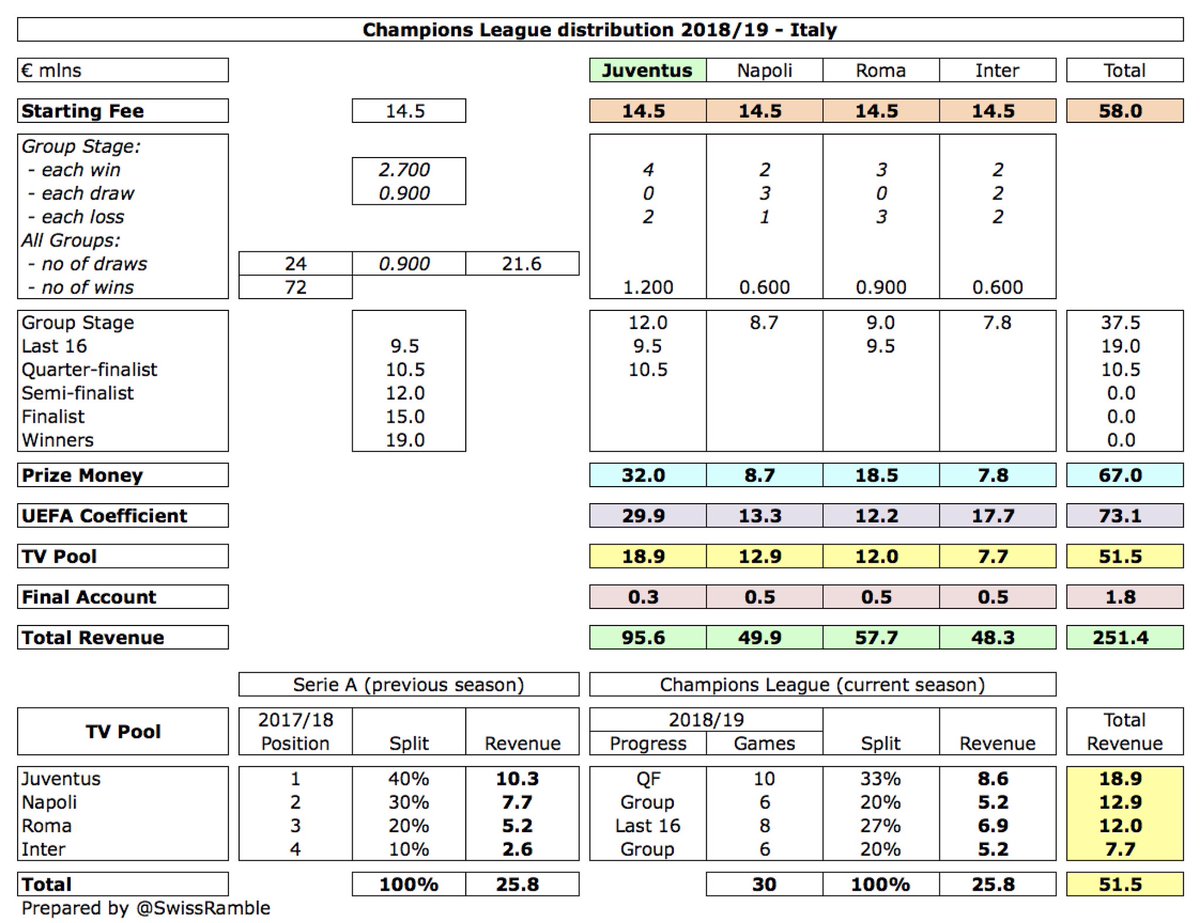

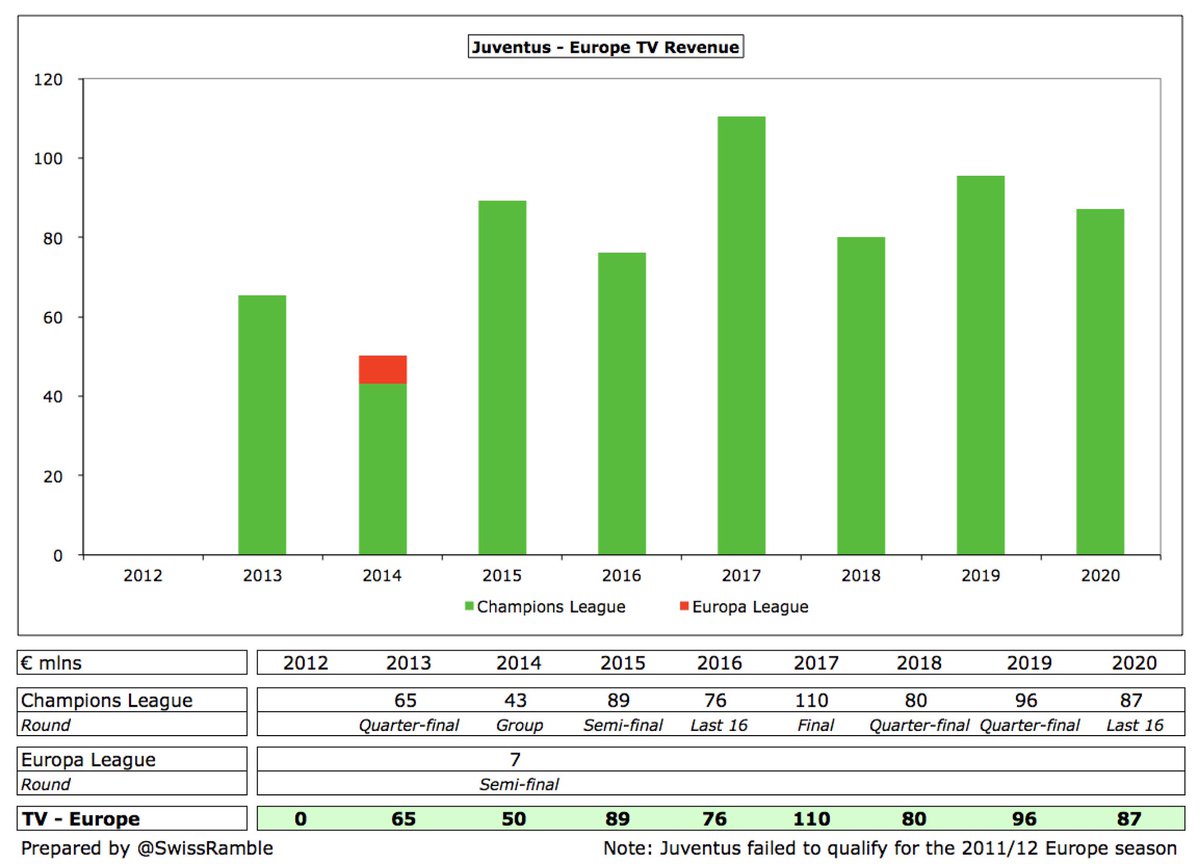

Based on my estimate, #Juventus earned €87m from the Champions League after going out in the last 16, lower than prior season’s €96m, when they reached the quarter-finals Other Italian clubs: Napoli €70m, Atalanta €57m & Inter €44m. These figures are before any COVID rebate.

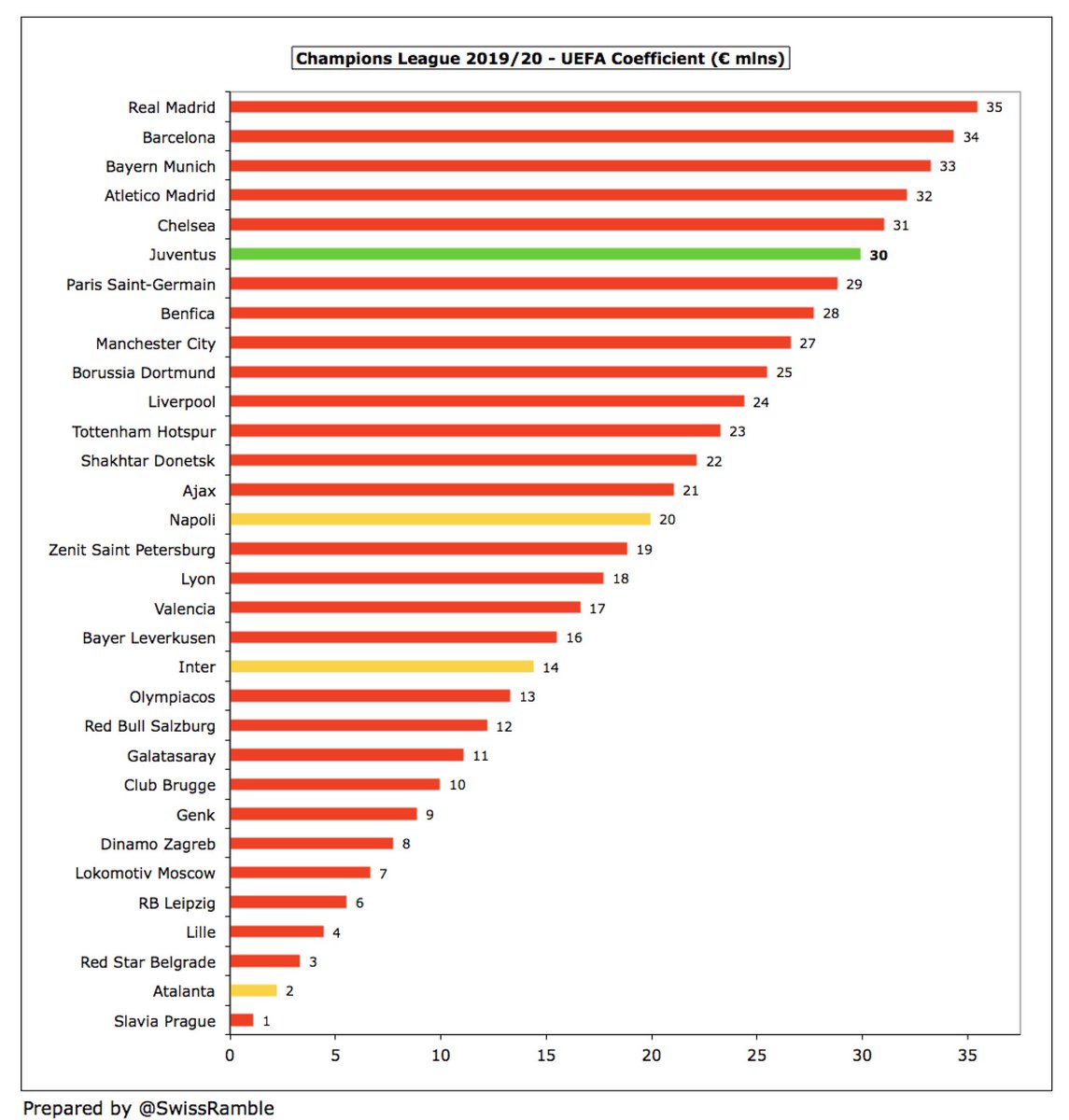

Worth noting the influence on Champions League money of the UEFA coefficient payment (based on performances over 10 years), where #Juventus has the 6th highest ranking of clubs competing this season, guaranteeing them €30m (Napoli €20m, Inter €14m & Atalanta €2m).

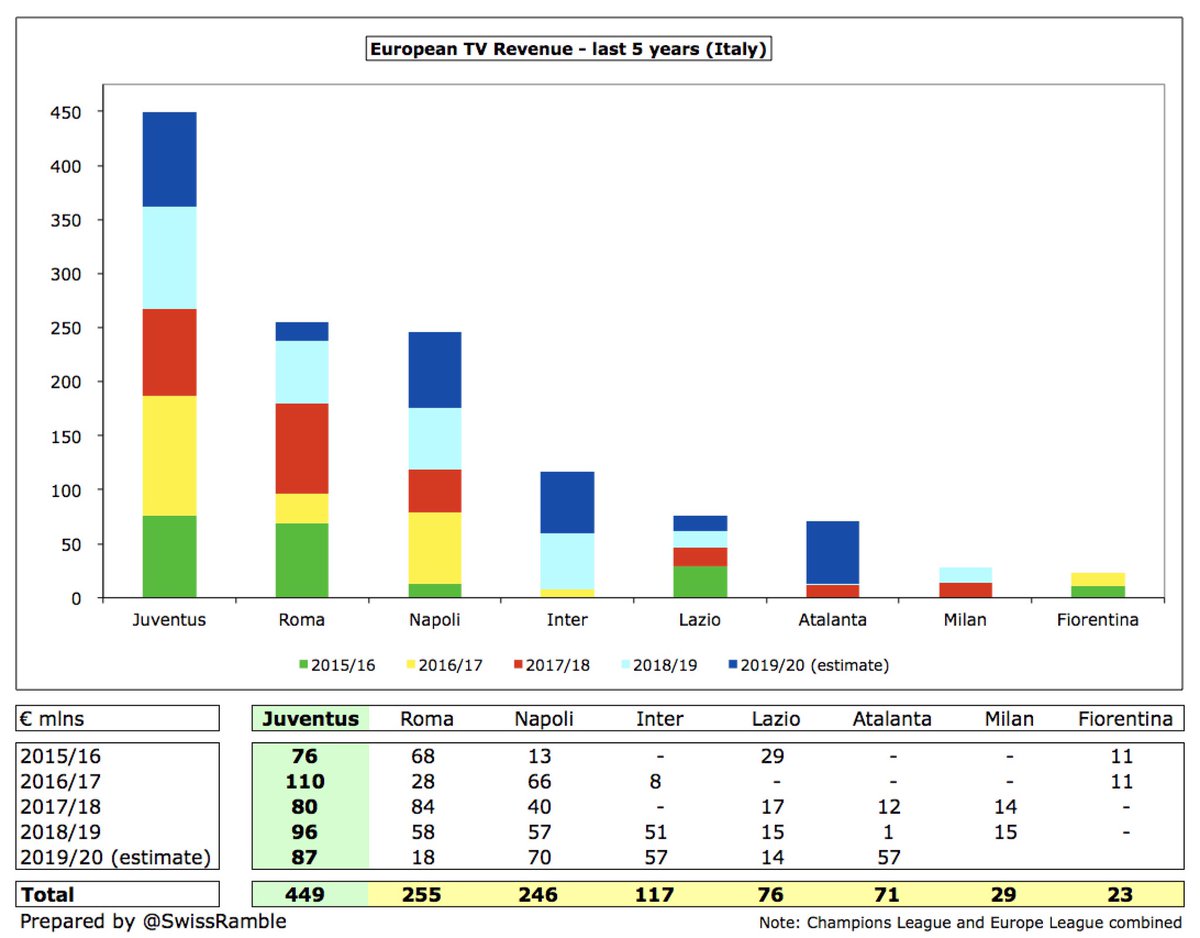

The Champions League is extremely important for #Juventus, who have earned an impressive €449m from Europe in last 5 seasons. Not only is this much higher than other Italian clubs (Roma €255m, Napoli €246m, Inter €117m), but best in Europe (next highest Real Madrid €418m).

