#stockmarket WE update. Sometimes when everything seems to be working, breaking out, acting as it should or we hope, IMO, means things are getting too easy. My gut says we are there & time to retrench a bit. Last wk pump job screwed the bears but could mean now we fall harder....

#Stockmarket hard to know how this shakes out but as you can see in this thread, my indicators are flashing yellow. $INDU currently w/ first Demark Seq 13 sell last wk since the low & new aggressive seq 13 w/ so sto overbot. also hitting wkly resistance. but Prop up tgt =29526...

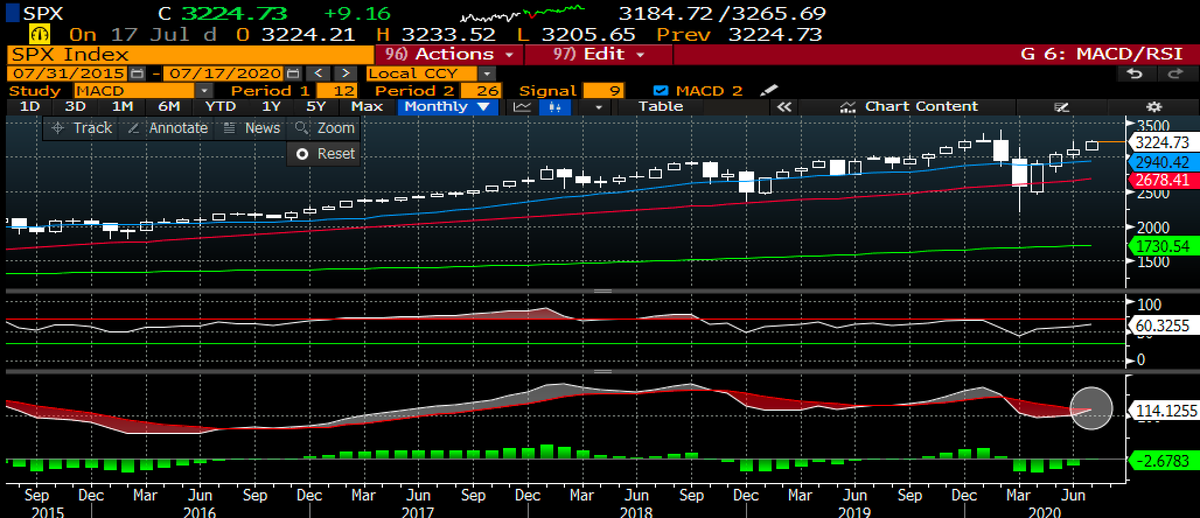

#stockmarket #SPX also w/ a Demark Seq 13 sell looming if trade +3509. Slot sto also overbot. upside & downside Trend factor lvls in white boxes. 3rd D-wave tgt @ 2975. currently hitting 1.5x upside level....

#stockmarket $RTY w/ perfected Demark green 9 sell, w/ propulsion up tgt being hit as well as new combo version 1B 13 sell present. Slot sto also overbought.....

#stockmarket $HYG also now w/ a new Demark 9 sell w/ Seq 13 sell looming. As you can see, 9's matter to this instrument w/ an almost perfect track record for a reaction the last 6 months. Neg reaction here likely would be construed negative equities....

#stockmarket Smart money Index not exactly a ringing endorsement for this recent mkt strength, still struggling, stuck on the mat and near the lows of my channel. makes you wonder especially since volume has been very light on the up moves.....

#stockmarket Stocks above their 200day making nice headway but still below peak and now w/ a new 9 Demark sell posting on Monday....

#stockmarket Ad/Decline has been undoubtedly bullish but also now w/ new Demark 13 combo/9 sell. Turning down here is bearish equities....

#StockMarket Valueline Index approaching a tough spot...

#StockMarket Most short growth basket also w/ a new Demark 13 combo/9 sell. All of the 13 sell signals the last 6 months have seen a drawdown of at least 9.5% peak to trough. RSI is overbot, BUT is definitely confirming this move....

