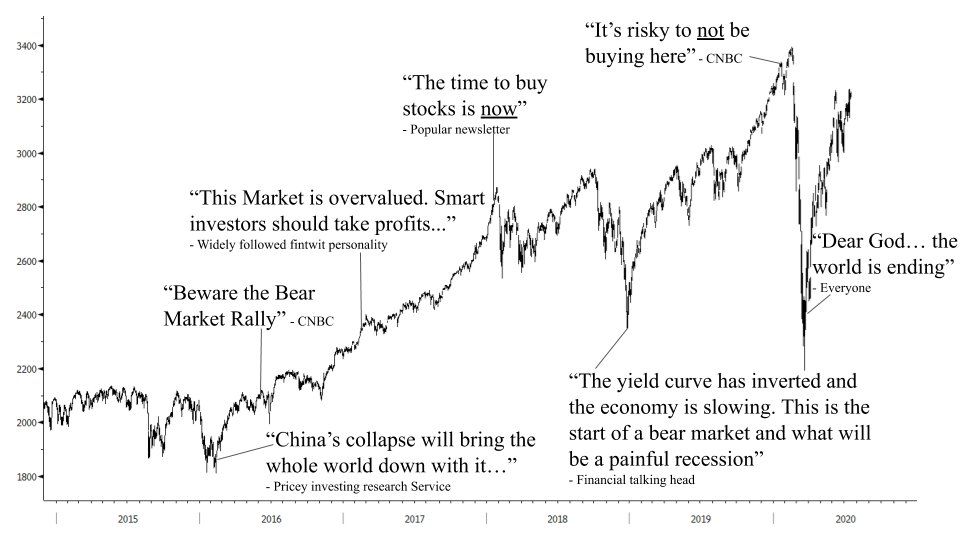

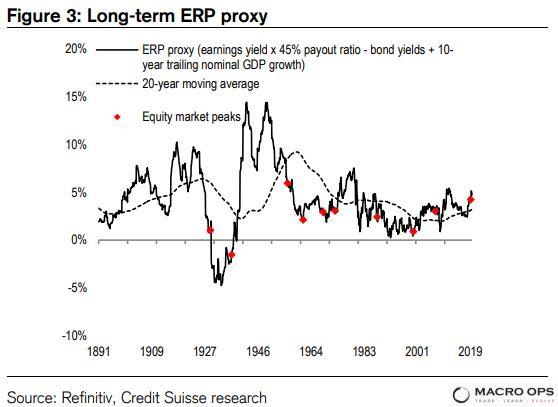

THREAD: The market is like a magician. It pulls your attention to one hand while stealing your watch with the other. The biggest trends kick-off when no one’s looking. The most contested areas of the market — the stocks everyone is talking about — do nothing.

2/ The fact that our hive mind is instantly embedded into the market price inherently means that most large moves will surprise most participants. After all, if everyone was already expecting it, it would have already happened.

3/ To catch the magician in the act we need to contrast what everyone is focusing on with what's *actually* happening in the tape. We can do this by looking at the Hierarchy of Technicals macro-ops.com/the-hierarchy-… which allows us to build a coherent picture from mltple data points

