Anglo Irish European Transatlantacist, Looking At The World Through A Beijing Lens

How to get URL link on X (Twitter) App

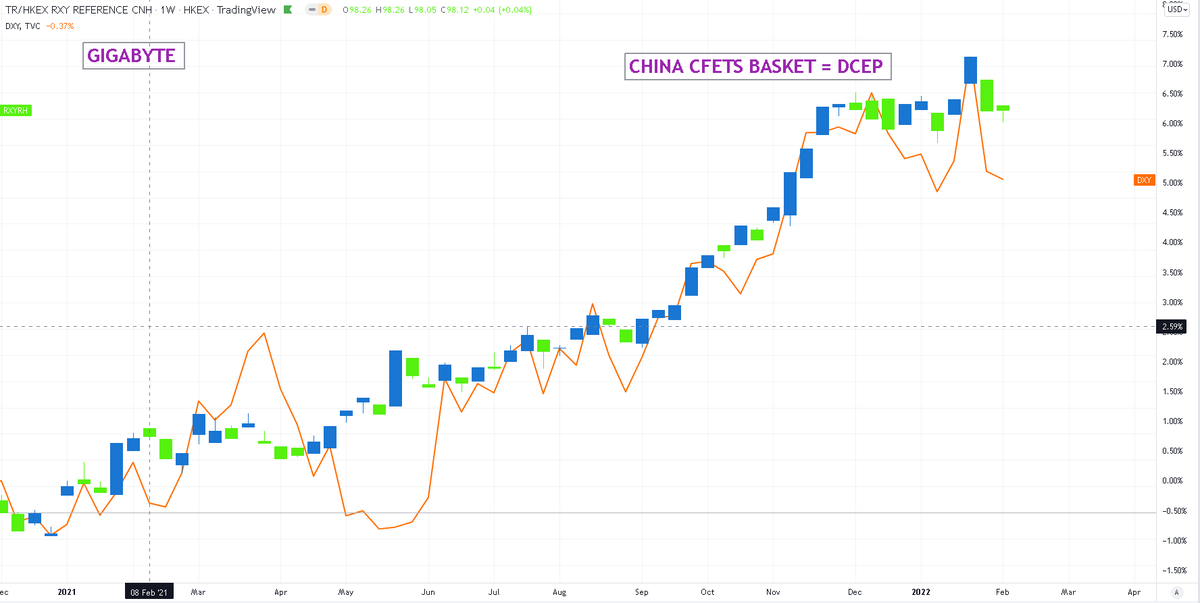

with $DXY strength. DCEP is now up & running and the $RMB strength necessary to its survival & credibility is no longer necessary, indeed its harmful. A strong $RMB was essential to avoid the loss of credibility endured by the only other reserve currency launched in the last 100

with $DXY strength. DCEP is now up & running and the $RMB strength necessary to its survival & credibility is no longer necessary, indeed its harmful. A strong $RMB was essential to avoid the loss of credibility endured by the only other reserve currency launched in the last 100

https://twitter.com/CurrencyWar1/status/1465472276040667136

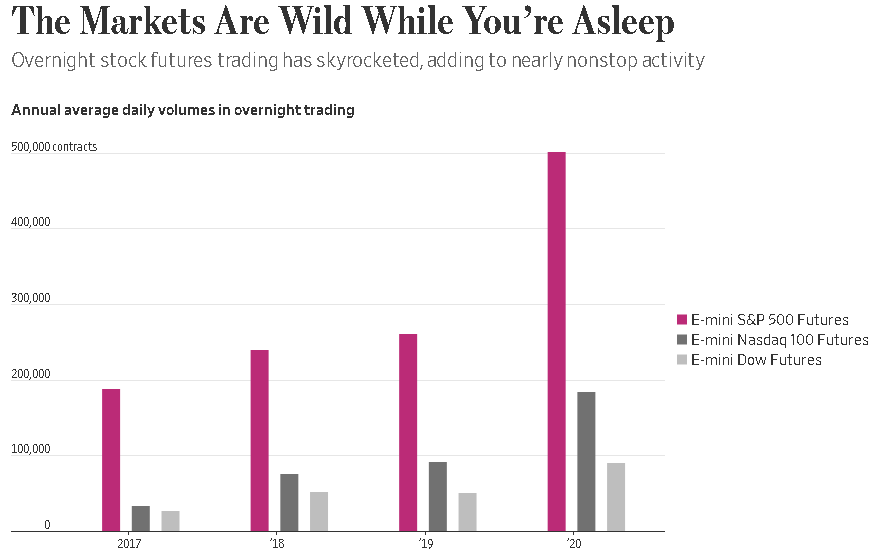

and @federalreserve Powell and many others didn't really care about a digital dollar 12 months ago, but policy stance has changed as has approach to #crypto broadly. @GaryGensler appeared hostile initially and then did a volte face. In recent days China has switched attention

and @federalreserve Powell and many others didn't really care about a digital dollar 12 months ago, but policy stance has changed as has approach to #crypto broadly. @GaryGensler appeared hostile initially and then did a volte face. In recent days China has switched attention

https://twitter.com/CurrencyWar1/status/1464332246584856576

Dollar hegemony and supreamacy. The vision will allow China open its Capital A/c and fund the massive deficits accrued by semi state enterprises. I forsee the Yuan as a stable coin, leading to a collapse in FX volatility and a genuine use case for RMB mass adoption via its

Dollar hegemony and supreamacy. The vision will allow China open its Capital A/c and fund the massive deficits accrued by semi state enterprises. I forsee the Yuan as a stable coin, leading to a collapse in FX volatility and a genuine use case for RMB mass adoption via its

https://twitter.com/CurrencyWar1/status/1440990812339331072

China began its DCEP project after 1.0 trio outflows from 2014/2017 with a large proportion of those outflows via stablecoins and #BTC. China's ambition is to upend Dollar hegemony, the evergrande bankruptcy is a perfect case in point with international capital markets concerned

China began its DCEP project after 1.0 trio outflows from 2014/2017 with a large proportion of those outflows via stablecoins and #BTC. China's ambition is to upend Dollar hegemony, the evergrande bankruptcy is a perfect case in point with international capital markets concerned

https://twitter.com/jnordvig/status/1440850557413982215

be resisted. As Jens highlights, China's FX reserves collapsed in 2015/16/17, falling 1.0 Trio USD. PBOC MU, the head of the digital lab told us at HK blockchain week in 2019 that the popularity of #bitcoin during this period lead the PBOC to fear for sovereignty of the Yuan. So

be resisted. As Jens highlights, China's FX reserves collapsed in 2015/16/17, falling 1.0 Trio USD. PBOC MU, the head of the digital lab told us at HK blockchain week in 2019 that the popularity of #bitcoin during this period lead the PBOC to fear for sovereignty of the Yuan. So

Eurozone is caught in a pincer movement where HICP is collapsing and Project Digital and EU 750 Bio bond will if they are to be successful require tolerance of validating inflows. Increasing QE further risks zombification of EZ banks which are already in trouble.

Eurozone is caught in a pincer movement where HICP is collapsing and Project Digital and EU 750 Bio bond will if they are to be successful require tolerance of validating inflows. Increasing QE further risks zombification of EZ banks which are already in trouble.

Contrast with China, now on road to recovery with monetary stimulus negligible vs FED which might do more (Clarida) & likely congress slow on more fiscal. Exploding dificits & easy Fed will weigh on dollar. Meanwhile China declared a war of its own, building a tech revolution &

Contrast with China, now on road to recovery with monetary stimulus negligible vs FED which might do more (Clarida) & likely congress slow on more fiscal. Exploding dificits & easy Fed will weigh on dollar. Meanwhile China declared a war of its own, building a tech revolution &