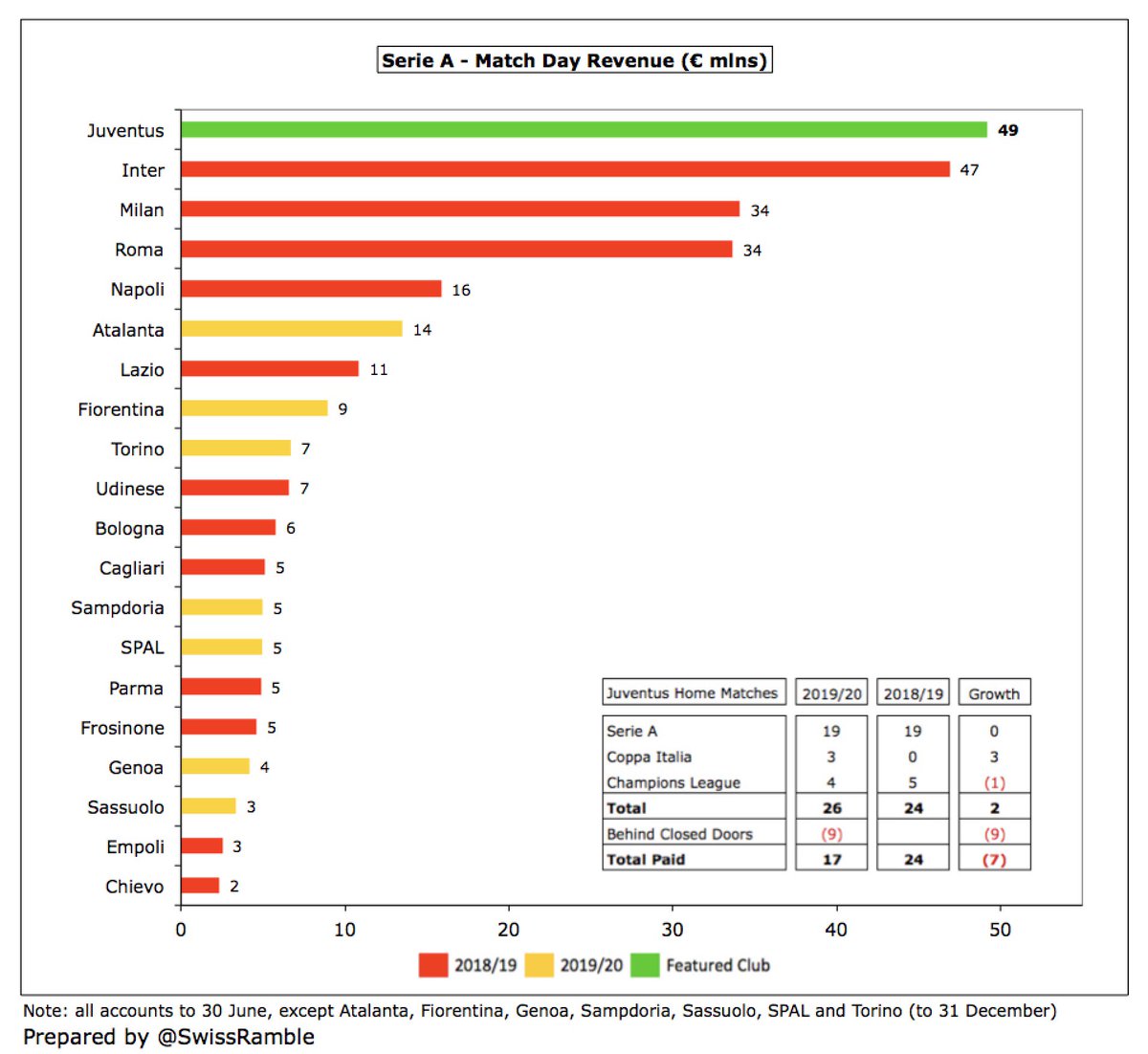

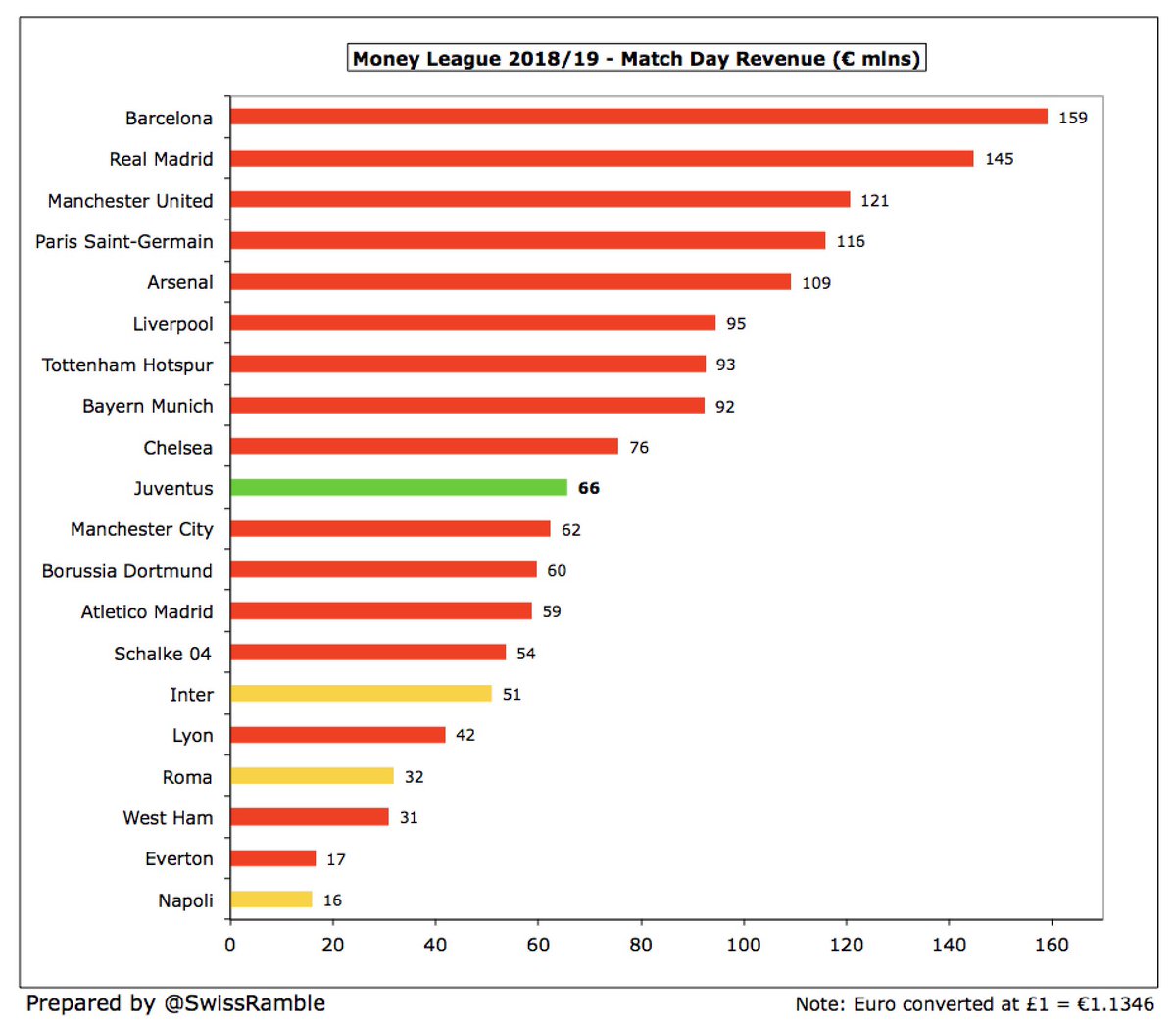

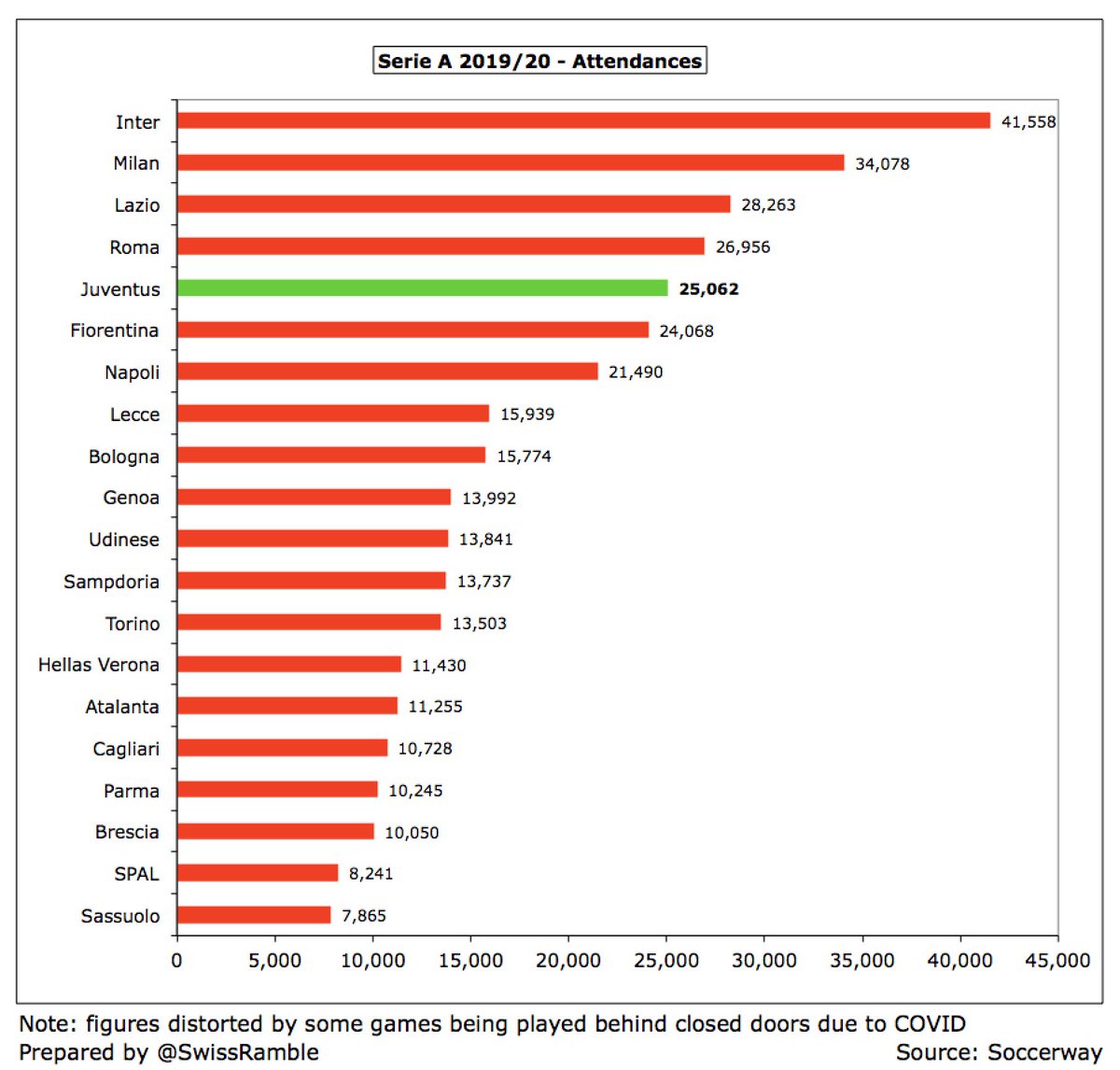

#Juventus match day income fell €22m (30%) from €71m to €49m, as 9 games were played behind closed doors (Serie A 7, Coppa Italia 1, Champions League 1), though still highest in Italy, ahead of Inter’s pre-COVID €47m. Only 10th highest in Money League in 2018/19.

As so many games were played without fans, #Juventus average attendance fell from 39,193 to 25,062, which was only the fifth highest in Italy, behind Inter 41,558, Milan 34,078, Lazio 28,263 and Roma 26.956. Post-pandemic would hope to get close top 41,500 stadium capacity.