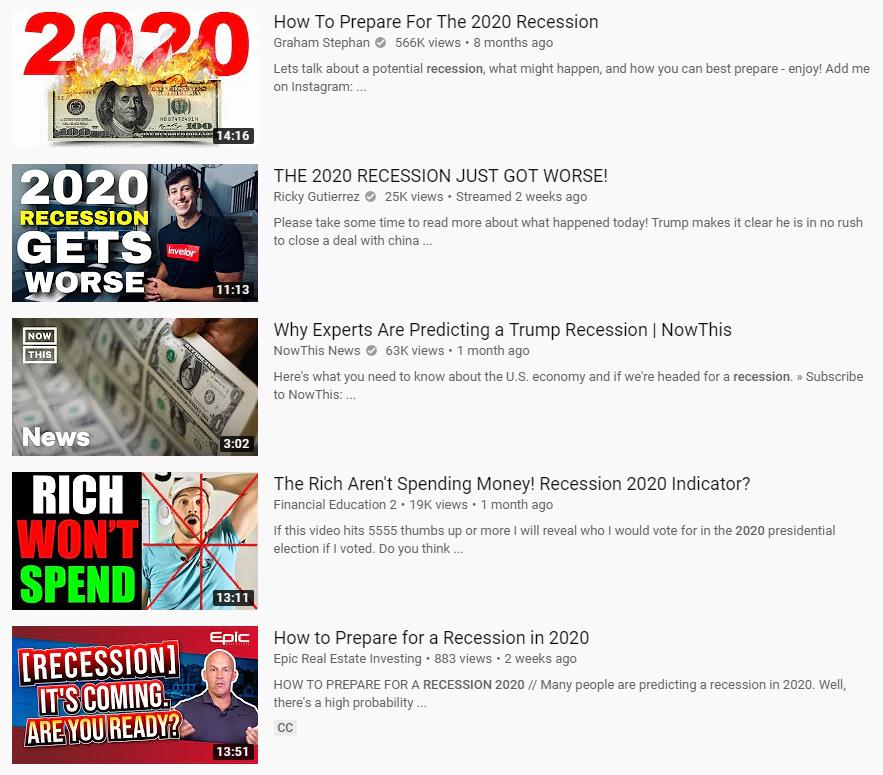

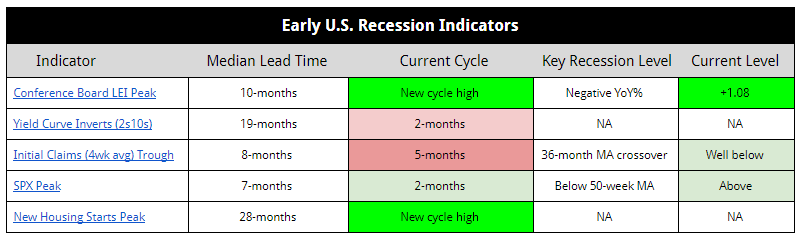

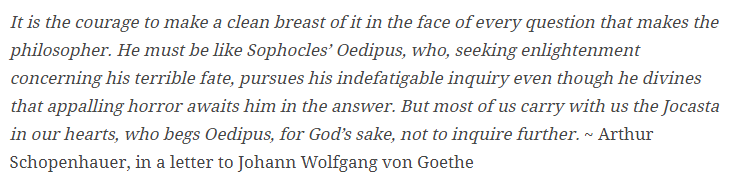

4/ Applying that framework to today we see three things dominate our attention, and they're all bearish:

1. Rising COVID cases (with little mention of falling hospitalizations or deaths)

2. Election Mess (*everyone* is bracing for a contested election)

3. Failure of fiscal talks

1. Rising COVID cases (with little mention of falling hospitalizations or deaths)

2. Election Mess (*everyone* is bracing for a contested election)

3. Failure of fiscal talks

5/ It's fair to say that the general sentiment is one of agitated apprehension. This sentiment is reflected in investor survey and positioning data.

- AAII Bull-Bear has put in one of its longest consecutive streaks of bearish readings

- AAII Bull-Bear has put in one of its longest consecutive streaks of bearish readings

