There are two CEO archetypes: Visionaries and Optimizers. Both types can create substantial value for shareholders, but require different evaluation tools.

Here’s how we think about it: 1/15

Here’s how we think about it: 1/15

A Visionary is best described as a rule breaker. They are ideally suited for situations in which there is no blueprint for success. They are creating opportunities where none existed. 2/

intrinsicinvesting.com/2018/09/18/see…

intrinsicinvesting.com/2018/09/18/see…

Precisely because their approach is unconventional, Visionary personalities and management styles tend to look weird or are off-putting to most observers. V-led companies often have a unique, insular, and quirky culture. 3/

intrinsicinvesting.com/2018/05/04/cor…

intrinsicinvesting.com/2018/05/04/cor…

Visionaries are there to take big swings. Sometimes they miss terribly, other times they knock it out of the park. Investors often confuse frequency and magnitude of V outcomes and use that as a reason to not invest or even short V-led companies. 4/

https://twitter.com/mjmauboussin/status/1148613457597652992?lang=en

Note that Visionaries don’t have to run high-octane growth companies; Optimizers don’t have to run low growth companies. For example, we think $FRC bank is run by V-style leaders while $BKNG is run with an O approach. 5/

intrinsicinvesting.com/2016/10/04/fir…

intrinsicinvesting.com/2016/10/04/fir…

Neither FRC or BKNG is “pure” Visionary or Optimizer, FRC has more V than O and BKNG has more O than V.

This is not a black-and-white framework, but one to help us identify nuance and companies with the right mix. 6/

This is not a black-and-white framework, but one to help us identify nuance and companies with the right mix. 6/

Visionaries are charismatic leaders by nature, which increases the probability of fraud/big misses. It’s important to evaluate many interactions and data points to determine integrity and authenticity. 7/

https://twitter.com/Post_Market/status/1291739985427730434?s=20

Even if you’re right on integrity/authenticity, Visionaries still rely on a ton of luck. $AMZN raised cash right before the dotcom bust. Legend has it that $FDX was saved by a winning blackjack hand. 8/

vox.com/new-money/2017…

vox.com/new-money/2017…

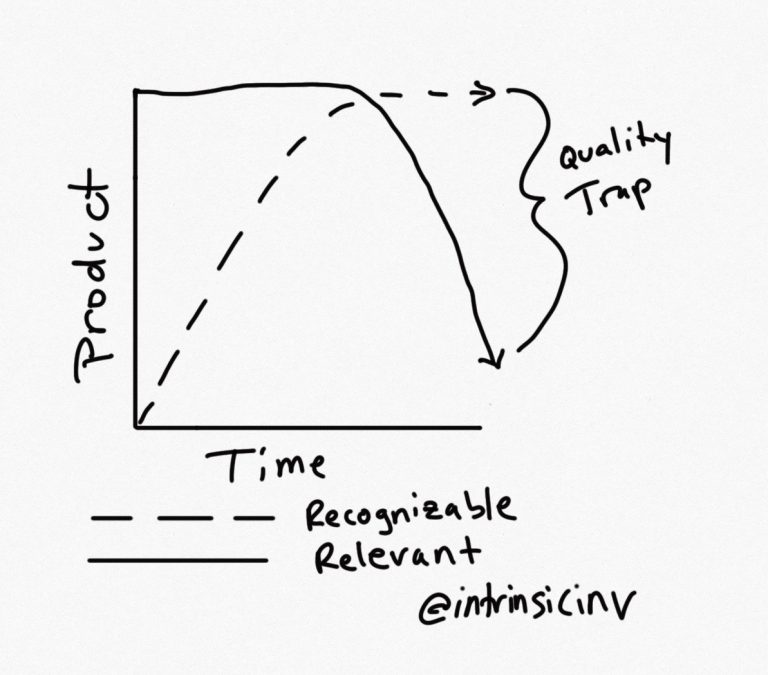

Optimizer characteristics become more important as the company transitions from rule breaker to rule maker status. It becomes a different game when you're the one other companies are chasing. 9/

intrinsicinvesting.com/2018/06/27/vis…

intrinsicinvesting.com/2018/06/27/vis…

Once there’s blueprint for success, the Optimizer’s job is to execute to further distance the company from its competitors. The focus is now on ROIC, cash flows, and capital allocation and less on revenue growth. 10/

intrinsicinvesting.com/2019/06/12/goi…

intrinsicinvesting.com/2019/06/12/goi…

Value investors tend to focus on Optimizers. Value enhancing actions by Os are more observable and less uncertain (e.g. large opportunistic buyback) than V’s. O-led companies may have greater low growth risk, however. 11/

intrinsicinvesting.com/2019/02/27/the…

intrinsicinvesting.com/2019/02/27/the…

Will Thorndike’s “The Outsiders” book is a value investor favorite and highlights 8 legendary CEOs including Buffett, Tom Murphy, and John Malone. It’s the best resource for understanding Optimizer CEOs. 12/

amazon.com/Outsiders-Unco…

amazon.com/Outsiders-Unco…

It’s rare that a CEO excels at being both Visionary and Optimizer. Sam Walton $WMT and Jeff Bezos $AMZN jump to mind.

At various points in their lifecycle, companies need to balance Visionary and Optimizer influence. 13/

intrinsicinvesting.com/2018/10/04/rig…

At various points in their lifecycle, companies need to balance Visionary and Optimizer influence. 13/

intrinsicinvesting.com/2018/10/04/rig…

Companies can stumble in V&O transitions. As a company matures, a Visionary may be unwilling to cede control to an Optimizer COO/CFO.

A declining company may also be culturally unwilling to hire a Visionary, even when it needs reinvention. 14/

A declining company may also be culturally unwilling to hire a Visionary, even when it needs reinvention. 14/

We think investors should understand what drives Visionaries and Optimizers and when one is better than the other for a company. Dismissing one or the other carries its own costs. /end

• • •

Missing some Tweet in this thread? You can try to

force a refresh