#SaaS week, Ep1⃣.

Not that SaaS needs anymore cheerleaders, but wanted to do one week of tweets related to SaaS resources and investing.

Starting with a list of my fav SaaS blogs.👇

Not that SaaS needs anymore cheerleaders, but wanted to do one week of tweets related to SaaS resources and investing.

Starting with a list of my fav SaaS blogs.👇

https://twitter.com/RamBhupatiraju/status/1263465760686555136

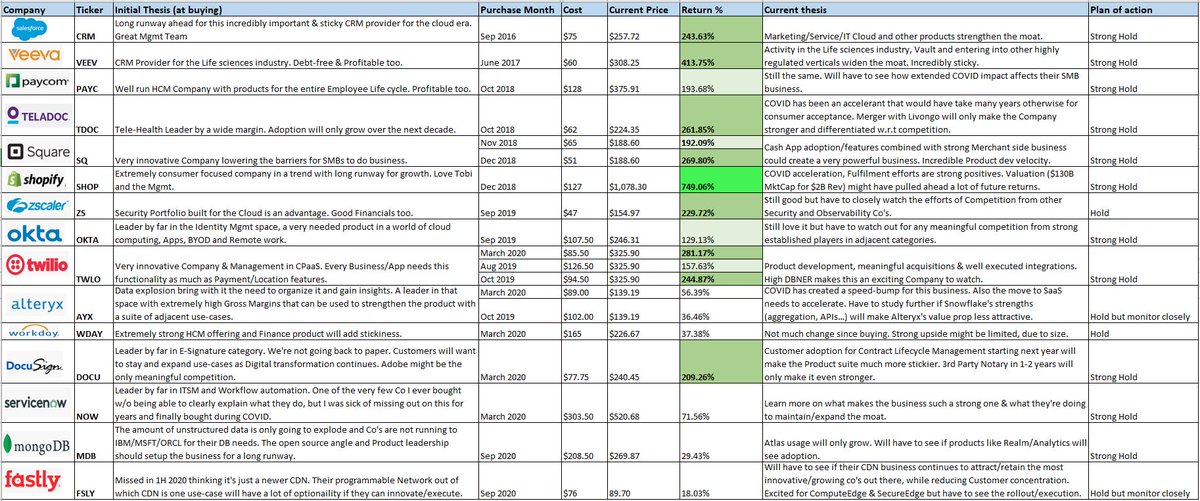

The last 5 yrs have been incredible for good SaaS companies in Public Markets (excluding which spoils the party with it's 6000% return since debut).

Below is just a quick but not exhaustive list.

Below is just a quick but not exhaustive list.

Few things to note

1) 2014 to mid-2016 wasn't exactly a smooth ride up for Tech/SaaS (like 2017, 2019, & post March 2020). Although Private investors were familiar with the SaaS model & benefits, the wider public haven't caught on to it. Early Feb 2016 was like GFC for SaaS.

1) 2014 to mid-2016 wasn't exactly a smooth ride up for Tech/SaaS (like 2017, 2019, & post March 2020). Although Private investors were familiar with the SaaS model & benefits, the wider public haven't caught on to it. Early Feb 2016 was like GFC for SaaS.

2) Last 6 months have been incredibly rewarding for this space (maybe a little too much too fast, time will tell...) as investors pull out of (COVID related) problematic sectors and gravitate towards the secular growth and high Revenue visibility sectors.

3) Although the next 5 yrs might not look as great on a broad level, there will be many good Co's in this space that can get a lot bigger as they leverage the SaaS model while innovating, broadening their Portfolio and building some moats around them.

4) There might be many other Co's which are currently trading at high multiples , but are too narrow in their offerings, cannot innovate fast enough and fall behind competition or the next wave of Tech disruption, seeing their growth rate & multiple disappear.

Keeping aside the stock prices discussion, this space is incredibly interesting to know the terminology, make sense of their Fin statements (huge S&M/SBC/losses, moderate R&D/G&A, low debt, high cash..) and trying to discern whether the story is getting stronger or weaker.

There are many good accounts on Medium and Substack also for SaaS, which I plan to compile and share at a later time.

So the next few tweets this week will be to highlight some good SaaS docs and resources I came across. Hope you find them useful. 👍

So the next few tweets this week will be to highlight some good SaaS docs and resources I came across. Hope you find them useful. 👍

Disc :

My current SaaS holdings 💼: , , , , , , , , , , , ,

Wishlist 👀: , , , , , , , ,

My current SaaS holdings 💼: , , , , , , , , , , , ,

Wishlist 👀: , , , , , , , ,

• • •

Missing some Tweet in this thread? You can try to

force a refresh