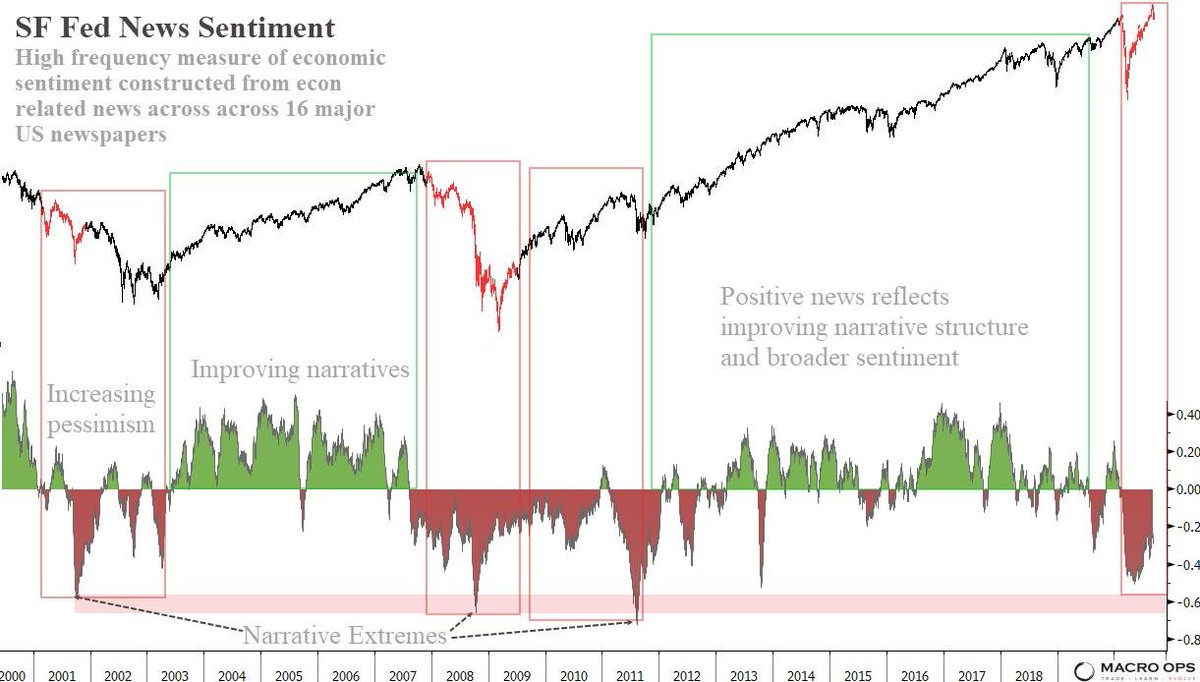

6/ NAAIM Exposure Index was taken down from elevated levels and is now at lows showing disbelief in the trend.

7/ Hedge funds continue to hold large amounts of case and underweight risk assets. Their current beta to the market is more typical of market bottoms than tops.

8/ Aggregate net commercial positioning in US Indices is elevated, reflecting crowded speculative shorts.

9/ And this is despite “one of the greatest stock market rallies of all time” according to BofA. Few believe the trend up will continue. Most are on the sidelines, sitting in cash, watching the rise in disbelief.

