(1/4) We've added several new features to our mobile app we hope you'll enjoy!

For data on the go find us on the Apple App Store and on Google Play

coinmetrics.io/mobile-app/

For data on the go find us on the Apple App Store and on Google Play

coinmetrics.io/mobile-app/

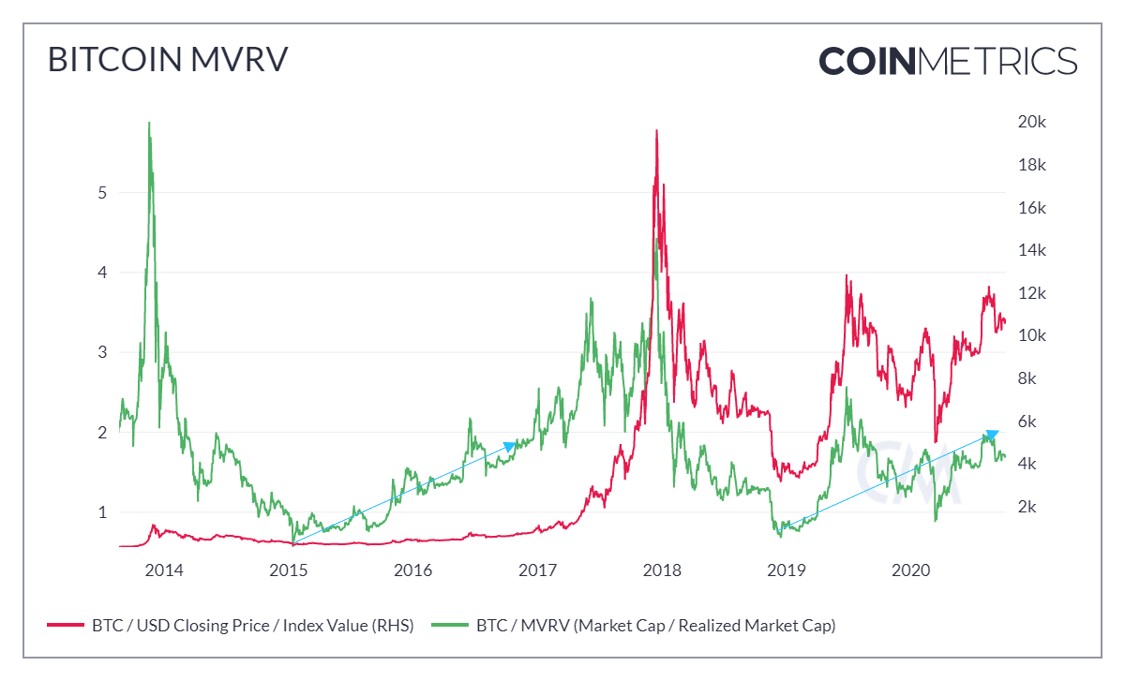

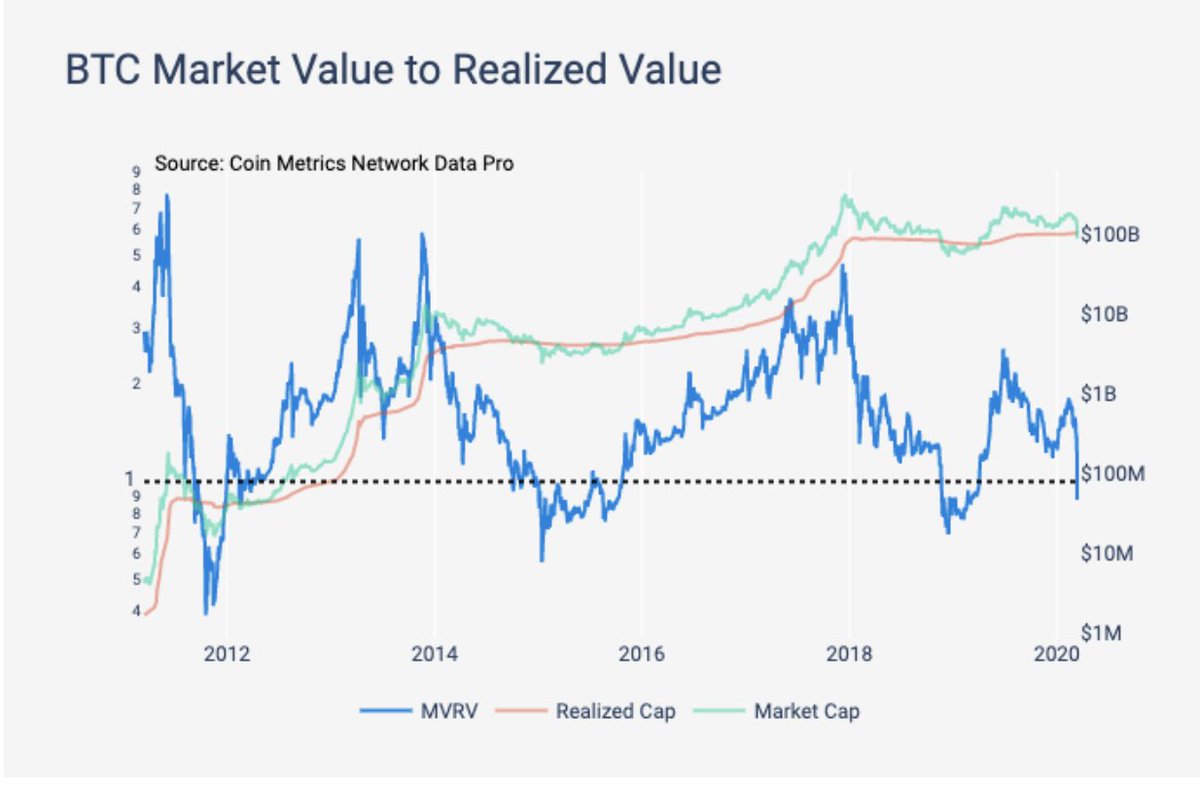

(2/4) Chart cryptoasset on-chain data at your fingertips

Congrats to those that found this feature in v1 via an Easter Egg!

Congrats to those that found this feature in v1 via an Easter Egg!

(4/4) And see all of our Coin Metrics Bletchley Indexes (CMBI) levels in real-time as well as view key statistics like performance, volatility and Sharpe ratios

• • •

Missing some Tweet in this thread? You can try to

force a refresh