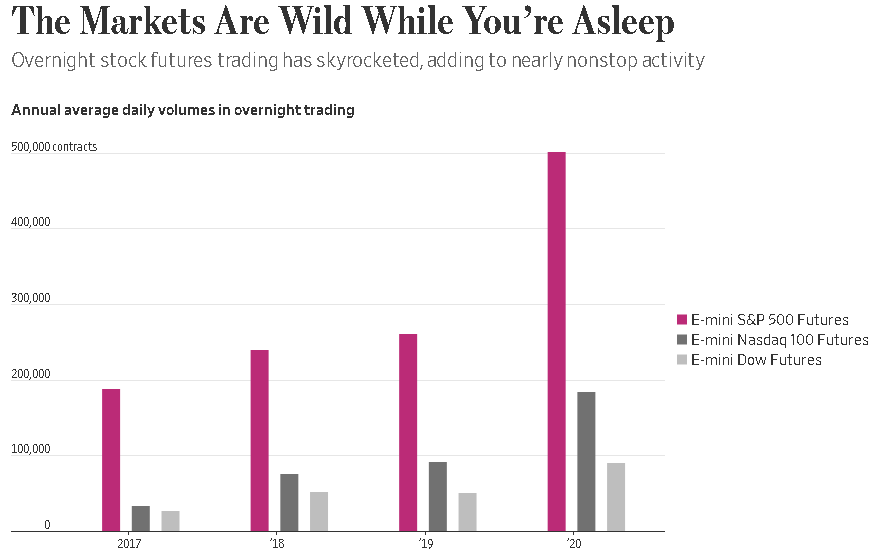

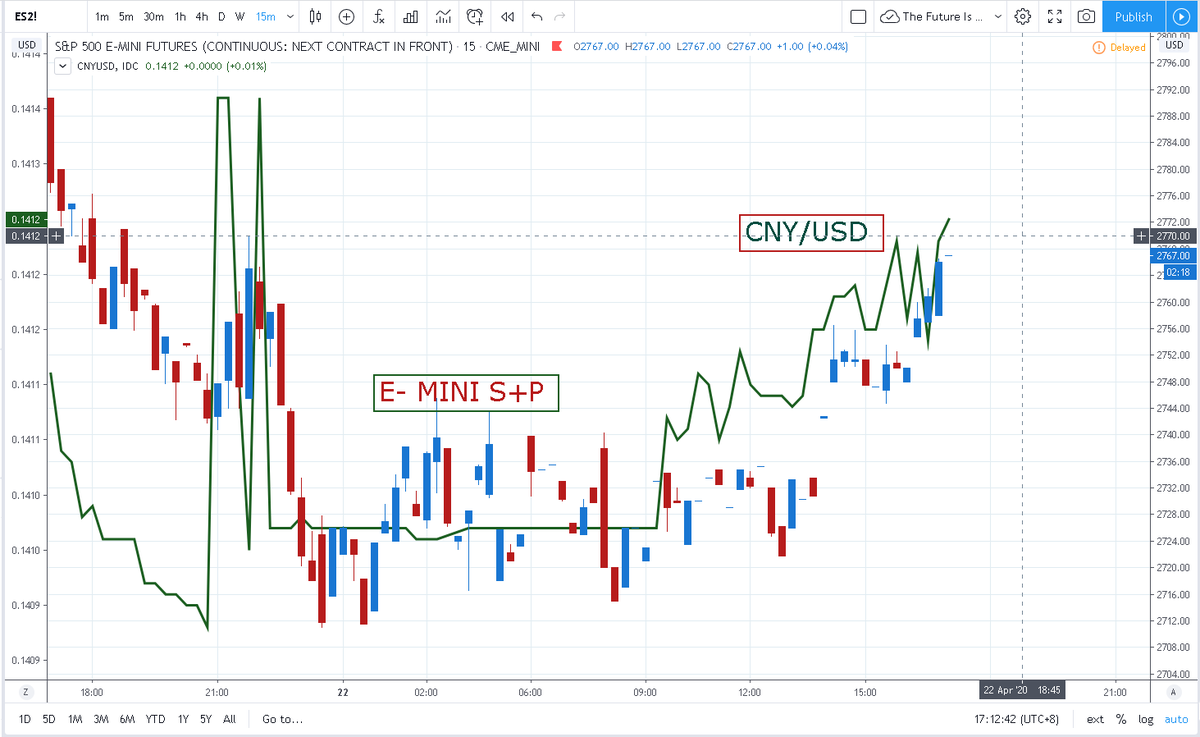

Why China Buys US Stocks

Why China Buys US Stocks