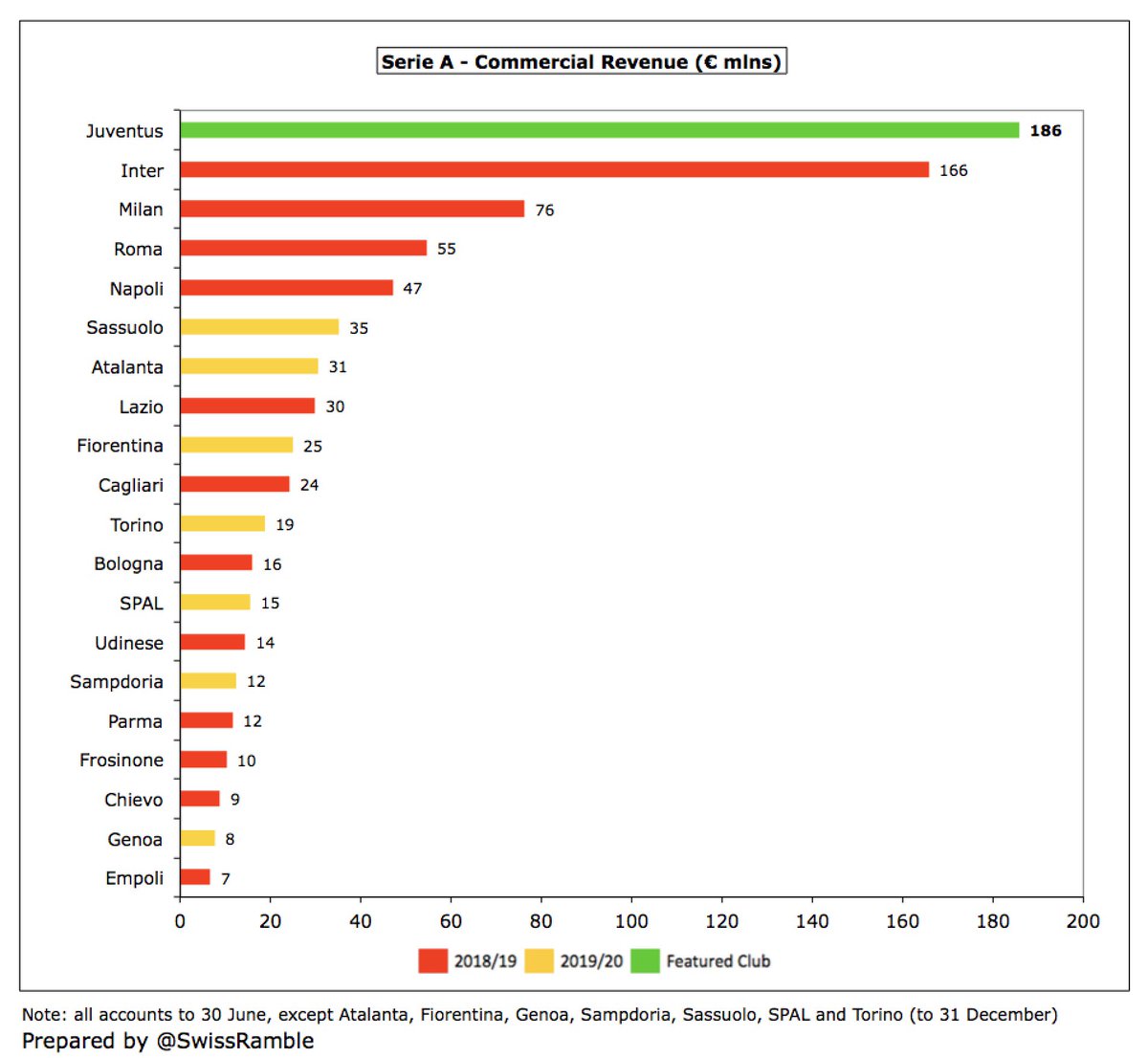

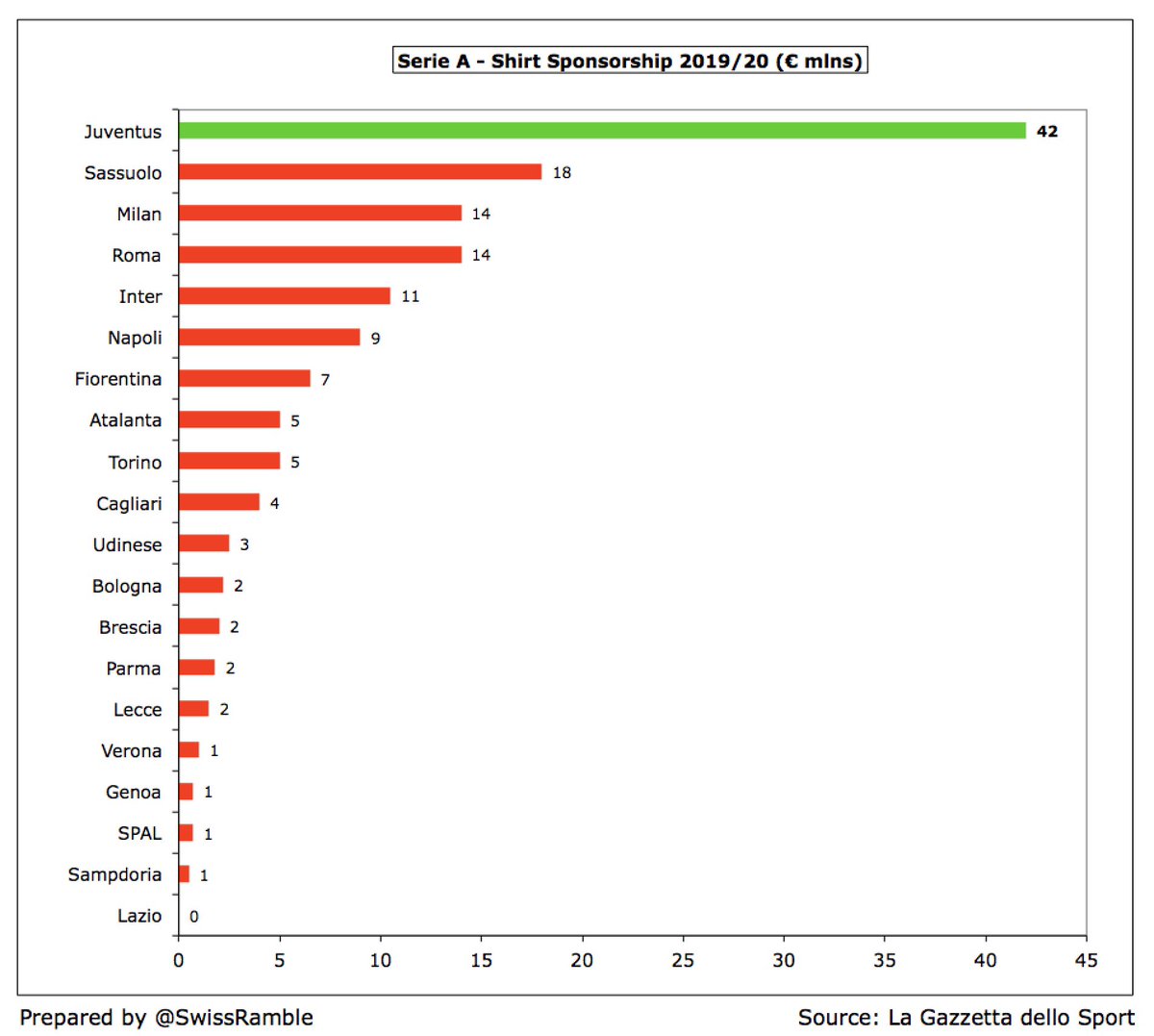

#Juventus commercial income fell slightly (1%) to €186m, as new sponsorship deals, up €21m (19%) to €130m, offset reductions in merchandising and museum/stadium tours. Highest in Italy, €20m ahead of Inter €166m, then a big gap to Milan €76m, Roma €55m & Napoli €45m.

Commercial growth linked to Ronaldo’s arrival, which Andrea Agnelli said, “brings us worldwide profile”. In fact, sponsorship deals surged in 19/20: Adidas €23m to €51m (€15m bonus in 18/19); Jeep €17m to €42m; Allianz stadium & training kit €10m; Cygames shirt back €10m.

The increase in #Juventus sponsorship deals is vital if they want to financially compete with the leading clubs in Spain, England, Germany and France, as their commercial income is much higher, e.g. five clubs were well above €300m in the 2018/19 Money League.

#Juventus player loans income decreased from €30m to €5m, though prior season was much higher than normal, mainly due to loans for Higuain €18m (Milan €10m, Chelsea €8m) and Favalli €5m (Genoa). Highest in Italy was Genoa €18m.

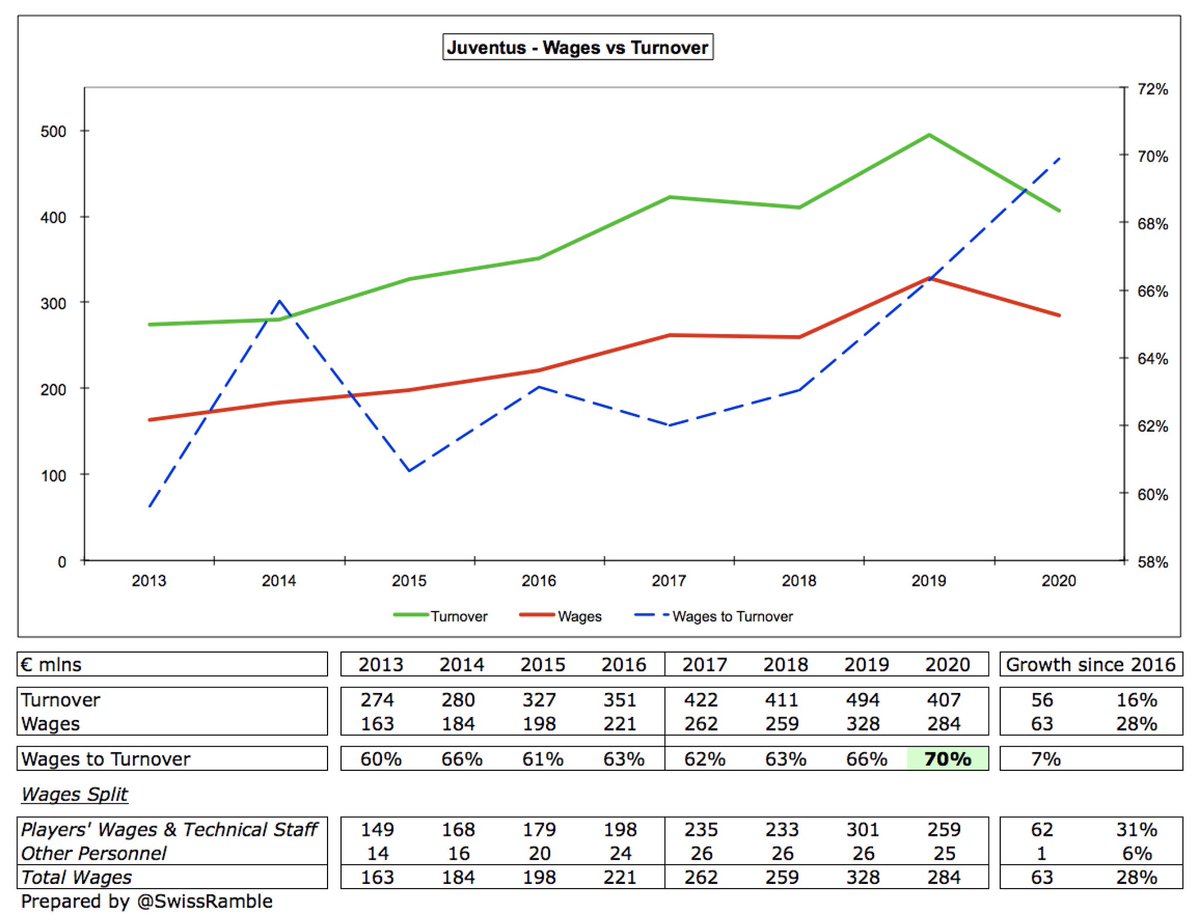

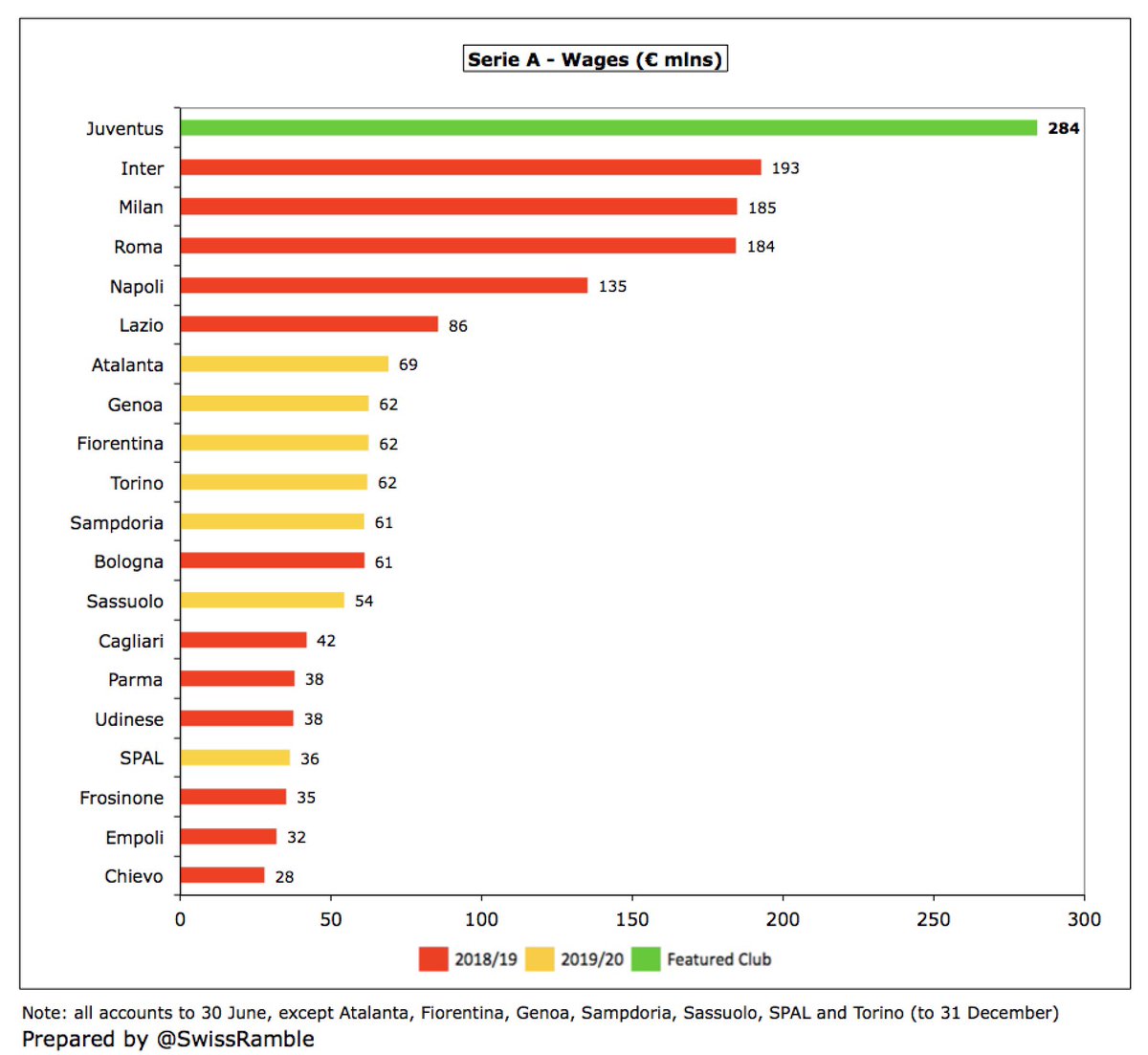

#Juventus wage bill was cut by €43m (13%) from €328m to €284m, largely because players and coaching staff gave up 4 months’ salary (March to June) worth €90m. The implication is that without this gesture (due to the pandemic) wages would have risen €47m to €375m.

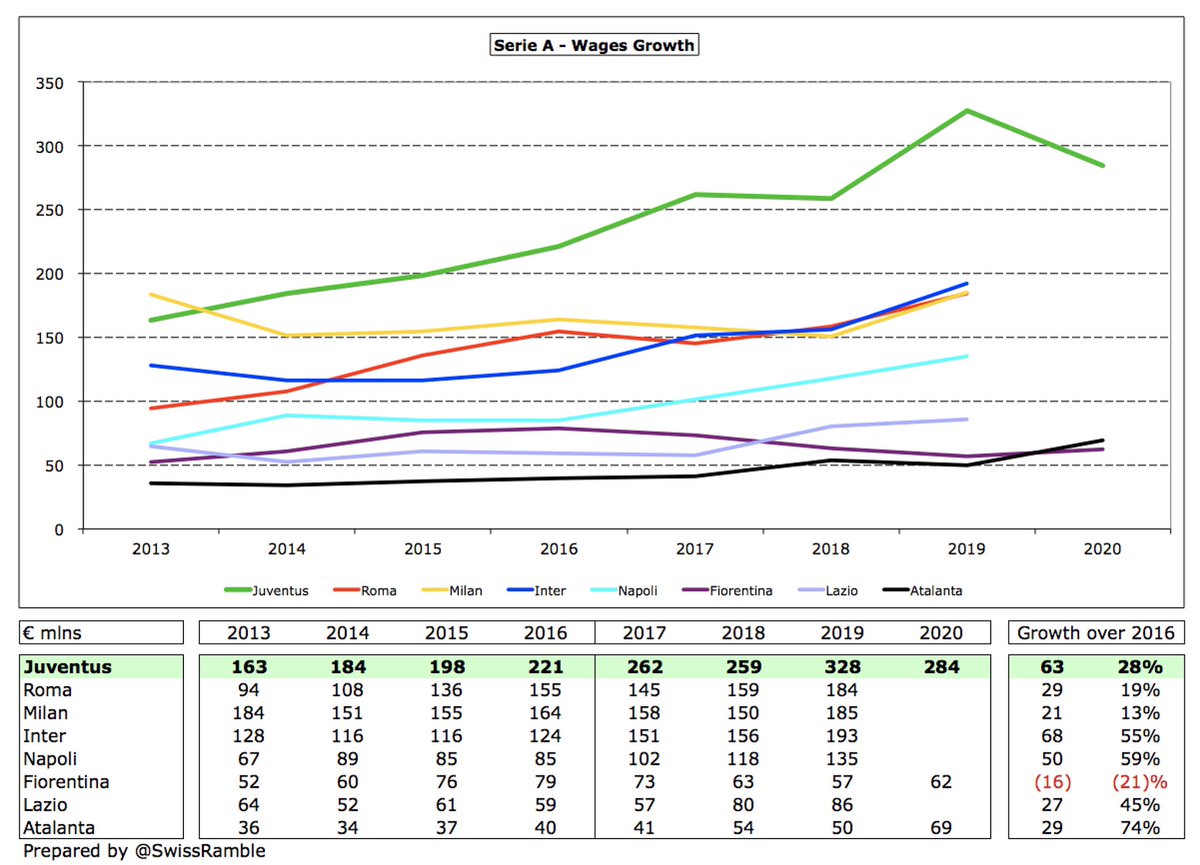

Despite this cut, #Juventus wages have still grown by €63m (28%) since 2016. The only other Italian clubs that have grown by a similar amount are Inter €68m and Napoli €50m, though they might have also reduced wages in the same way as Juve in 2019/20.

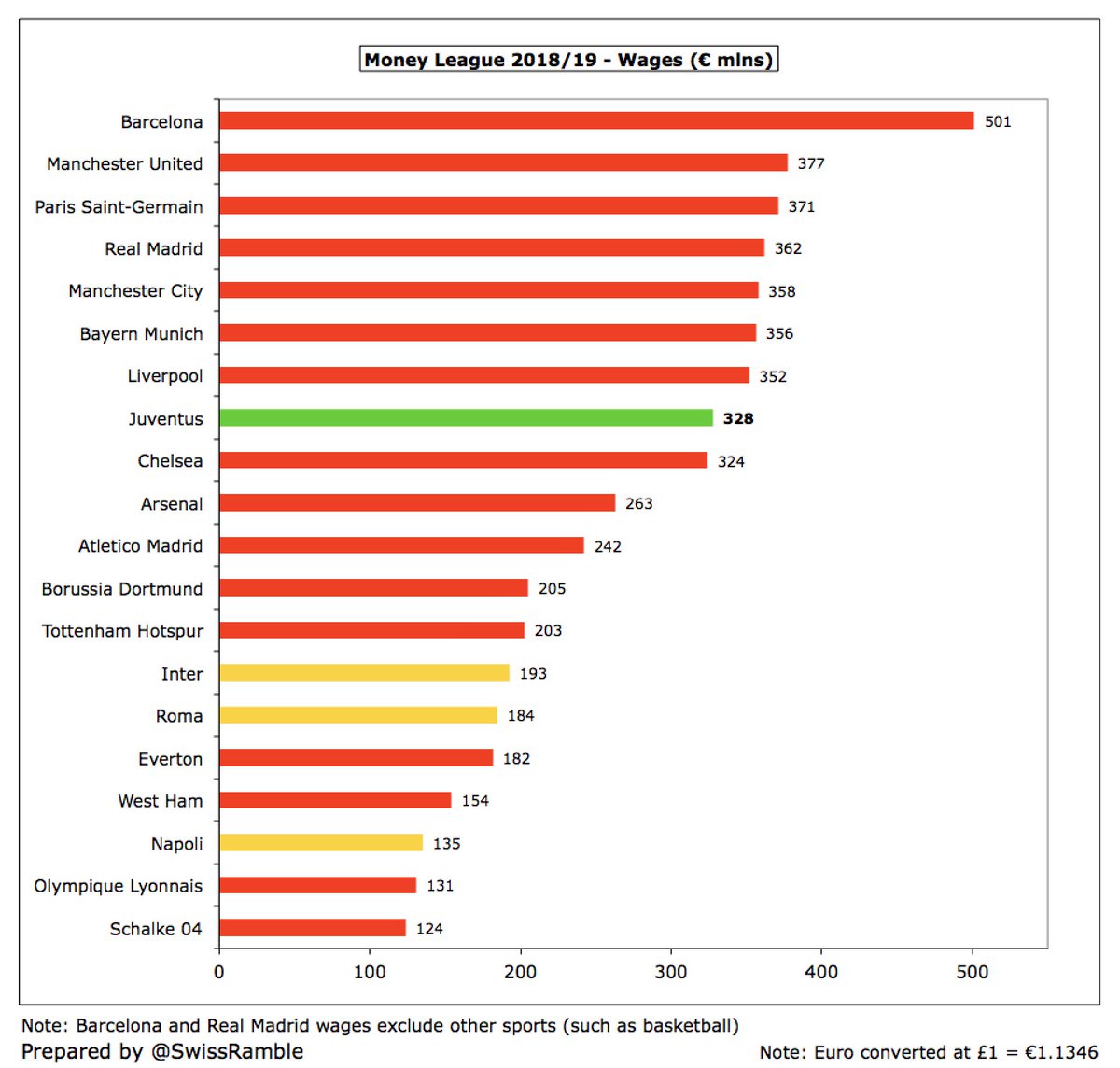

The #Juventus wage bill of €284m is still significantly higher than the rest of Serie A. The closest challengers are around €100m lower: Inter €193m, Milan €185m and Roma €184m. Furthermore, they might also have cut in 2019/20 due to COVID pressures.

Last season #Juventus had the 8th highest wage bill in Europe, sandwiched between #LFC €352m and #CFC €324m, though their €328m was significantly lower than Barcelona €501m. Further reductions will come from Higuain and Matuidi leaving with an “economic impact” of €40m.

