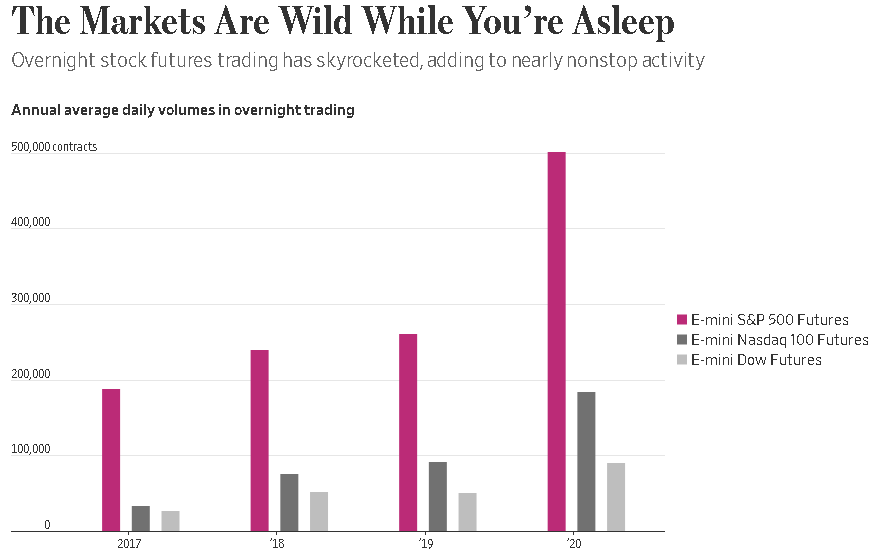

I've argued China bought dips 17 X from March Asian lows. bit.ly/2VQ4trY Price action today same MO-> rally on little news, coincidentally rallies also. @WSJ concludes same. Asia Buys While U Sleep on.wsj.com/2KnmM2i

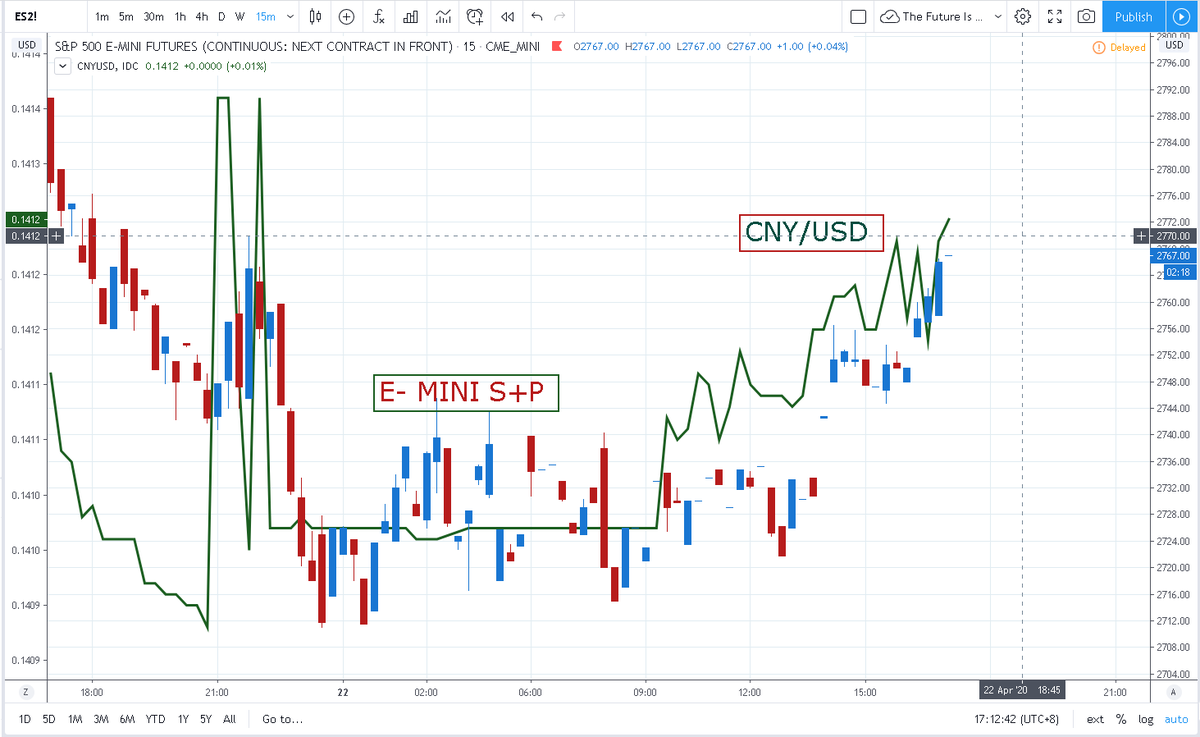

See chart and previous tweets showing China's footprint.

As Ive highlighted China has been buying in Asia and are again today.