US STIMULUS & ELECTION US Stimulus Update

Firstly, bear in mind, Presidential EOs are the back stop, especially for UI and PPP.

However, as our very own @Halsrethink states, Pelosi’s rejection of the $1.8 trillion offer is more about the details of its content, and the

Firstly, bear in mind, Presidential EOs are the back stop, especially for UI and PPP.

However, as our very own @Halsrethink states, Pelosi’s rejection of the $1.8 trillion offer is more about the details of its content, and the

treatment of possible add-ons, such as aid for airlines. Talks have been ongoing over the weekend, despite the tactical public rhetoric, as evidenced by the following headlines yesterday:

*MNUCHIN MAY STILL INCREASE STIMULUS OFFER: KUDLOW

I would also recommend reading

*MNUCHIN MAY STILL INCREASE STIMULUS OFFER: KUDLOW

I would also recommend reading

Pelosi’s actual statement, which can be found on her website here, as opposed to the more sensationalist headlines of the press.

Then, according to Fox News, between 10 and 12 GOP Senators would support the above offer, including Ted Cruz. Add that number to the 47 Democrat

Then, according to Fox News, between 10 and 12 GOP Senators would support the above offer, including Ted Cruz. Add that number to the 47 Democrat

Senators, and you have a majority. Given that McConnell is playing an active role in the discussions behind the scenes, you do have to wonder whether the political optics would incline him to pushing for a bipartisan vote in favour thereof. Also, significantly, McConnell has

control over the Senate re-election fund and thus control over the votes. We probably land at a $2 trillion bill after all the theatrics. @nglinsman