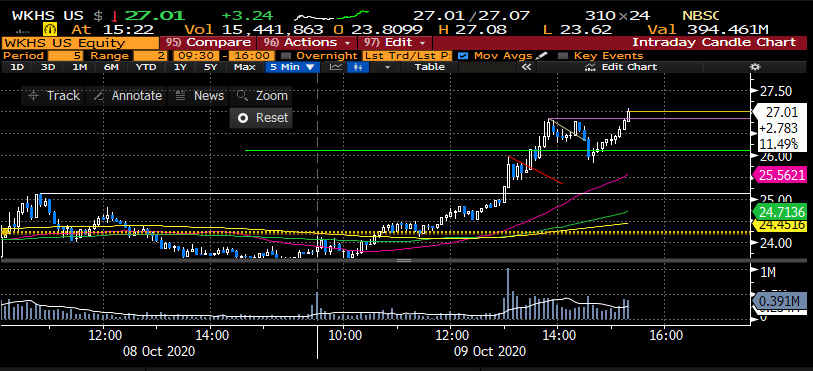

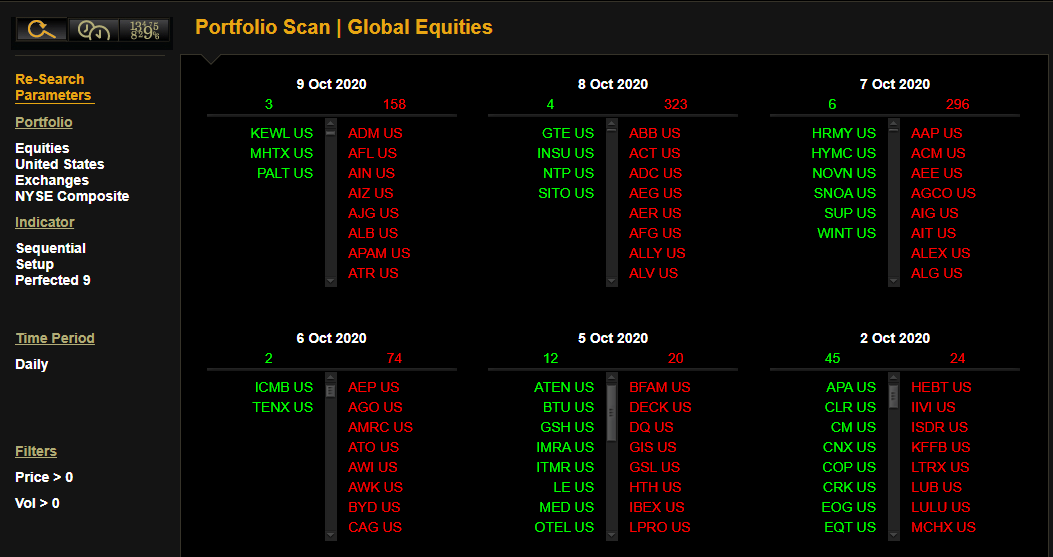

#StockMarket I posted this last wk & is a snapshot of all the perfected green 9 sells in the exchanges. This list is quite sizeable for 3 days. #NYSE has 777 names #Nasdaq has 525. This suggests a decent amount of stks have Demark exhaustion & can be subject to a reversal....

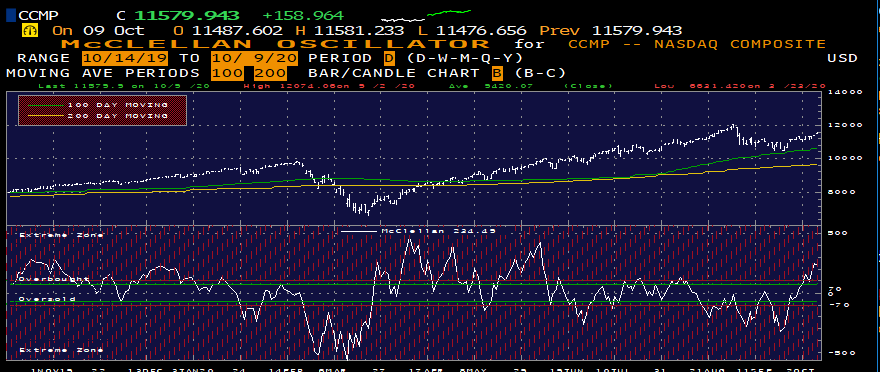

#StockMarket I also posted these charts of the McClellan Oscillator which is now firmly in the overbot zone and not a great place to add new longs....

#stockmarket lastly, I think $TLT is a great place to hide w/ a new Demark 13 buy right @ the 200day and slo sto curling up. the Move Index (Treasury volatility) w/ recent Demark exhaustion is signaling a big move is coming....

#stockmarket Concl: tons of great stk set ups, yes, I see them. stick w/ them, but tight leash, tighten stops & maybe start hedging or taking profits. I've read a ton about recent breadth thrusts = all bullish LT, but NT could still experience painful drawdowns. Stay safe/nimble

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh