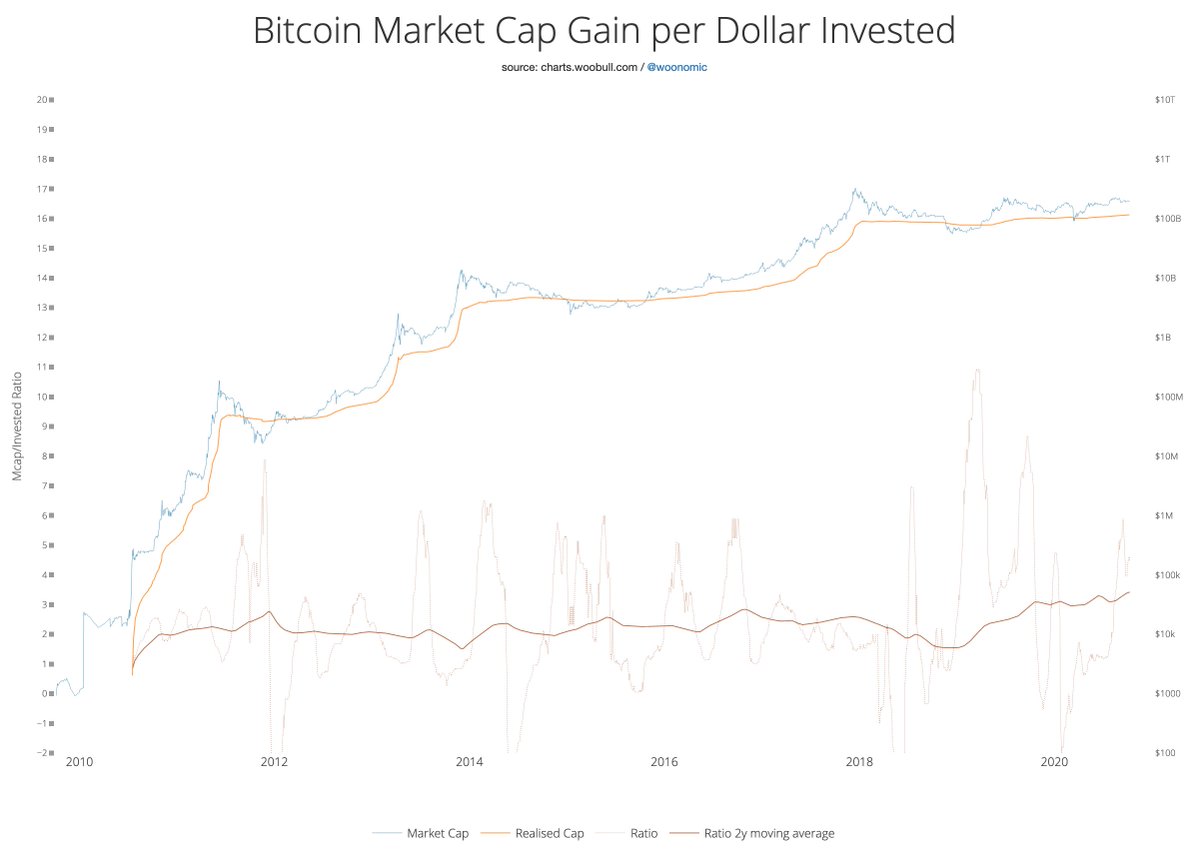

This is my study of Bitcoin's market cap gain per dollar of net capital captured. It's presently sitting at $3.30 of price gain per dollar invested.

Some interesting findings below...

👇

Some interesting findings below...

👇

Reflectivity is increasing over each macro cycle! This is the tendency of HODLers to hold onto their coins harder as price increases.

I had expected reflexivity to increase during the mania phase of BULL markets, but it looks quite constant from the last two cycles.

This tells us that mania phases are driven by equally significant capital instead side effects of supply drying up.

This tells us that mania phases are driven by equally significant capital instead side effects of supply drying up.

This cycle in interesting; reflexivity is increasing rather than static compared to last cycles.

While we now need more capital invested to get similar % gains in price, the effect of HODLers holding onto coins tighter is magnifying "number go up" per dollar invested.

While we now need more capital invested to get similar % gains in price, the effect of HODLers holding onto coins tighter is magnifying "number go up" per dollar invested.

Methodology for this study here described here.

https://twitter.com/woonomic/status/1314434039663652864?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh