“I’m so grateful for #Gleevec. It keeps me alive. But the price tag ($10k/month) constantly hangs over my head.”

"When I'm on Enbrel, I don't have symptoms... But I also have to carry the fear knowing all this could be ripped away." Enbrel is priced at $6k per month.

First up: autoimmune drug Enbrel. Even though the primary patent on Enbrel expired in 2010, $AMGN has filed more than 50 additional patents on the drug to thwart cheaper competition, according to analysis by @IMAKglobal (1/) statnews.com/2020/09/29/dru…

This strategy has been effective. Multiple biosimilars have been approved by the @US_FDA but ultimately aren’t on the market yet due to #patent disputes.(2/)

#Pharma has long gamed the U.S. patent system, building “patent walls” to gain a stranglehold over the market for decades that blocks competition and drives prices ever higher. Read @IMAKglobal’s full analysis (3/) medium.com/@tahir_5675/th…

"The time is now, the place is here to do something," $AMGN's CEO says. We agree. There is bipartisan support for drug pricing reforms that would lower the cost of drugs by stopping #pharma's anticompetitive behavior.

Some background on H.P. Acthar Gel. $MNK's CEO says this drug is “life-saving” therapy, but the $ of this drug has increased from $40/vial in 2001 to $39K by 2018. $MNK has been sued repeatedly over the pricing of this drug. Background reading: ajmc.s3.amazonaws.com/_media/_pdf/AJ…

About Gleevec: When it launched in '01, this drug cost $30k/year -- making it one of the most expensive on the market. In 2017, this drug cost more than $140K/year, according to news reports. $NVS repeatedly hiked the price of this drug before #generics entered the market.

Gleevec has been off-patent for years now; but generic Gleevec still has an annual price tag equivalent to a luxury vehicle @46brooklyn 46brooklyn.com/research/2018/…

Pharma's reputation used to be "revered" $NVS CEO says, but that has diminished. Why? Americans have grown wise to #pharma's profiteering off patients' pain. @HouseOversight's reports demonstrate this clearly. @P4AD_

Claims that price increases are justified by R&D costs are untrue. Acthar Gel was first approved by the FDA in 1952, & $MNK explicitly acquired Quest because of the high profitability of HP Acthar Gel which accounted for 50% of $MNK sales after the acquisition (1/)

$MNK described HP Acthar Gel as a "cash cow"

Reports are out! Since acquiring Enbrel in 2002, $AMGN raised its price 27 times. A 50 mg dose of Enbrel is now $72,240/year -- 457% more than the price tag when $AMGN acquired it oversight.house.gov/sites/democrat…

Enbrel's primary competitor is Humira, a blockbuster treatment by $ABBV, but $AMGN didn't lower the price to gain market share as you would in a competitive market. Instead, $AMGN "engaged in shadow pricing" -- following $ABBV's price increases to jack up the price of Enbrel

Re rebates: Internal documents show $AMGN's list prices for Enbrel outpaced rebates paid. Price increases allowed $AMGN to maintain high net revenue, despite declines in sales volumes and increases in rebates.

HP Acthar's price has increased by almost **100,000%** since Questcor acquired the rights in 2001. $MNK acquired Questcor in part because of the drug's high price -- then raised the price again, @HouseOversight reports show

Re: Gleevec: $NVS has raised the price 22 times. A yearly course of Gleevec is priced at more than $123k today (compared to just under $25k in 2003), according to the report.

A tidbit from internal docs: $NVS execs discussed changing the narrative around price increases, shifting from a R&D justification to an investment in patient assistance programs, proving that these programs are a PR sham.