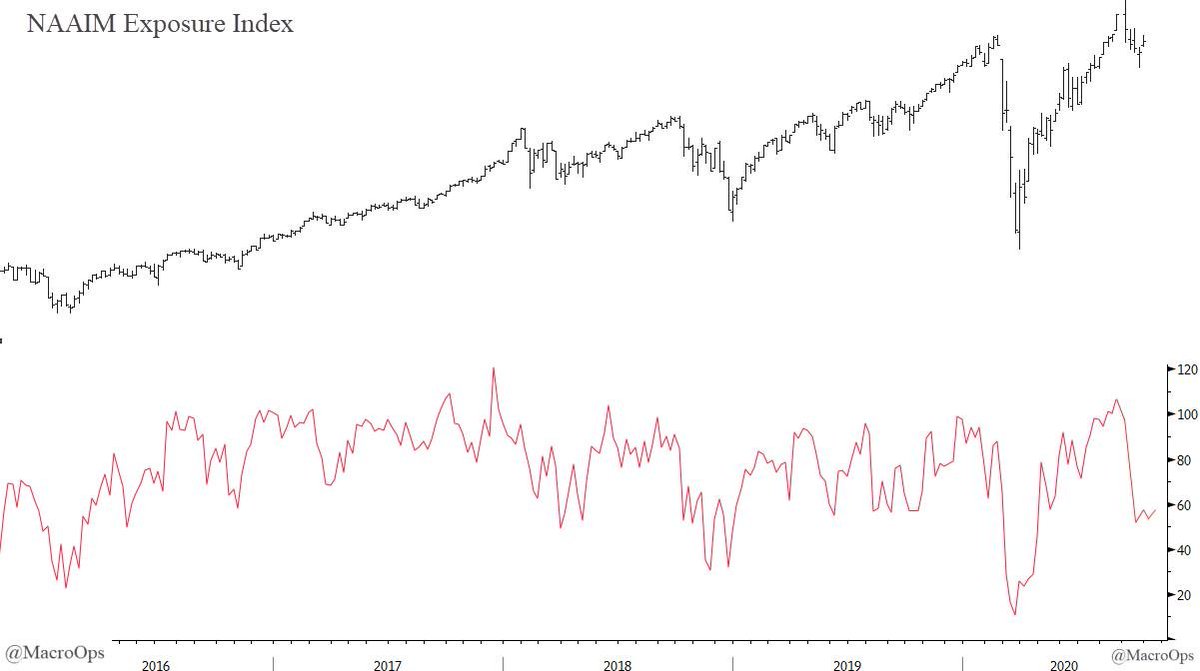

10/ With yields pinned down for the foreseeable future, we have incredibly favorable tailwinds for risk assets. The Stock/Bond ratio is rebounding off 20yr lows and the ERP remains well above levels that have marked tops over the last 60yrs.

11/ This is against the backdrop of extremely easy financial conditions and an accommodative policy mix, which as CS points out, is twice as loose as what was seen at the height of the GFC.

12/ We’re building a picture here…

We have a bearish consensus in sentiment and positioning. Stocks at 20yr+ lows relative to bonds. A fat risk premium. And some of the easiest liquidity conditions we’ve seen in years.

Now we have to look at market structure and the tape.

We have a bearish consensus in sentiment and positioning. Stocks at 20yr+ lows relative to bonds. A fat risk premium. And some of the easiest liquidity conditions we’ve seen in years.

Now we have to look at market structure and the tape.

