AMMs aren't broken

Professional MM's don't need them, but they are great for the rest of us and improve liquidity for the space as whole

Good thing that blockchain data is public so we can see what's really going on

Professional MM's don't need them, but they are great for the rest of us and improve liquidity for the space as whole

Good thing that blockchain data is public so we can see what's really going on

https://twitter.com/SBF_Alameda/status/1316509291017203712

Low latency, high throughput orderbook based hybrid DEXs have actually existed for years now e.g. dydx, IDEX, etc.

They consistently are lower than 10% market share

They consistently are lower than 10% market share

https://twitter.com/SBF_Alameda/status/1316509294712381440

I would refute the the idea that AMMs had very little usage before yield farming summer.

Uniswap had already started to surpass volumes of some well known CEXs and had been experiencing hockey stick growth pre-yield farming

Uniswap had already started to surpass volumes of some well known CEXs and had been experiencing hockey stick growth pre-yield farming

Out of the top 10 pairs on Uniswap by weekly volume, 4 contain "yield farming tokens". The volume from them make up 22% of total top 10 volume.

I'm not sure about calling incentivization "not natural", because liquidity incentivization is here to stay

I'm not sure about calling incentivization "not natural", because liquidity incentivization is here to stay

https://twitter.com/SBF_Alameda/status/1316509296046141440

It's true - much of the growth of AMMs came from incentivization & subsidies, but so did a lot of the growth of most startups and even mature companies e.g. Uber, Amazon, Spotify, etc. It's a central strategy for every startup to bootstrap growth.

https://twitter.com/SBF_Alameda/status/1316509297384153088

Yes AMMs "make bad trades" on a trade by trade basis

But the fees shouldn't be understated as they are game changers.

Imagine if the Charlotte Hornets got 2x points per bucket. Yea they might be awful shooters but the bonus is enough to turn a L to a W

But the fees shouldn't be understated as they are game changers.

Imagine if the Charlotte Hornets got 2x points per bucket. Yea they might be awful shooters but the bonus is enough to turn a L to a W

https://twitter.com/SBF_Alameda/status/1316509306770997249

IL is independent of fees. IL only changes based on start and end price.

30 bps is huge for HFT, but 90%+ of crypto volume comes from apes, not HFT. For Apes, 30 bps on 200+ vol assets is completely fine.

30 bps is huge for HFT, but 90%+ of crypto volume comes from apes, not HFT. For Apes, 30 bps on 200+ vol assets is completely fine.

https://twitter.com/SBF_Alameda/status/1316509308083871744

LPs are not losing without incentives.

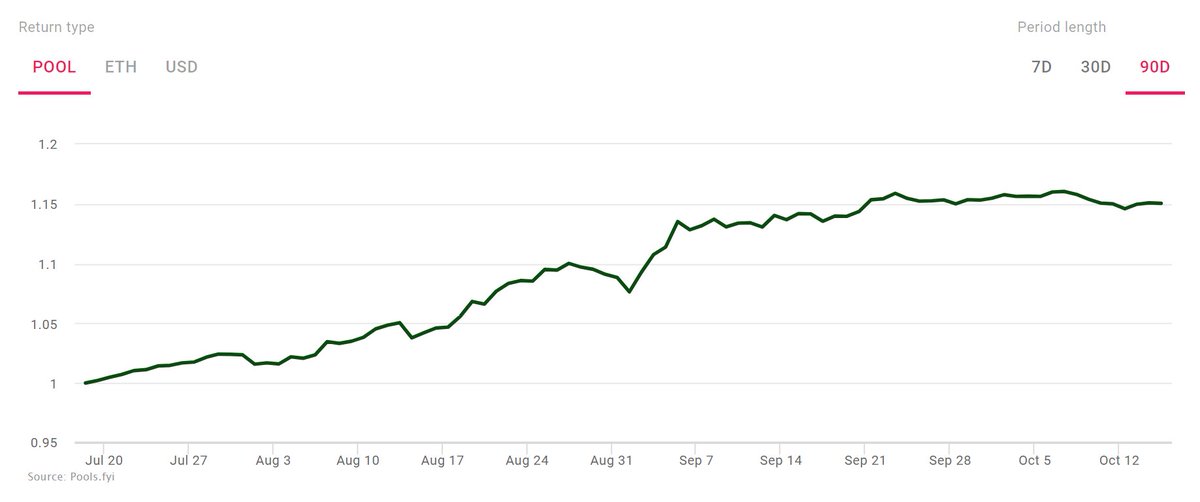

You can look at pool yields net of IL, EXCLUDING incentives to see yourself. Here's ETH-USDT returns:

30D - 13% APY

90D - 60% APY

APY dropped recently because of massive pool growth (large dilution) and IL

You can look at pool yields net of IL, EXCLUDING incentives to see yourself. Here's ETH-USDT returns:

30D - 13% APY

90D - 60% APY

APY dropped recently because of massive pool growth (large dilution) and IL

https://twitter.com/SBF_Alameda/status/1316509313217622018

AMMs are not bad, imo they will coexist with orderbooks and serve a pretty large population.

Yes, they lose $ in trending environments, but actually perform the best in high volatility, mean reverting markets - exactly what crypto has been

Yes, they lose $ in trending environments, but actually perform the best in high volatility, mean reverting markets - exactly what crypto has been

https://twitter.com/SBF_Alameda/status/1316509319878197248

LPs don't need to blindly enter and exit. Some will be smart enough to identify a time horizon and entry/exit targets to minimize IL and maximize profits.

Single formula does NOT mean single strategy

Single formula does NOT mean single strategy

• • •

Missing some Tweet in this thread? You can try to

force a refresh