$NVS did everything it could to maintain the monopoly on Gleevec, using several anticompetitive tactics to delay generic competition and maintain its profits, including pay for delay. These tactics resulted in an estimated $700m excess cost to payers between 2015-16

Another titillating tidbit: $NVS markets its co-pay programs as making sure “every patient who needs Gleevec has access to it” but internal docs show these programs were “a crucial piece of Novartis’ strategy to mitigate its loss of exclusivity.” oversight.house.gov/sites/democrat…

To justify the $ of Acthar Gel, $MNK claims it invested $500m in the drug. For context: that’s less than 7% of the net revenue it received from the drug during the same period. In internal docs, $MNK said studies would *not* support Acthar's effectiveness over cheaper treatments.

Day 2 of @HouseOversight testimony delivers more #pharma pleading for longer patents, but it's clear that the industry already games the system to extend patents, sometimes for decades @ProfRobnFeldman academic.oup.com/jlb/article/5/…

Internal data shows $MNK charges #Medicare more for Acthar Gel than any other payer. If Medicare got the same discount as others, taxpayers could've saved $656m in just three years.

An example of patent gaming: Internal documents indicate $AMGN is seeking patents for minor tweaks to Enbrel's design to drive sales & limit competition. These patent applications have prevented cheaper competition - already available in other countries -- from coming to the U.S.

If approved, $AMGN's monopoly would be extended to 2038. Internal documents indicate these tweaks (injection device, life cycle management) were designed to block competition. $AMGN projected its tactics would net $41m in 2018 @IMAKglobal

Publicly, $NVS says Gleevec's price tag is based on the drug's value, cost and R&D investment. Privately, $NVS execs connected raising prices w/ meeting revenue goals, according to @HouseOversight findings

$NVS developed a strategy of hiking the price of #Gleevec by at least 9.9% each year until it lost exclusivity for the drug, according to the committee report.

📣Once again, for the people in the back. #Pharma's claims that R&D justifies high drug prices are undermined by its *own* data. Gleevec's preclinical R&D costs were almost entirely (90%) paid for by taxpayers via the National Cancer Institute & nonprofit orgs

📈For those doing the math: Enbrel is one of the world's most profitable drugs. $AMGN's net U.S. revenue increased to $5b in 2019. The company's net income has grown every year since it began selling Enbrel.