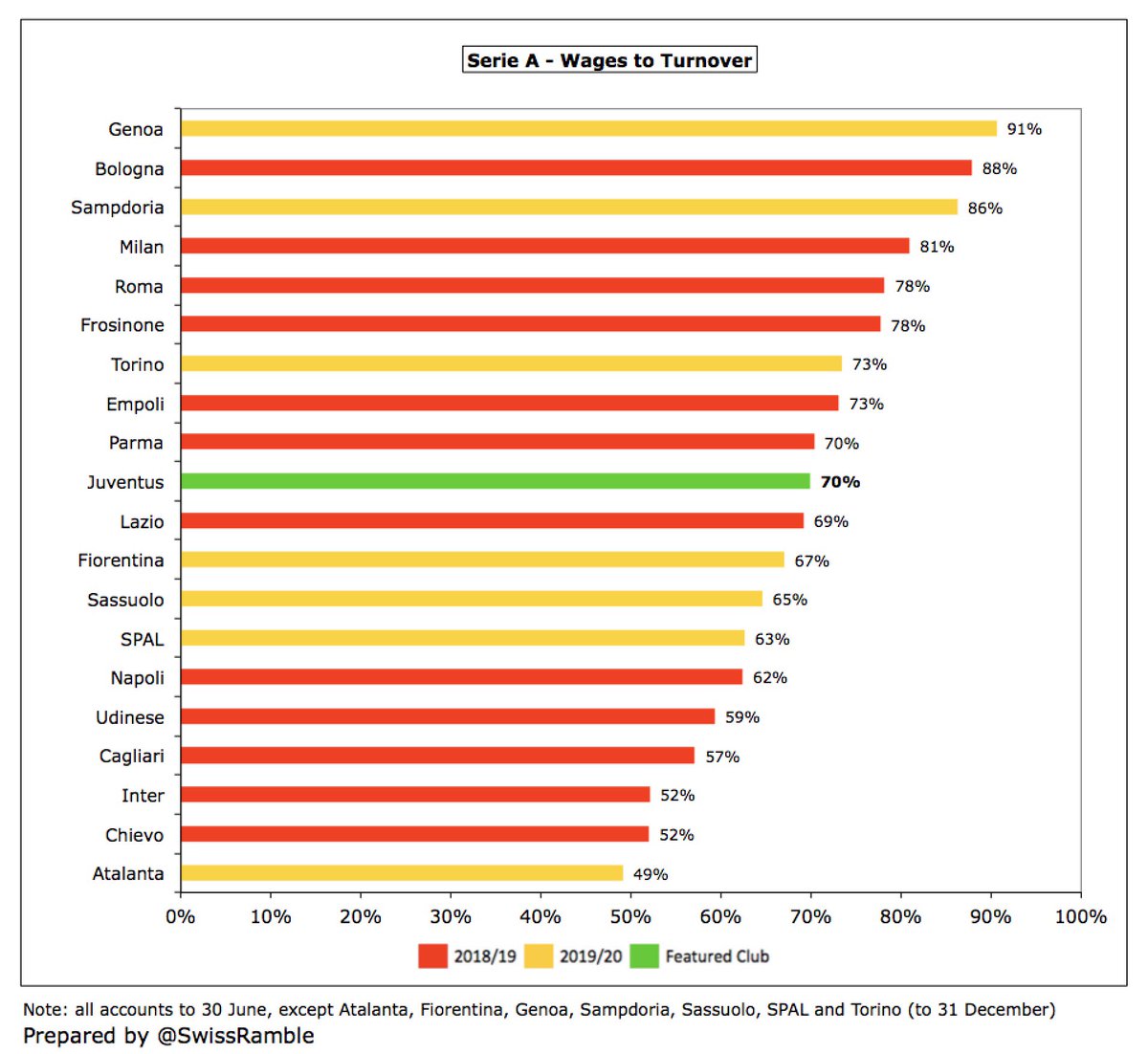

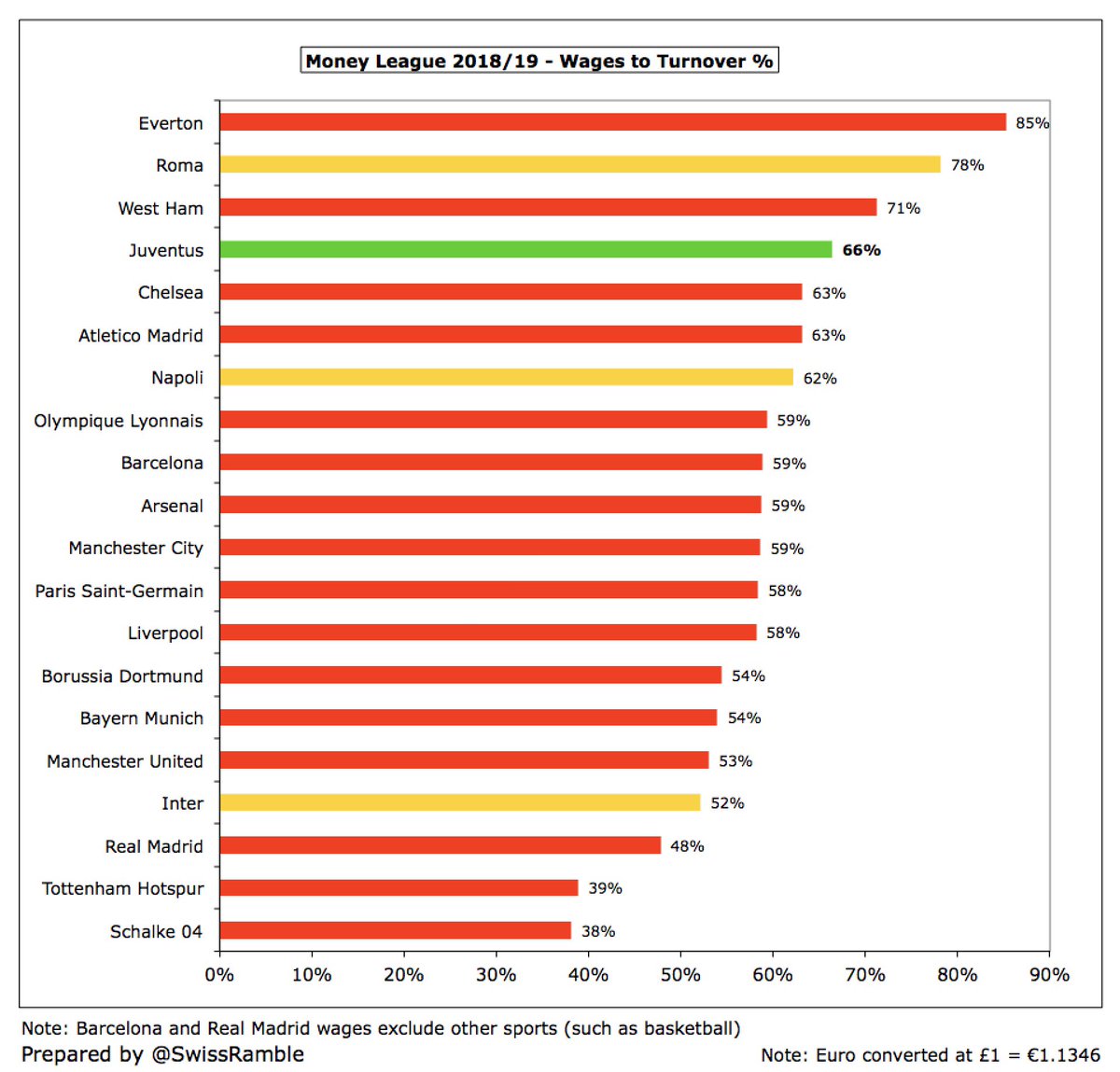

#Juventus wages to turnover ratio increased from 66% to 70%, the club’s highest since 2012 and right on UEFA’s recommended upper limit. This is mid-table in Italy. Of the bigger clubs, this is better than Milan 81% and Roma 78%, but worse than Napoli 62% and Inter 52%.

However, it is worth noting that #Juventus wages to turnover ratio is one of the worst among the European elite clubs (previous season’s 66% was 4th highest). At the other end of the spectrum, Real Madrid were only 48% and #THFC 39%.

#Juventus player amortisation, the annual cost of writing-off transfer fees, rose by €18m (12%) from €149m to €167m, reflecting investment in the squad and application of IFRS 16. This expense has tripled from €54m in 2015. Also £27m player write-downs (mainly Higuain).

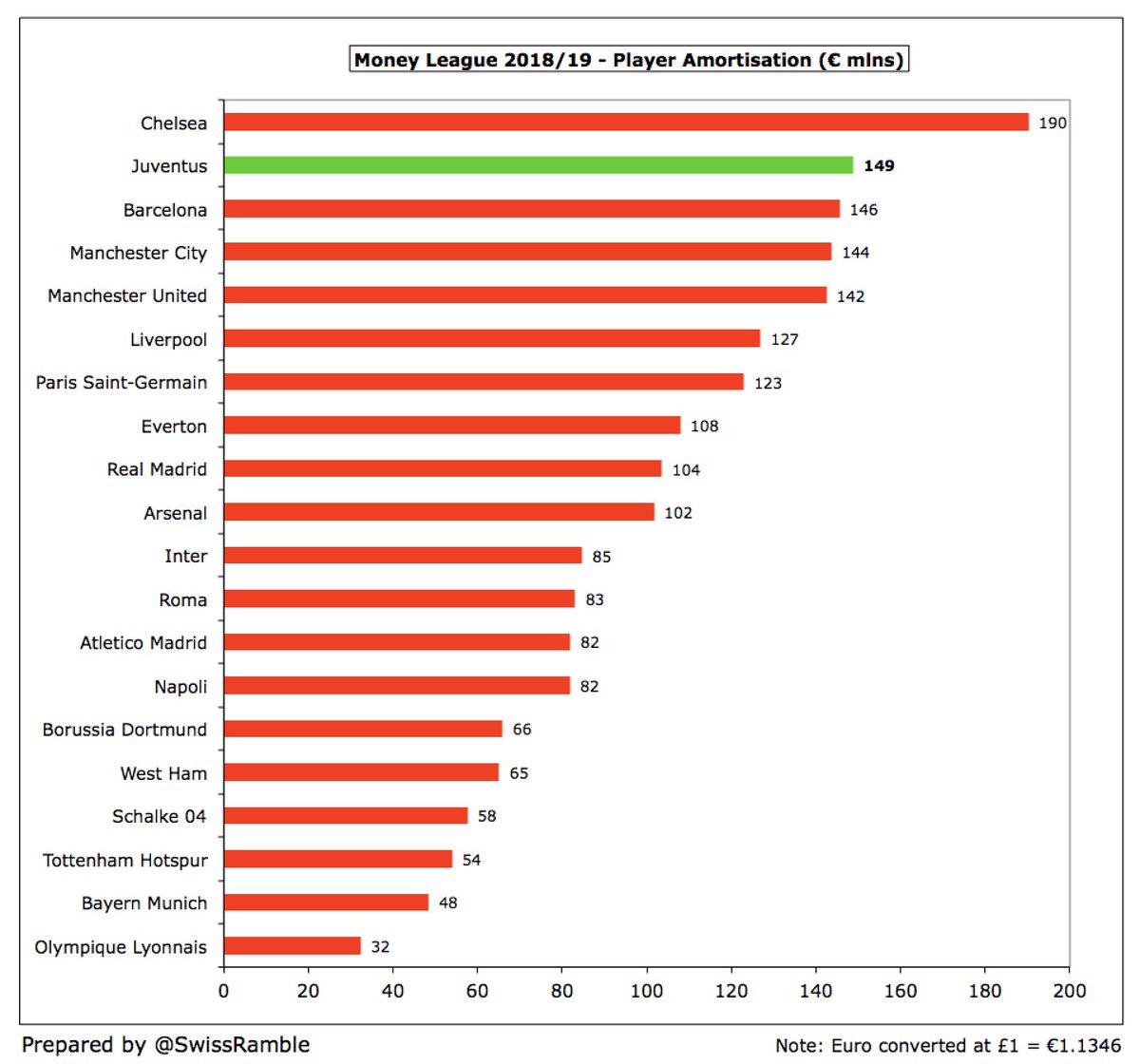

As a result, #Juventus player amortisation of €167m is by far the highest in Italy, more than twice as much as Inter €85m, Roma €83m, Napoli €82m and Milan €80m. To place this into context, their €149m in 2018/19 was more than all other European clubs except #CFC.

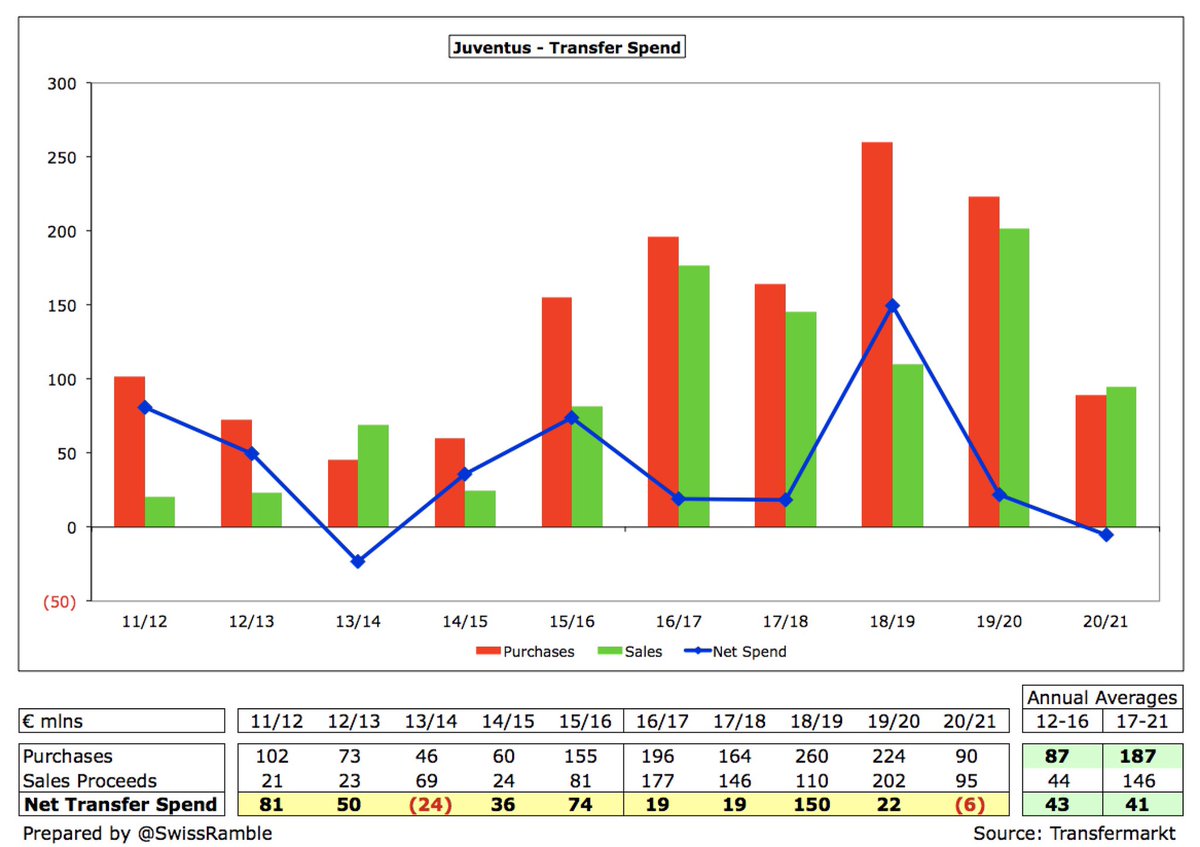

Although #Juventus net spend has been relatively unchanged over the last 5 years at €41m, this masks a significant increase in gross spend (average €187m), offset by a similar movement in sales (average €146m).

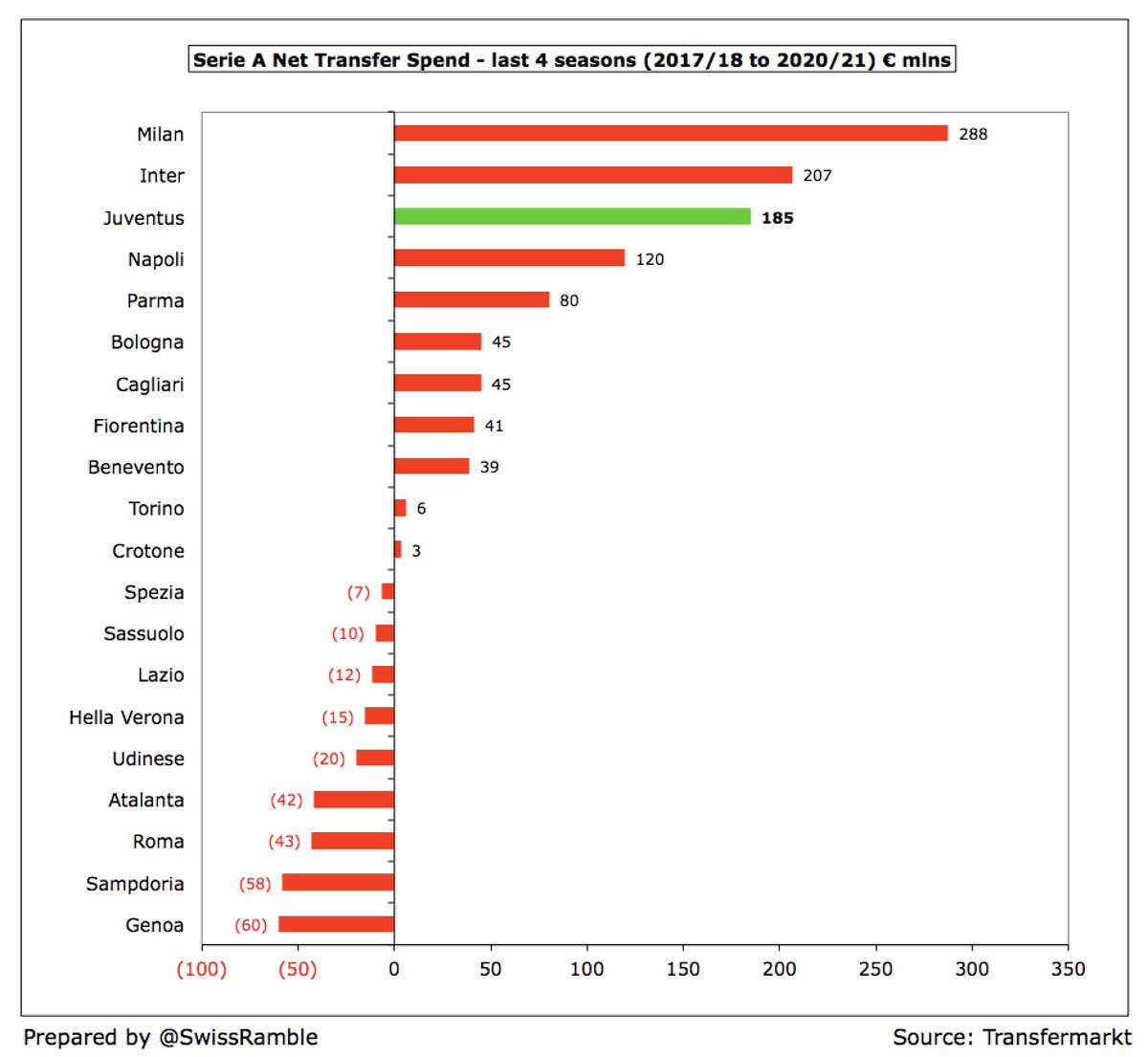

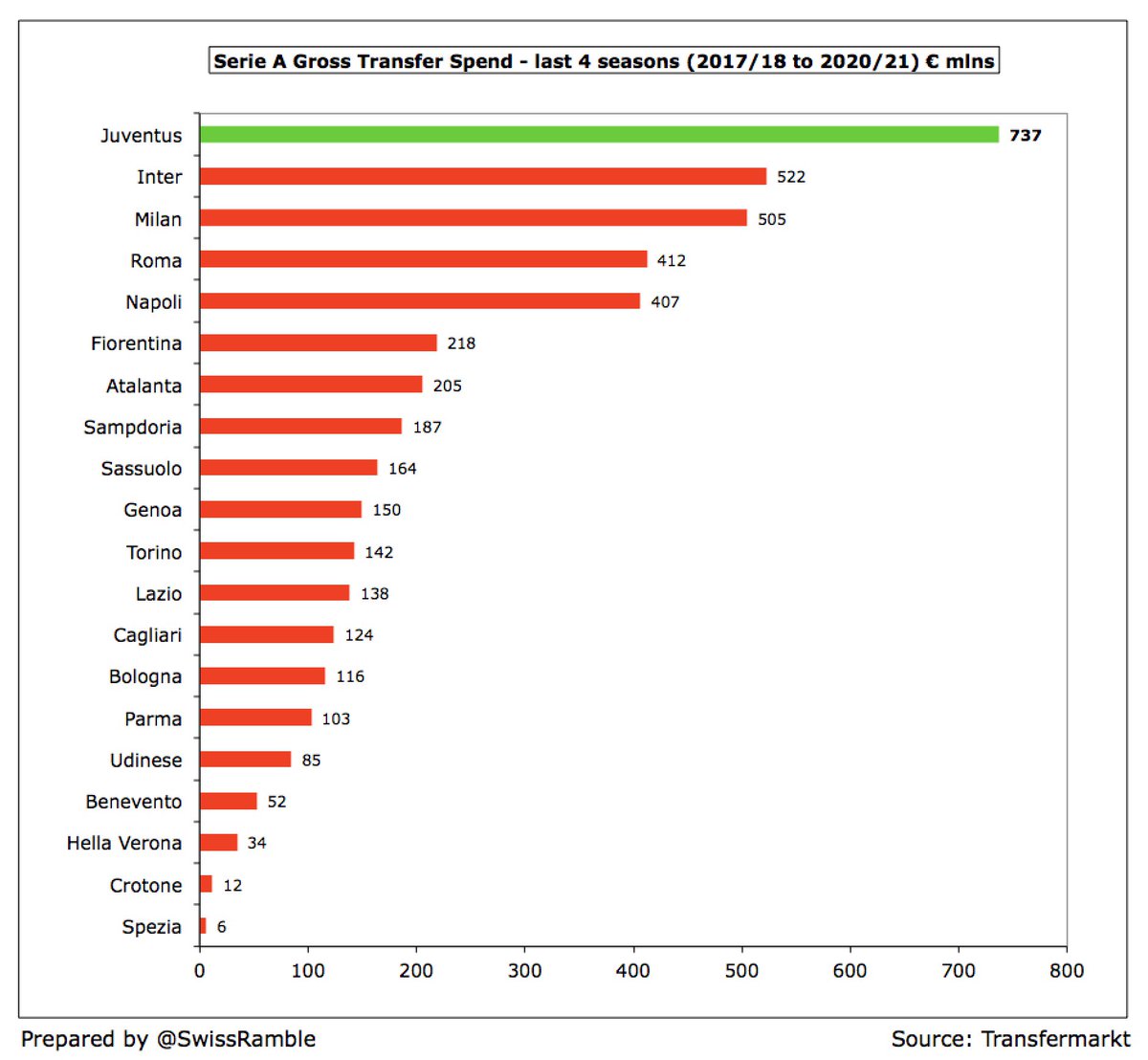

Over the last four seasons, #Juventus have the third highest net spend in Serie A of €185m, though this is a fair way behind Milan €288m with Inter in second place with €207m. 2020 window is not complete, but includes €72m for Artur’s transfer from Barcelona.

However, it’s a different story in gross spend with #Juventus €737m in the last four years being the highest in Italy, much more than Inter €522m, Milan €505m, Roma €412m and Napoli €407m. 2019/20 purchases included de Ligt, Danilo and Kulusevski.

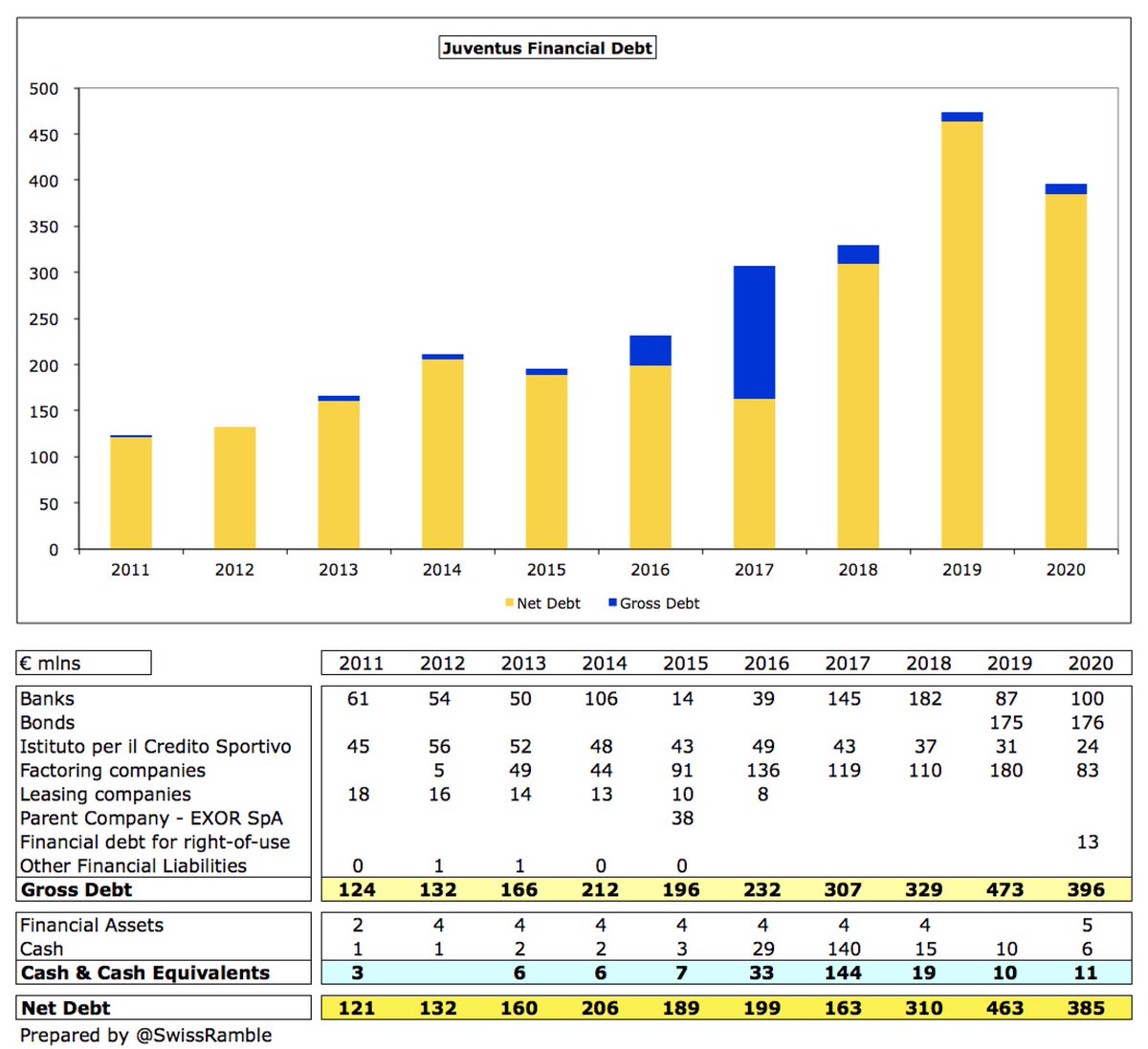

#Juventus gross financial debt decreased from €473m to €396m, including €176m bonds, as well as bank loans €100m, amounts owed to factoring companies €83m, Istituto per il Credito Sportivo €24m and other debt €13m. This has tripled since €132m in 2012.

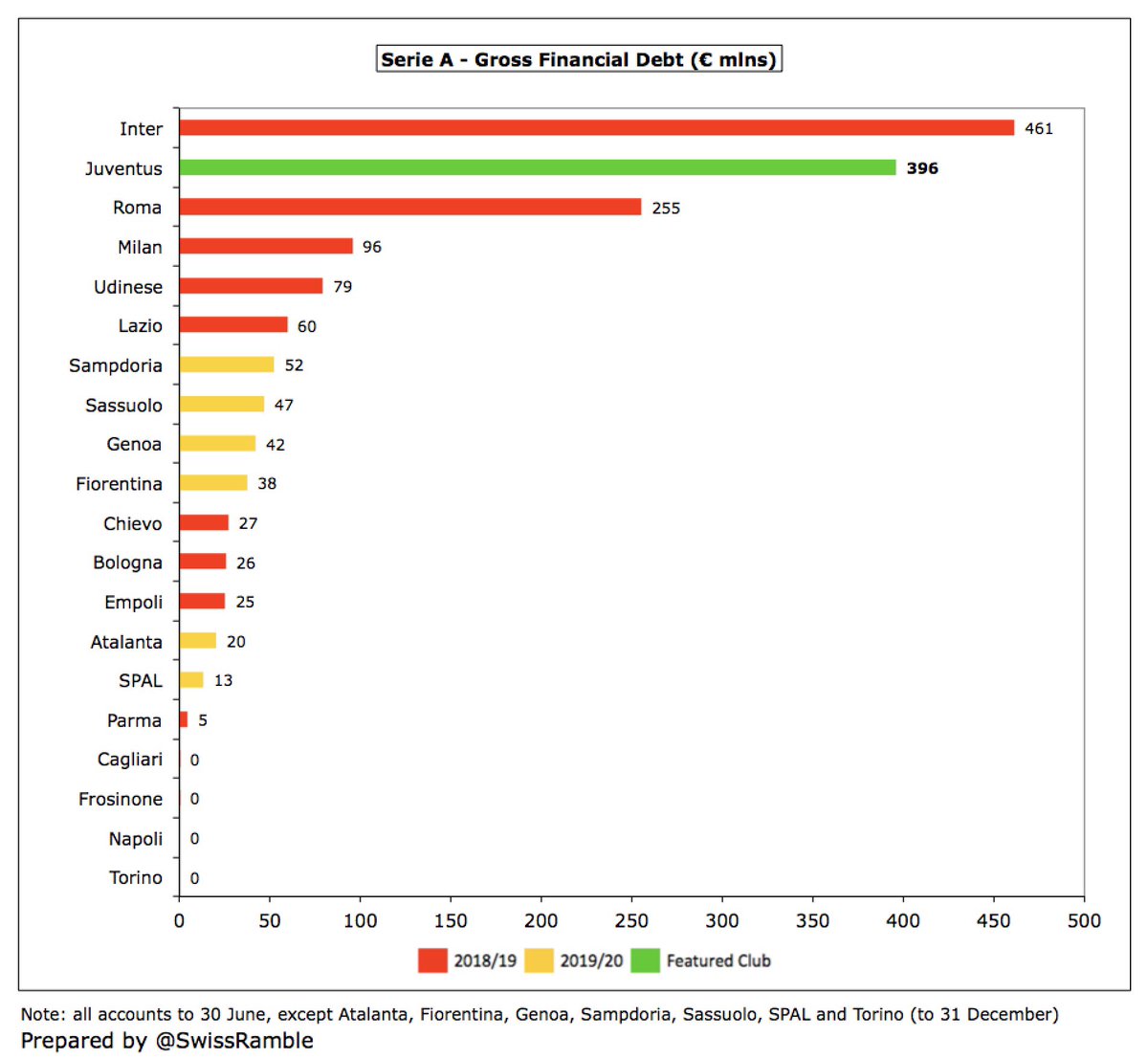

#Juventus gross debt of €396m is the second highest in Italy, only surpassed by Inter €461m (Goldman Sachs financing). Much of Juve’s debt was down to funding required for their new stadium development, but has increasingly been used to finance investment in the squad.

