Irreconsilable

US twin deficit's & Fed policy point to continued dollar weakness.

Fed adopted new inflation regime targeting 2.5% AIT.

China, tied No1 holder of $DXY reserves intend's to offer its DCEP/CBDC as a dollar alternative leading CB's to diversify away from $USD

US twin deficit's & Fed policy point to continued dollar weakness.

Fed adopted new inflation regime targeting 2.5% AIT.

China, tied No1 holder of $DXY reserves intend's to offer its DCEP/CBDC as a dollar alternative leading CB's to diversify away from $USD

Eurozone is caught in a pincer movement where HICP is collapsing and Project Digital and EU 750 Bio bond will if they are to be successful require tolerance of validating inflows. Increasing QE further risks zombification of EZ banks which are already in trouble.

Europe needs

Europe needs

a magic bullet. Talking down the Euro when @Lagarde and @Paschald highlight the urgent need to adopt a digital Euro and at the same time welcome europe's forthcoming 750 Bio 'Safe Asset' common bond which will inevitably lead much needed inflows if they are to validate Europe's

determination to make the Euro and enduring feature on the landscape. @Paschald shows his his inexperience right off the bat '' And third, we will focus on the common currency,....which is also now one of the two predominant world currencies. The simple reason Europe is focussed

on a Digital Euro is becasue China's DCEP has caught, Europe and the US off guard and to omit the Yuan's potential status as a major reserve currency risks irking the largest soveriegn holder of Foreign Bonds.

Euro success depends on a digital strategy and the @ECB must welcome

Euro success depends on a digital strategy and the @ECB must welcome

foreign buyers of its new bond and the resulting currency strength that comes with it. Donahue in his comments highlighs the key objectives : Capital Markets and Banking Union, EU 750 Bio recvovery bond, a Digial strategy. All of them imply Euro strength irrespective of the tides

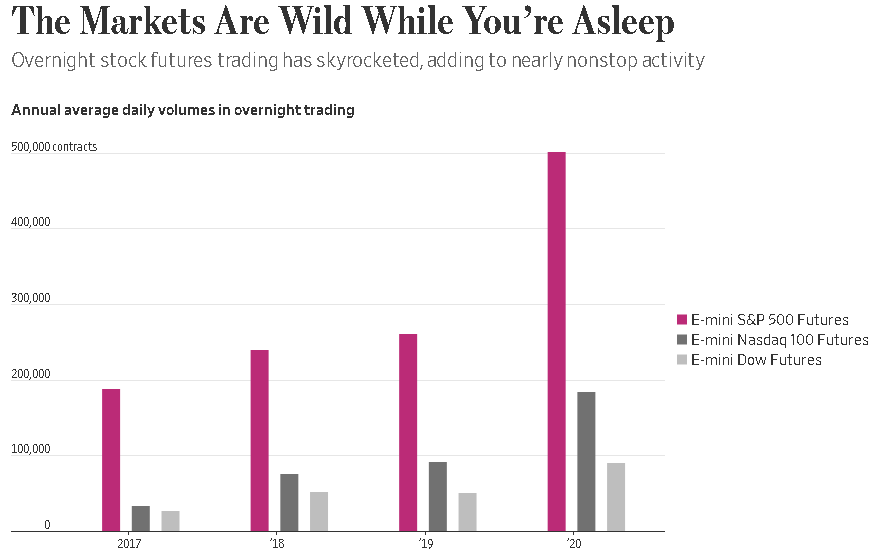

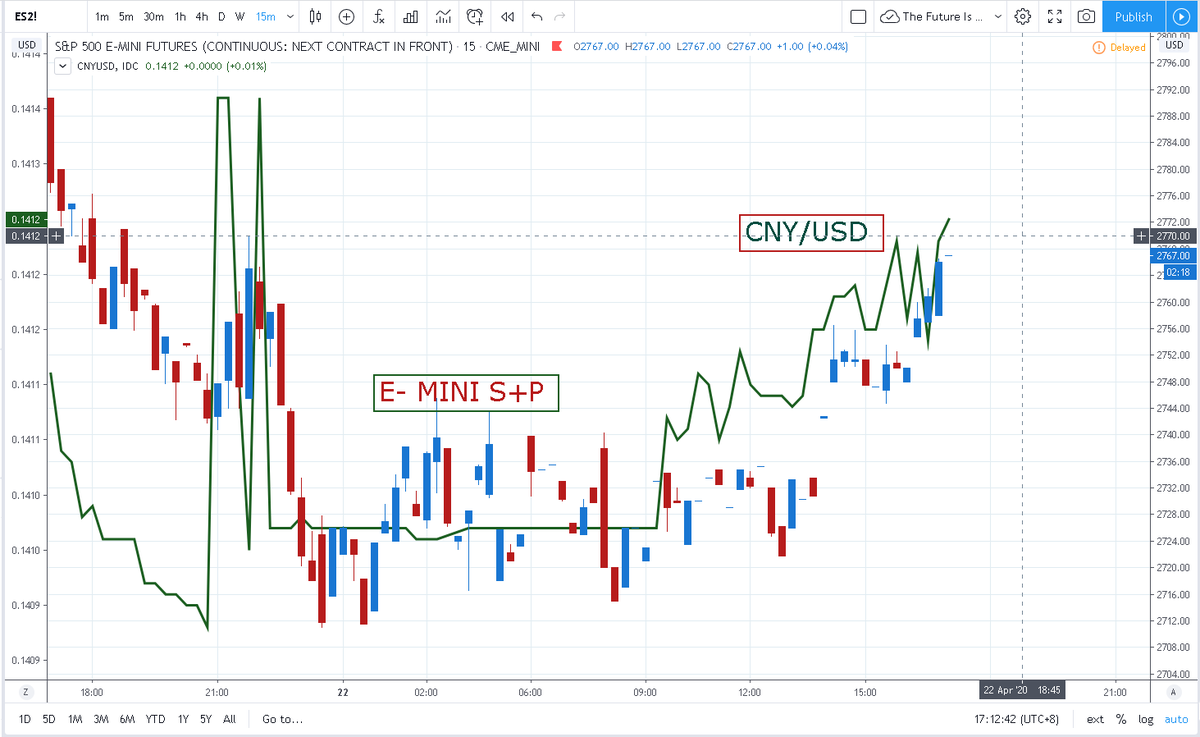

of US fiscal and monetary policy weakening the dollar, while China's DCEP vies for the same pool of capital that Europe is targetting. Notice during a time of crises, many of them that were China centric, the Chinese authorities worked hard to keep CNY strong versus the dollar

a lesson the @ECB would do well to emulate.

I learned about FX from @bundesbank legends like Tietmeyer, Issing, Stark whose only mantra was a strong currency. Talking down Euro is counterproductive and wont work. you could hardly say Euro was strong cc @joergkukies

I learned about FX from @bundesbank legends like Tietmeyer, Issing, Stark whose only mantra was a strong currency. Talking down Euro is counterproductive and wont work. you could hardly say Euro was strong cc @joergkukies

• • •

Missing some Tweet in this thread? You can try to

force a refresh