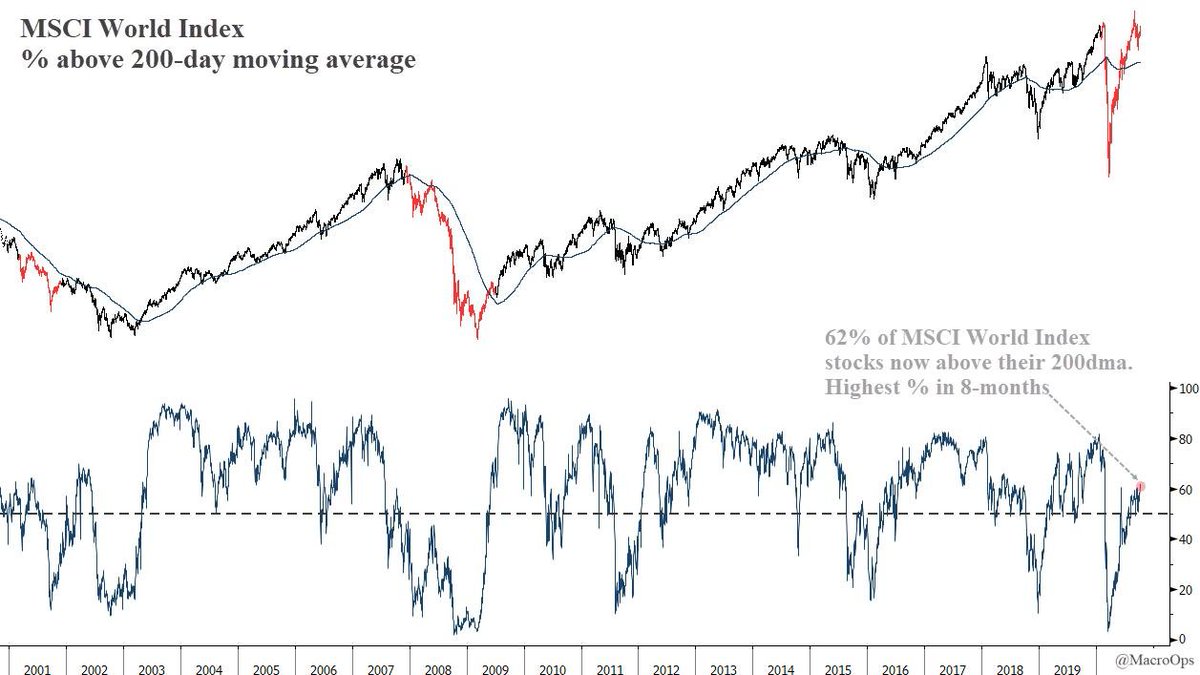

13/ Here we're seeing improving breadth. This week, the MSCI World Index saw 62% of its stocks climb above their 200-day moving average. The strongest breadth reading in 8-months.

