1/ $CRV is by far the most extreme juxtaposition of being both an amazing investment with huge addressable markets and not being investable at the same time

2/ In less than 6 months, it dominated the stablecoin swap market

And it will play a central role in the two strongest emerging themes in DeFi:

1. Cross-chain interoperability

2. Synthetic Assets

And it will play a central role in the two strongest emerging themes in DeFi:

1. Cross-chain interoperability

2. Synthetic Assets

3/ Both of these themes already have demonstrated strong traction & PMF out of the gate but are still only in the early stages

Cross Chain Interop - @WrappedBTC @renprotocol @thorchain_org @CreamdotFinance @ptokens_io etc

Synthetic Assets - @MakerDAO @synthetix_io @arcxgame etc

Cross Chain Interop - @WrappedBTC @renprotocol @thorchain_org @CreamdotFinance @ptokens_io etc

Synthetic Assets - @MakerDAO @synthetix_io @arcxgame etc

3/ In terms of cross chain interop, you will have major asset exist as a pegged asset on every other chain.

Just like we have a dozen different versions of BTC on ETH, Solana, Polkadot, etc will all have multiple versions of BTC on their chains, traded through @CurveFinance

Just like we have a dozen different versions of BTC on ETH, Solana, Polkadot, etc will all have multiple versions of BTC on their chains, traded through @CurveFinance

4/ This won't just be limited to BTC. Multiple different versions of XRP, LTC, BCH, etc. will be demanded on each layer 1 building their own DeFi ecosystem

There are already more than a dozen Curve pools on Ethereum, and this proliferation will happen on other chains as well

There are already more than a dozen Curve pools on Ethereum, and this proliferation will happen on other chains as well

5/ Right now, the only synthetic assets with meaningful liquidity are DAI, sUSD and sBTC

But there will be demand for synthetics representing assets other than USD and BTC

Gold, TSLA stock, Oil, etc.

@CurveFinance + @synthetix_io can serve as the bridge between all assets

But there will be demand for synthetics representing assets other than USD and BTC

Gold, TSLA stock, Oil, etc.

@CurveFinance + @synthetix_io can serve as the bridge between all assets

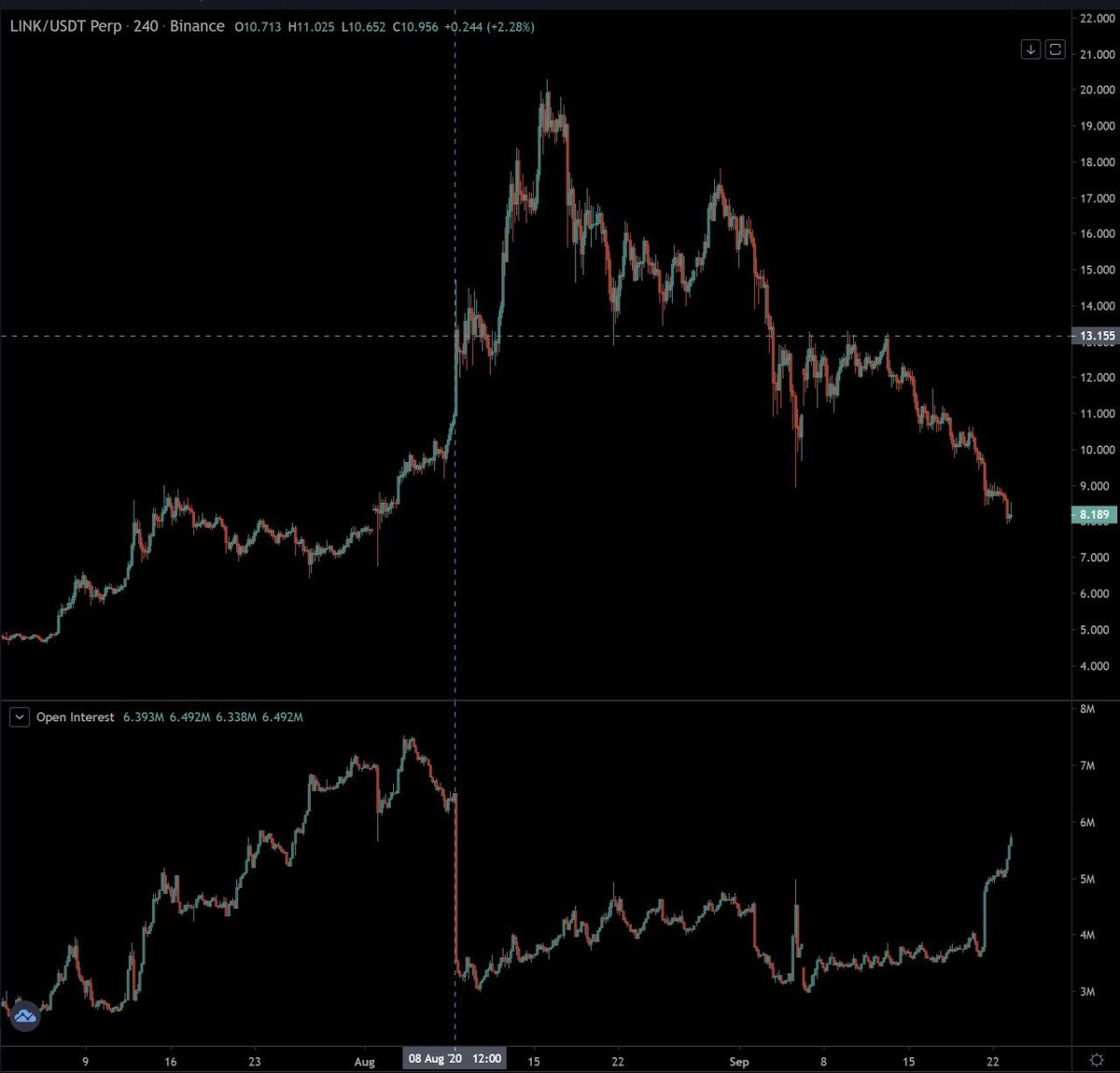

6/ Unfortunately, the supply schedule & heavy inflation of $CRV makes it a short biased asset (dumpamentals).

The cost of inflation is greater than the value created for Curve

Fortunately, this makes Curve a great potential target for activist investors. Whose up for a change?

The cost of inflation is greater than the value created for Curve

Fortunately, this makes Curve a great potential target for activist investors. Whose up for a change?

• • •

Missing some Tweet in this thread? You can try to

force a refresh