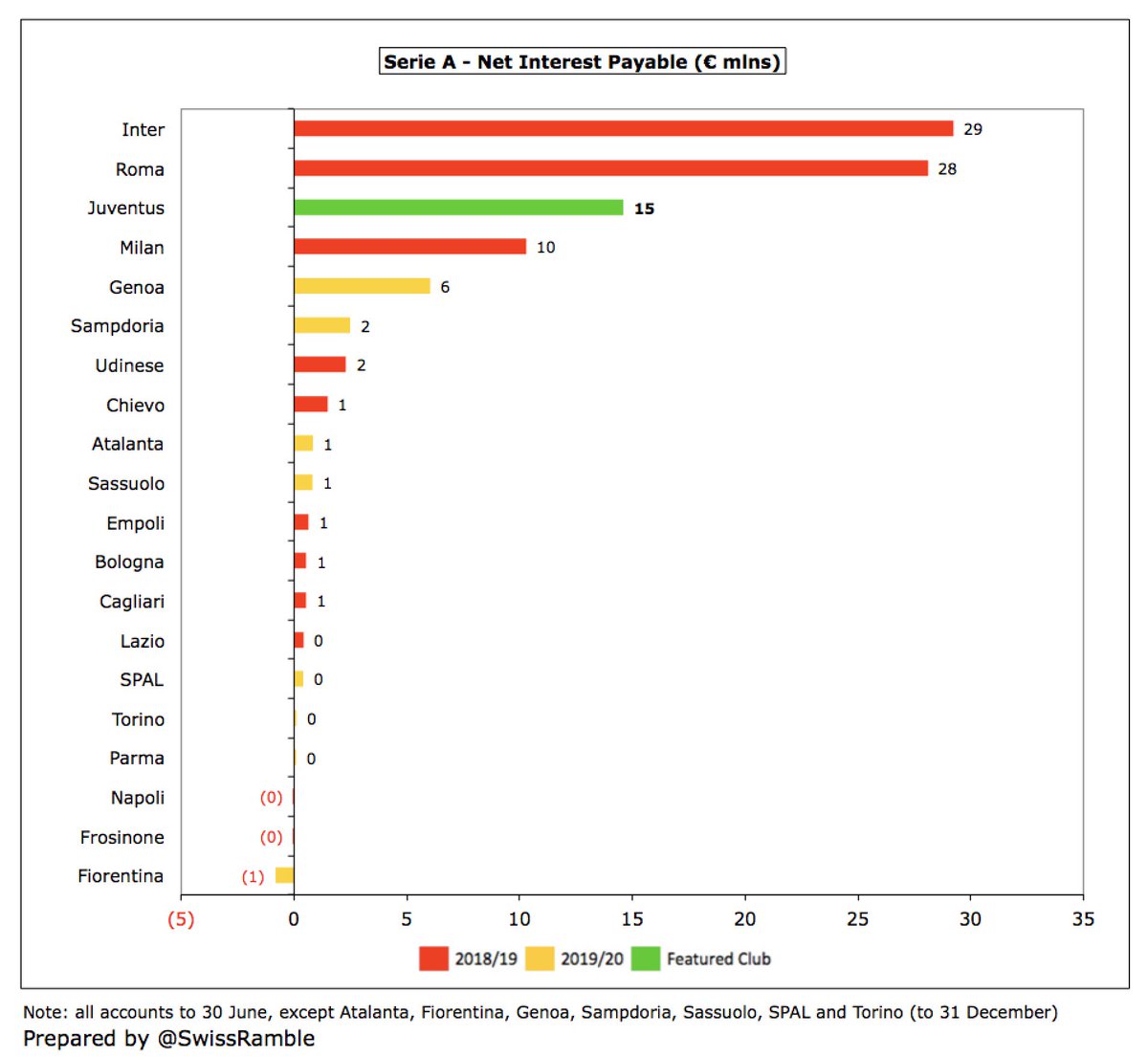

#Juventus net interest payable was up €3m (26%) from €12m to €15m, the third highest in Italy, but a fair way below Inter €29m and Roma €28m.

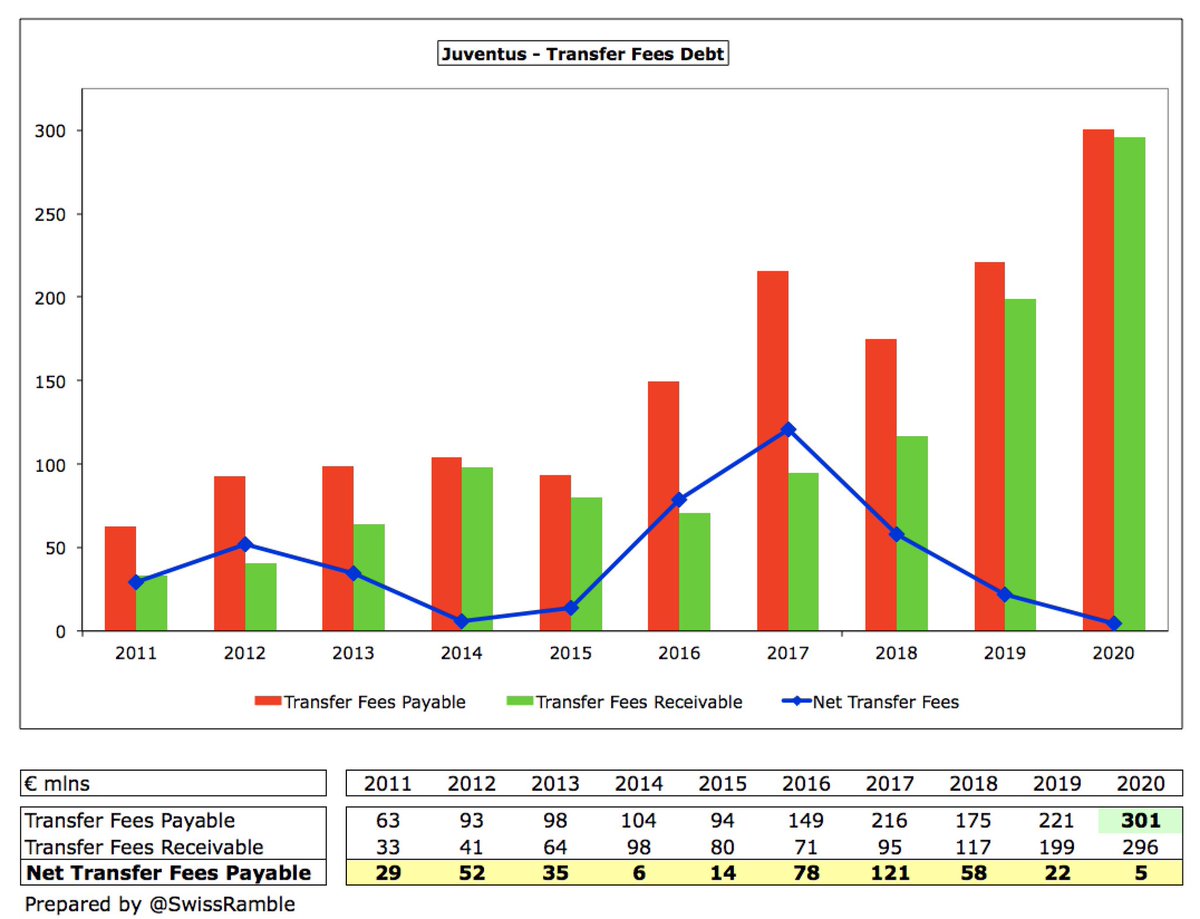

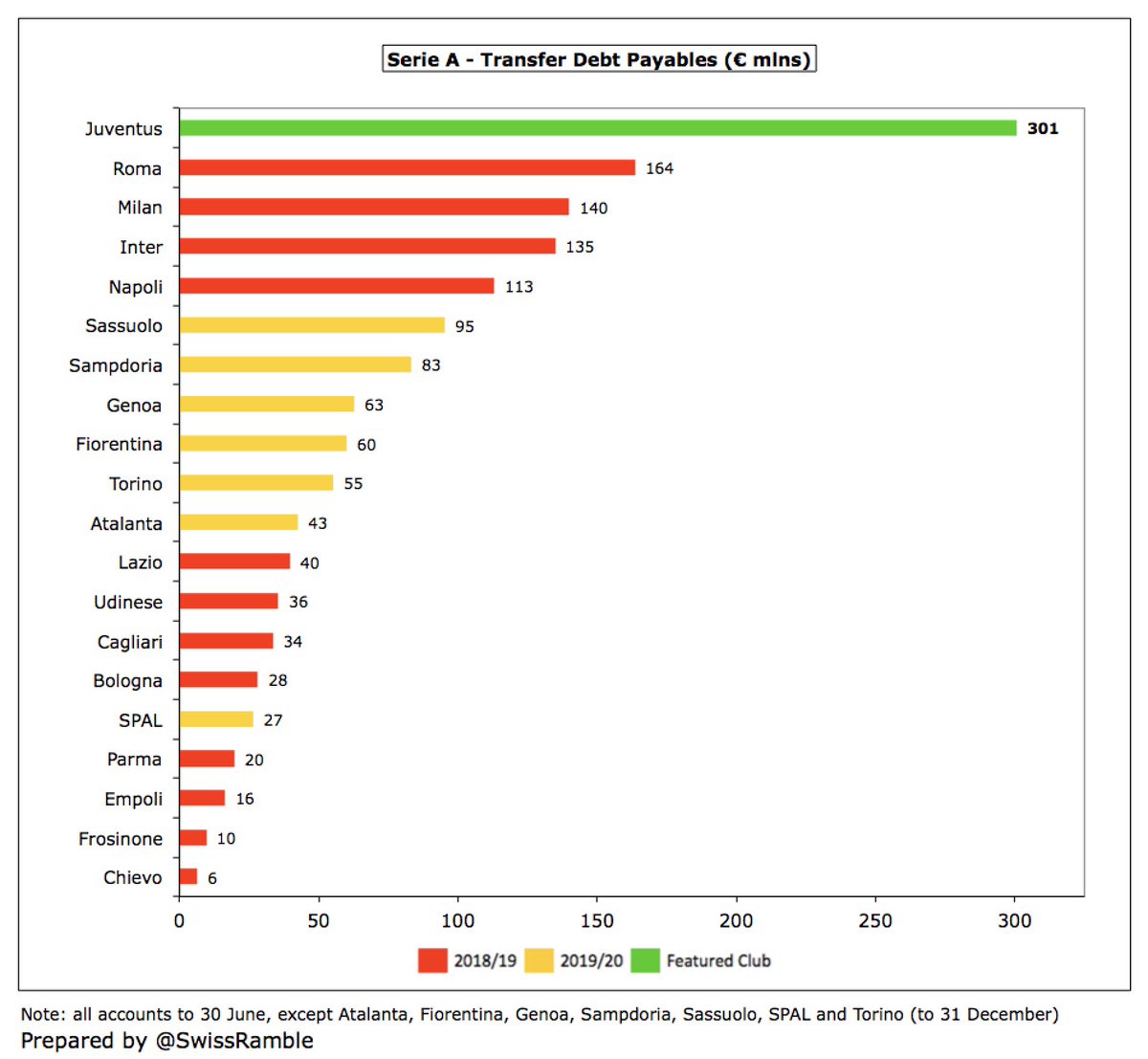

In addition, #Juventus owe €301m transfer fees, the highest in Italy, way ahead of Roma €164m, Milan €140m and Inter €135m. However, on a net basis this reduces to just €5m after considering €296m owed to Juve by other clubs.