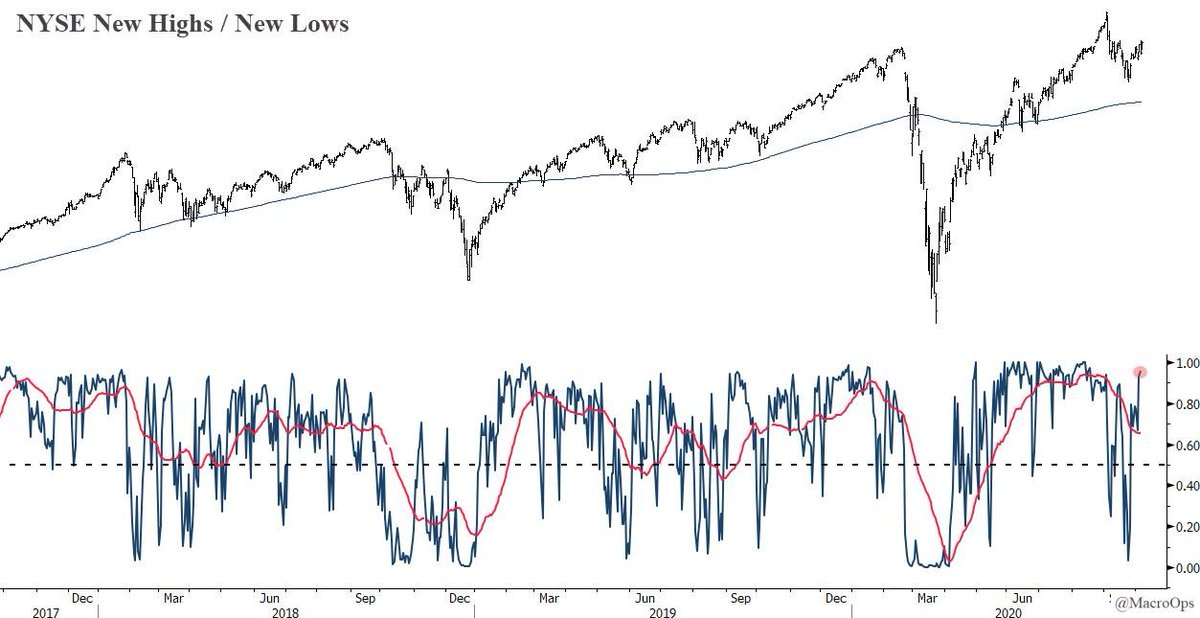

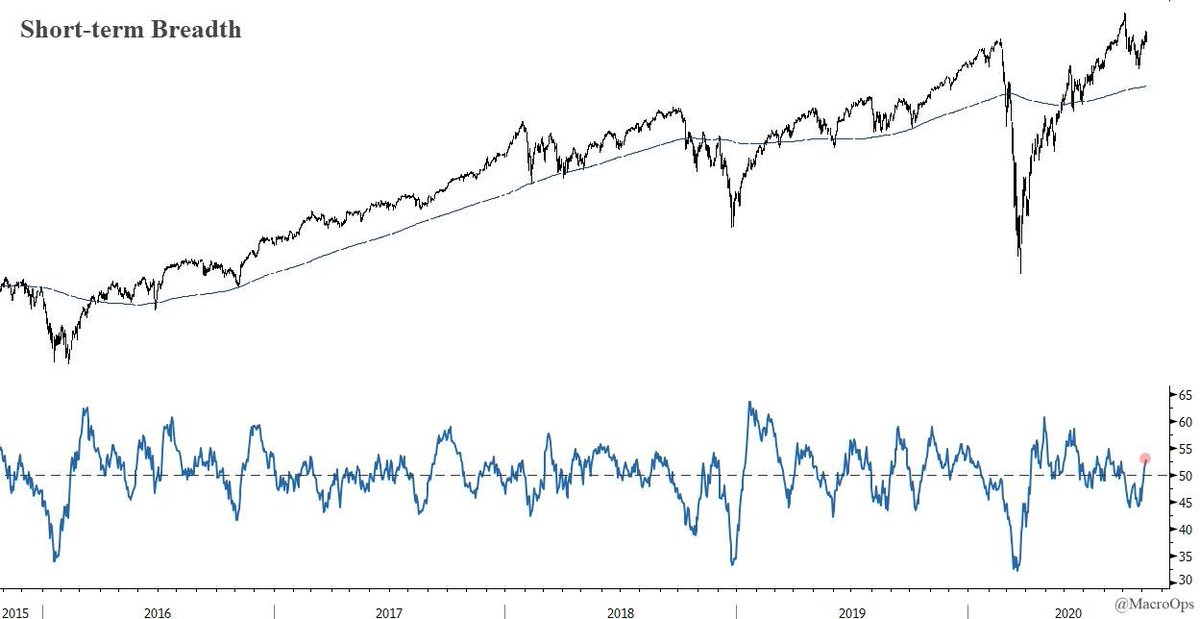

14/ US short and intermediate-term breadth signals have perked up as well, and are showing budding strength.

16/ $SPY is in a Bull Quiet regime less than a few % from new highs. In a bull quiet, you want to be long. You want to buy dips, buy new highs, buy because it’s sunny out etc… Furthermore, our TL Score is now giving a +2, which is very supportive. macro-ops.com/how-to-stay-in…

17/ To sum up, we have a fairly bearish consensus, defensive positioning (sans RH call buyers), flush liquidity, rebounding breadth, leading indices breaking out to new highs, a Bull Quiet regime, and a +TL score...

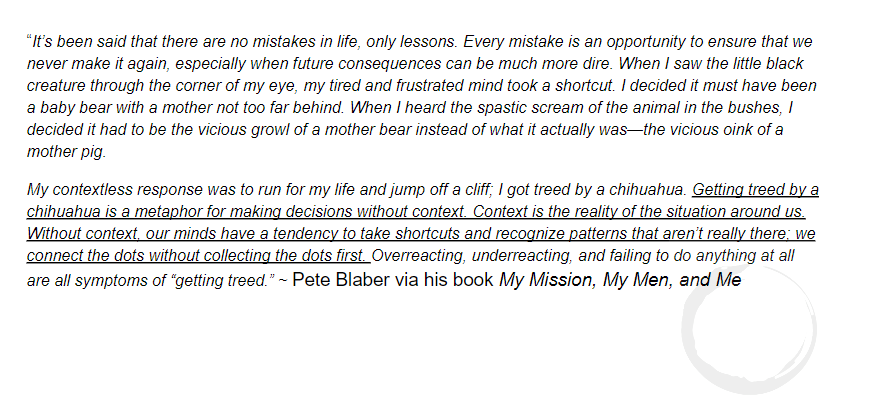

18/ People make this game tougher than it needs to be. They get fooled by the Market's sleight of hand.

This thread is a summary of a post I wrote today where I outline the bullish technical case for the markets. You can read that here 👇 /fin

macro-ops.com/the-markets-sl…

This thread is a summary of a post I wrote today where I outline the bullish technical case for the markets. You can read that here 👇 /fin

macro-ops.com/the-markets-sl…

• • •

Missing some Tweet in this thread? You can try to

force a refresh