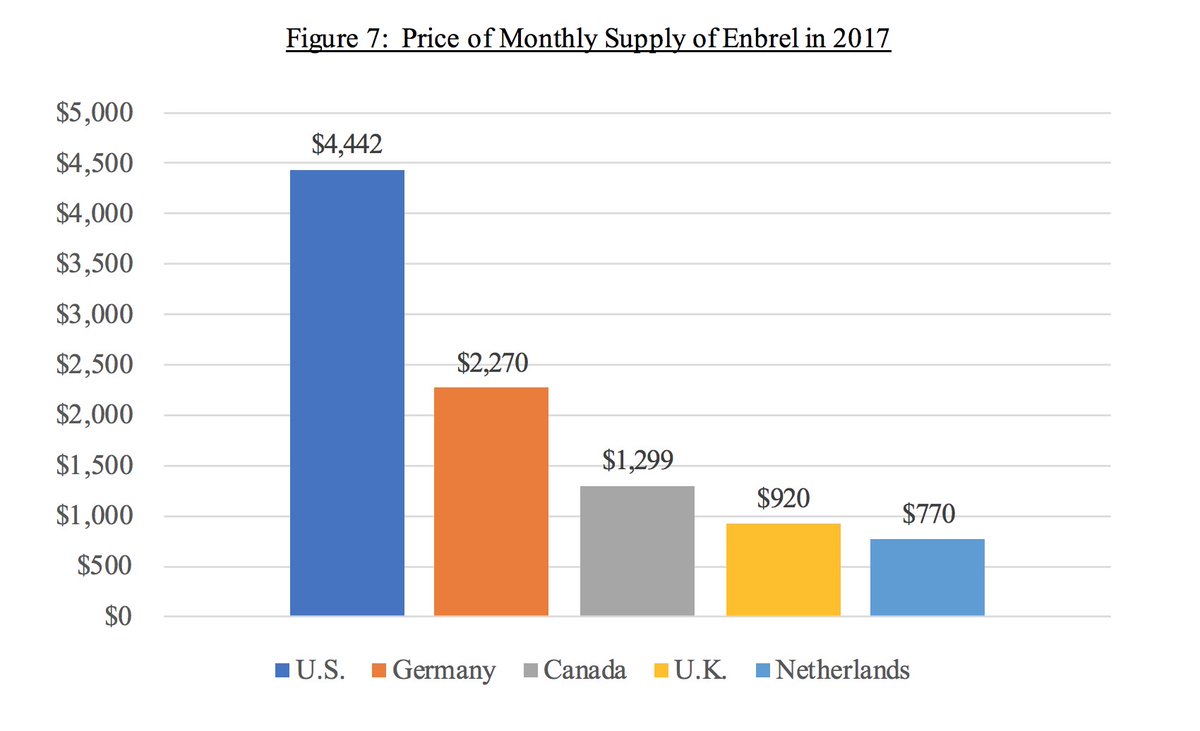

The same drugs cost more in the U.S. than they do in other countries that can negotiate. Now we know just how much. $AMGN's charges 2x more for Sensipar in the U.S. than it does across the border in Canada. Of Enbrel's $6.7b in revenue, $5b came from the U.S.

Is this a competitive market, #pharma? $NVS sued at least 5 companies to thwart generic competition for Gleevec, leading to a class action lawsuit accusing $NVS of "sham litigation." This legal wrangling cost U.S. payers dearly, an estimated $700m in excess costs in 1 year alone

Pop quiz: How many patents has $AMGN filed on Enbrel? Answer: 68. @IMAKglobal estimates granted patents will extend Amgen's monopoly until 2037

Claim: Patient assistance programs give away "free" drugs to those who need them, $AMGN's CEO says. Reality: These programs don't effectively lower drug prices, instead contributing to higher drug spend for the system, taxpayers & patients through premiums

$AMGN is fully aware of the financial harm of Enbrel & Sensipar, receiving frequent complaints from patients seeking help.

Here's what $NVS considered when pricing Gleevec: coverage, product price relative to competitors, sales v. budget, PR impact. Not on this list? R&D, rebates, value to patients

Gleevec received 9 orphan drug designations/approvals from @US_FDA. Current law permits manufacturers to exclude sales of orphan drug act approved drugs hospitals through the #340B program

Internal documents show that $MNK pursued acquiring Acthar because its orphan drug status allowed it to set a "premium price." $MNK sought to drive revenue growth by expanding Acthar's sales volumes for other indications

One component of $NVS's strategy to preserve Gleevec's sales revenue: A "Demand the brand" campaign aimed at providers and patients to "Dispense-As-Written." The company also had a co-pay card for patients & copay promotion program.

Passing on discounts at the pharmacy counter will not lower drug prices. In fact, it would increase patient premiums healthaffairs.org/do/10.1377/hbl…

Committee reports: $NVS used co-pay programs to drive demand for Gleevec, esp. after losing exclusivity, encouraging patients to stay on the branded drug after generics entered the market. $NVS's said its copay program would result in an ROI of $8.90 for every $1 invested

In 2019, #pharma employed 836 lobbyists & spent over $330 million on lobbying and political contributions – these are dollars that could be redeployed to R&D.

Internal documents show that 60% of bonus amounts at $AMGN are determined by the company's achievement of net revenue targets.

In Jan. 2018, $AMGN execs asked their team to explore a higher-than-planned price increase to meet revenue targets. The price of Enbrel then went up 9.7%

And that's a wrap. Day 2 of @OversightDems is adjourned. We look forward to seeing the results of the committee's subpoena of $ABBV. In the meantime, visit arnoldventures.org/work/drug-pric… to learn more about drug pricing reforms.

• • •

Missing some Tweet in this thread? You can try to

force a refresh