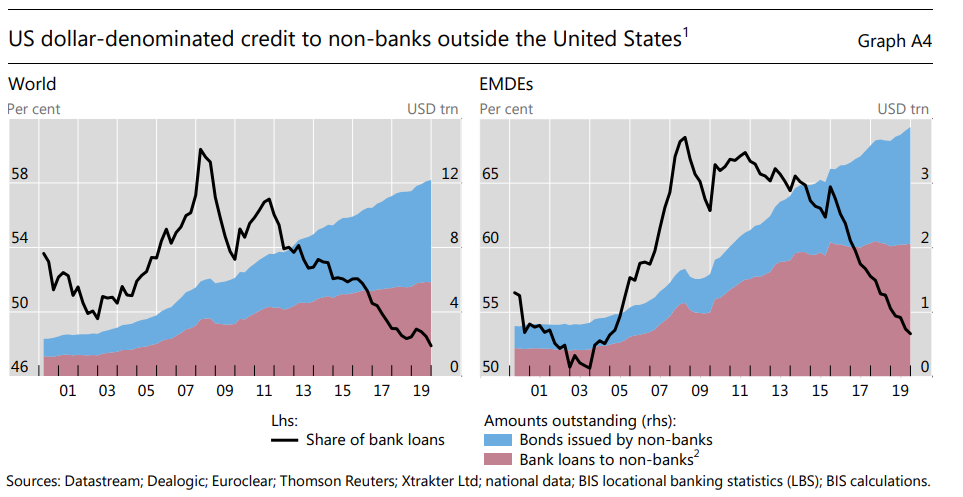

New Treasury holders report out yesterday. The foreign sector slightly reduced U.S. Treasury holdings in Aug, from July, despite ongoing large issuance.

YTD through August, the foreign sector only bought about 5% of net new Treasury issuance.

YTD through August, the foreign sector only bought about 5% of net new Treasury issuance.

We know from Fed custody data, which is incomplete but faster-updating, that going into October, the foreign sector still isn't really buying Treasuries in size:

About 2/3rds of net new U.S. Treasury issuance this year was bought by the combo of the Fed and U.S. banking system.

There's very little foreign demand. There's moderate non-bank domestic demand, but not enough vs the massive issuance (at least at current prices).

There's very little foreign demand. There's moderate non-bank domestic demand, but not enough vs the massive issuance (at least at current prices).

This is why Randal Quarles of the Fed recently stated that the Fed likely has to continue Treasury purchases, because the Treasury market has become so big vs the amount of realistic demand out there.

wsj.com/articles/fed-o…

wsj.com/articles/fed-o…

• • •

Missing some Tweet in this thread? You can try to

force a refresh