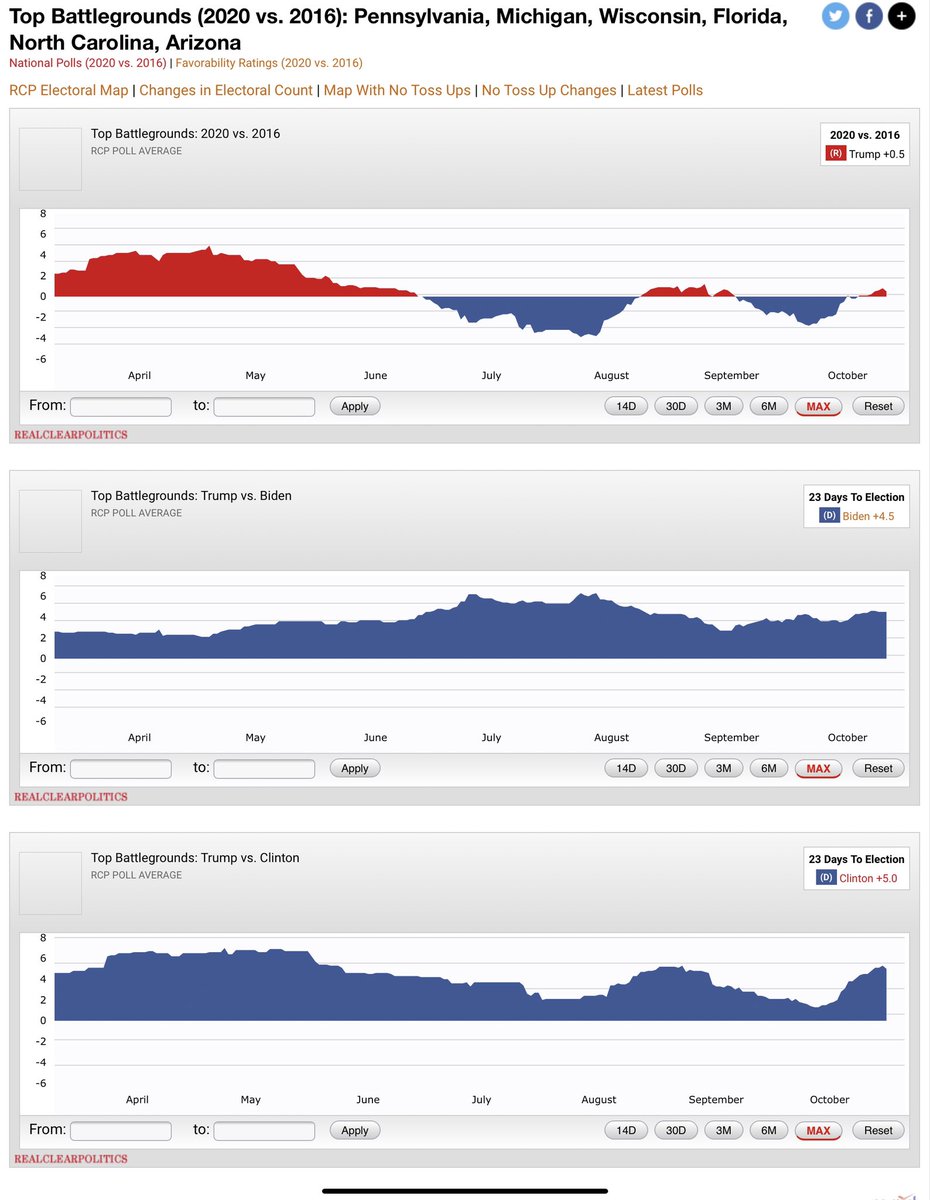

Be careful the opinion polls

Firstly, it should be noted that President Trump is outperforming his 2016 polling in the battleground states, with Biden trailing Hilary Clintons numbers at the same point in the last election. This is according to RealClearPolitics – have a look:

Firstly, it should be noted that President Trump is outperforming his 2016 polling in the battleground states, with Biden trailing Hilary Clintons numbers at the same point in the last election. This is according to RealClearPolitics – have a look:

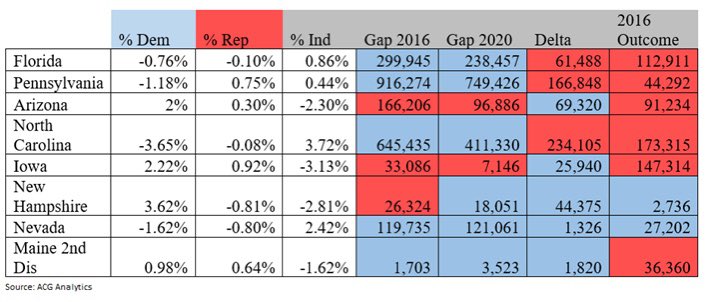

Secondly, the GOP has cut the Democrats’ voter advantage in:

· Florida

· Pennsylvania

· North Carolina

· Arizona

GOP turnout is historically higher than that of the Democrats, so this will be problematic for Biden in those states.

· Florida

· Pennsylvania

· North Carolina

· Arizona

GOP turnout is historically higher than that of the Democrats, so this will be problematic for Biden in those states.

As a guide to the above table:

%s = change in % of registered voters

Gap 2016 = difference between Dem and GOP in 2016 – colour coded according to who has more

Gap 2020 = difference between Dem and GOP in 2020 – colour coded according to who has more

Delta = change in Dem/GOP

%s = change in % of registered voters

Gap 2016 = difference between Dem and GOP in 2016 – colour coded according to who has more

Gap 2020 = difference between Dem and GOP in 2020 – colour coded according to who has more

Delta = change in Dem/GOP

difference from 2016 to 2020 – colour coded according to who has Now, let’s consider the impact of the above on a couple of the swing states.

FLORIDA Voter Registration Numbers:

2008:

Dem edge GOP 694,147

Obama wins by 236,14

FLORIDA Voter Registration Numbers:

2008:

Dem edge GOP 694,147

Obama wins by 236,14

2012:

Dem edge GOP 558,272

Obama wins by 74,309

2016:

Dem edge GOP 330,428

Trump wins by 112,991

2020:

GOP edge Dem as of 9 October by 61,488

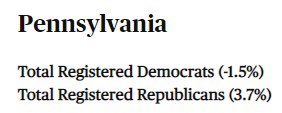

PENNSYLVANIA Voter Registration Numbers:

2000:

GOP 3,250,764

DEM: 3,736,304

Dem edge GOP 558,272

Obama wins by 74,309

2016:

Dem edge GOP 330,428

Trump wins by 112,991

2020:

GOP edge Dem as of 9 October by 61,488

PENNSYLVANIA Voter Registration Numbers:

2000:

GOP 3,250,764

DEM: 3,736,304

Difference: DEM +485,540

Bush wins by 4.17%

2004:

GOP: 3,405,278

DEM: 3,985,486

Difference: 580,208

Bush wins by 2.50%

2008:

GOP: 3,243,046

DEM: 4,479,513

Difference: 1,236,467

Obama wins by 10.35%

2012:

GOP: 3,131,144

DEM: 4,266,317

Bush wins by 4.17%

2004:

GOP: 3,405,278

DEM: 3,985,486

Difference: 580,208

Bush wins by 2.50%

2008:

GOP: 3,243,046

DEM: 4,479,513

Difference: 1,236,467

Obama wins by 10.35%

2012:

GOP: 3,131,144

DEM: 4,266,317

Difference: 1,135,173

Obama wins by 5.40%

2016:

GOP: 3,301,182

DEM: 4,217,456

Difference: 916,274

Trump wins by 0.72%

2020:

GOP: 3,451,121

DEM: 4,168,468

Difference: 717,344

???