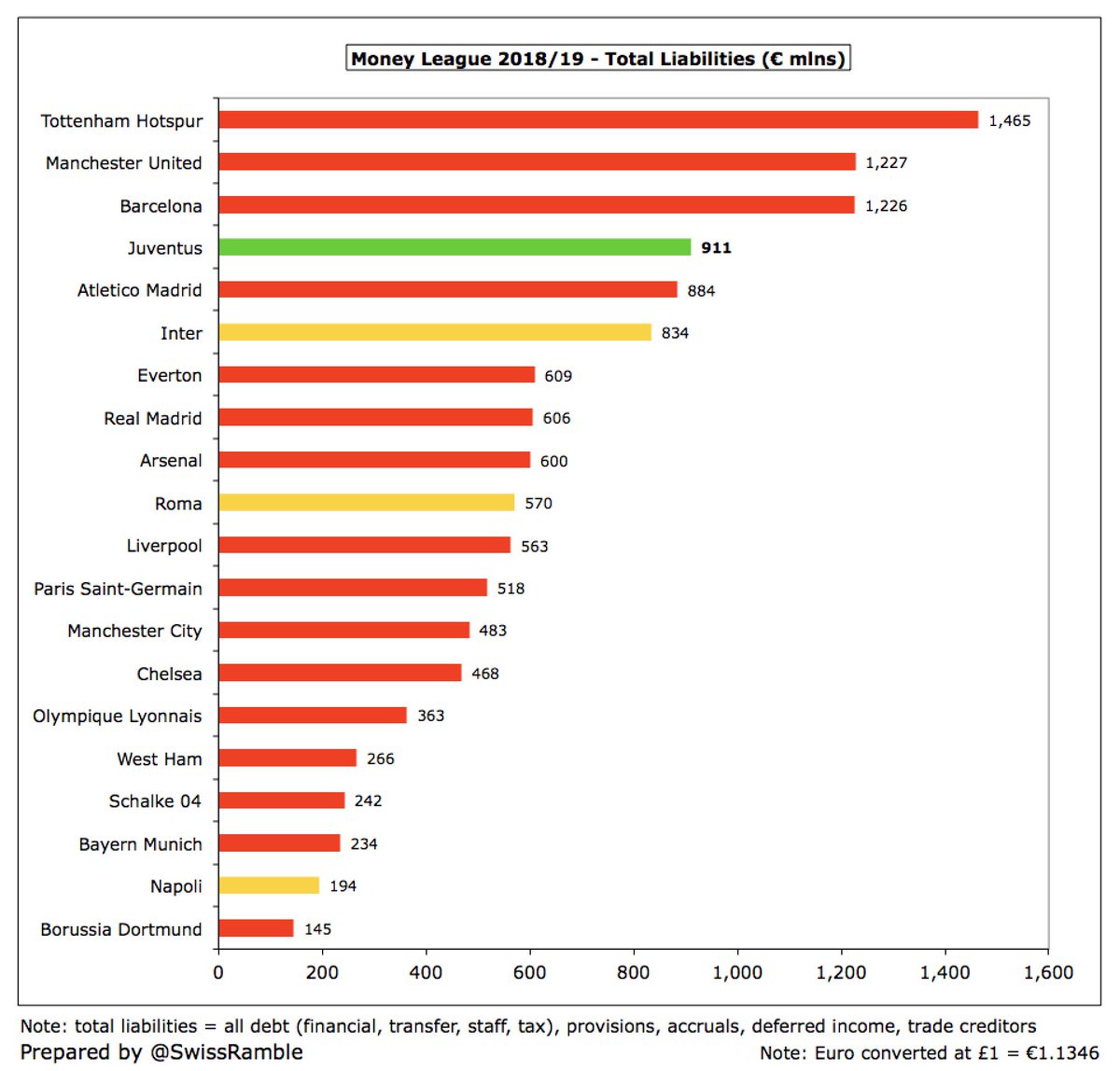

Total liabilities include bank debt, transfer debt, tax liabilities, trade creditors, staff debt, provisions, accrued expenses and even deferred income. Here, #Juventus €911m in 2018/19 was one of the highest balances in Europe, only below #THFC, #MUFC and Barcelona.

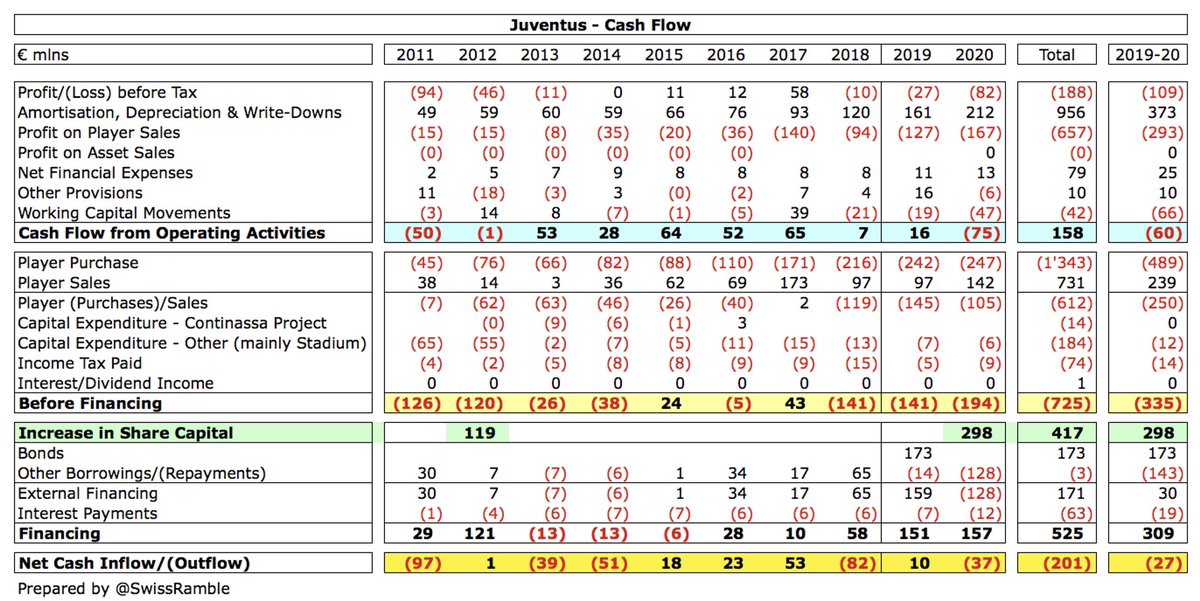

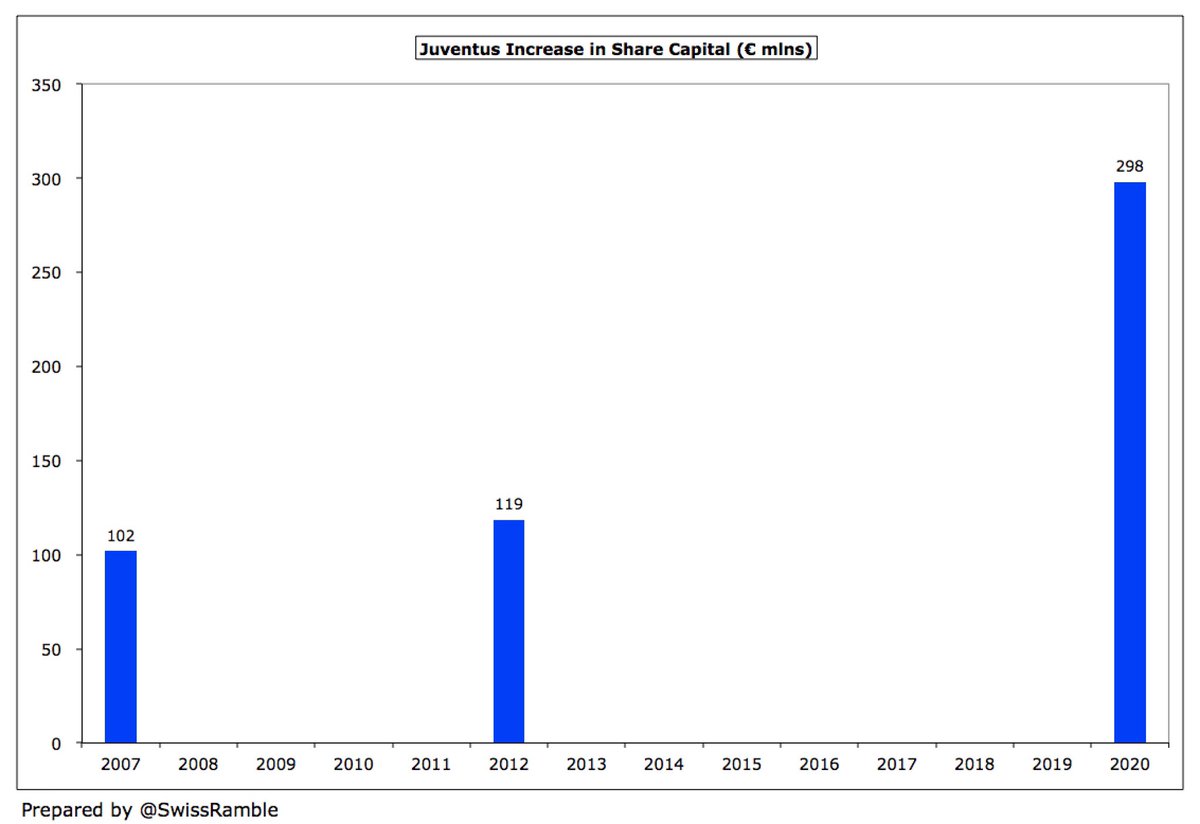

#Juventus had a net €37m cash outflow in 2018/19, but it would have been much worse without a €298m capital injection. This allowed them to spend a net €105m on players and make €128m loan repayments and €12m interest payments.

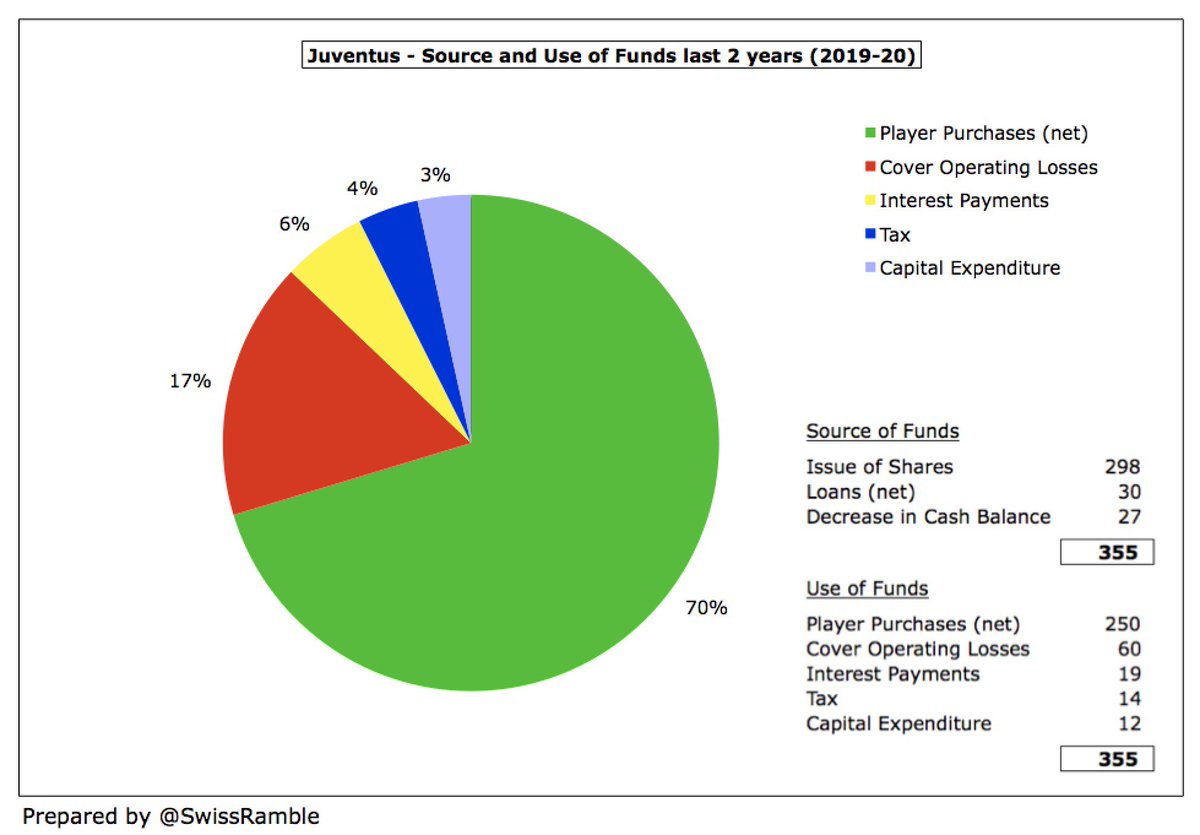

In the last two years #Juventus have had €355m available cash, but that was largely due to the €298m capital increase plus €30m additional loans and a €27m higher overdraft. This was primarily used to make €250m net player purchases and cover €60m operating losses.

#Juventus shareholders have provided over half a billion Euros capital since 2007. Agnelli had noted that the latest funding “would not have been necessary, but was a strategic choice to finance further growth.” That said, it has become vital, given the effects of the pandemic.

The #Juventus strategy to invest significantly in players to drive success to increase revenue, as exemplified by Ronaldo’s purchase, will surely need to be reviewed in the current economic climate. Either way, Champions League progress and profitable player sales are a must.

• • •

Missing some Tweet in this thread? You can try to

force a refresh