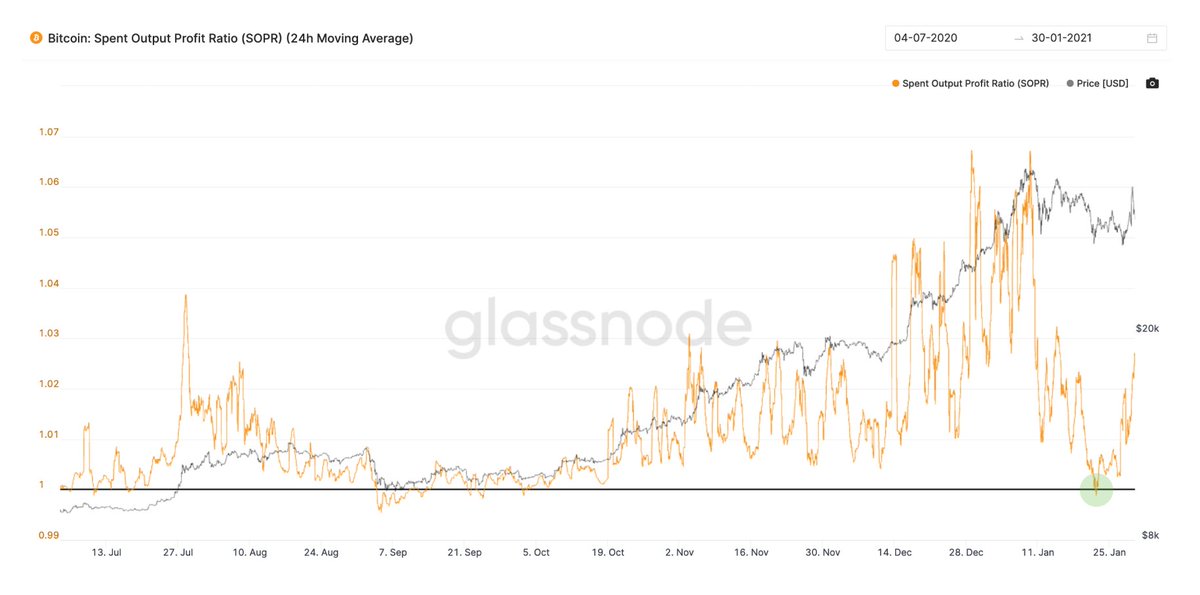

Zooming in from weekly to daily... oh yes. Today we have a new all-time-high in BTC leaving the exchanges for 2021. And a new dip buying prize to award.

It's also a new Rick Astley high score.

Remember, the red bars is the daily count of coins moving to Rick Astley, the HODLer of last resort, who never gives up or deserts BTC.

Remember, the red bars is the daily count of coins moving to Rick Astley, the HODLer of last resort, who never gives up or deserts BTC.

@glassnode data, but my own terminology.

• • •

Missing some Tweet in this thread? You can try to

force a refresh