Now, consider this report from CBS News:

Obama wins by 5.40%

2016:

GOP: 3,301,182

DEM: 4,217,456

Difference: 916,274

Trump wins by 0.72%

2020:

GOP: 3,451,121

DEM: 4,168,468

Difference: 717,344

???

Now, consider this report from CBS News:

Of note, Trump’s approval rating with registered Republican voters is currently running at 94% according to Gallup, with independents at 39% and with registered Democrats at 7%, according to Gallup.

The next issue to consider is how the Covid lockdowns have restricted students coming back to liberal-leaning college towns. This adds another layer of deterrence to voting for students, who were registered under Dem voter drives in their respective college towns.

From what we are being told, the following are empty of residents:

· Madison, Wisconsin

· The Research Triangle in North Carolina

· State college in Pennsylvania

· Ann Arbor in Michigan

· Madison, Wisconsin

· The Research Triangle in North Carolina

· State college in Pennsylvania

· Ann Arbor in Michigan

Furthermore, the lockdowns and riots forced many urban residents away from Minnesota, Pennsylvania and Wisconsin cities.

What about the opinion polling methodology in the age of Covid? Well, 100% of the polling is done by phone and online, with no in-person polling being done

What about the opinion polling methodology in the age of Covid? Well, 100% of the polling is done by phone and online, with no in-person polling being done

to ensure reliability thereof. Many studies have questioned the relative efficacy of online, telephone and face-to-face surveys, all of which come out in favour of face-to-face, regardless of the subject being polled.

Now, for a look at those states where mail-in and early in-person voting has already started – you may be surprised.

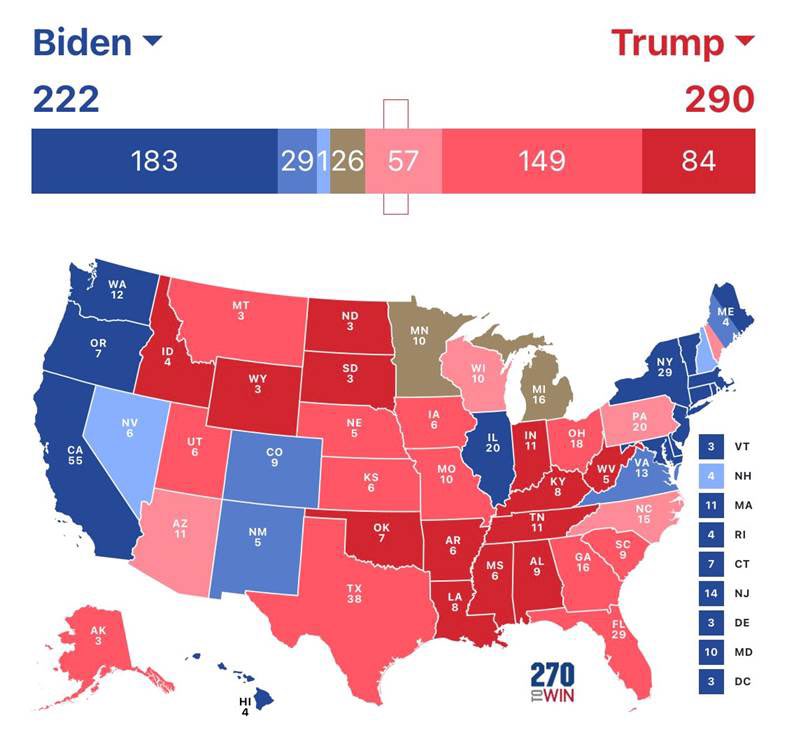

Hence, this is why myself and @nglinsman , have the following update to the electoral college map and why we still believe that Trump is on course to win.

As Mnuchin-Pelosi continue to talk, the better a chance a deal is done and the market continues to rise.

• • •

Missing some Tweet in this thread? You can try to

force a refresh